5 Stocks That Could Dip on China Woes презентация

Содержание

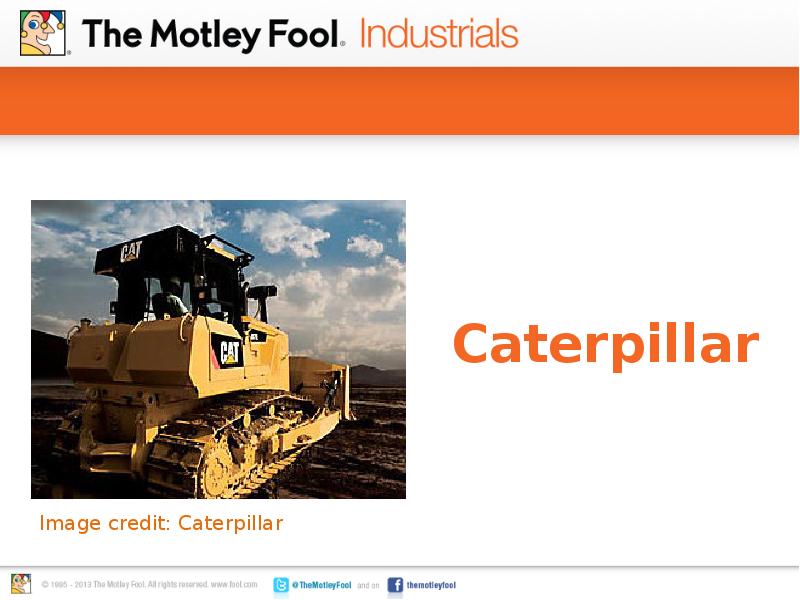

- 2. Caterpillar Caterpillar

- 3. Connection with China In 2011, Caterpillar acquired Bucyrus International for

- 4. The concerns going forward Caterpillar’s sales from Asia-Pacific slumped 25% in

- 5. Joy Global Joy Global

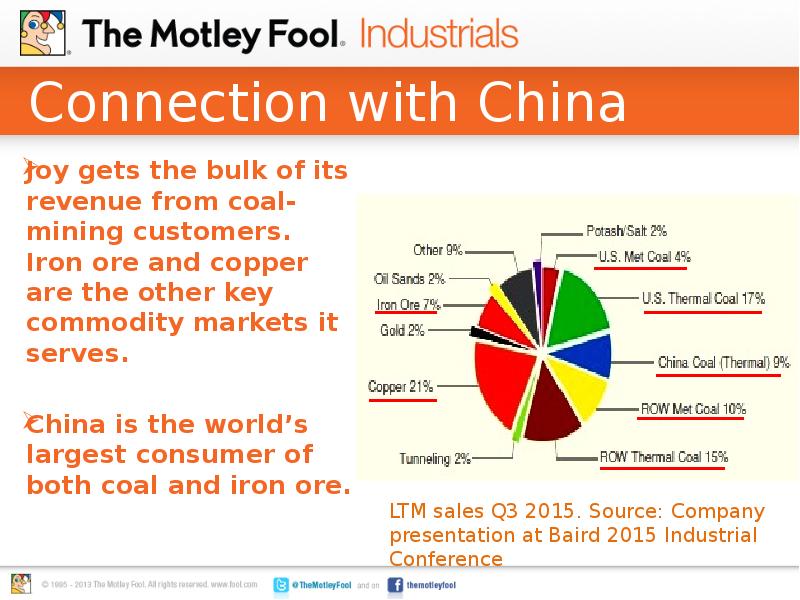

- 6. Connection with China Joy gets the bulk of its revenue from

- 7. The concerns going forward Joy’s original equipment orders and backlog value

- 8. Manitowoc Manitowoc

- 9. Connection with China Manitowoc gets 12% of its revenue from Asia-Pacific,

- 10. The concerns going forward Manitowoc’s crane sales slumped 23% year over

- 11. Cummins Cummins

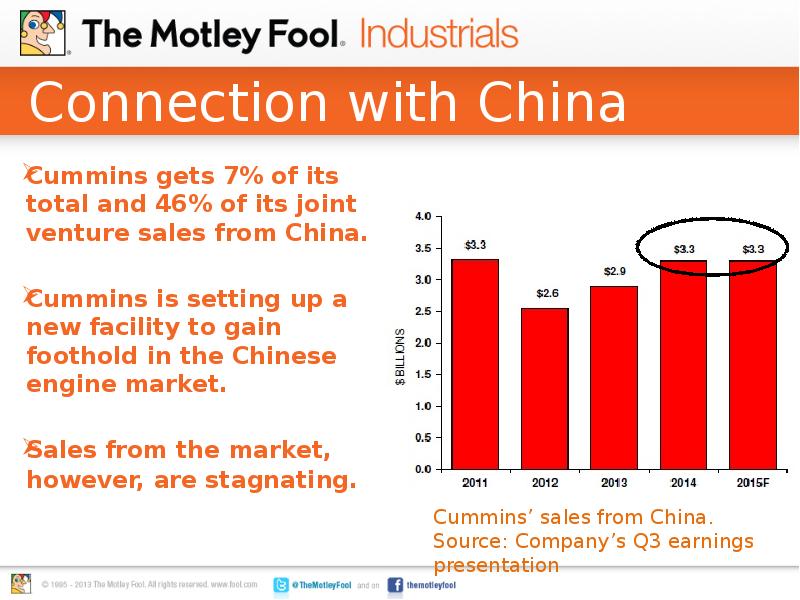

- 12. Connection with China Cummins gets 7% of its total and 46%

- 13. The concerns going forward Each of Cummins’ business segments faces risks:

- 14. Westport Innovations Westport Innovations

- 15. Connection with China Westport’s joint venture with China-based Weichai Power

- 16. The concerns going forward Westport’s share of income from Weichai-Westport slumped

- 18. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему 5 Stocks That Could Dip on China Woes можно ниже:

Похожие презентации