How to Become Financially Indestructible презентация

Содержание

- 3. Which Would You Be?

- 4. The Inspiration The concept comes from Nassim Taleb’s best-seller Antifragile: Things

- 5. A Working Definition Financial Antifragility: Not only being protected from personal

- 7. 1) Limit Your Downside Remember, this isn’t about maximizing your returns

- 8. Two Key Ways to Limit Downside Emergency Cash

- 9. 2) Avoid Debt In times of uncertainty and distress, nothing is

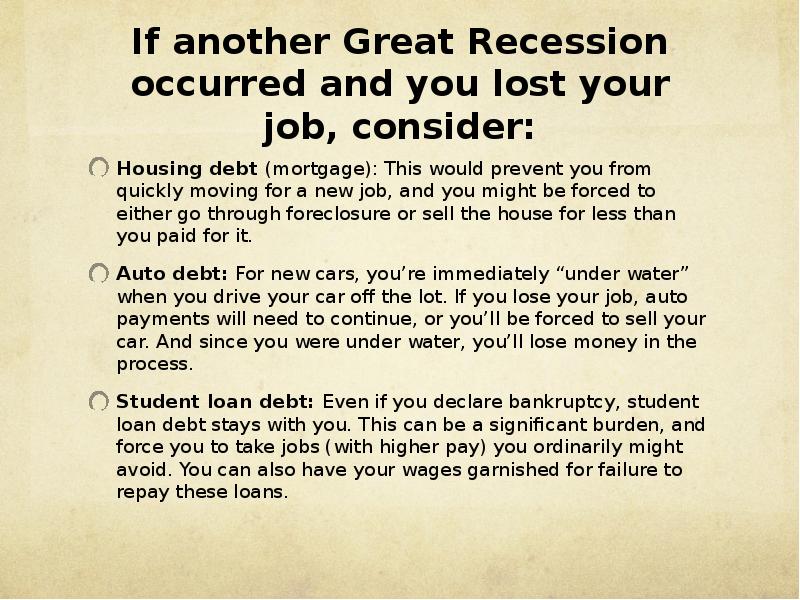

- 10. If another Great Recession occurred and you lost your job, consider:

- 12. 3) Live Frugally The less you need to be happy, the

- 14. 4) Have Redundancies in Place Planning for things to go wrong

- 15. Efficiency vs. Redundancy The business world is focused on making things

- 16. Are Your Redundancies In Place? If you lost your job tomorrow:

- 17. An Example From Real-Life

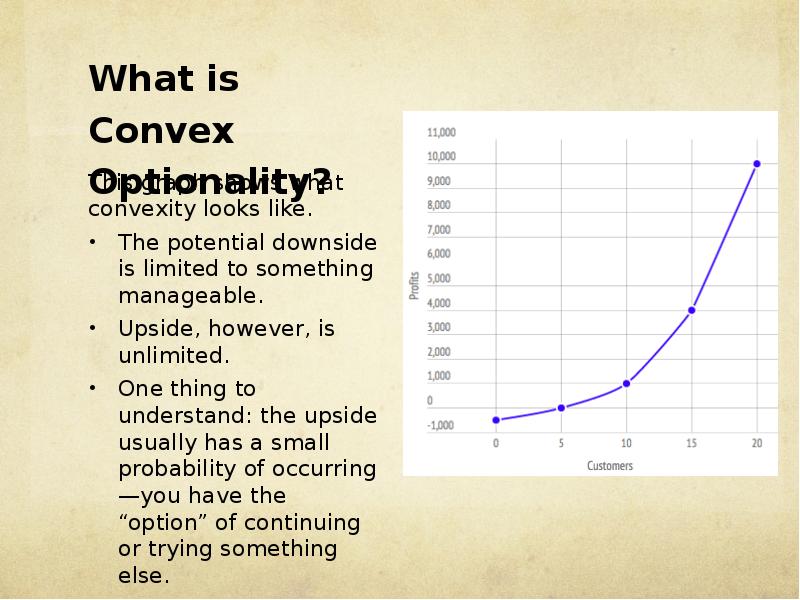

- 18. 5) Use Convex Optionality to Your Benefit Tinker with ideas that

- 19. What is Convex Optionality? This graph shows what convexity looks like.

- 20. The Barbell Approach Taleb defines this as: “A dual strategy: one

- 21. Examples from Real Life Albert Einstein worked at the Swiss patent

- 22. A Quick Review Limit Your Downside Avoid Debt Live Frugally Have

- 23. If you find that it’s too late in the game to

- 24. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему How to Become Financially Indestructible можно ниже:

Похожие презентации