Lecture 5. Principles of Macroeconomics презентация

Содержание

- 2. In this Lecture:

- 3. Intertemporal decisions They involve a trade off across periods of time:

- 4. Our model Two period model: today and tomorrow For simplicity: income

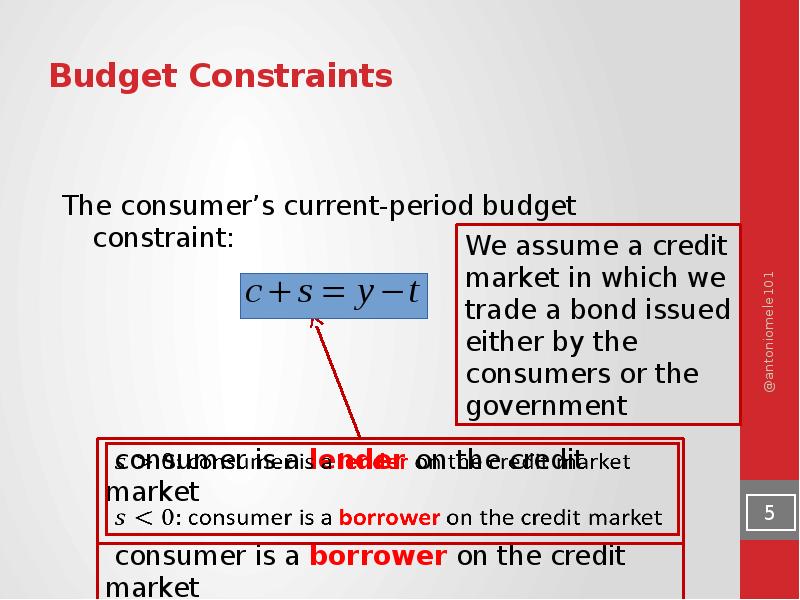

- 5. Budget Constraints

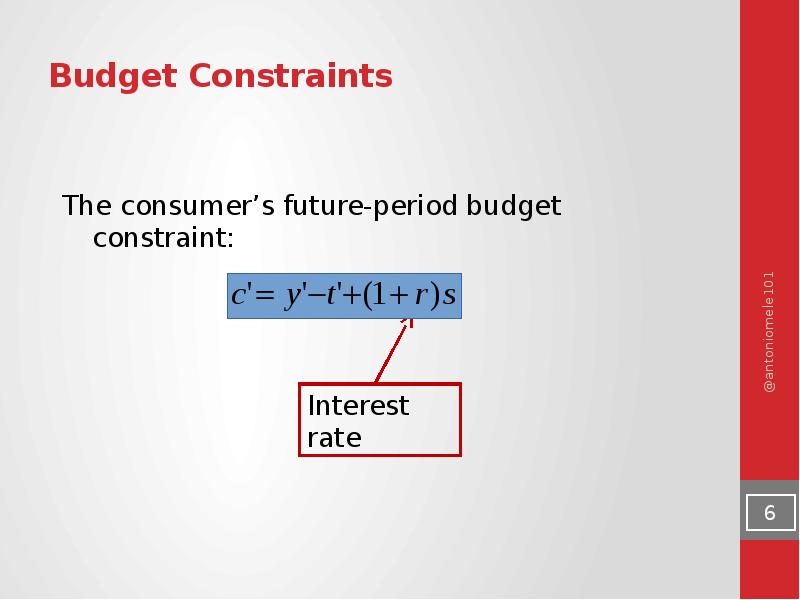

- 6. Budget Constraints

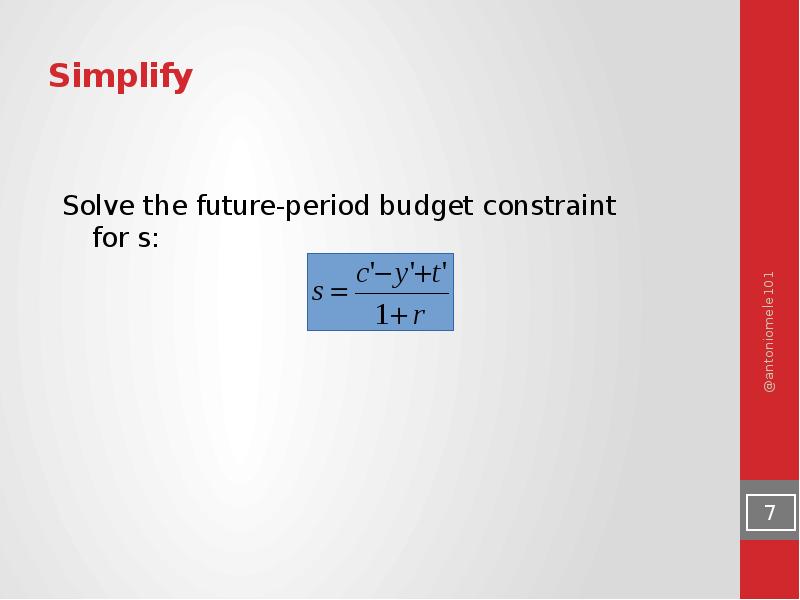

- 7. Simplify

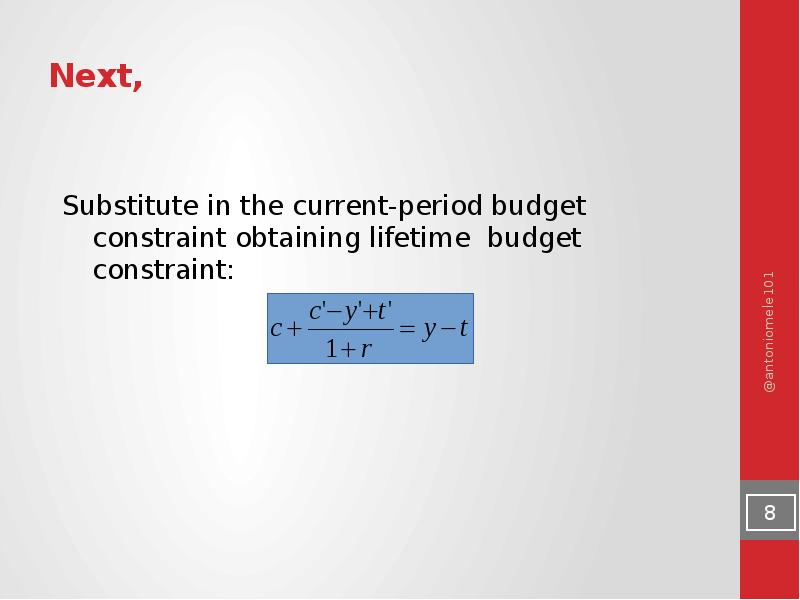

- 8. Next,

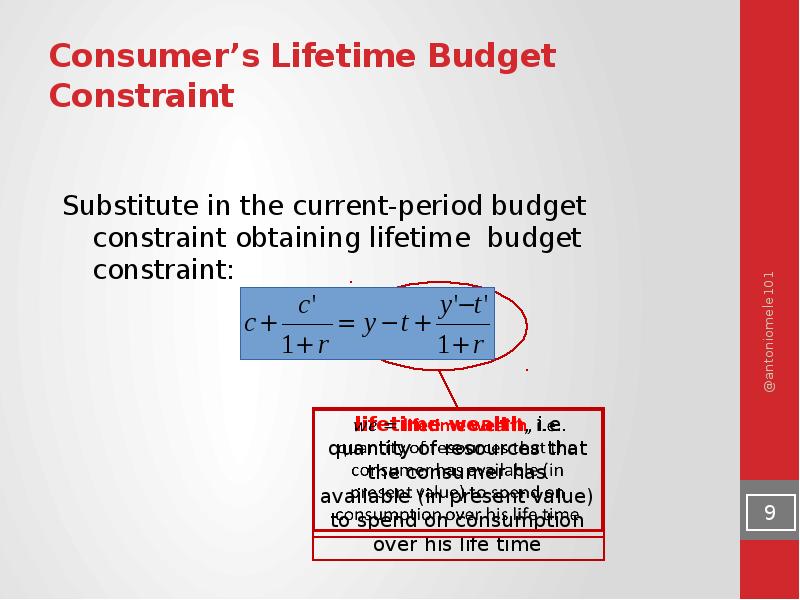

- 9. Consumer’s Lifetime Budget Constraint

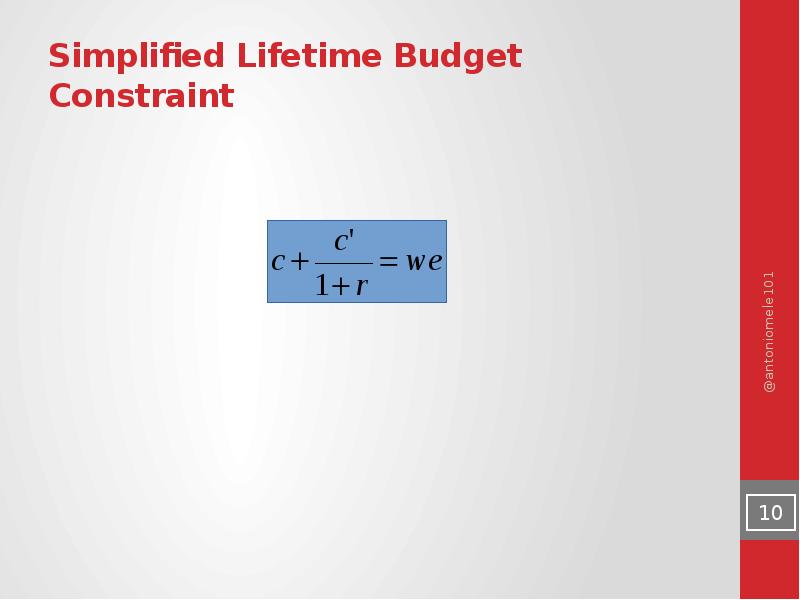

- 10. Simplified Lifetime Budget Constraint

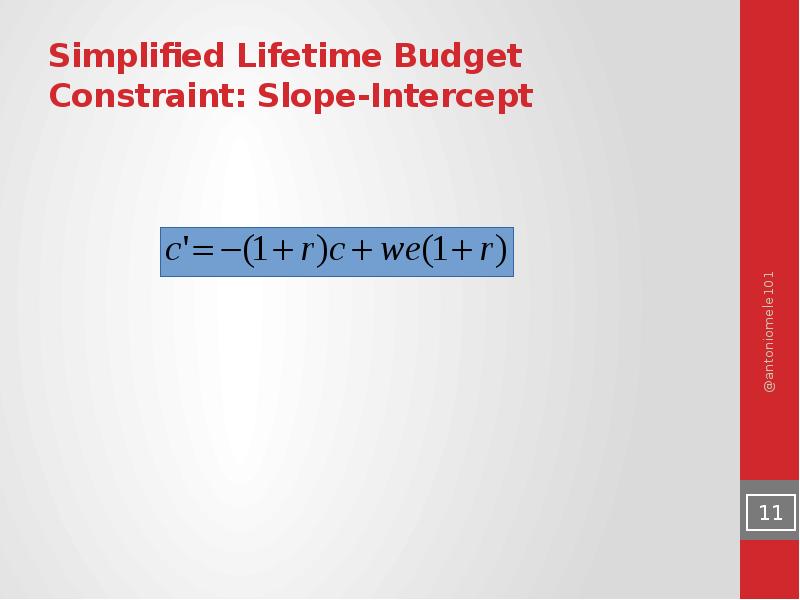

- 11. Simplified Lifetime Budget Constraint: Slope-Intercept

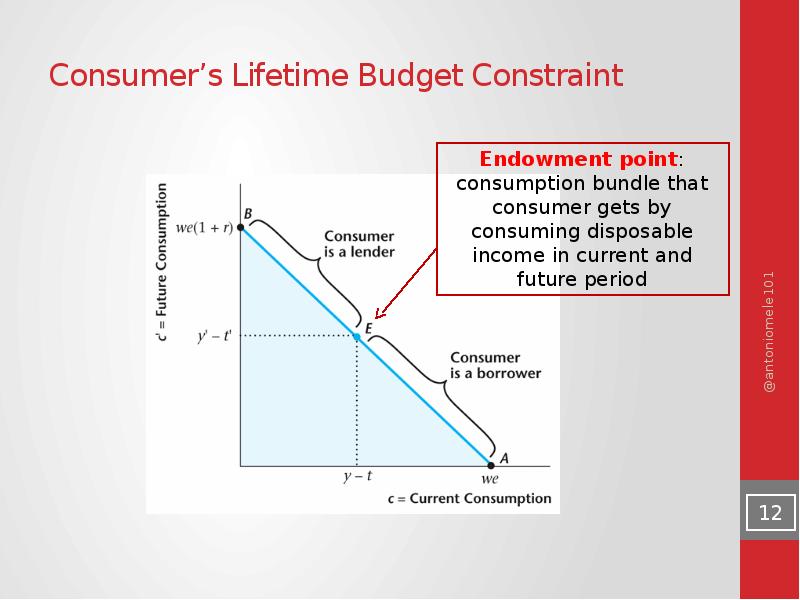

- 12. Consumer’s Lifetime Budget Constraint

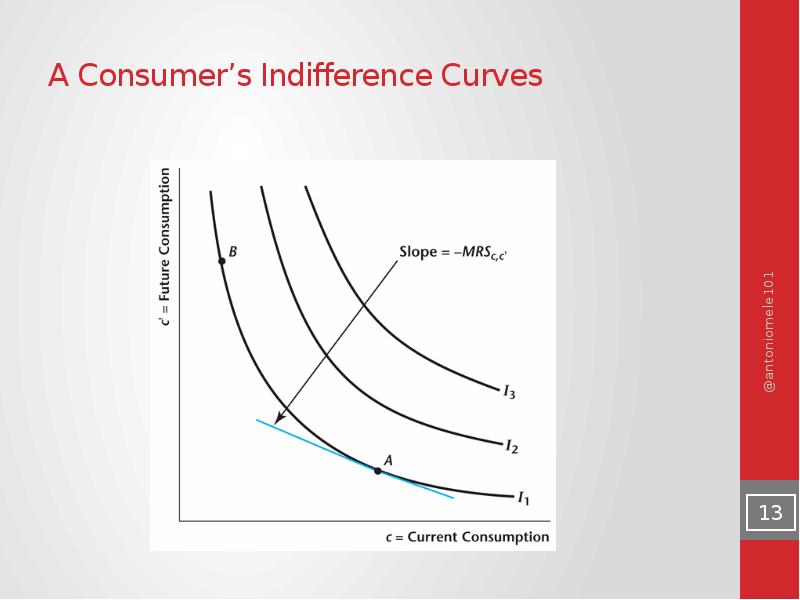

- 13. A Consumer’s Indifference Curves

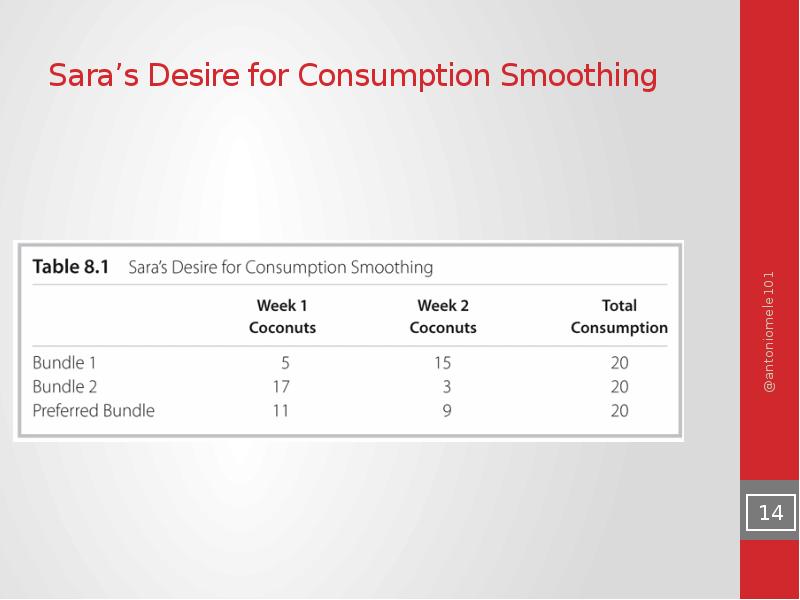

- 14. Sara’s Desire for Consumption Smoothing

- 15. Optimization

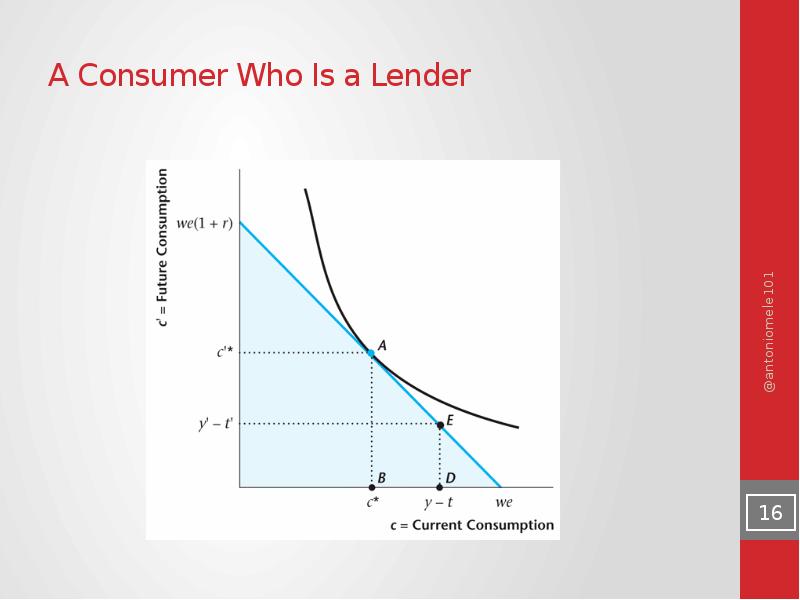

- 16. A Consumer Who Is a Lender

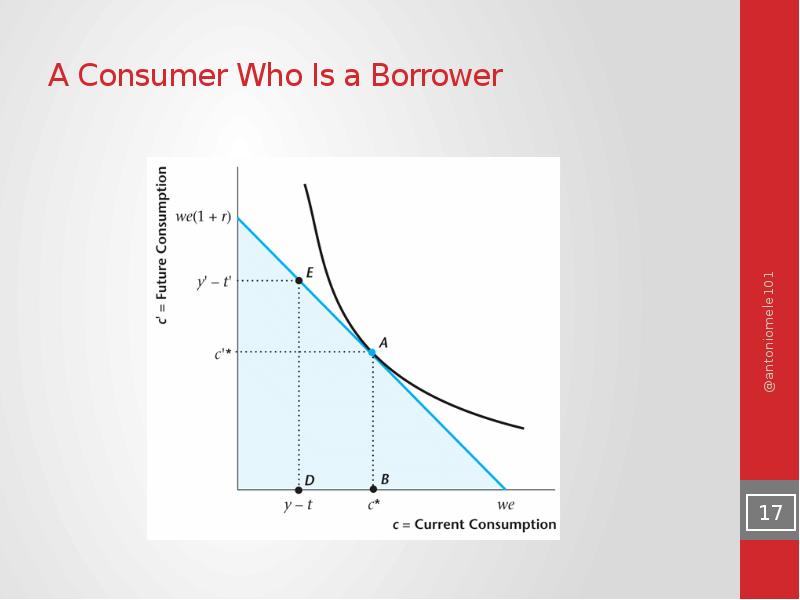

- 17. A Consumer Who Is a Borrower

- 18. An Increase in Current Income for the Consumer

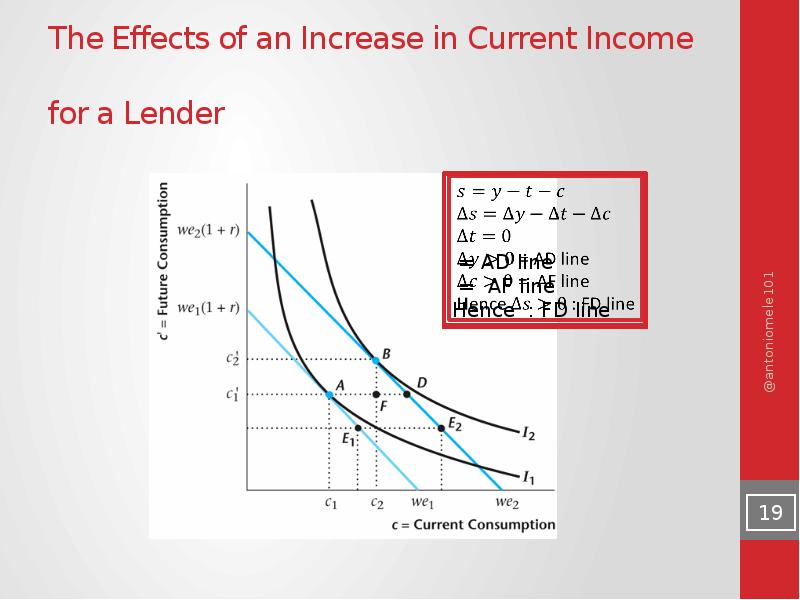

- 19. The Effects of an Increase in Current Income for a Lender

- 20. Observed Consumption-Smoothing Behavior

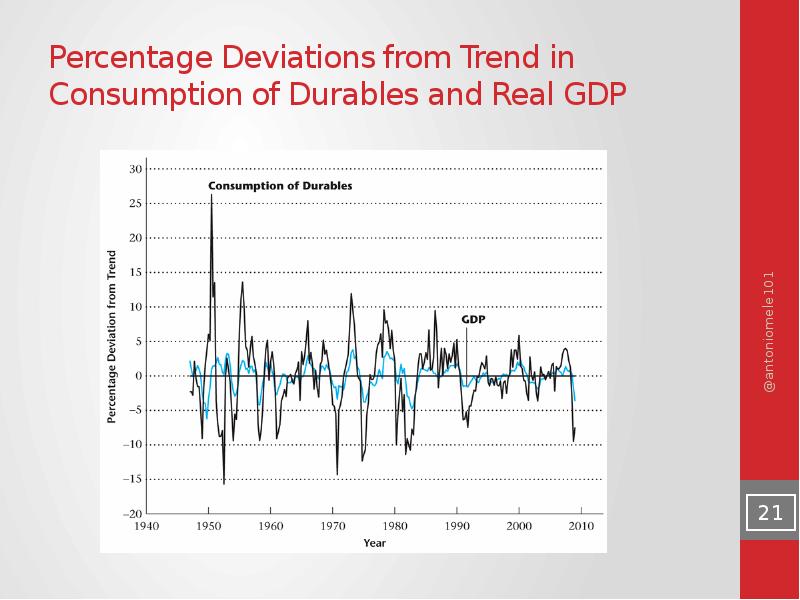

- 21. Percentage Deviations from Trend in Consumption of Durables and Real GDP

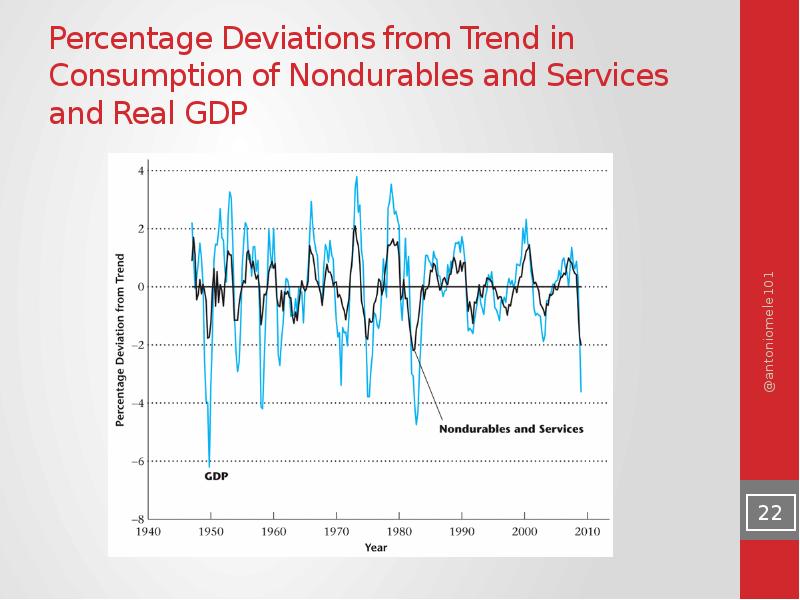

- 22. Percentage Deviations from Trend in Consumption of Nondurables and Services and

- 23. An Increase in Future Income for the Consumer

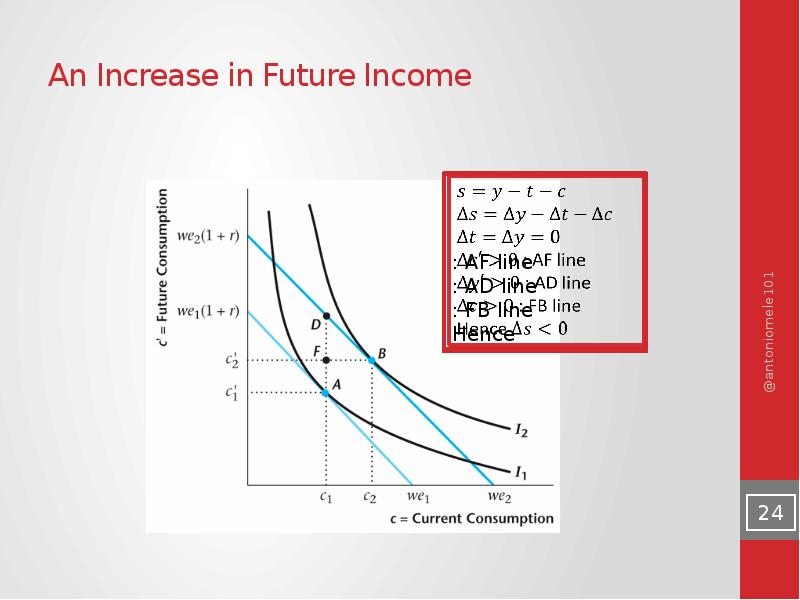

- 24. An Increase in Future Income

- 25. Temporary and Permanent Increases in Income

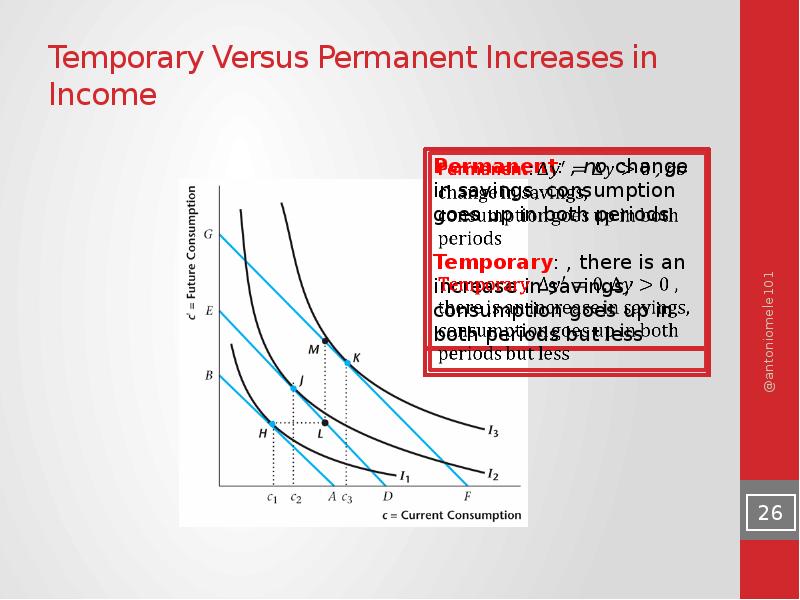

- 26. Temporary Versus Permanent Increases in Income

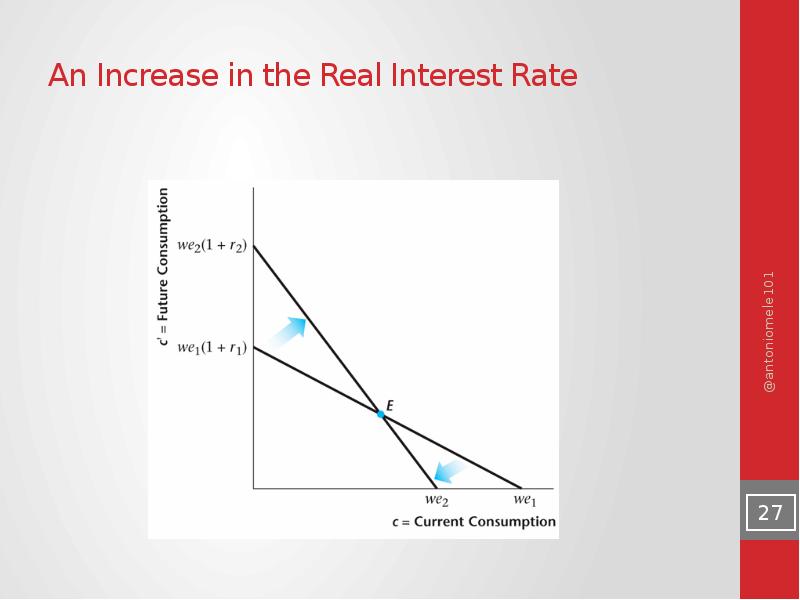

- 27. An Increase in the Real Interest Rate

- 28. An Increase in the Market Real Interest Rate

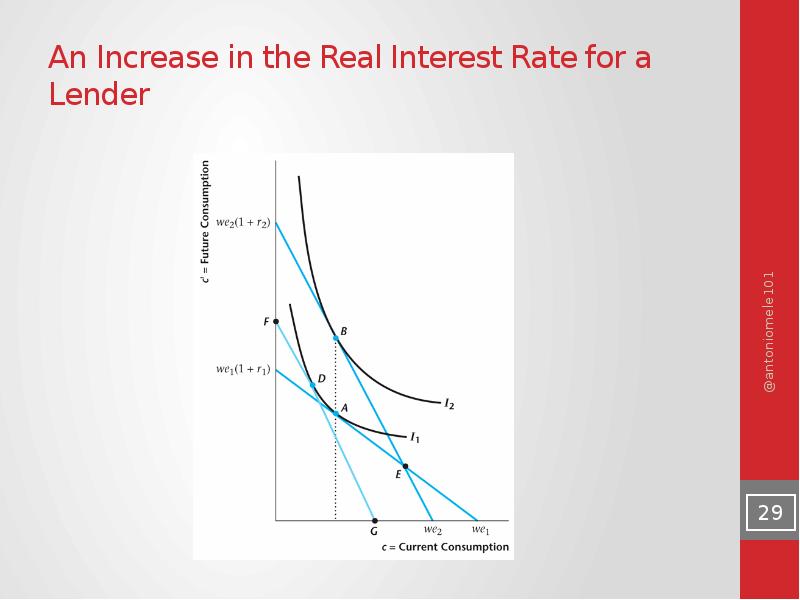

- 29. An Increase in the Real Interest Rate for a Lender

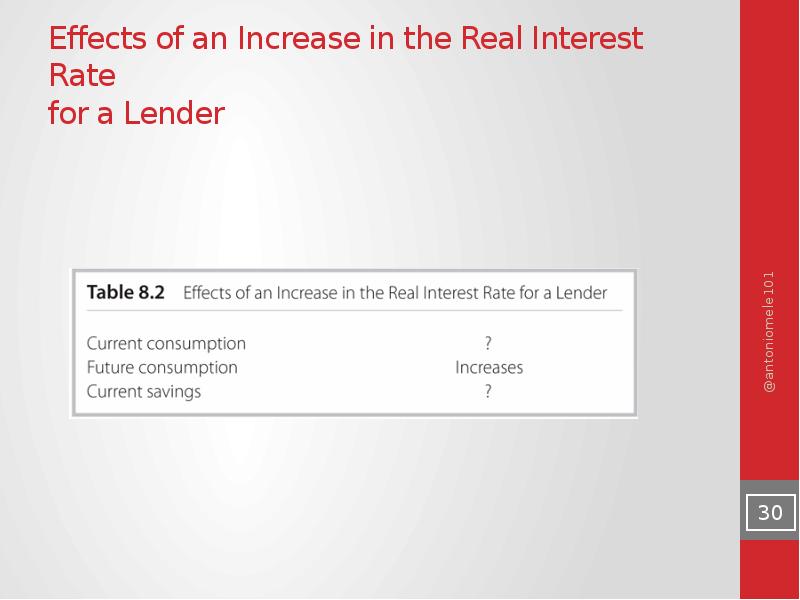

- 30. Effects of an Increase in the Real Interest Rate for a

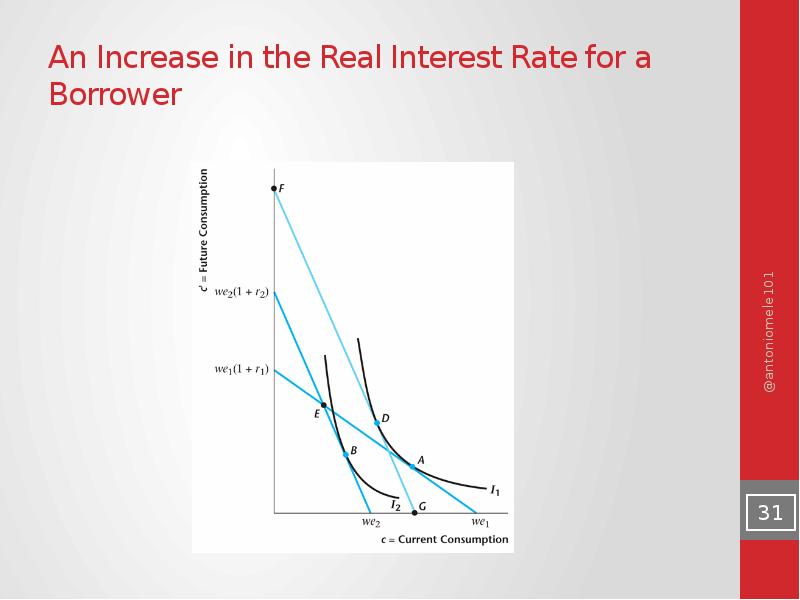

- 31. An Increase in the Real Interest Rate for a Borrower

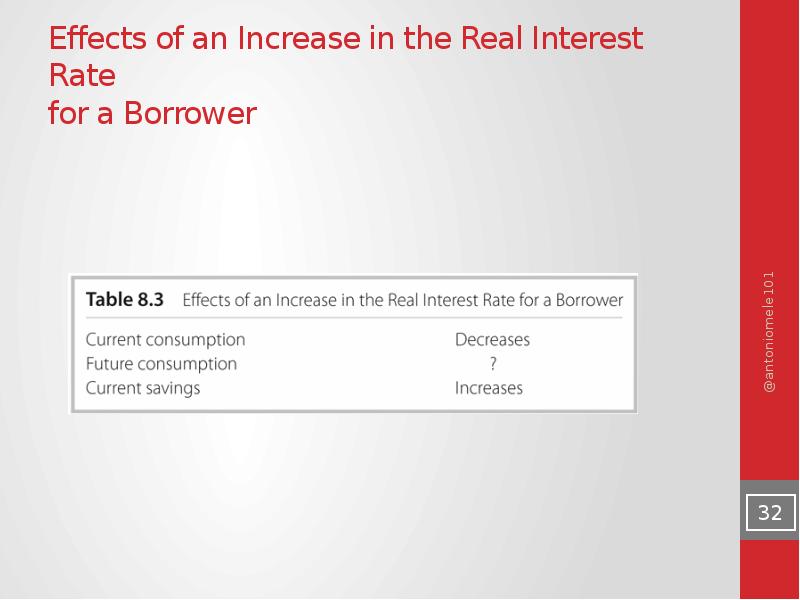

- 32. Effects of an Increase in the Real Interest Rate for a

- 33. Introducing the government Government buys G, financed either with taxes or

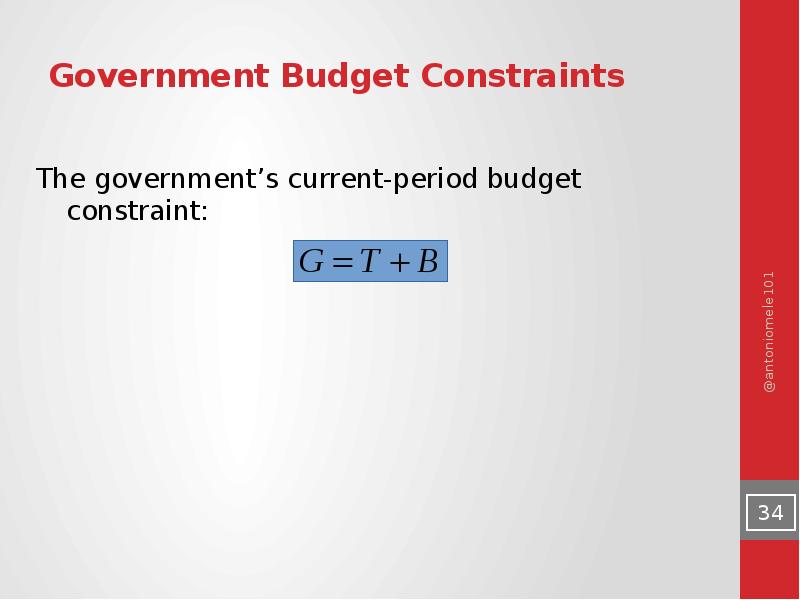

- 34. Government Budget Constraints

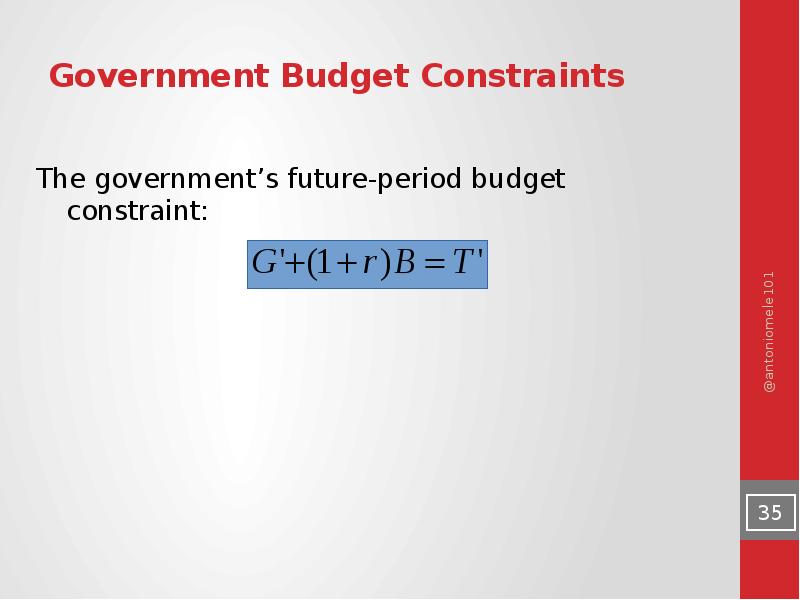

- 35. Government Budget Constraints

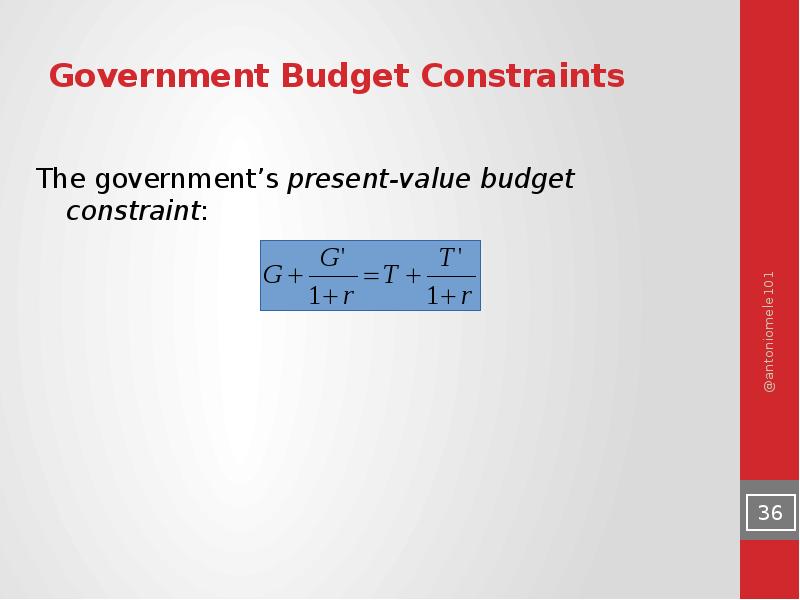

- 36. Government Budget Constraints

- 37. Competitive equilibrium Each consumer chooses current and future consumption and savings

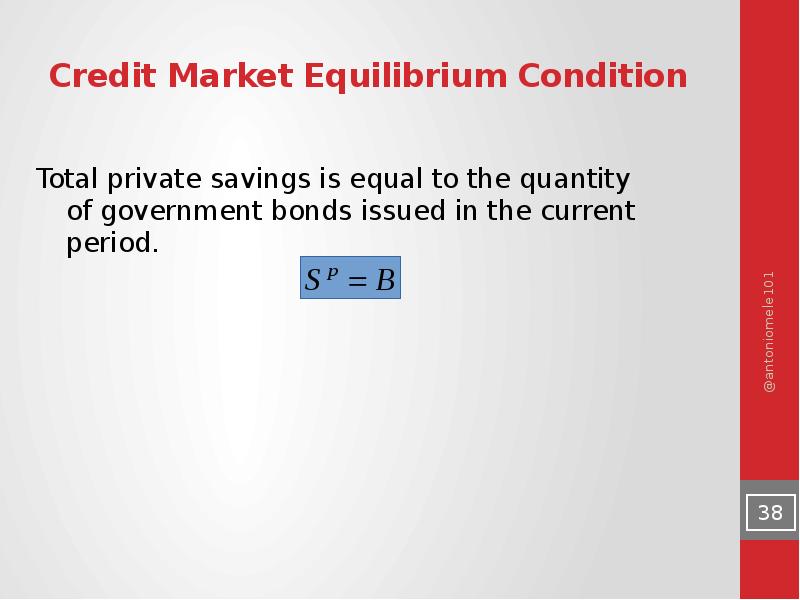

- 38. Credit Market Equilibrium Condition

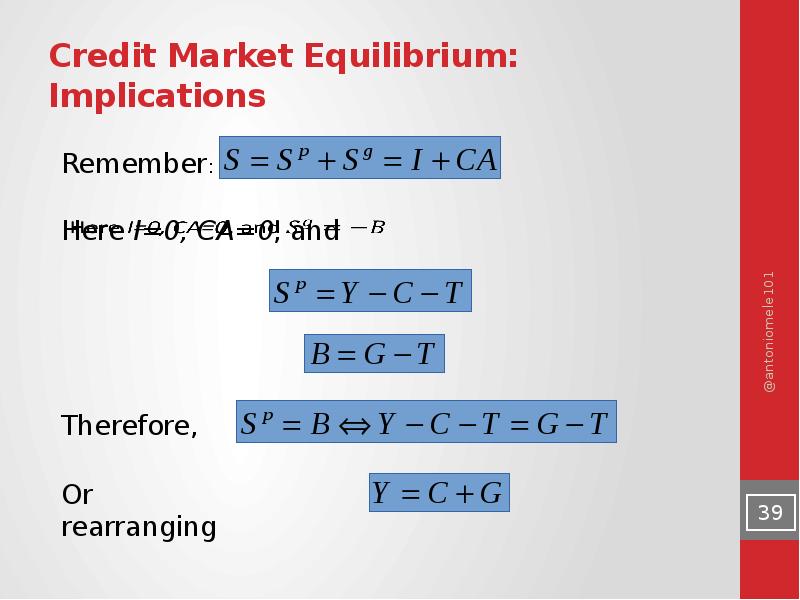

- 39. Credit Market Equilibrium: Implications

- 40. Income-Expenditure Identity

- 41. Ricardian Equivalence

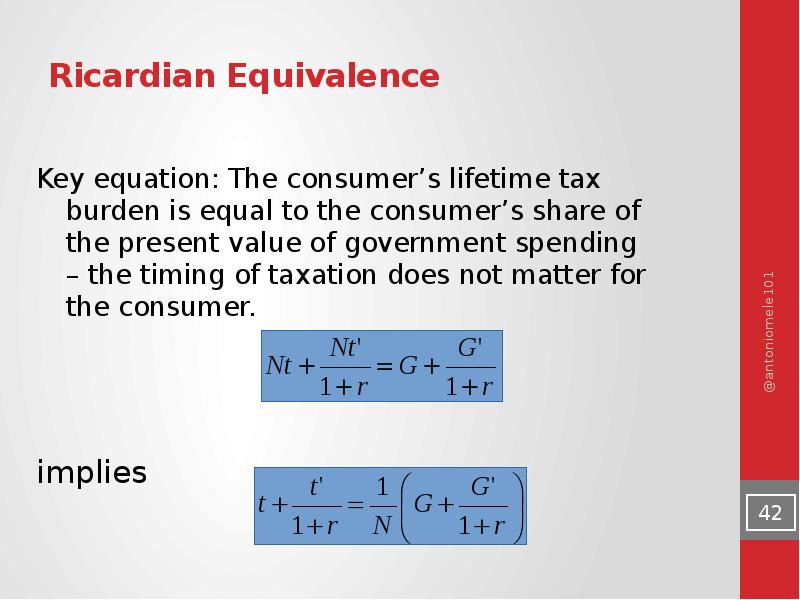

- 42. Ricardian Equivalence

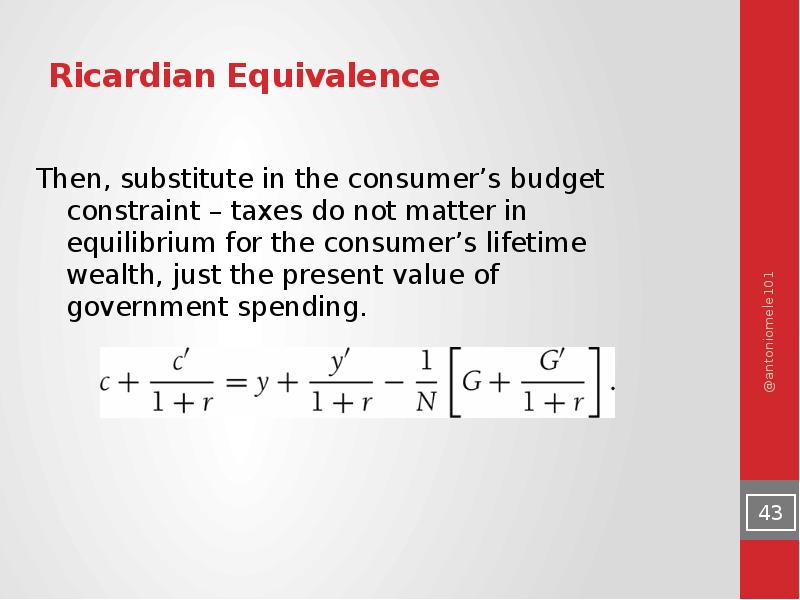

- 43. Ricardian Equivalence

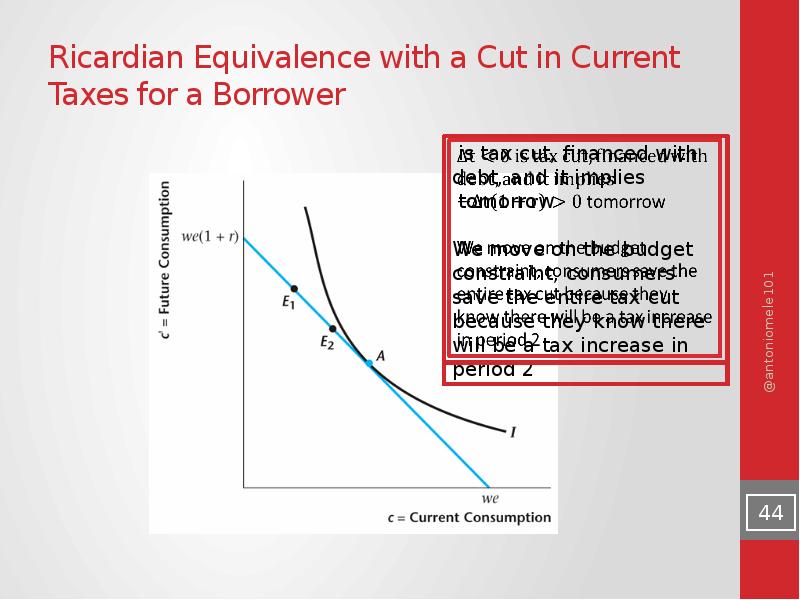

- 44. Ricardian Equivalence with a Cut in Current Taxes for a Borrower

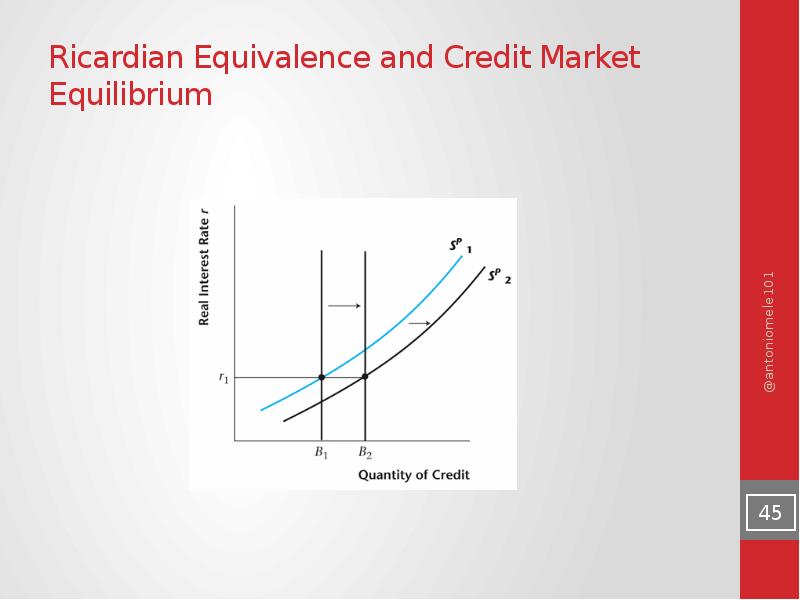

- 45. Ricardian Equivalence and Credit Market Equilibrium

- 46. Discussion of the assumptions Ricardian equivalence theorems says government debt represents

- 47. Readings Savings are generally a good idea http://www.youtube.com/watch?v=C_8TGTKdrlY The cost of

- 48. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему Lecture 5. Principles of Macroeconomics можно ниже:

Похожие презентации