10 Easy Ways to Save More for Retirement презентация

Содержание

- 2. A Quick Note Before Starting The most effective ways for saving

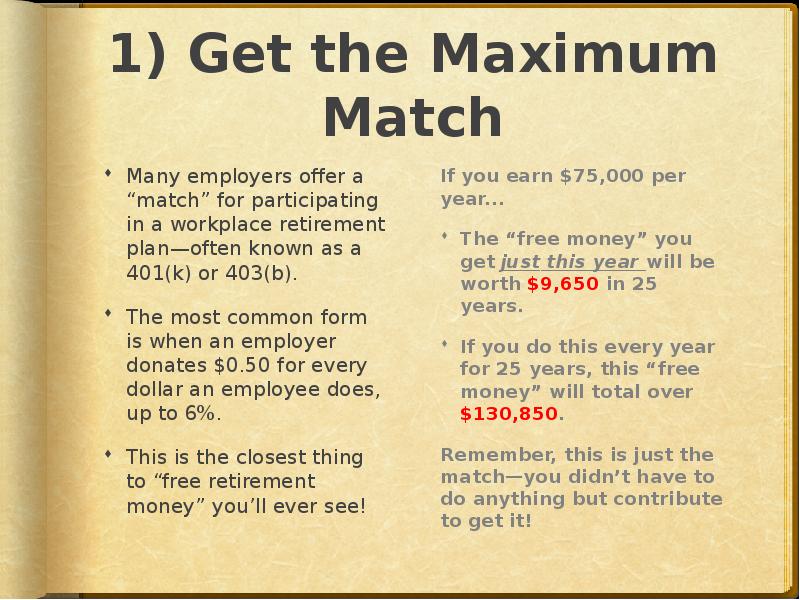

- 3. 1) Get the Maximum Match Many employers offer a “match” for

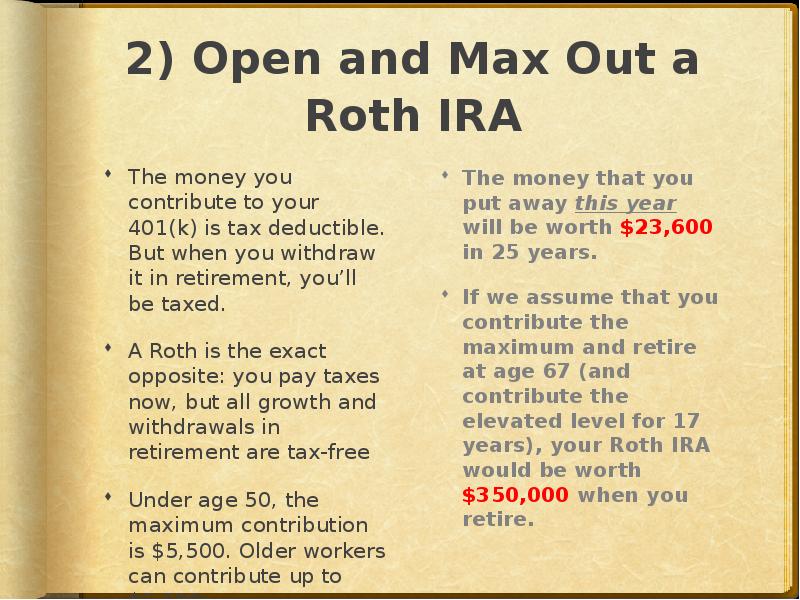

- 4. 2) Open and Max Out a Roth IRA The money you

- 5. 3) Open a Health Savings Account (HSA) You must have a

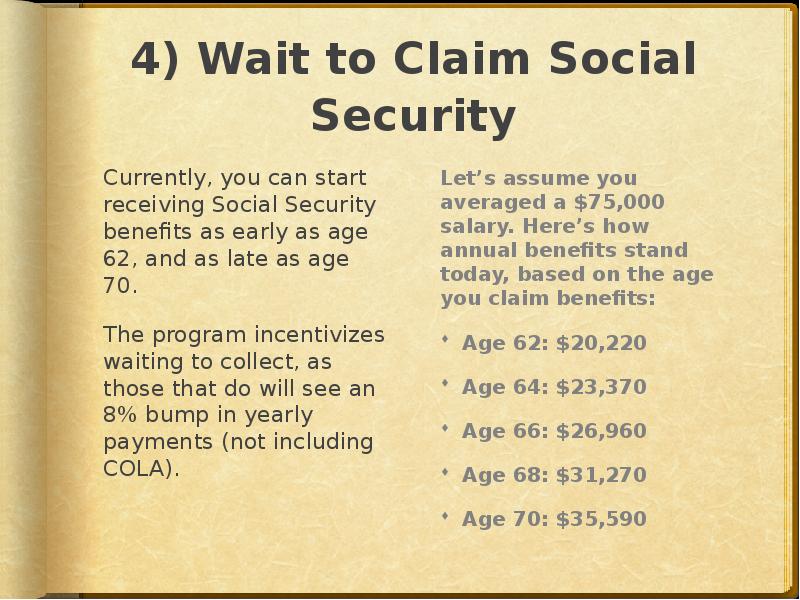

- 6. 4) Wait to Claim Social Security Currently, you can start receiving

- 7. 5) Invest with Low Fees ETFs or Index Funds

- 10. 6) Save That Raise We have an awful tendency as human

- 11. 7) Learn How to Cook Last year, for the first time,

- 12. 8) Switch to Republic Wireless In late 2013, the average household

- 13. 9) Cut the Cable The average monthly cable bill is $64;

- 14. 10) Get those Credit Cards Working for You Some expenses are

- 16. To learn more, check out: The $60,000 Social Security Bonus Most

- 17. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему 10 Easy Ways to Save More for Retirement можно ниже:

Похожие презентации