5 Reasons Oil Prices Could Jump презентация

Содержание

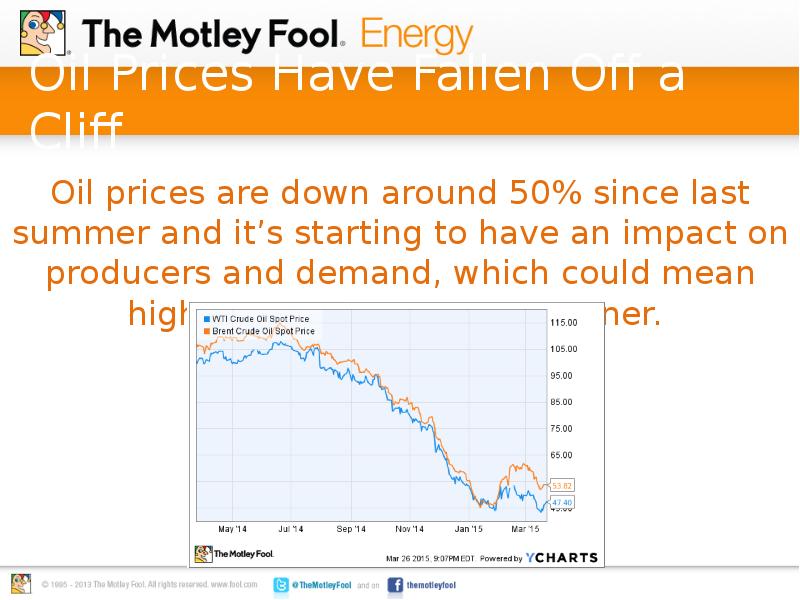

- 2. Oil Prices Have Fallen Off a Cliff Oil prices are down

- 3. Capital Spending Cuts Oil explorers are slashing capital budgets to stay

- 4. OPEC May Be Tired of Low Prices OPEC will lose an

- 5. International Unrest After a decade of wars, revolutions, and terrorism that

- 6. Bigger Cars and a Better Economy With oil prices near $2

- 7. China and India Could Boost Growth One of the fears that

- 8. Will Oil Prices Jump in 2015? We don’t know exactly where

- 10. Скачать презентацию

Слайды и текст этой презентации

Похожие презентации