International Trade : Theory and Policy презентация

Содержание

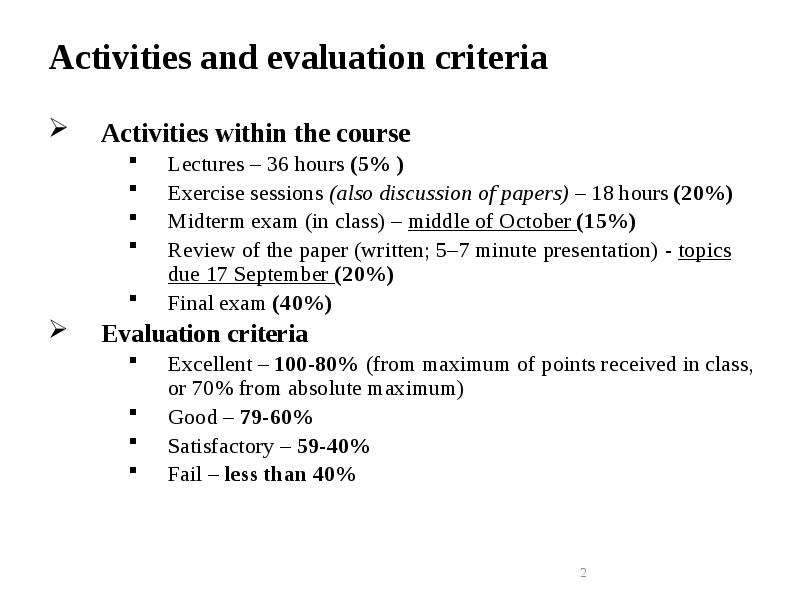

- 2. Activities and evaluation criteria Activities within the course Lectures – 36

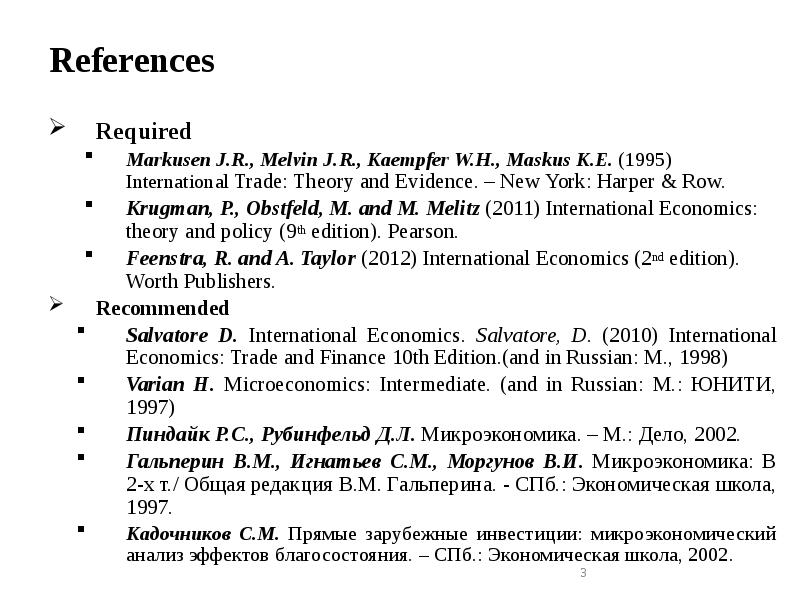

- 3. References Required Markusen J.R., Melvin J.R., Kaempfer W.H., Maskus K.E. (1995)

- 4. Part I. General equilibrium in closed and open economies Topic 1.

- 5. Topic 1. Issues of modern International Trade Theory. Technical concepts of

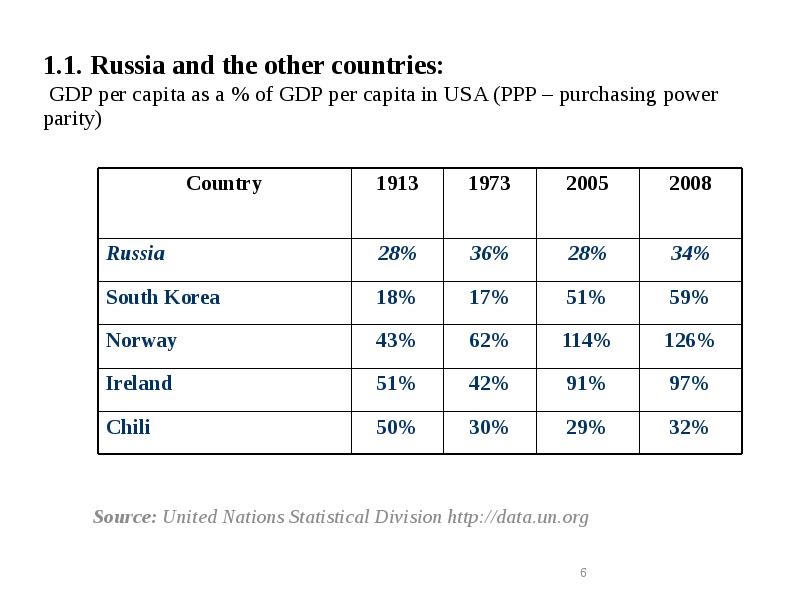

- 6. 1.1. Russia and the other countries: GDP per capita as a

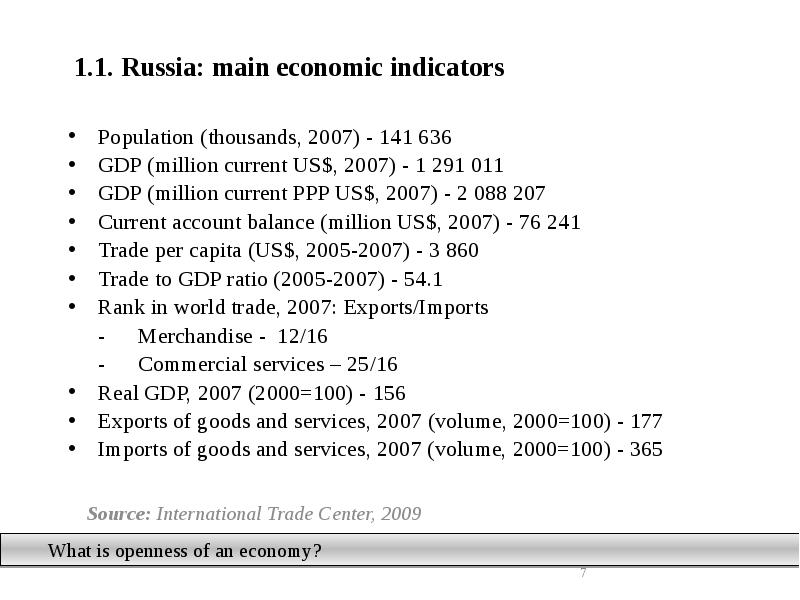

- 7. 1.1. Russia: main economic indicators Source: International Trade Center, 2009

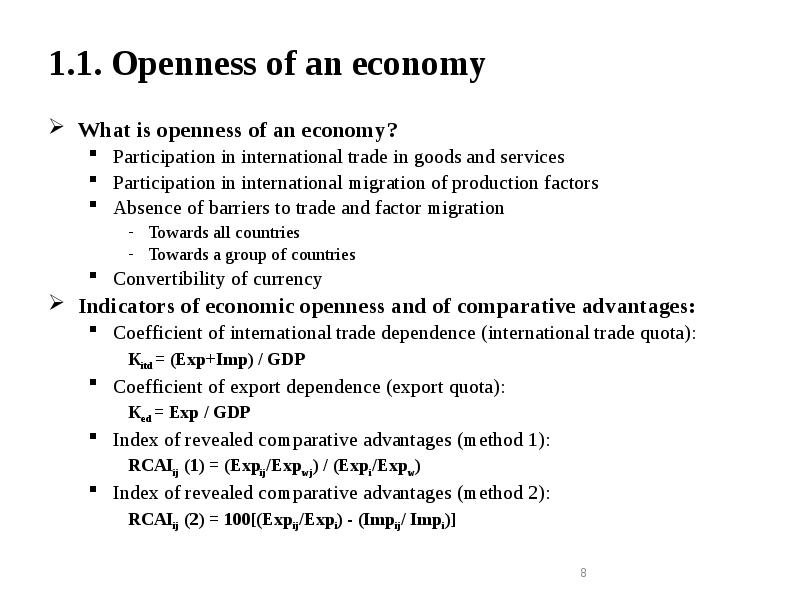

- 8. 1.1. Openness of an economy What is openness of an economy?

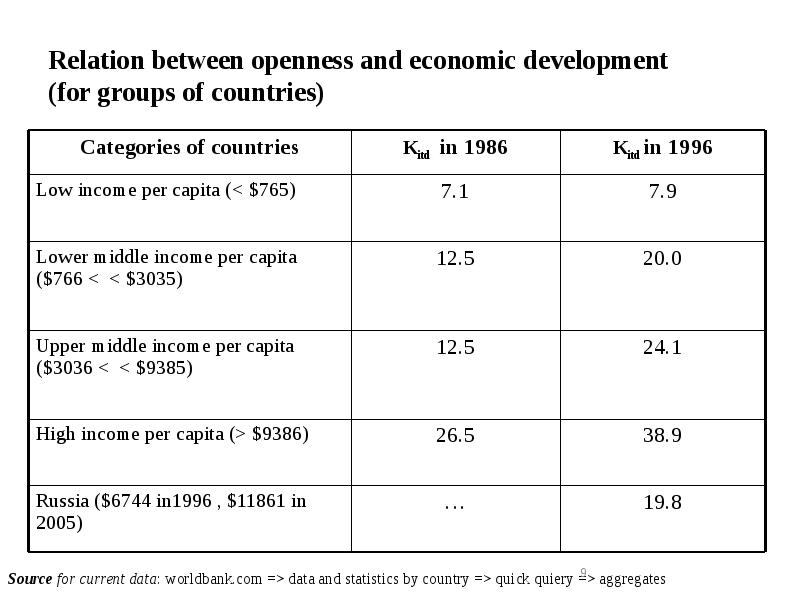

- 9. Relation between openness and economic development (for groups of countries)

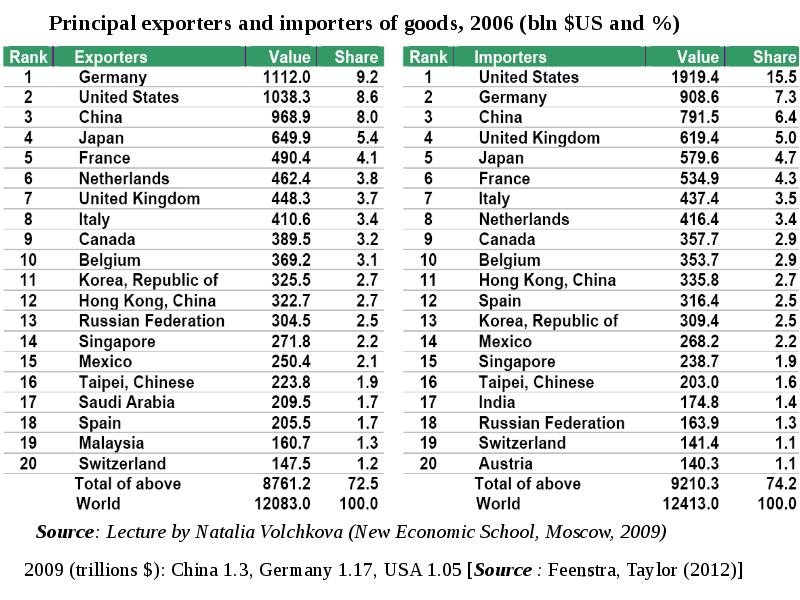

- 10. Principal exporters and importers of goods, 2006 (bln $US and %)

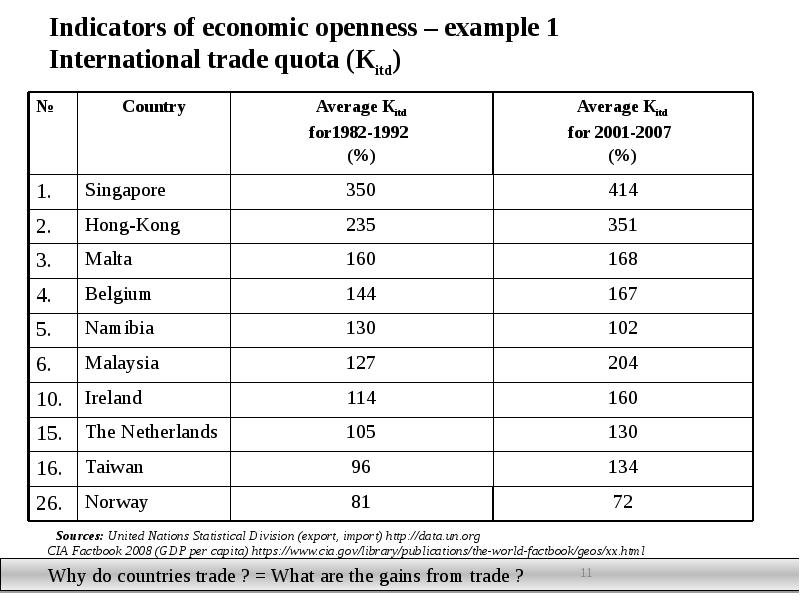

- 11. Indicators of economic openness – example 1 International trade quota (Кitd)

- 12. Gains from openness i.e. arguments for economic openness (1) Access to

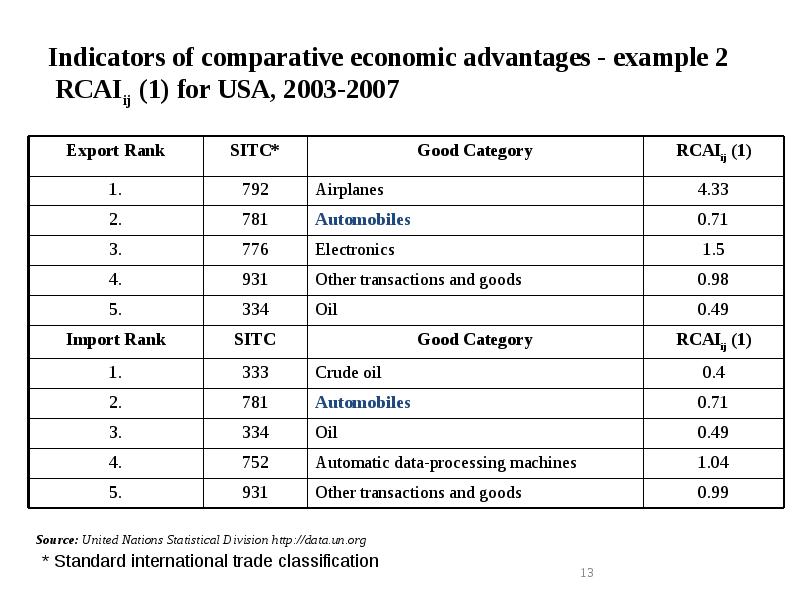

- 13. Indicators of comparative economic advantages - example 2 RCAIij (1) for

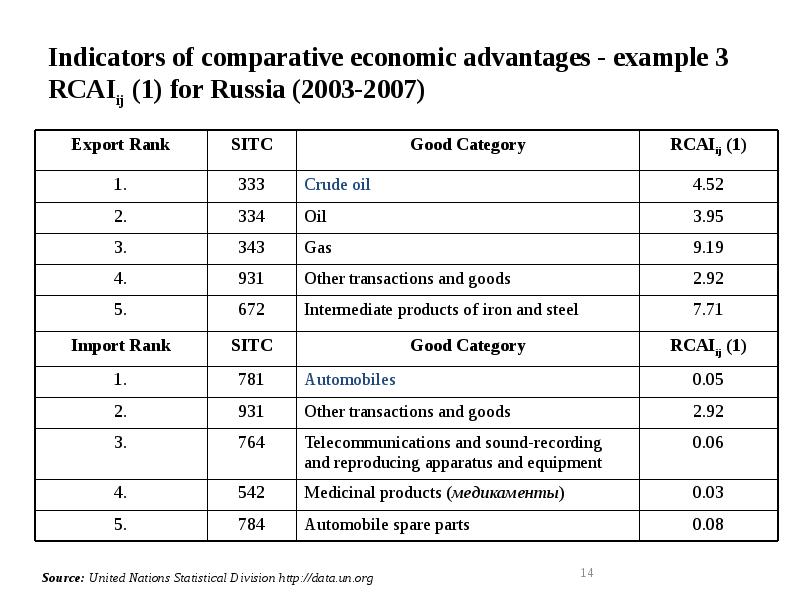

- 14. Indicators of comparative economic advantages - example 3 RCAIij (1) for

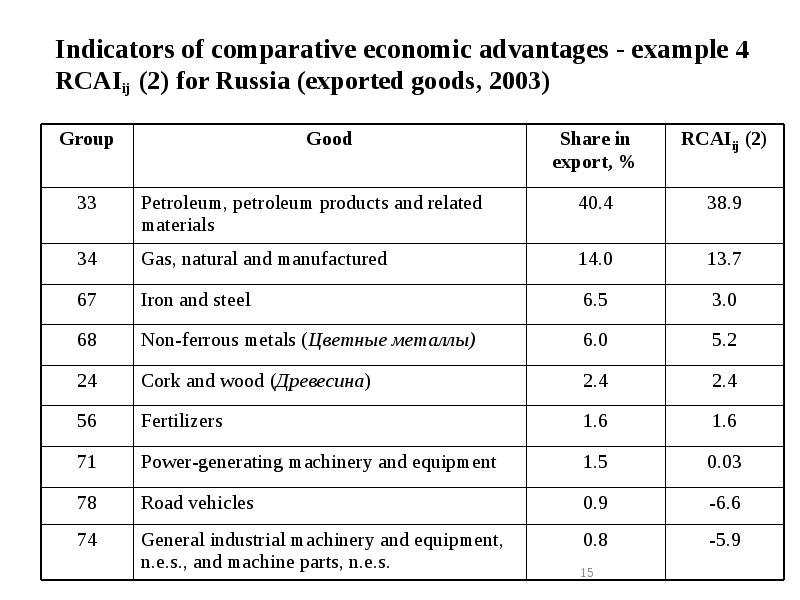

- 15. Indicators of comparative economic advantages - example 4 RCAIij (2) for

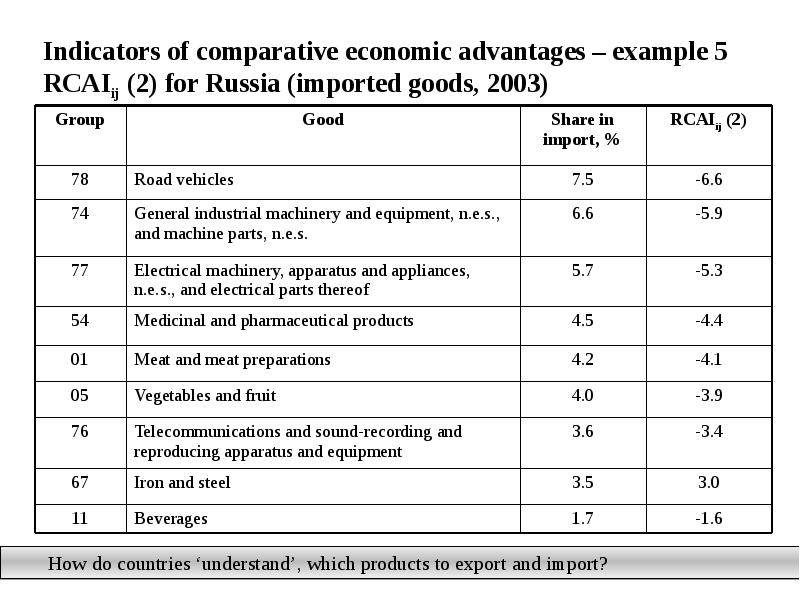

- 16. Indicators of comparative economic advantages – example 5 RCAIij (2) for

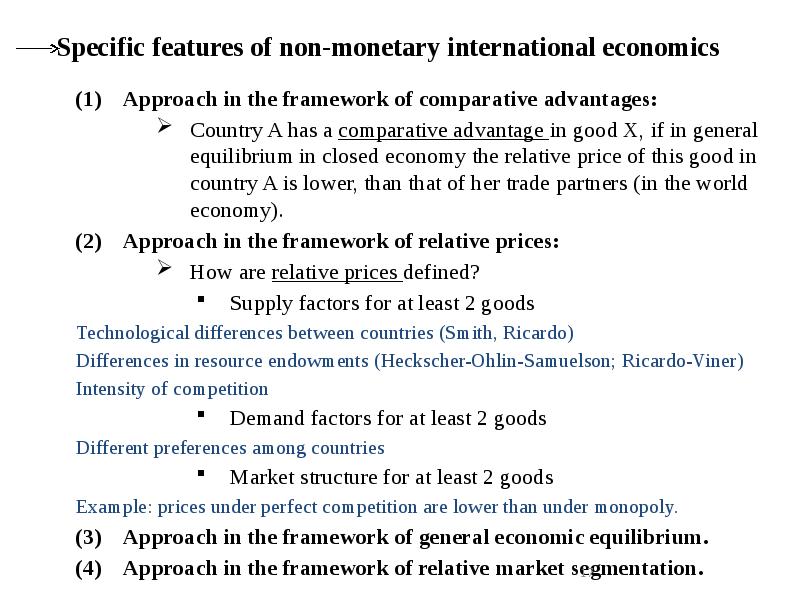

- 17. Specific features of non-monetary international economics Approach in the framework of

- 19. Main macroeconomic indicators of the Russian economy (% to the respective

- 20. Dynamics of Russian export (with seasonal correction, 1st quarter of 1994

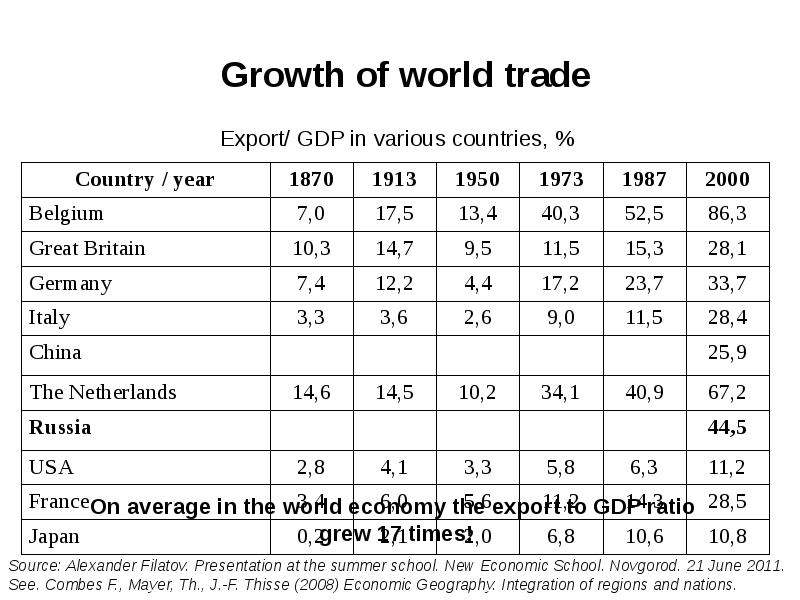

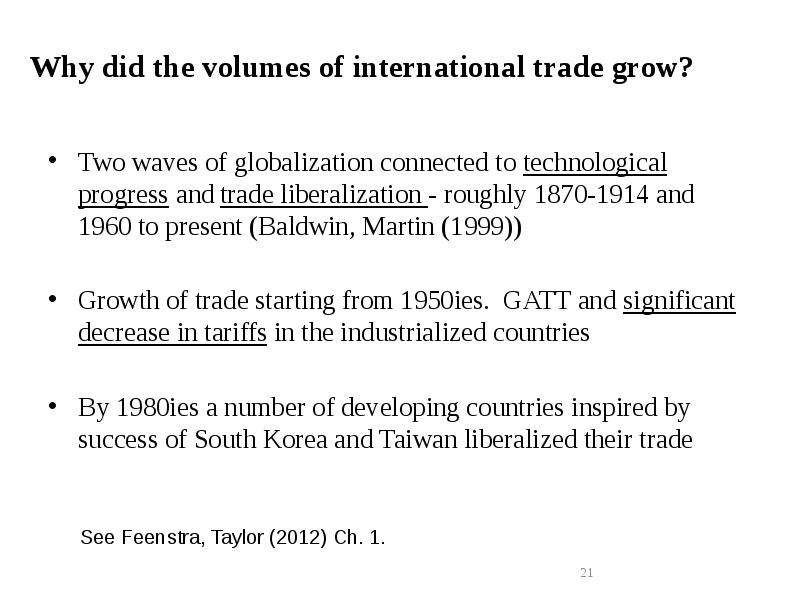

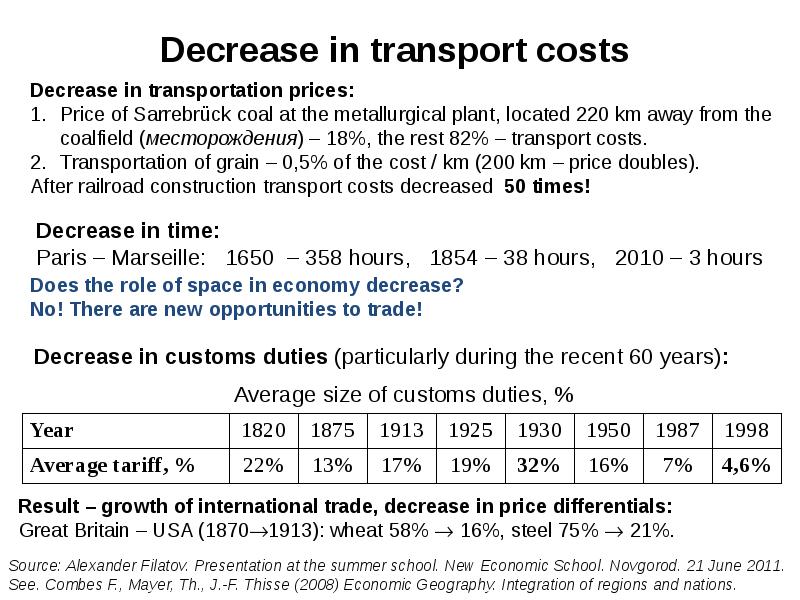

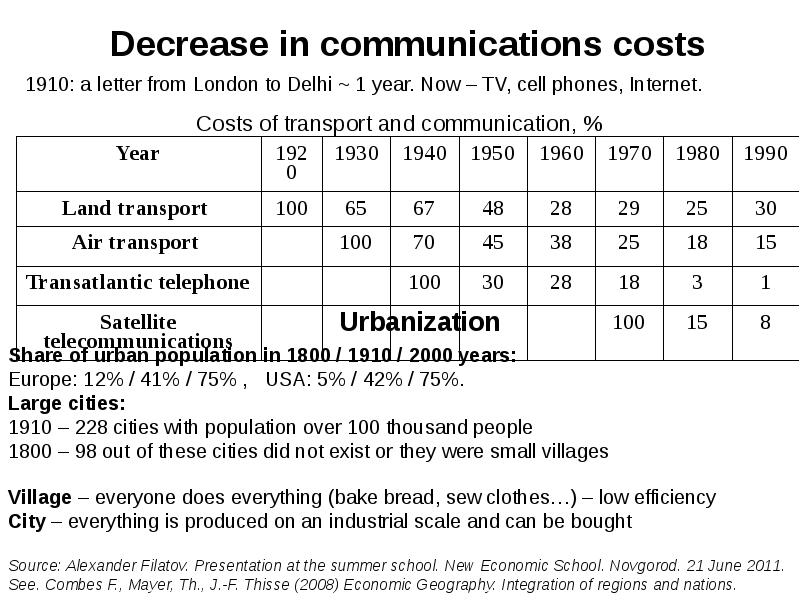

- 21. Why did the volumes of international trade grow? Two waves

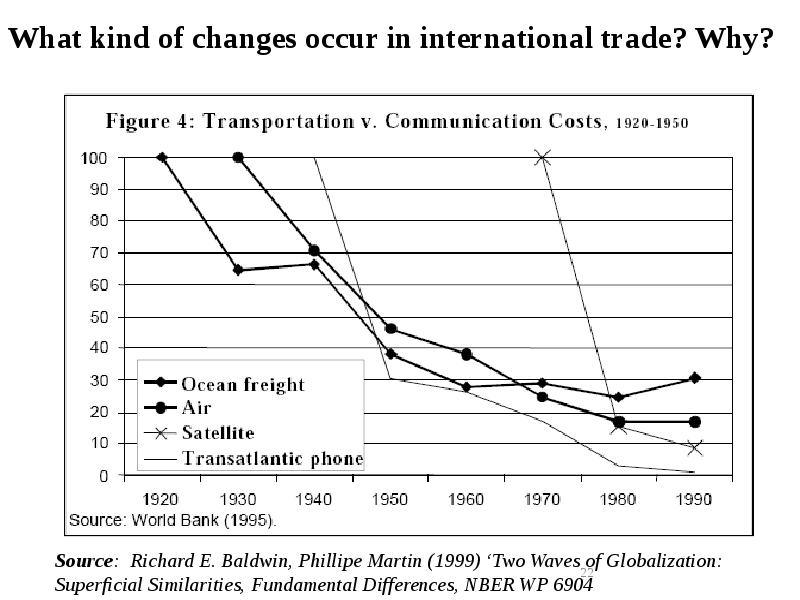

- 22. What kind of changes occur in international trade? Why?

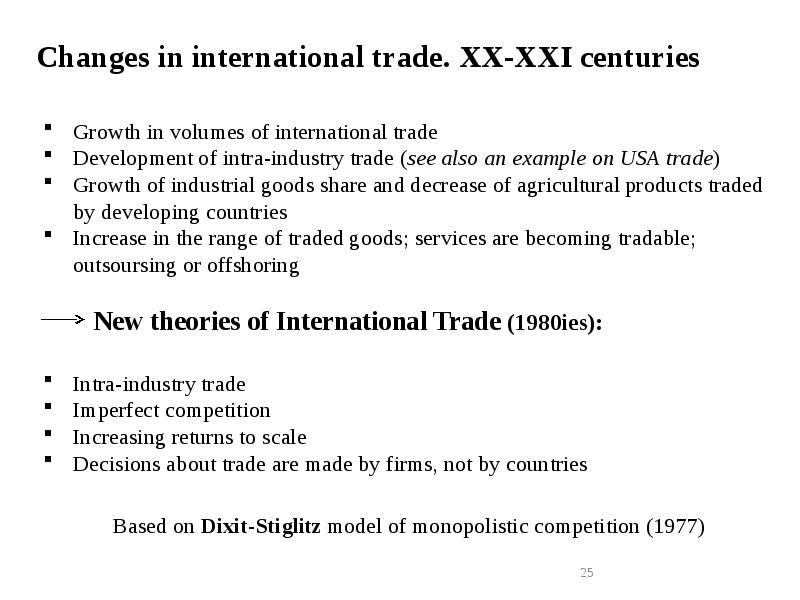

- 25. Changes in international trade. XX-XXI centuries Growth in volumes of

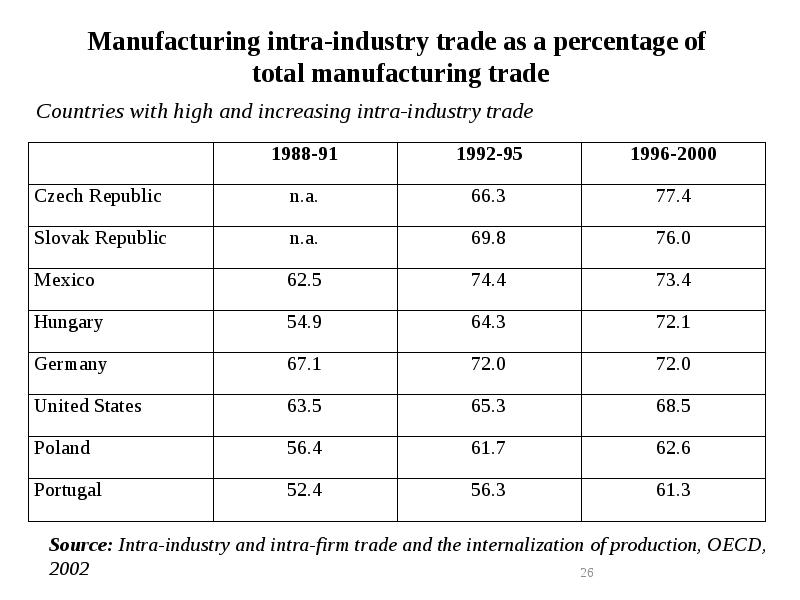

- 26. Manufacturing intra-industry trade as a percentage of total manufacturing trade

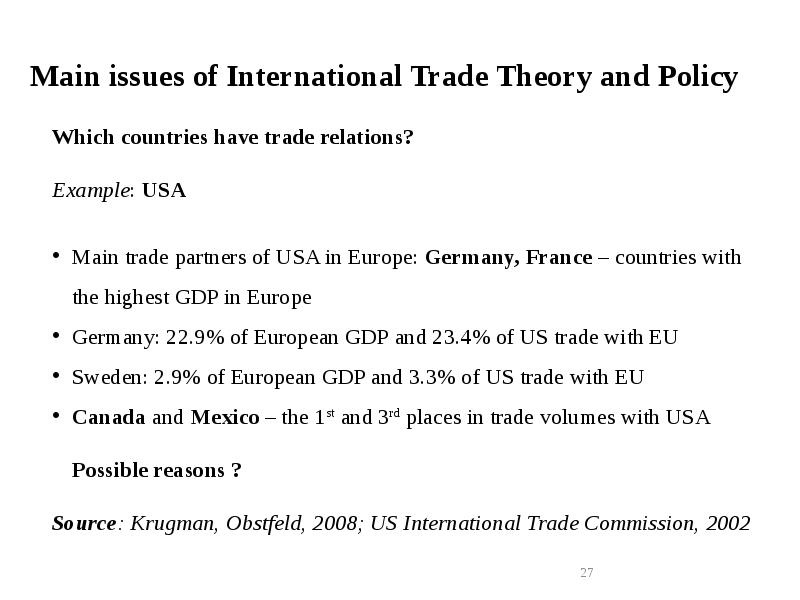

- 27. Main issues of International Trade Theory and Policy Which countries have

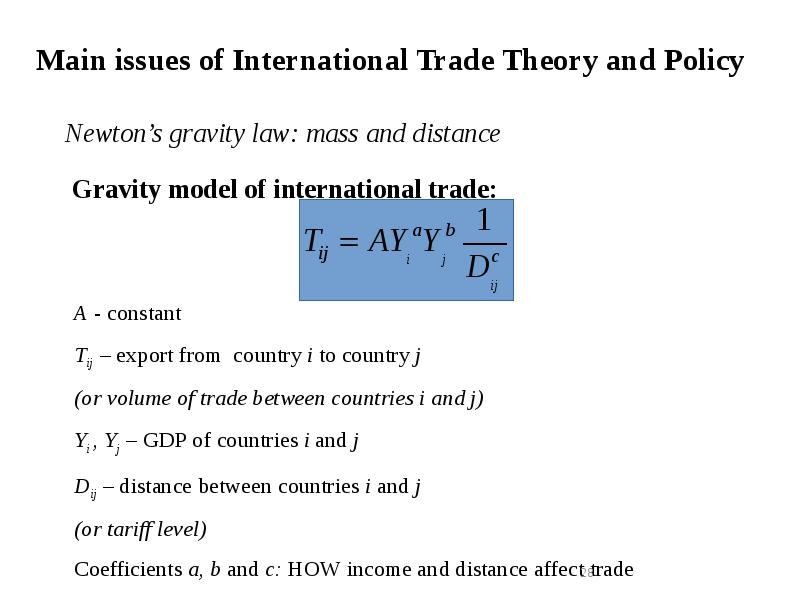

- 28. Main issues of International Trade Theory and Policy Newton’s gravity law:

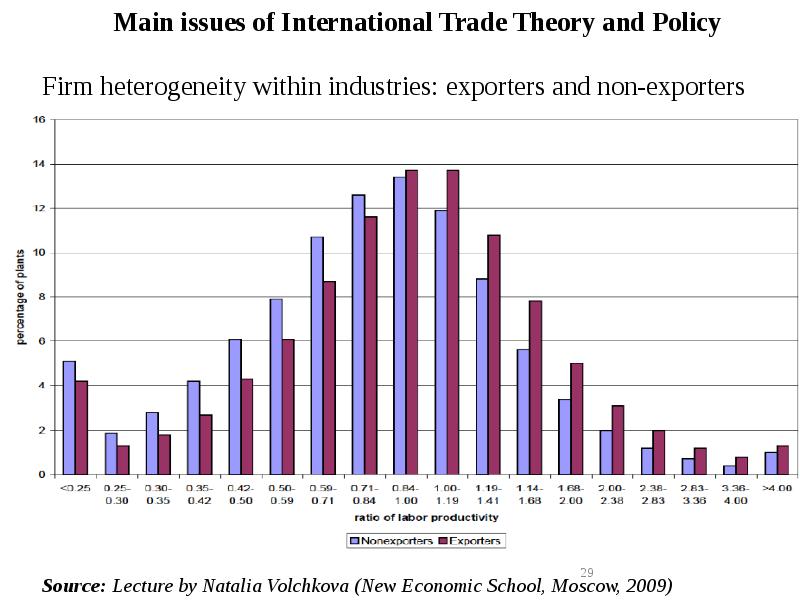

- 30. Models with heterogeneous firms* Models with heterogeneous firms*

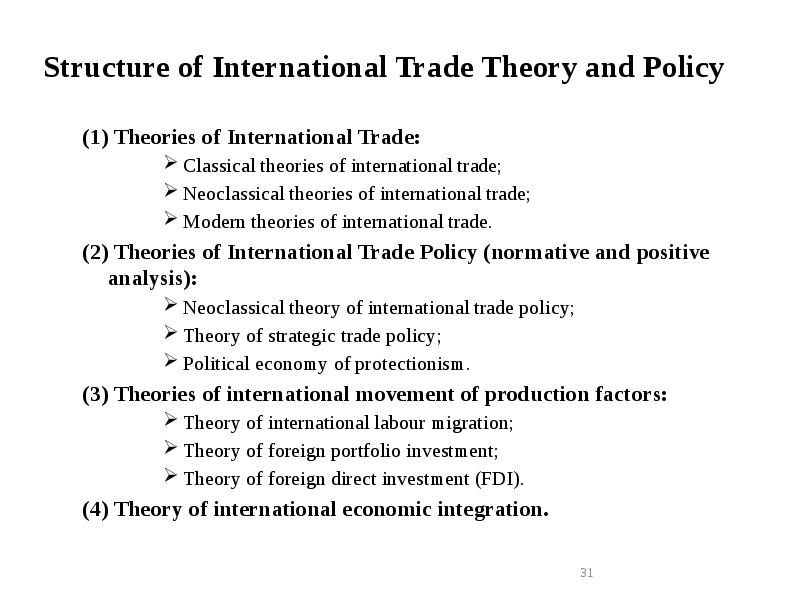

- 31. Structure of International Trade Theory and Policy (1) Theories of International

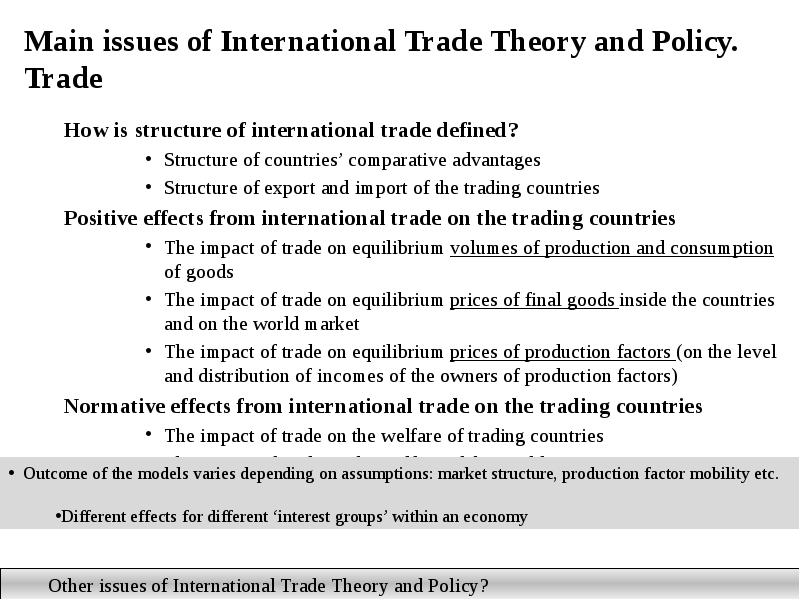

- 32. Main issues of International Trade Theory and Policy. Trade How is

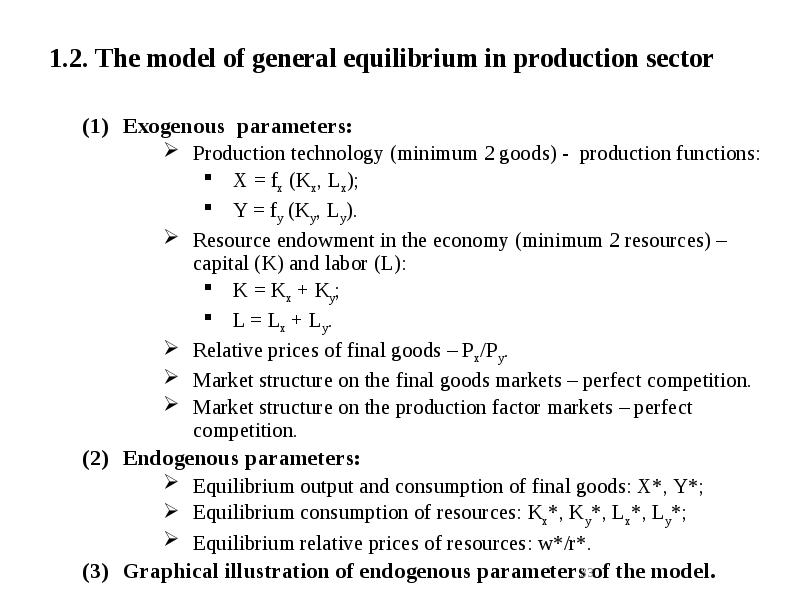

- 33. 1.2. The model of general equilibrium in production sector Exogenous parameters:

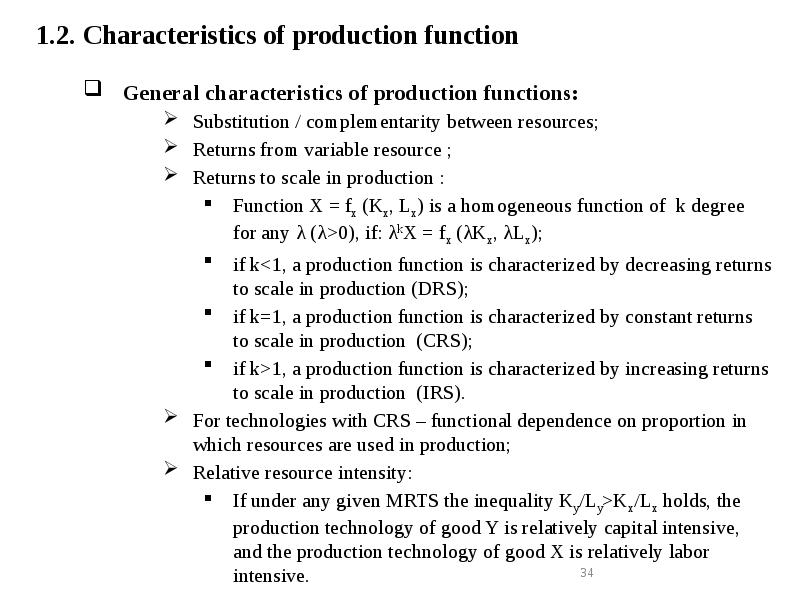

- 34. 1.2. Characteristics of production function General characteristics of production functions: Substitution

- 35. 1.2. Characteristics of production function - continued Specific features of the

- 36. 1.2. Concept of Pareto-efficiency in production sector Pareto-efficiency in production sector:

- 37. 1.2. Algebraic solution of general equilibrium model in production sector Algebraic

- 38. 1.2. Graphical illustration of general equilibrium in production sector Graphical illustration

- 39. 1.3. Interrelation between technology and production possibility curve Properties of

- 40. Homework: Homework: Exercise session 1 Some references (please see details in

- 41. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему International Trade : Theory and Policy можно ниже:

Похожие презентации