4 Great Stocks For Beginners презентация

Содержание

- 2. What makes a good “beginner” stock? What makes a good “beginner”

- 3. Low risk The best stocks for beginners won’t make you

- 4. “100-year” businesses Look for businesses will be around forever For example,

- 5. A diverse revenue stream Ideally, stocks for beginners will make their

- 6. Other things to look for… Stocks with a history of dividend

- 7. 4 “Beginner” stocks to get you started… 4 “Beginner” stocks to

- 8. 1. Berkshire Hathaway (NYSE: BRK.B) Berkshire Hathaway one of the best

- 9. Berkshire Hathaway has more than 50 subsidiary companies, as well as

- 10. Just a few of Berkshire’s subsidiaries… GEICO The Pampered Chef Fruit

- 11. Some of Berkshire’s major stock holdings… American Express Deere & Company

- 12. 2. Colgate-Palmolive (NYSE: CL) Colgate-Palmolive produces many name-brand products including Ajax

- 13. Colgate Palmolive is a “dividend aristocrat”, which means that it raises

- 14. Geographic diversity Colgate-Palmolive’s sales come from all over the globe

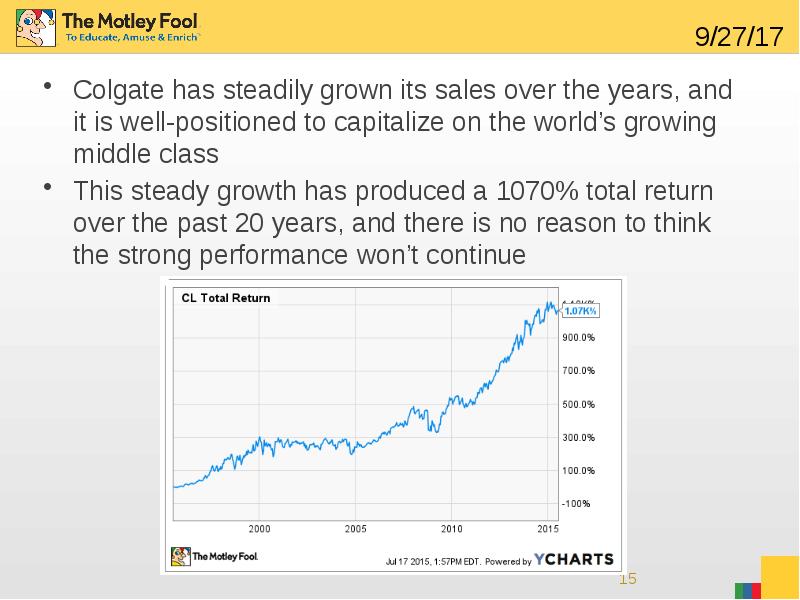

- 15. Colgate has steadily grown its sales over the years, and it

- 16. 3. ExxonMobil (NYSE: XOM) The largest publicly-traded integrated oil company ExxonMobil

- 17. ExxonMobil has exposure to all aspects of the oil business So,

- 18. During tough times, ExxonMobil has the ability to capitalize on smaller,

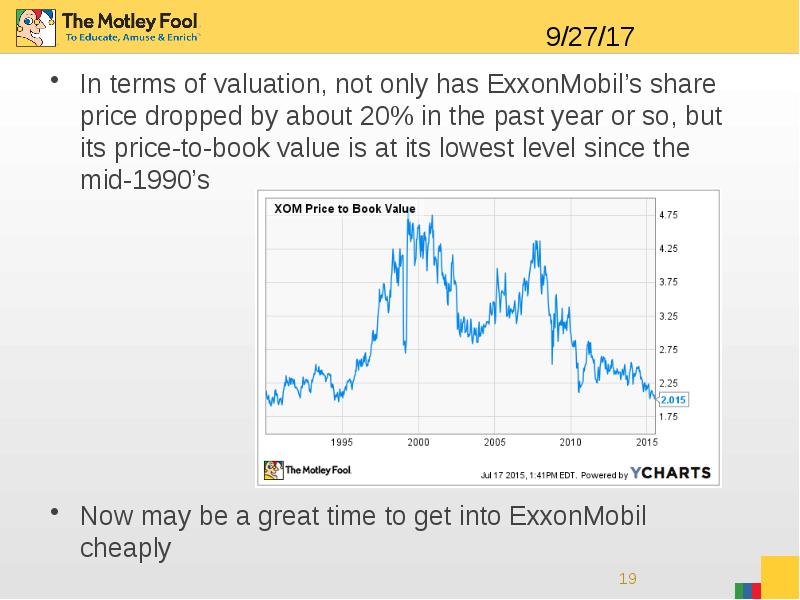

- 19. In terms of valuation, not only has ExxonMobil’s share price dropped

- 20. 4. Johnson & Johnson (NYSE: JNJ) In addition to its portfolio

- 21. J&J’s size and brand power are tremendous competitive advantages Its size

- 22. Johnson & Johnson has an outstanding 53-year history of dividend increases

- 23. SFR CLICK HERE TO READ NOW

- 24. Скачать презентацию

Слайды и текст этой презентации

Похожие презентации