5 Signs Your Dividend Stocks Might Be In Trouble презентация

Содержание

- 2. Many investors look at dividend stocks as a safe way to

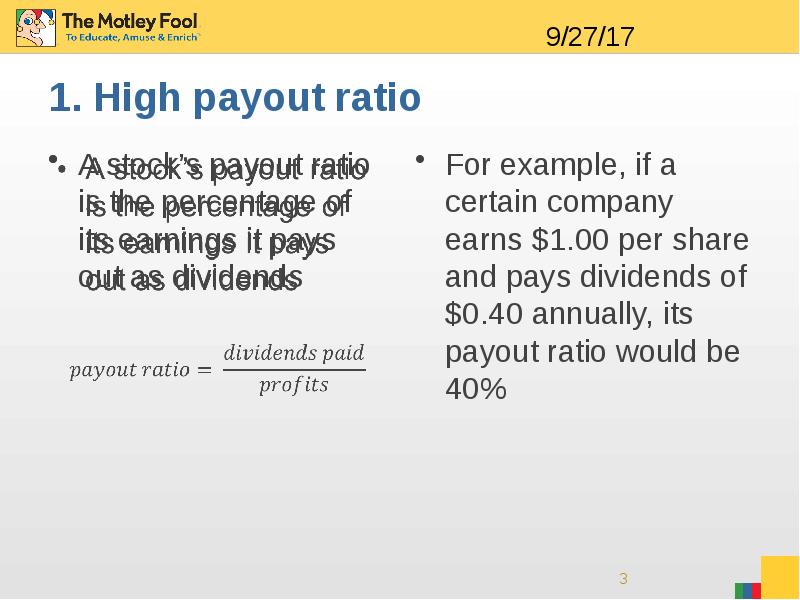

- 3. 1. High payout ratio A stock’s payout ratio is the percentage

- 4. The lower the payout ratio, the easier it is for a

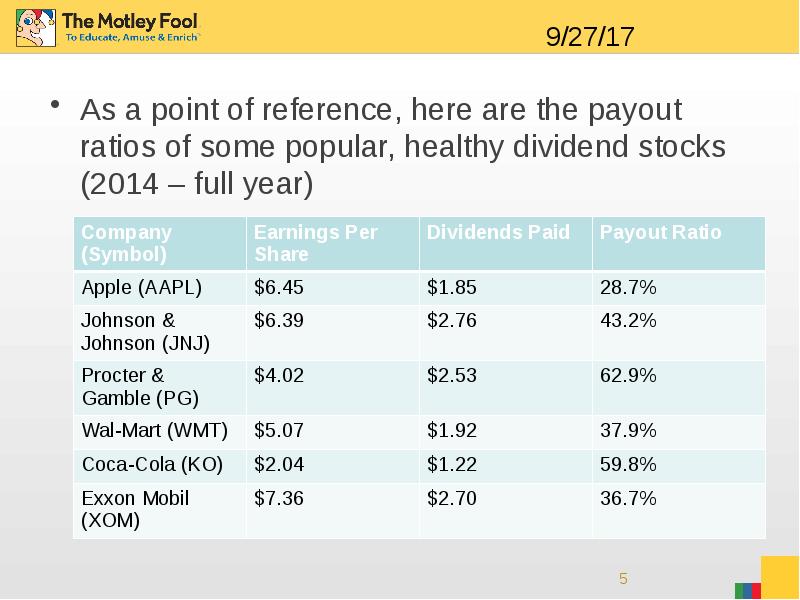

- 5. As a point of reference, here are the payout ratios of

- 6. A dangerous payout ratio… GlaxoSmithKline (NYSE: GSK) has a payout ratio

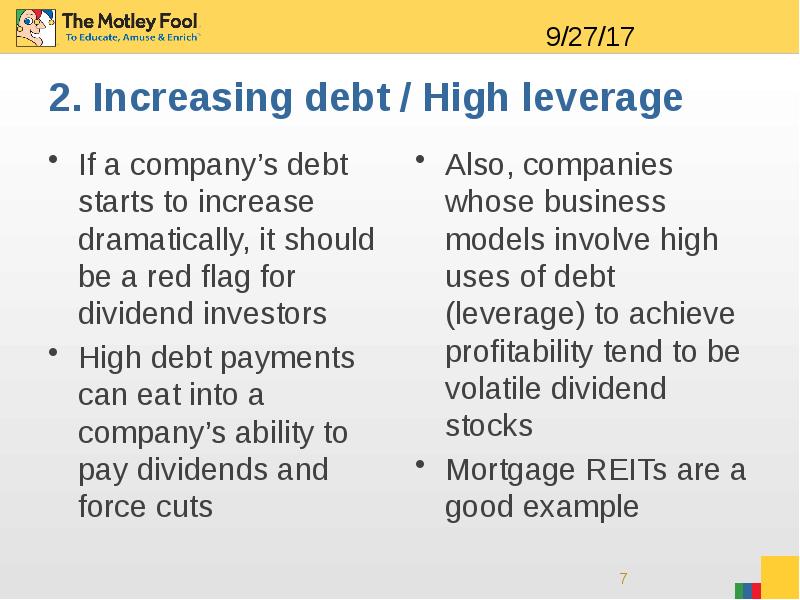

- 7. 2. Increasing debt / High leverage If a company’s debt starts

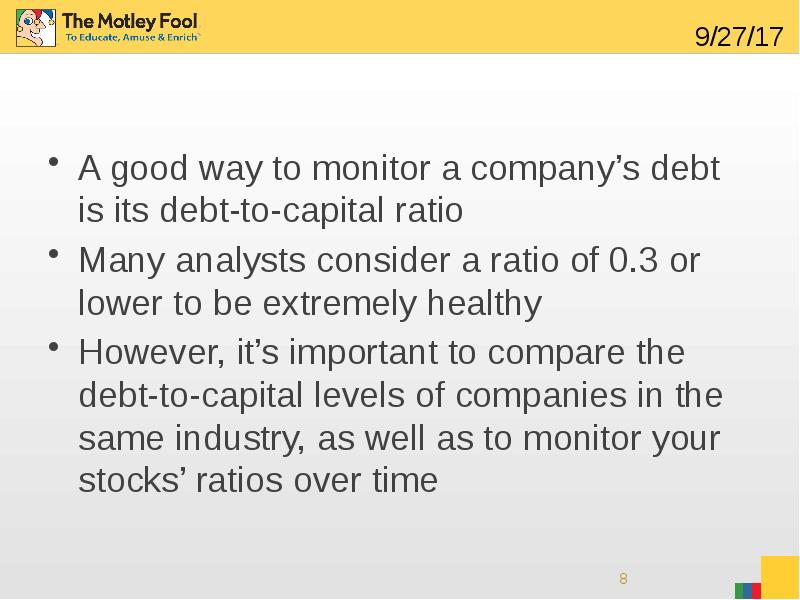

- 8. A good way to monitor a company’s debt is its debt-to-capital

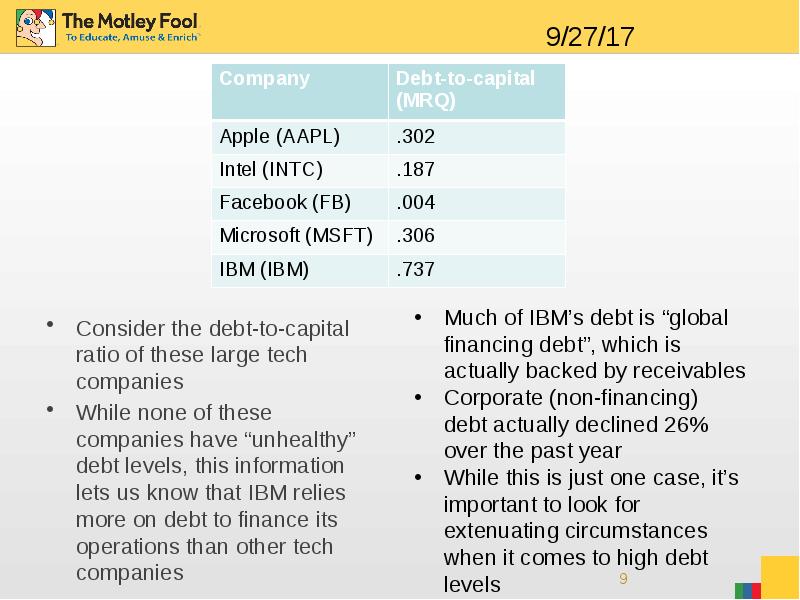

- 9. Consider the debt-to-capital ratio of these large tech companies While none

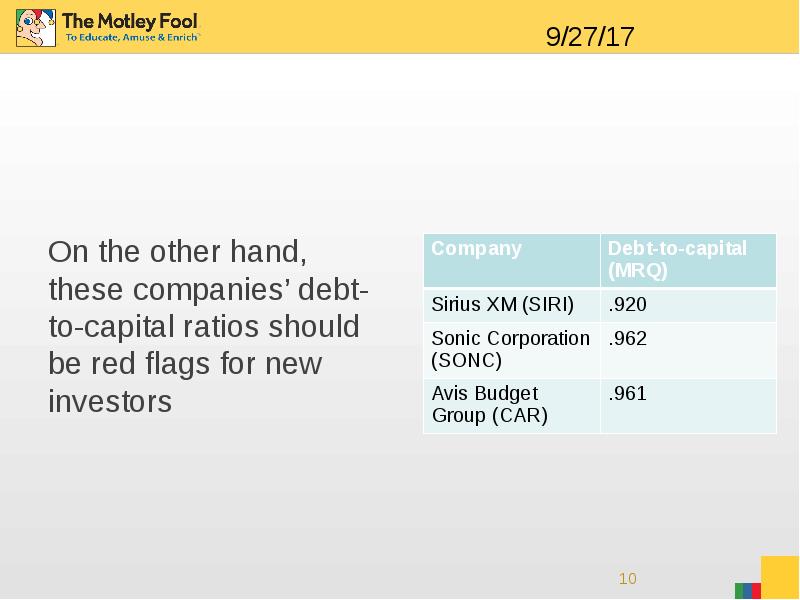

- 10. On the other hand, these companies’ debt-to-capital ratios should be red

- 11. 3. An “unhealthy” industry Trouble within an industry can be a

- 12. 4. Recent dividend cuts If a company is forced to make

- 13. While a dividend cut isn’t necessarily the wrong move in 100%

- 14. On the other hand, some companies experience temporary cash flow issues

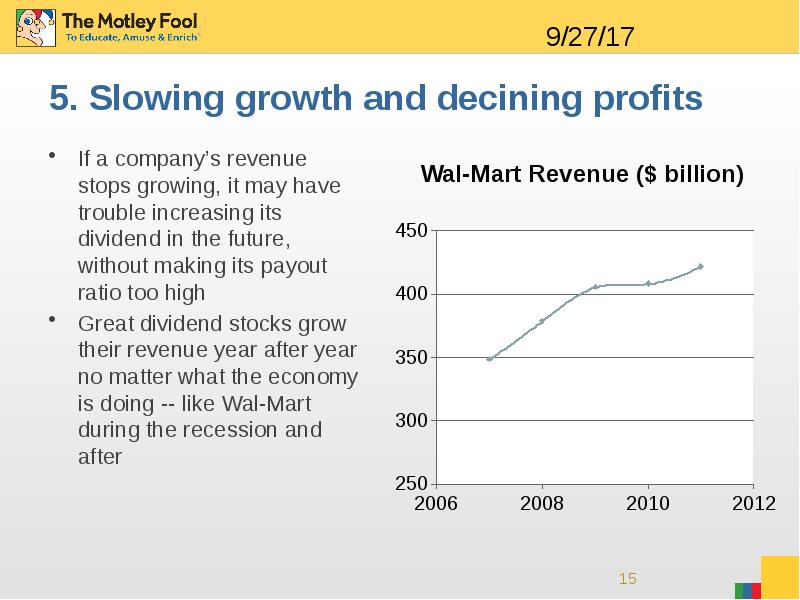

- 15. 5. Slowing growth and decining profits If a company’s revenue stops

- 16. Declining profitability Declining profits (earnings per share) can be a red

- 17. You may also like…The $60,000 Social Security Bonus Most Retirees OverlookCLICK

- 18. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему 5 Signs Your Dividend Stocks Might Be In Trouble можно ниже:

Похожие презентации