How The 2016 Presidential Election Could Affect Your Taxes презентация

Содержание

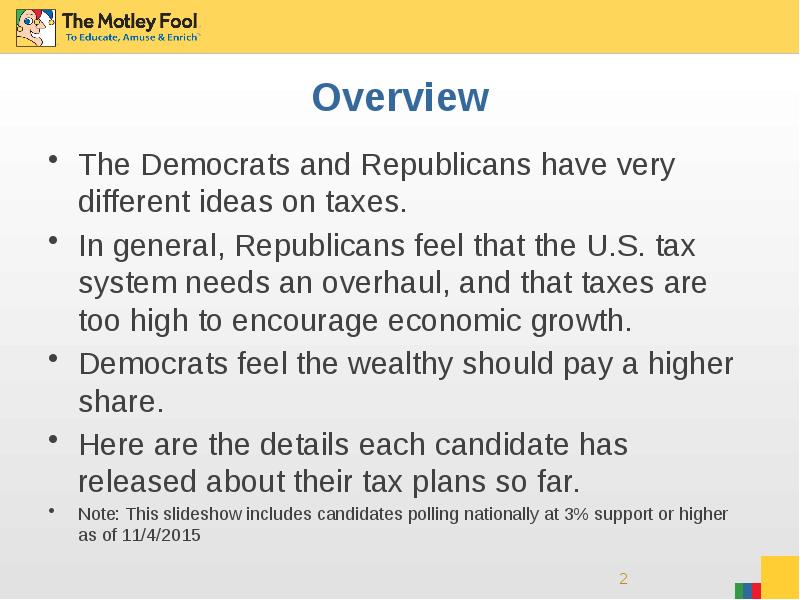

- 2. Overview The Democrats and Republicans have very different ideas on taxes.

- 3. The Republican Candidates

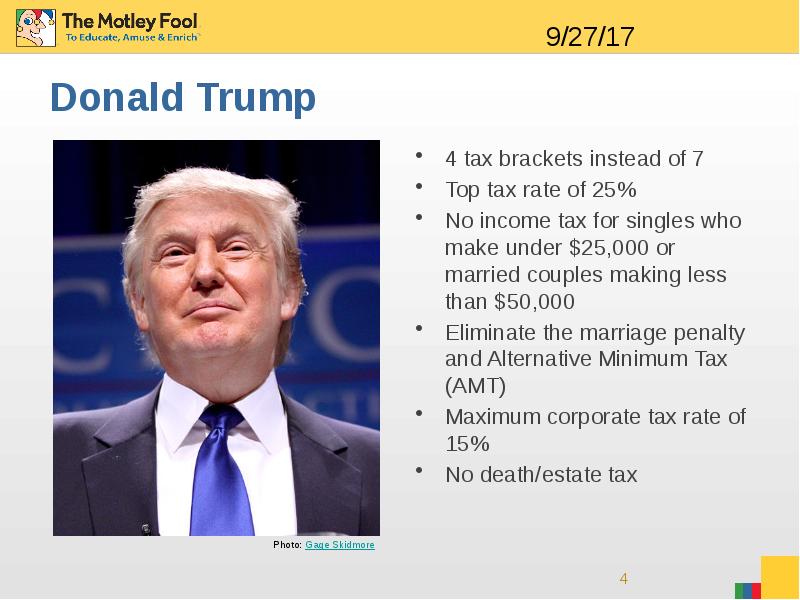

- 4. Donald Trump 4 tax brackets instead of 7 Top tax rate

- 5. Dr. Ben Carson Carson is yet to release a detailed tax

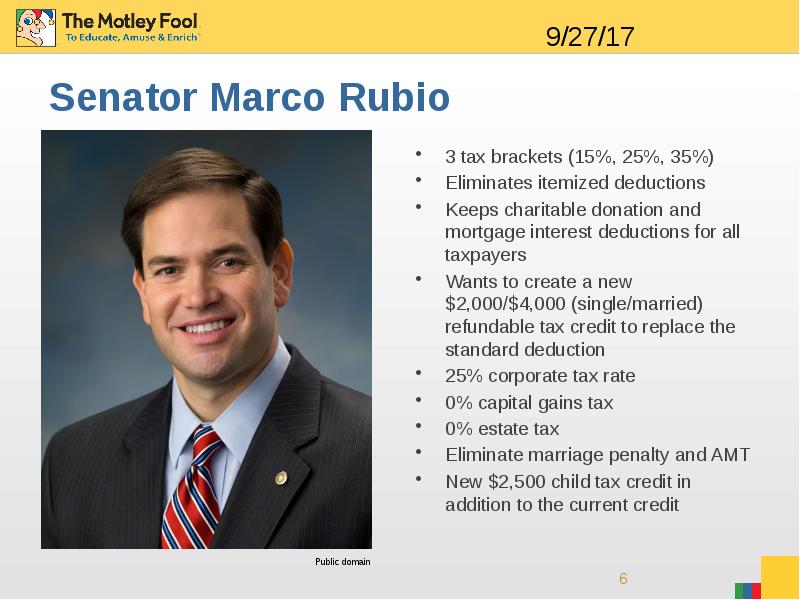

- 6. Senator Marco Rubio 3 tax brackets (15%, 25%, 35%) Eliminates itemized

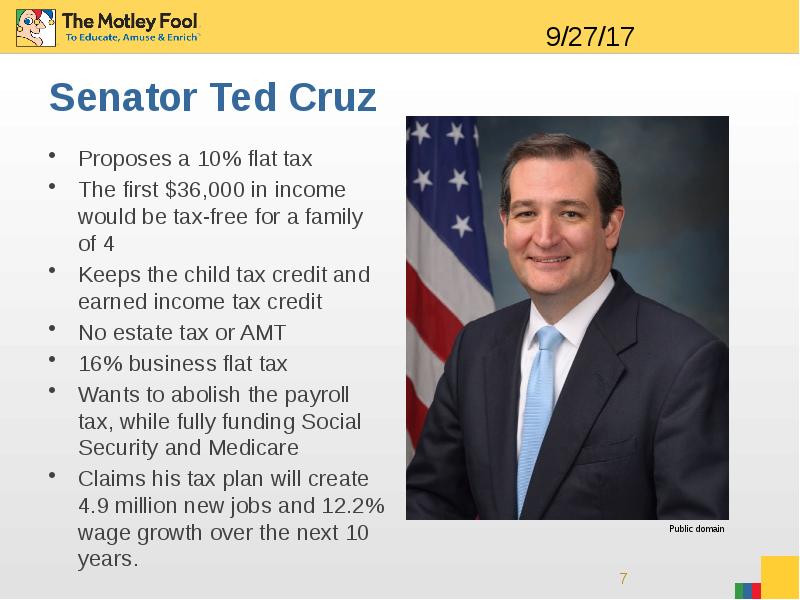

- 7. Senator Ted Cruz Proposes a 10% flat tax The first $36,000

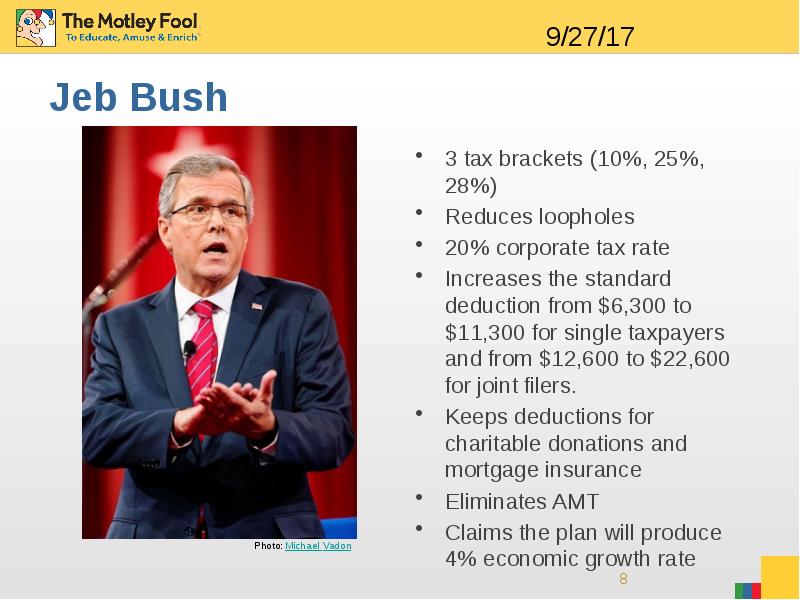

- 8. Jeb Bush 3 tax brackets (10%, 25%, 28%) Reduces loopholes 20%

- 9. Carly Fiorina Has not released a detailed tax plan, but wants

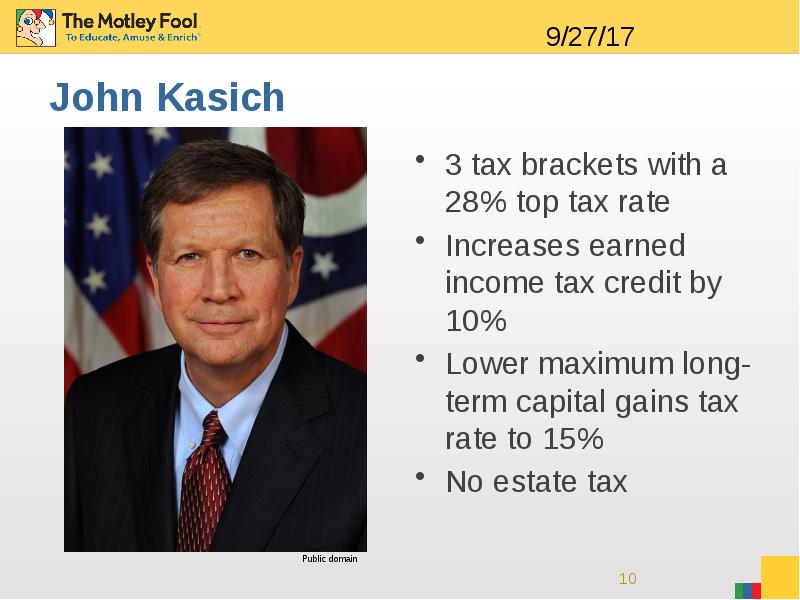

- 10. John Kasich 3 tax brackets with a 28% top tax rate

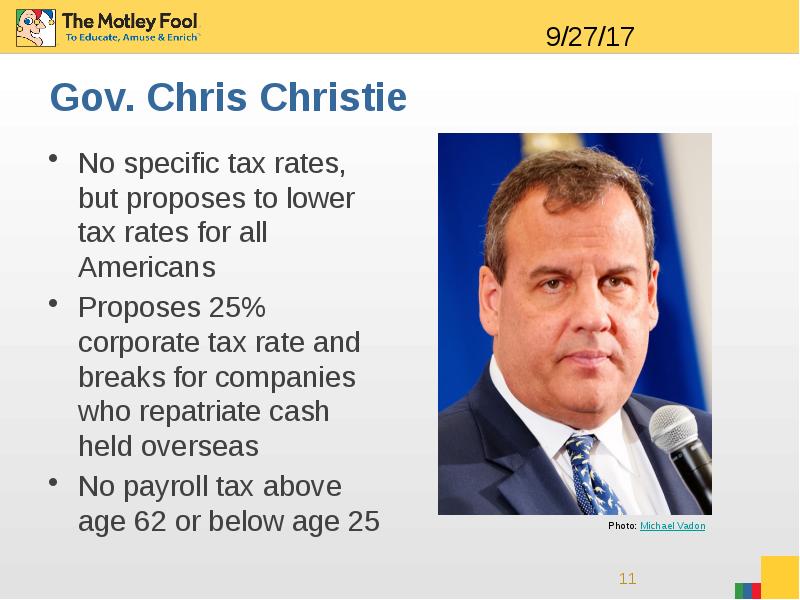

- 11. Gov. Chris Christie No specific tax rates, but proposes to lower

- 12. The Democratic Candidates

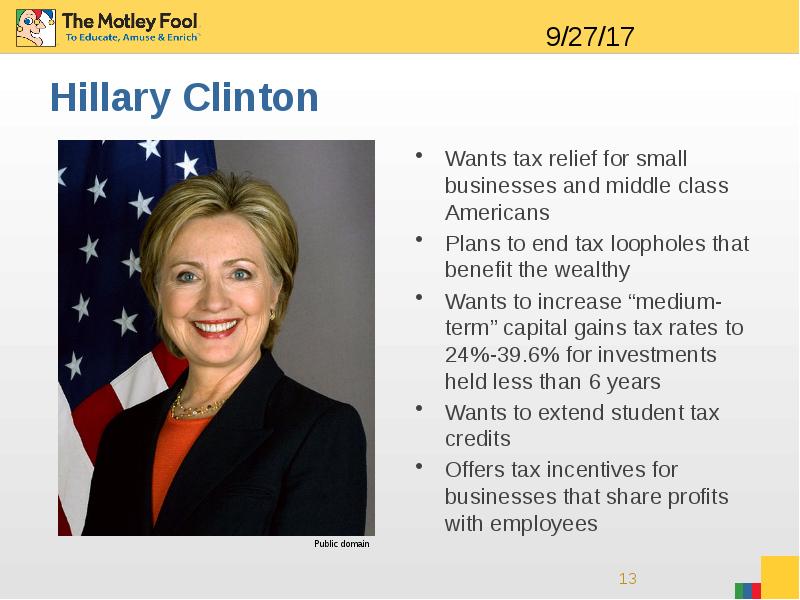

- 13. Hillary Clinton Wants tax relief for small businesses and middle class

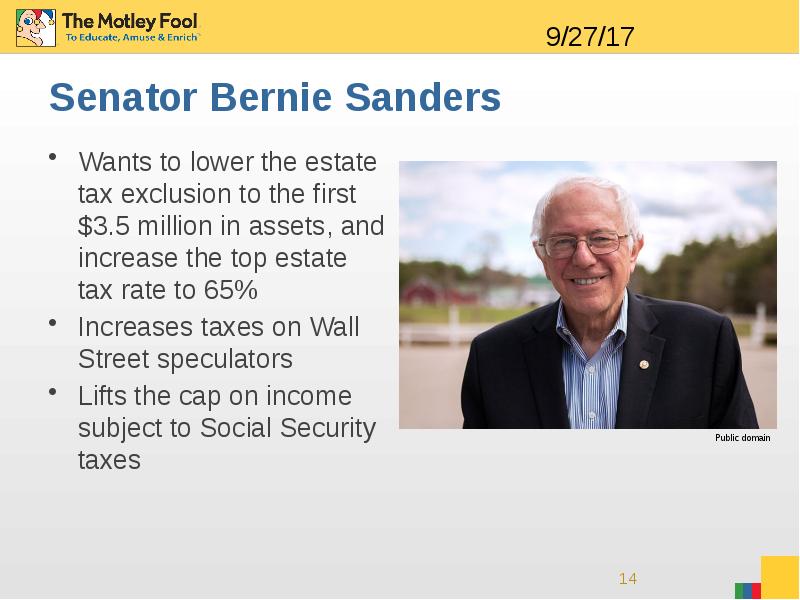

- 14. Senator Bernie Sanders Wants to lower the estate tax exclusion to

- 15. You also may be interested in…The $15,978 Social Security Bonus Most

- 16. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему How The 2016 Presidential Election Could Affect Your Taxes можно ниже:

Похожие презентации