Is Jack in the Box’s Share Buyback Program a Good Deal for Shareholders? презентация

Содержание

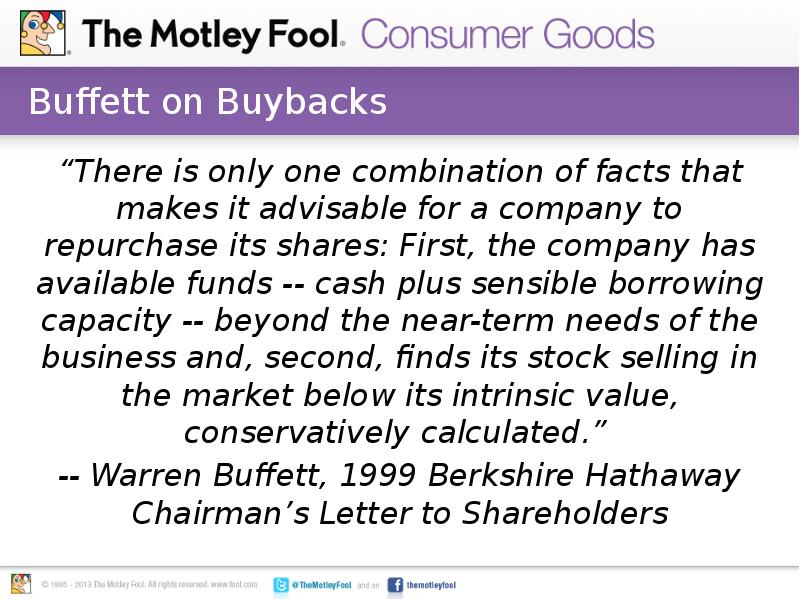

- 2. Buffett on Buybacks “There is only one combination of facts that

- 3. A $200 Million Announcement On September 21, 2015 Jack in

- 4. A Solid Third Quarter Reported 3rd quarter FY 2015 results on

- 5. Why the drop? Stock fell 6% on the earnings news, and

- 6. What Would Warren Do? Is JACKs’ latest share repurchase program a

- 7. What Would Warren Do? There are four possible uses for shareholder’s

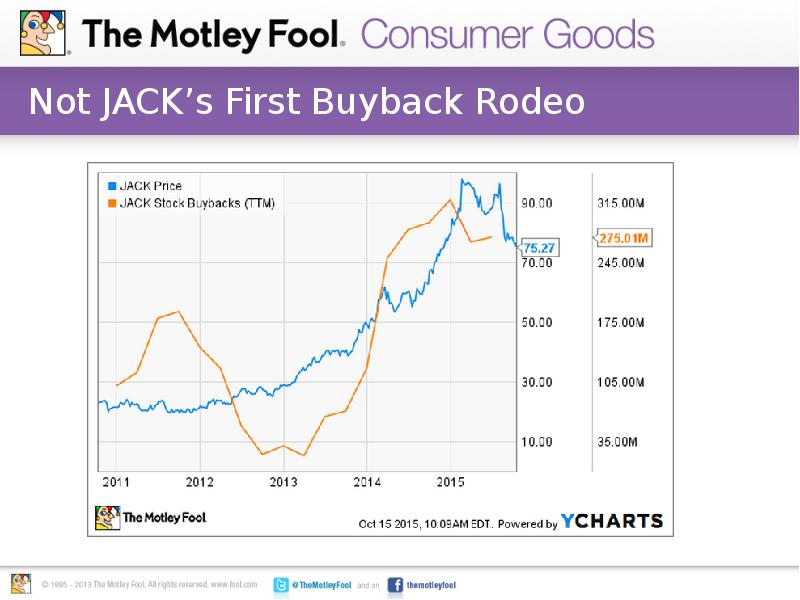

- 8. Not JACK’s First Buyback Rodeo

- 9. JACK’s buyback record is questionable Buyback’s made in FY 2012 were

- 10. Best use of shareholders’ capital? JACK currently trades for 25 times

- 11. Best use of shareholders’ capital? S&P 500 Index’s current P/E ratio

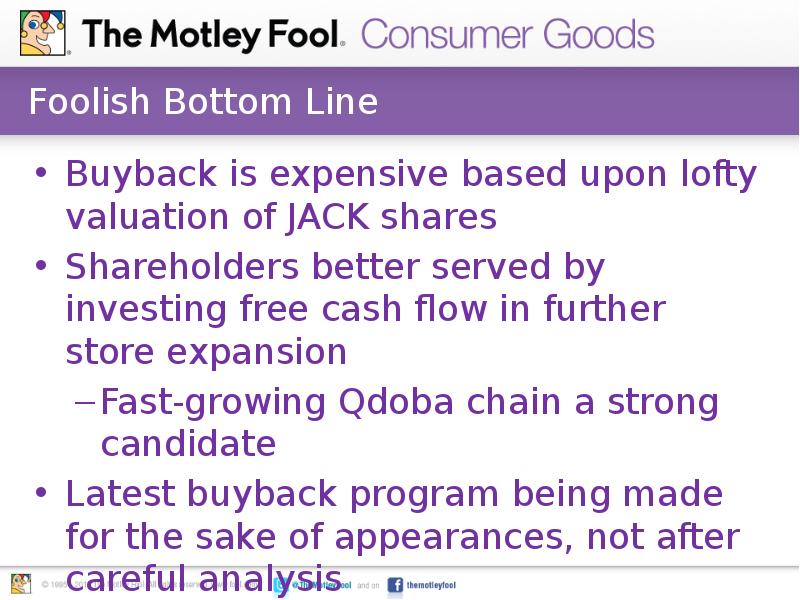

- 12. Foolish Bottom Line Buyback is expensive based upon lofty valuation of

- 14. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему Is Jack in the Box’s Share Buyback Program a Good Deal for Shareholders? можно ниже:

Похожие презентации