Retirement Saving & Spending Study презентация

Содержание

- 2. Table of Contents Methodology Workers with 401(k)s: Millennials, Gen

- 3. Methodology 3,026 working adults 18+ currently contributing to a 401(k) plan

- 4. Workers’ 401(k) Accounts

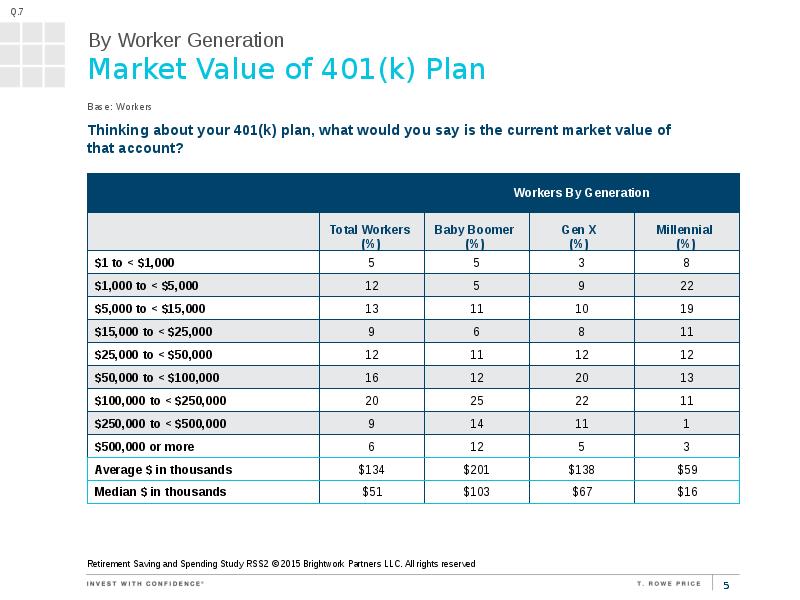

- 5. Market Value of 401(k) Plan

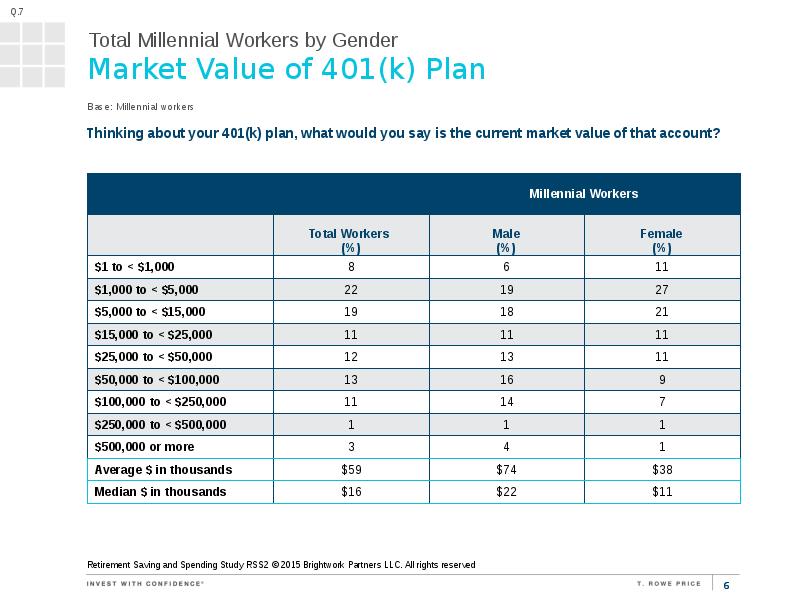

- 6. Base: Millennial workers Base: Millennial workers

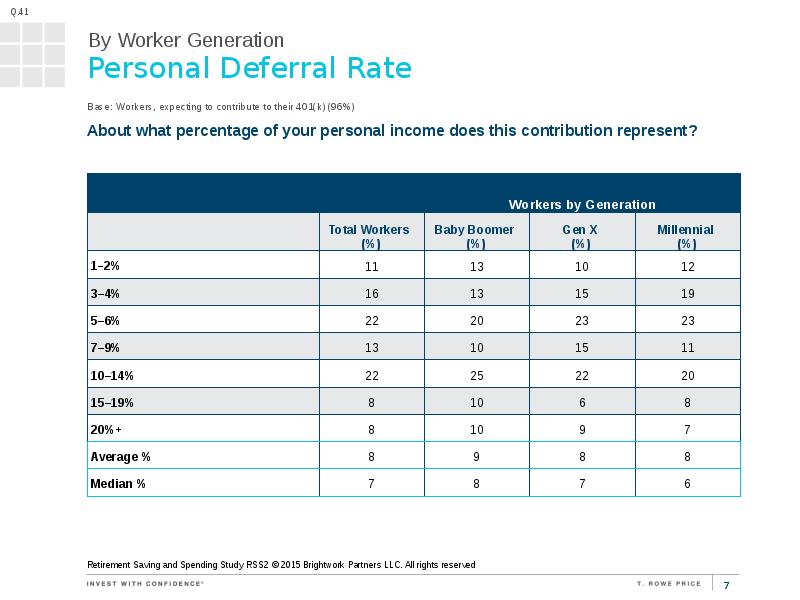

- 7. Personal Deferral Rate

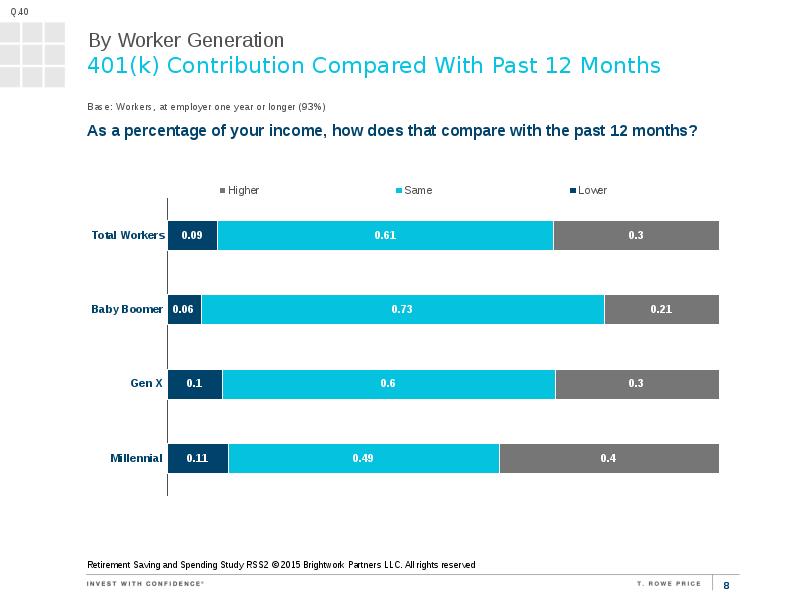

- 8. 401(k) Contribution Compared With Past 12 Months Retirement Saving and Spending

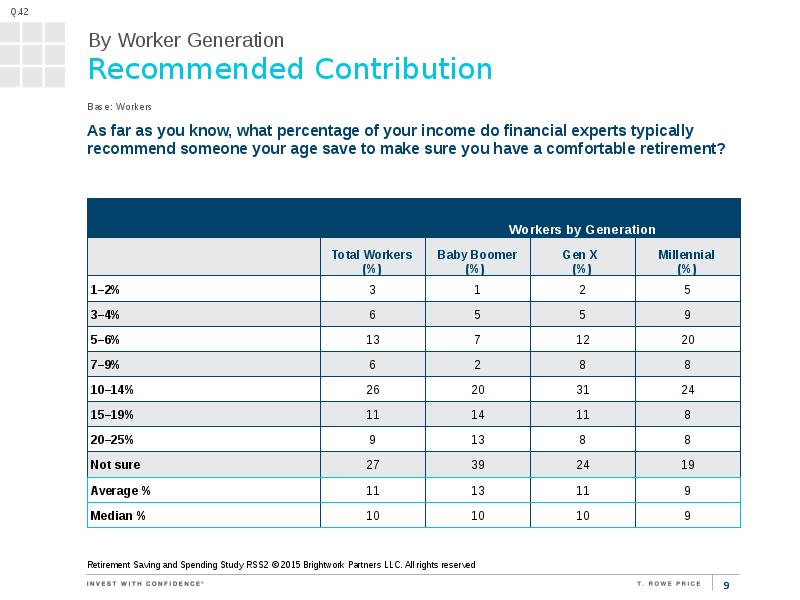

- 9. Recommended Contribution Retirement Saving and Spending Study RSS2 © 2015 Brightwork

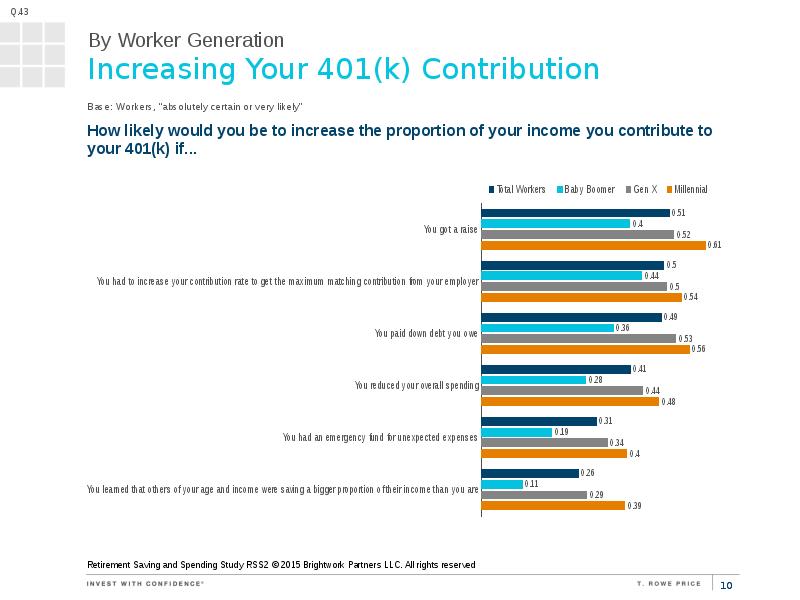

- 10. Increasing Your 401(k) Contribution Retirement Saving and Spending Study RSS2 ©

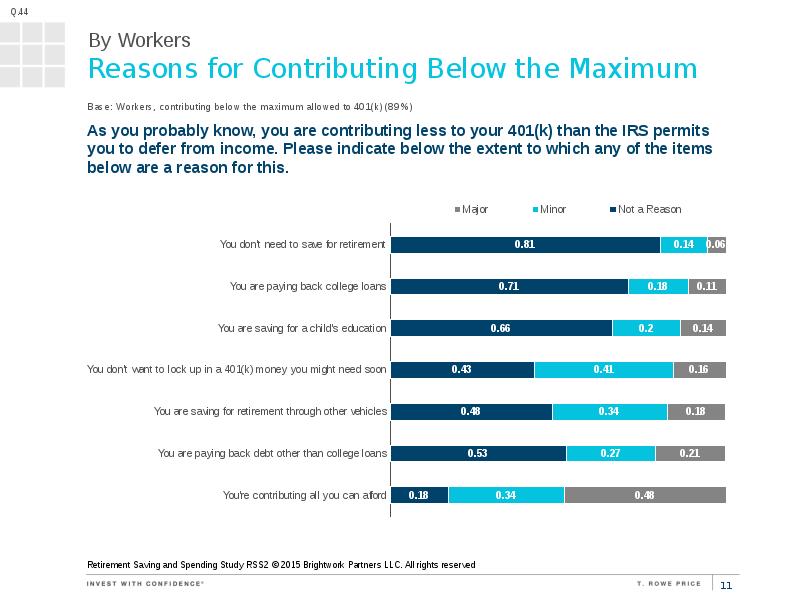

- 11. Reasons for Contributing Below the Maximum Retirement Saving and Spending Study

- 12. Major Reasons for Contributing Below the Maximum Retirement Saving and Spending

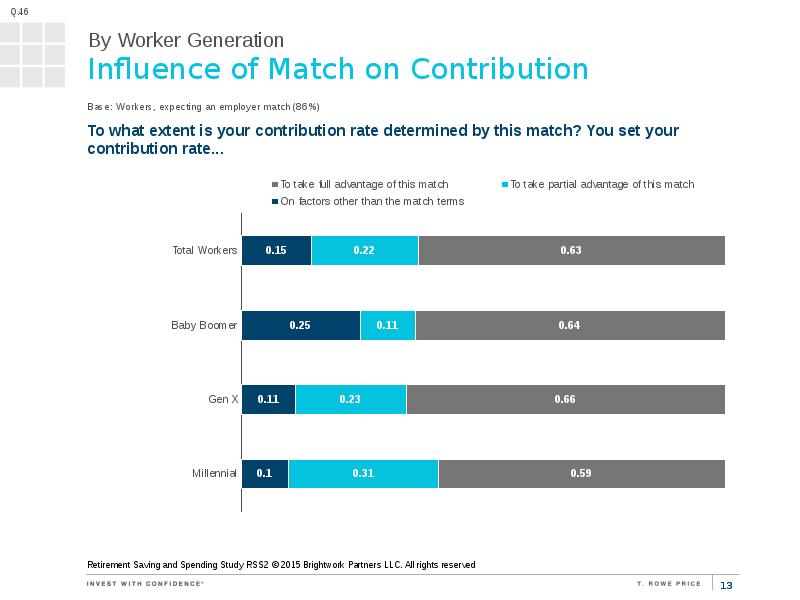

- 13. Influence of Match on Contribution Retirement Saving and Spending Study RSS2

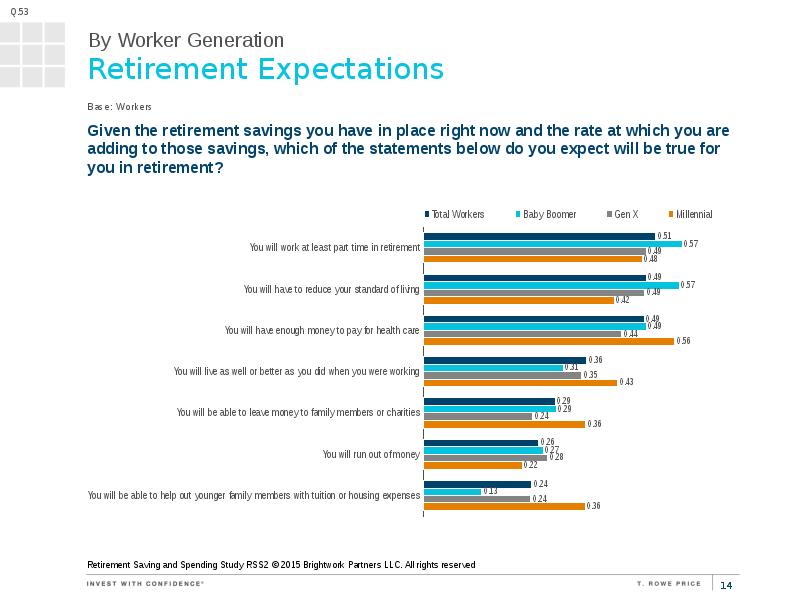

- 14. Retirement Expectations Retirement Saving and Spending Study RSS2 © 2015 Brightwork

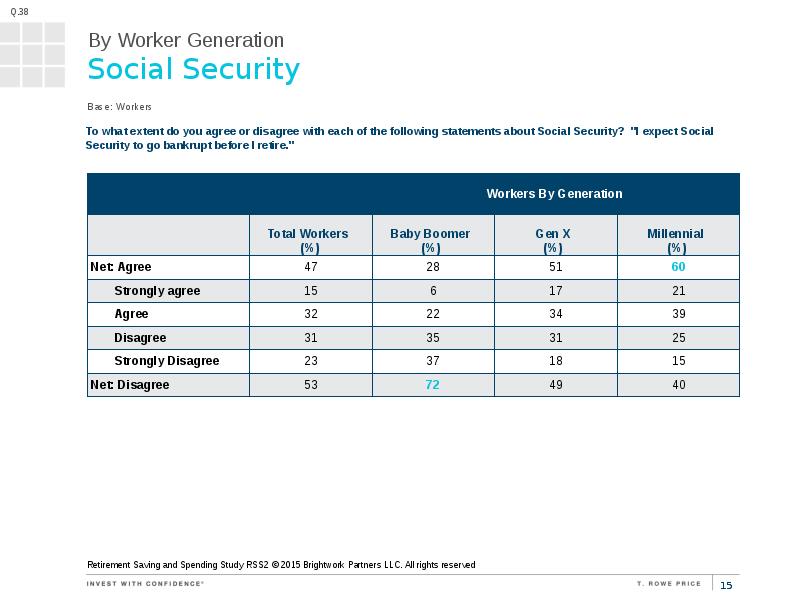

- 15. Base: Workers Base: Workers

- 16. Auto-Features and Target Date FUNDS

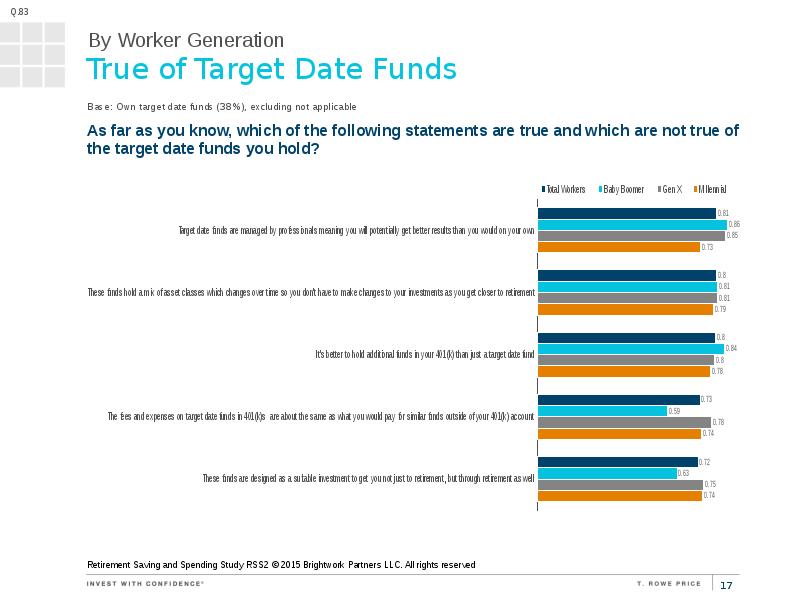

- 17. True of Target Date Funds Retirement Saving and Spending Study RSS2

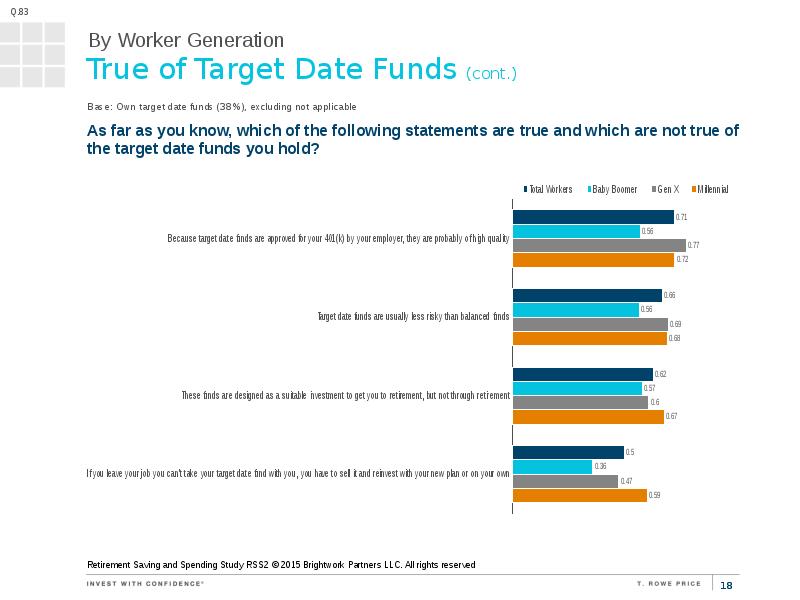

- 18. True of Target Date Funds (cont.) Retirement Saving and Spending Study

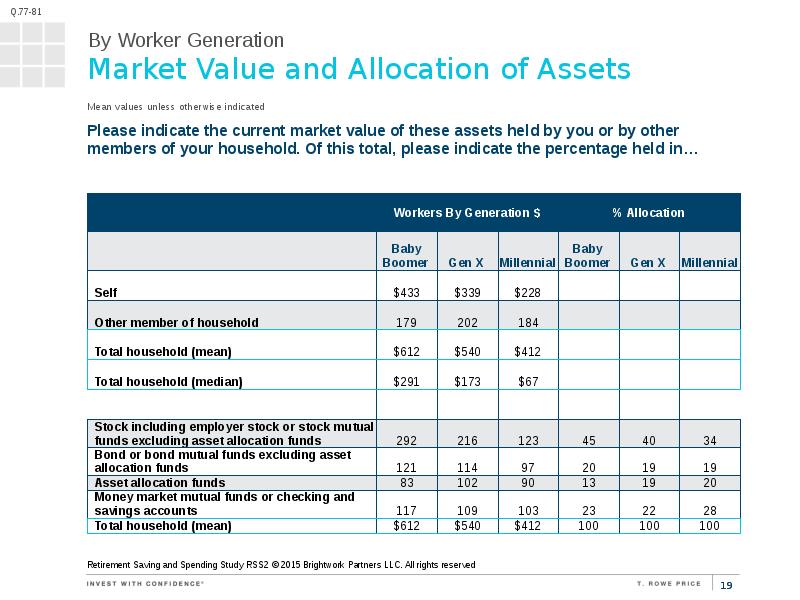

- 19. Market Value and Allocation of Assets Retirement Saving and Spending Study

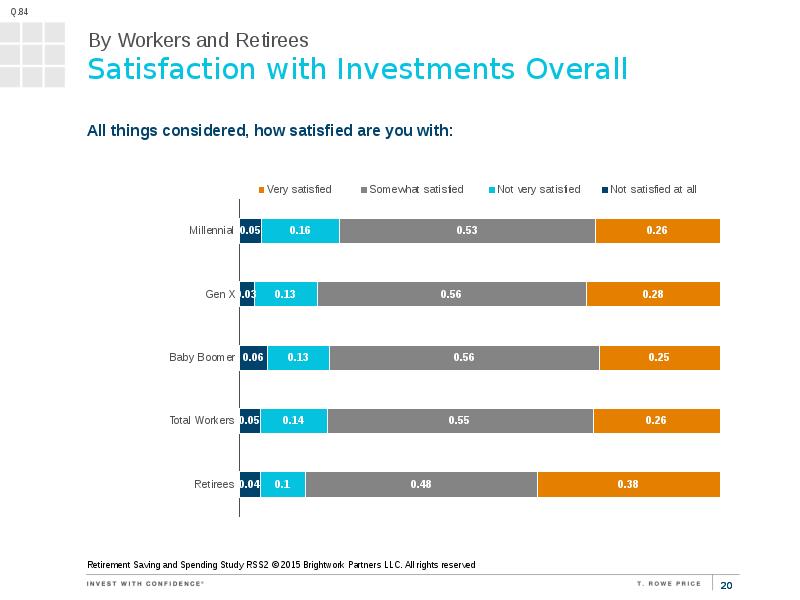

- 20. Satisfaction with Investments Overall Retirement Saving and Spending Study RSS2 ©

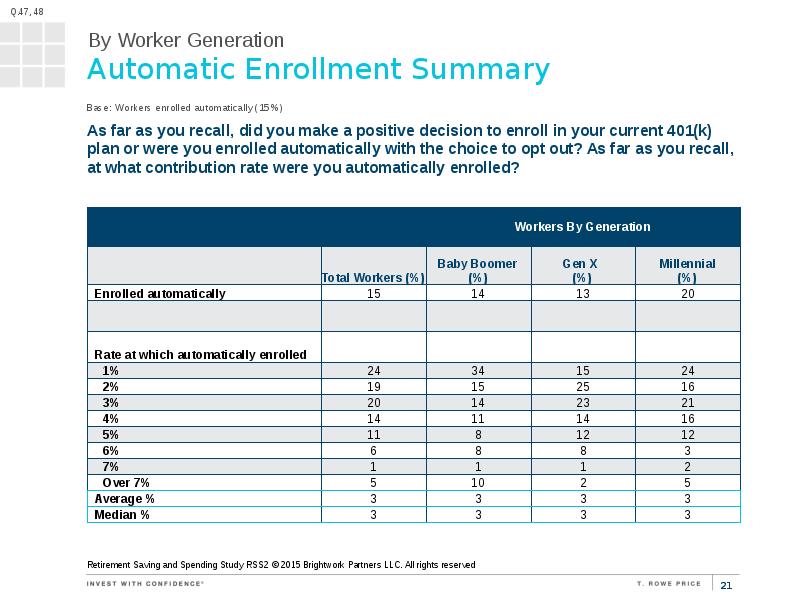

- 21. Automatic Enrollment Summary Retirement Saving and Spending Study RSS2 © 2015

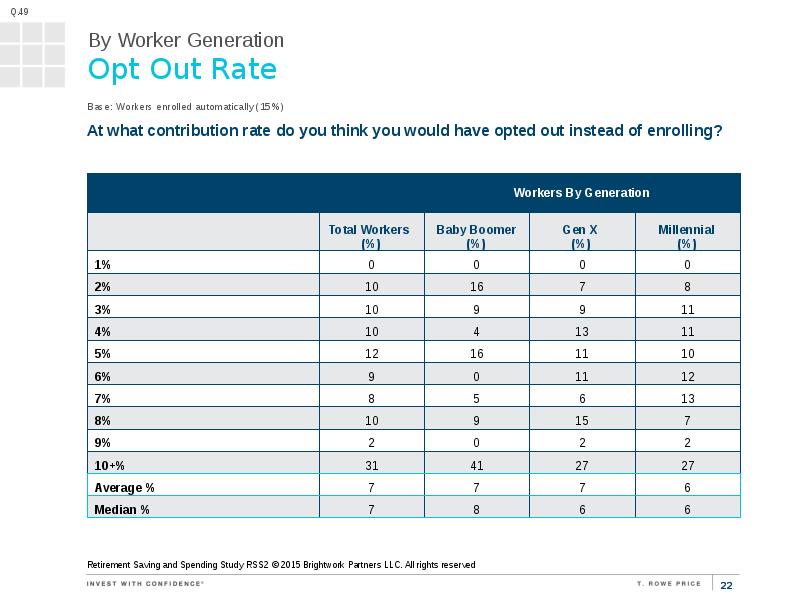

- 22. Opt Out Rate Retirement Saving and Spending Study RSS2 © 2015

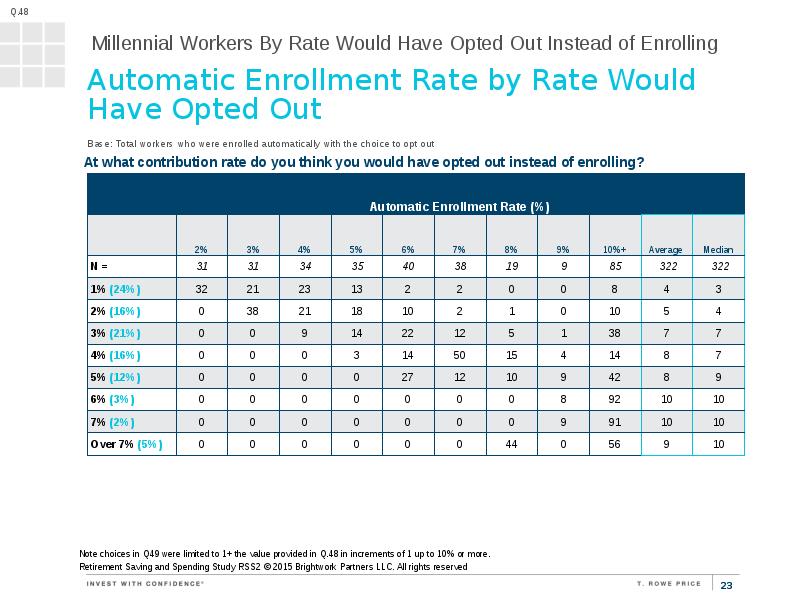

- 23. Base: Total workers who were enrolled automatically with the choice to

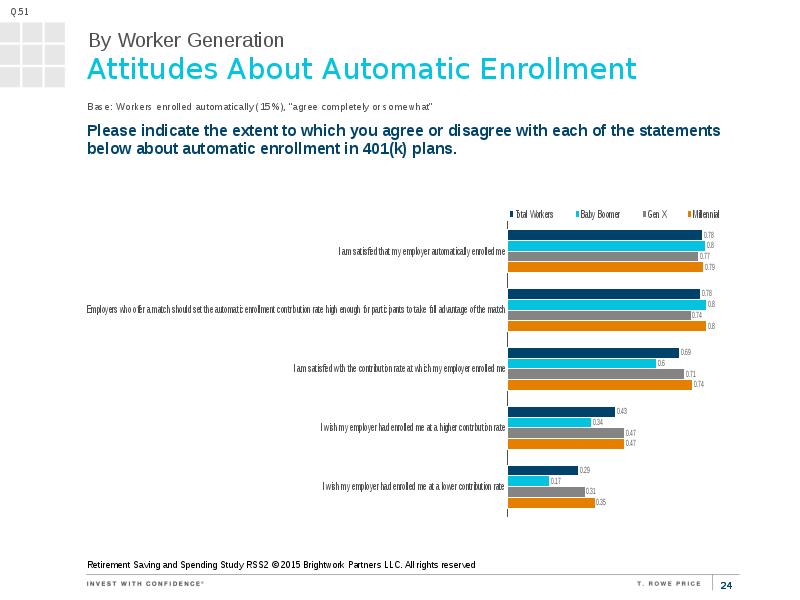

- 24. Attitudes About Automatic Enrollment Retirement Saving and Spending Study RSS2 ©

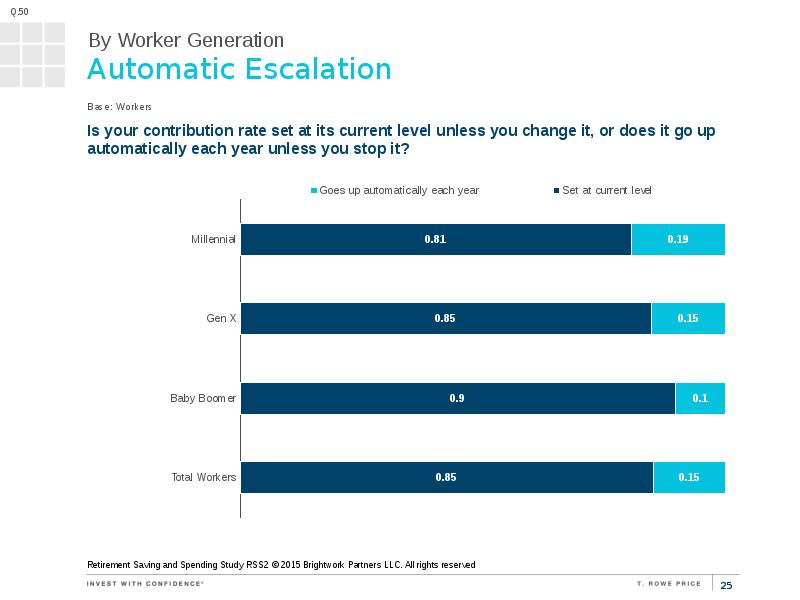

- 25. Automatic Escalation Retirement Saving and Spending Study RSS2 © 2015 Brightwork

- 26. Spending, saving, and advice

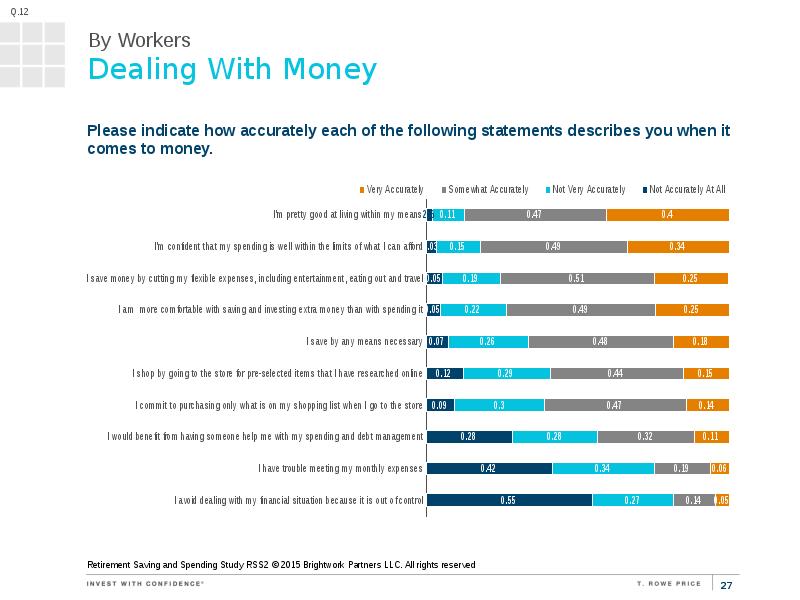

- 27. Dealing With Money Retirement Saving and Spending Study RSS2 © 2015

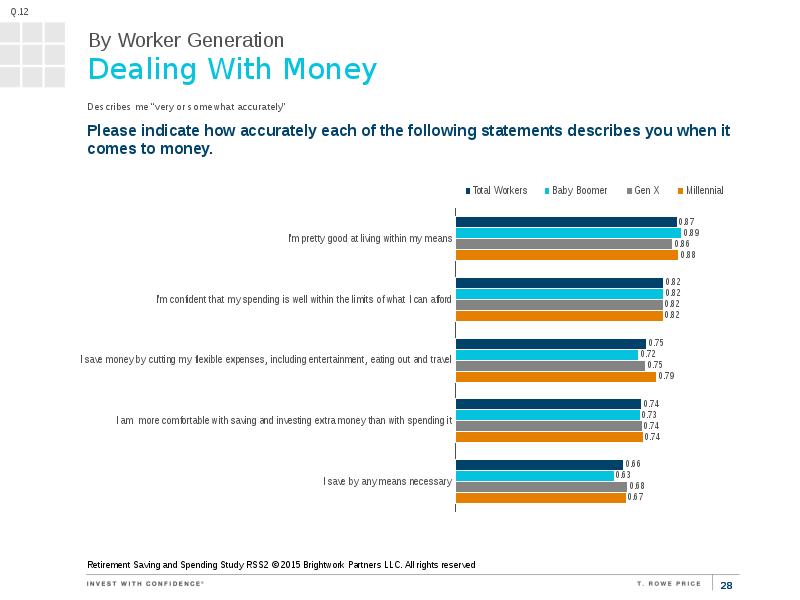

- 28. Dealing With Money Retirement Saving and Spending Study RSS2 © 2015

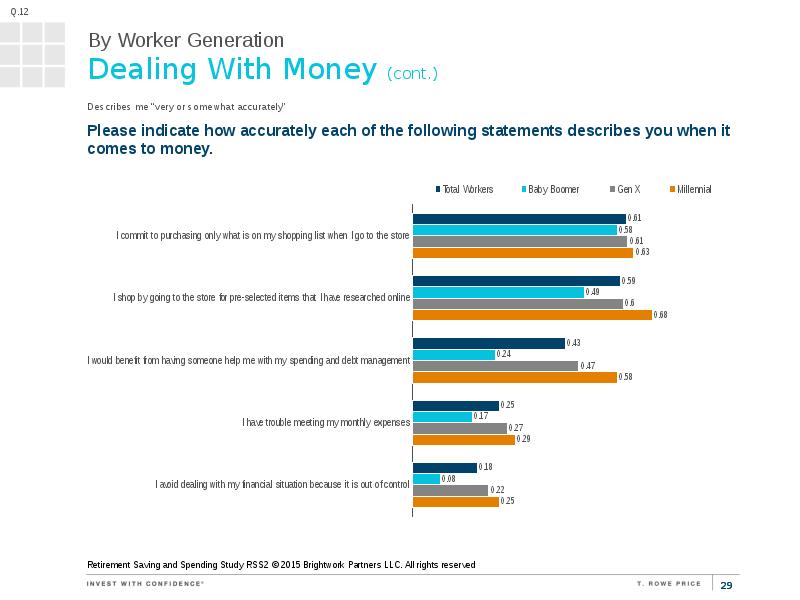

- 29. Dealing With Money (cont.) Retirement Saving and Spending Study RSS2 ©

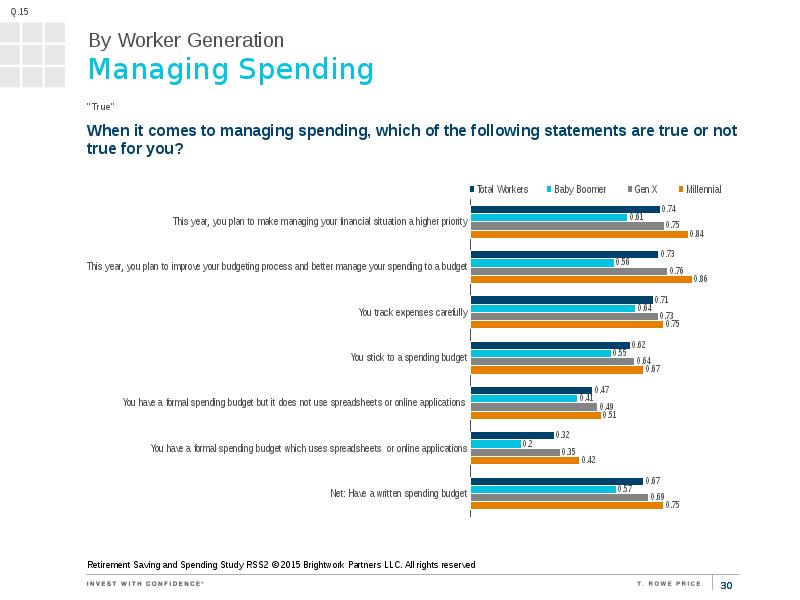

- 30. Managing Spending Retirement Saving and Spending Study RSS2 © 2015 Brightwork

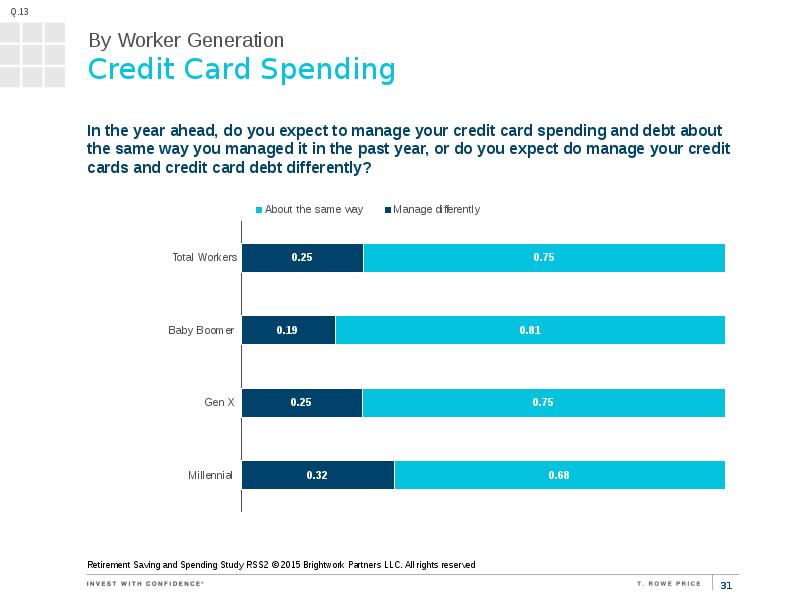

- 31. Credit Card Spending Retirement Saving and Spending Study RSS2 © 2015

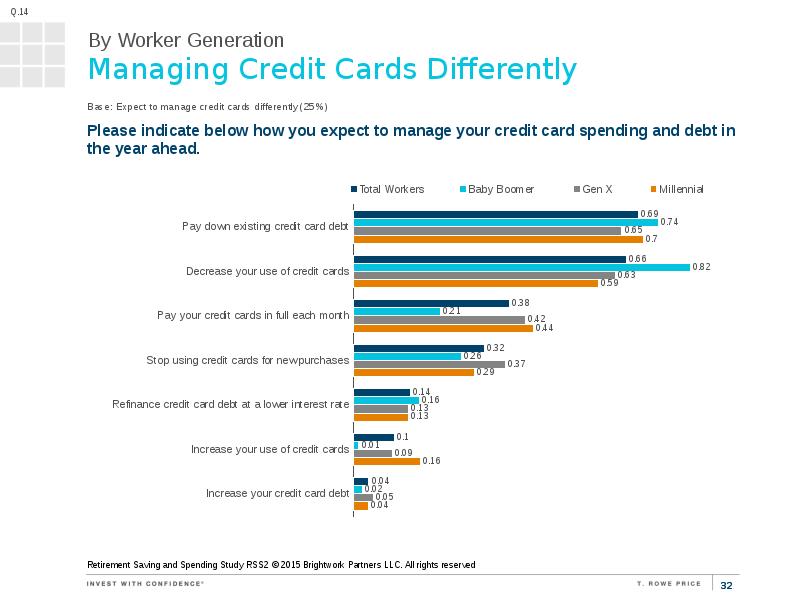

- 32. Managing Credit Cards Differently Retirement Saving and Spending Study RSS2 ©

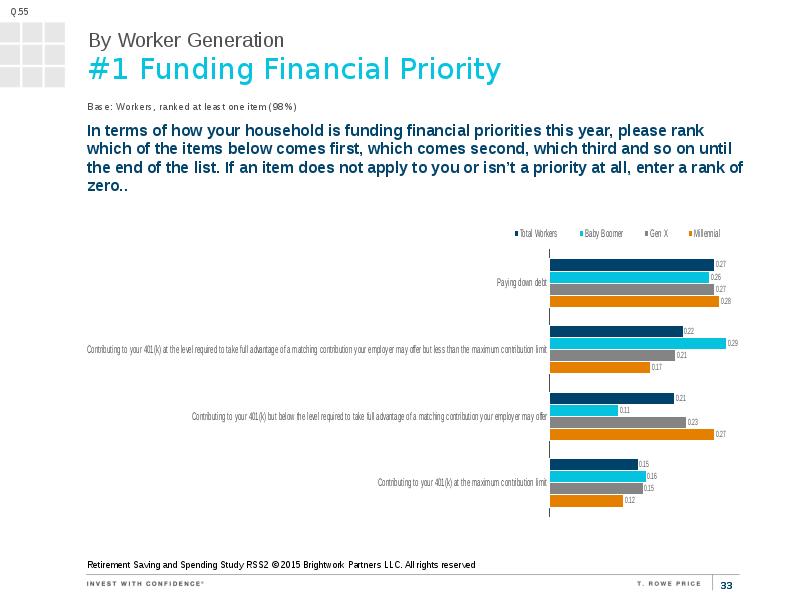

- 33. #1 Funding Financial Priority Retirement Saving and Spending Study RSS2 ©

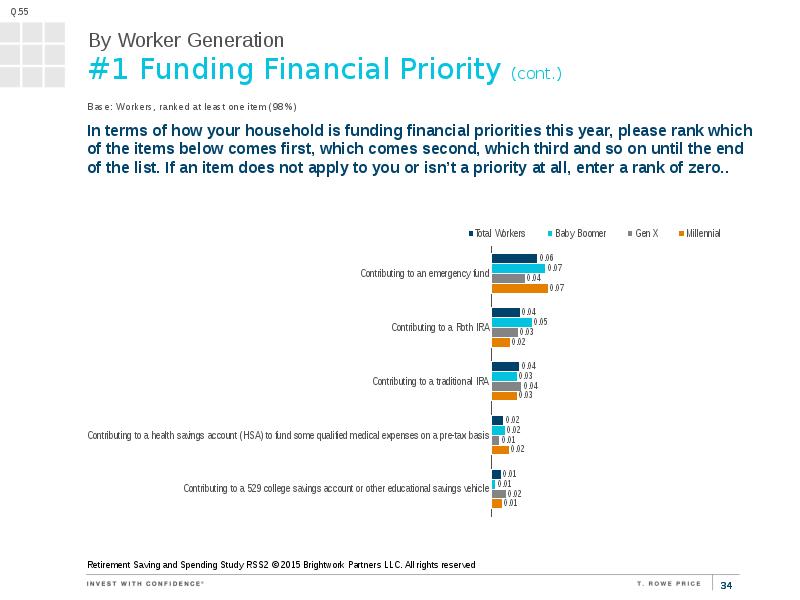

- 34. #1 Funding Financial Priority (cont.) Retirement Saving and Spending Study RSS2

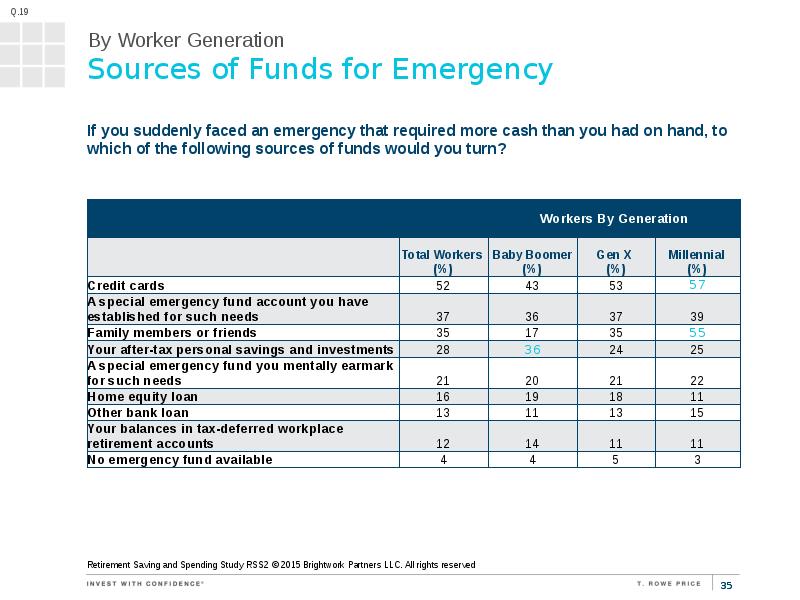

- 35. Sources of Funds for Emergency Retirement Saving and Spending Study RSS2

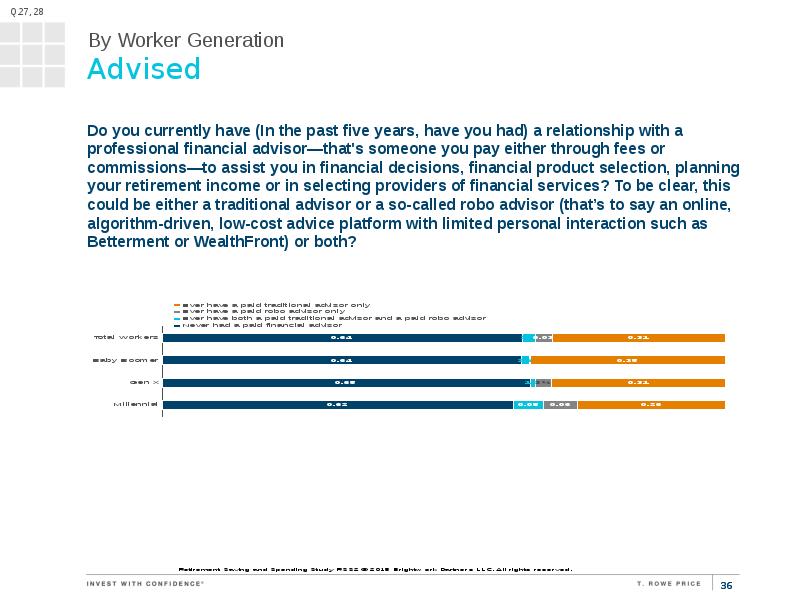

- 36. Advised

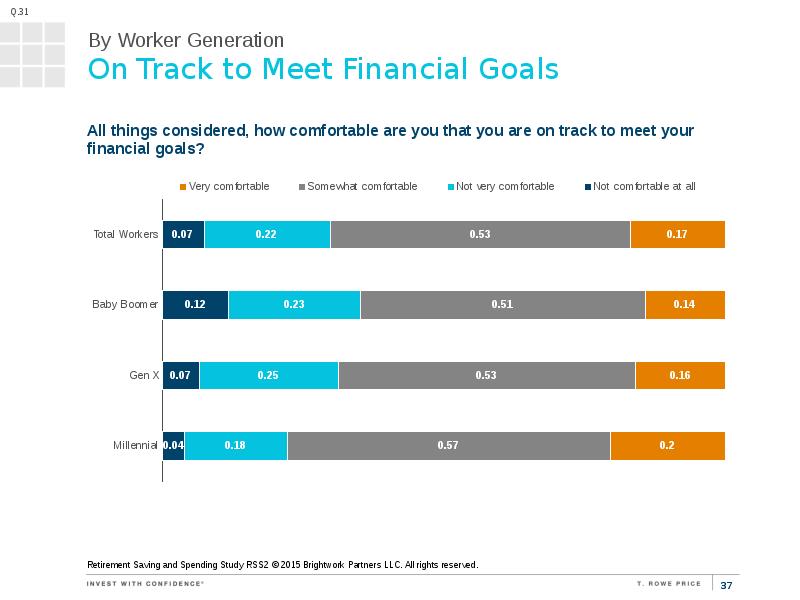

- 37. On Track to Meet Financial Goals

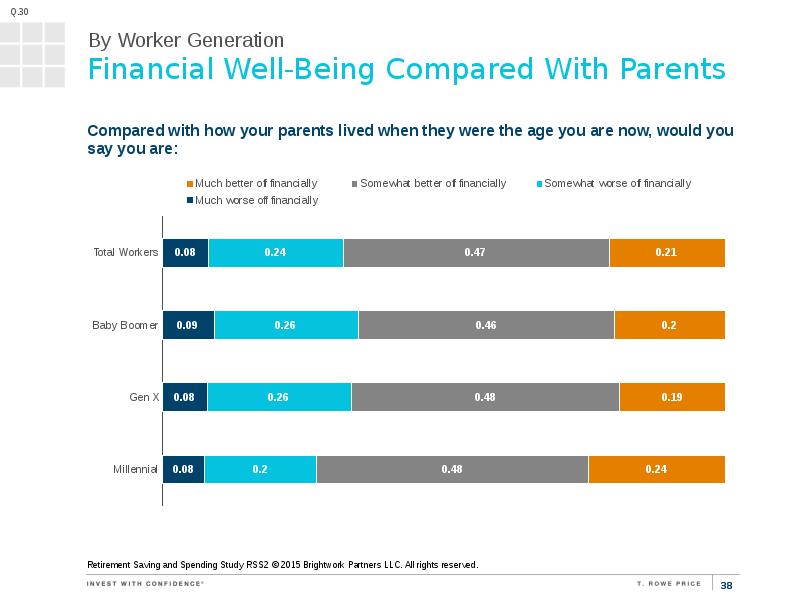

- 38. Financial Well-Being Compared With Parents

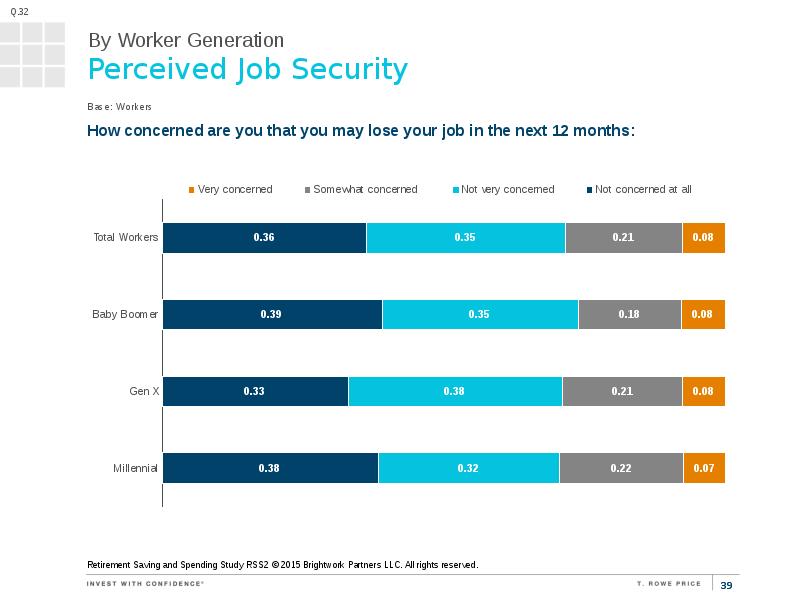

- 39. Perceived Job Security Base: Workers

- 40. Profiles of workers with 401(k)s: Millennials, Gen X, and Baby Boomers

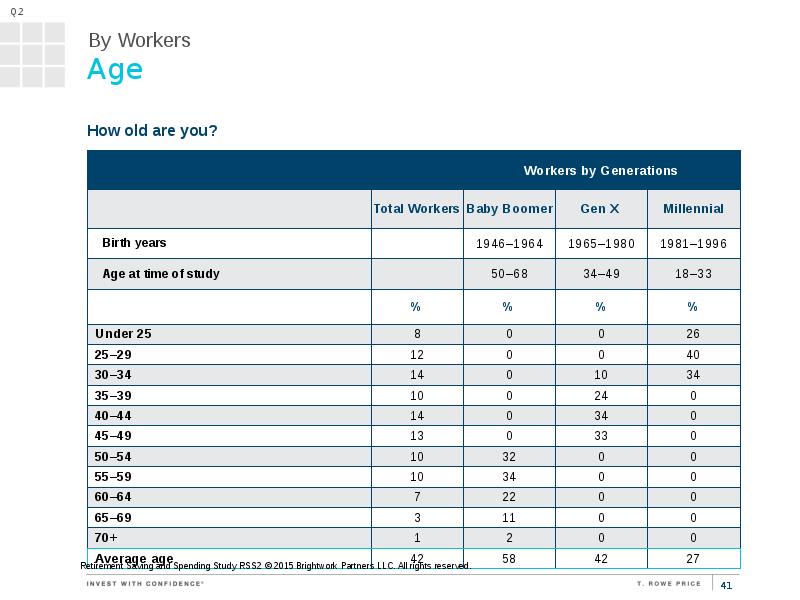

- 41. Age Q. 2

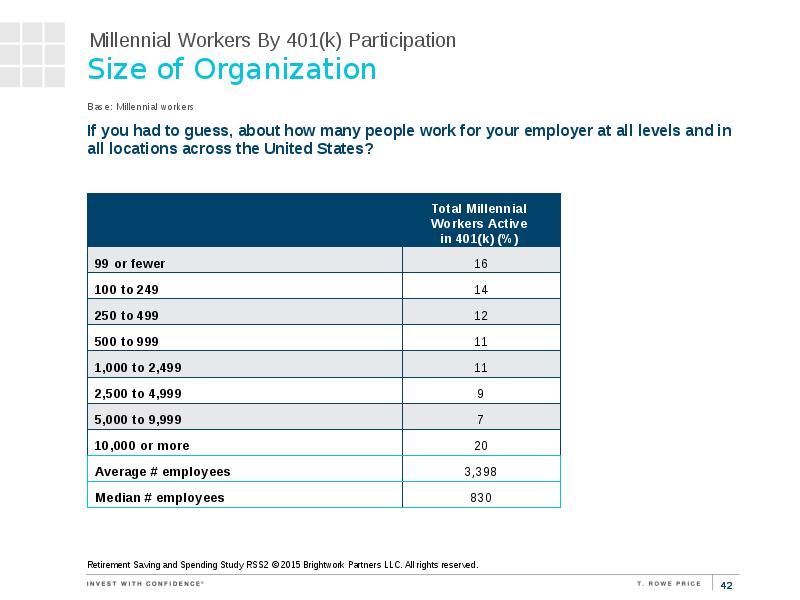

- 42. Size of Organization Retirement Saving and Spending Study RSS2 © 2015

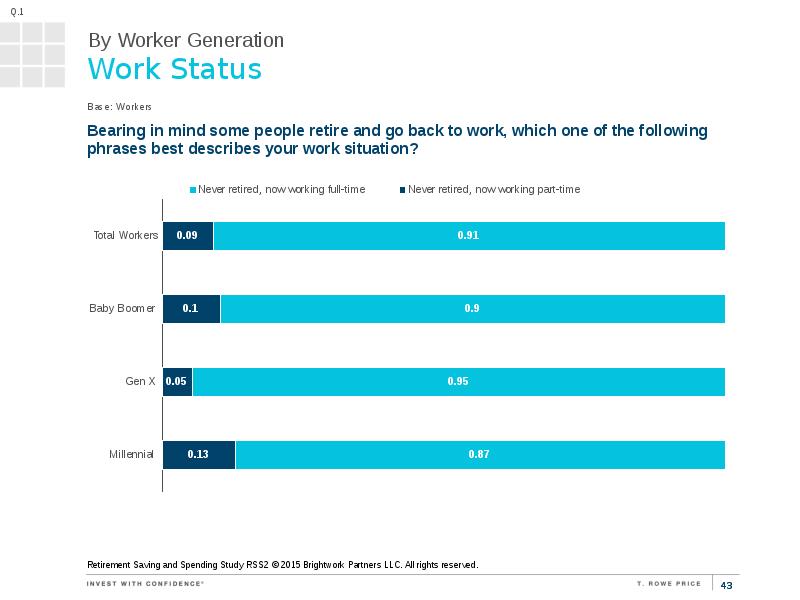

- 43. Work Status Base: Workers

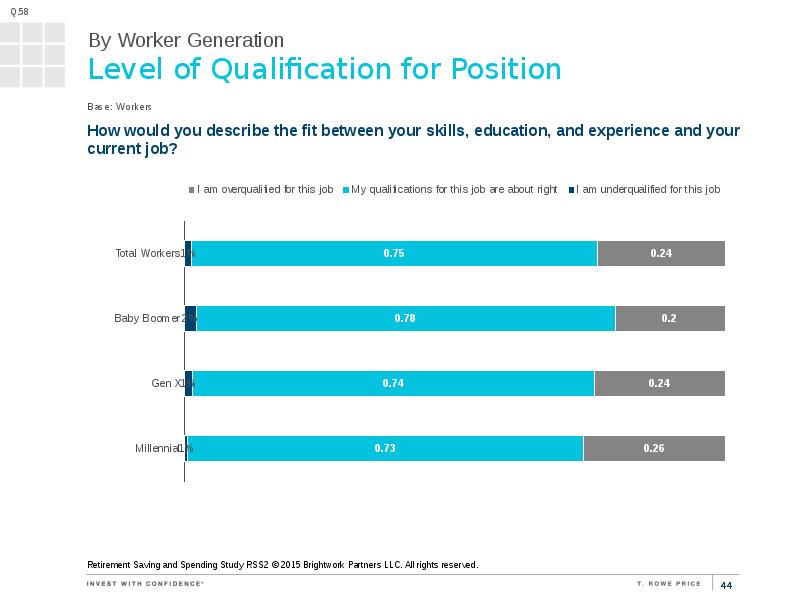

- 44. Level of Qualification for Position Base: Workers

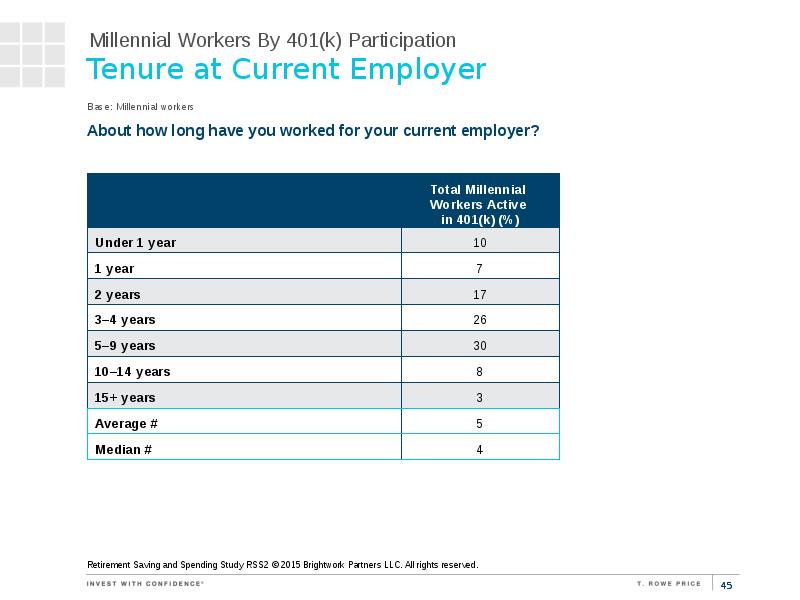

- 45. Tenure at Current Employer Base: Millennial workers

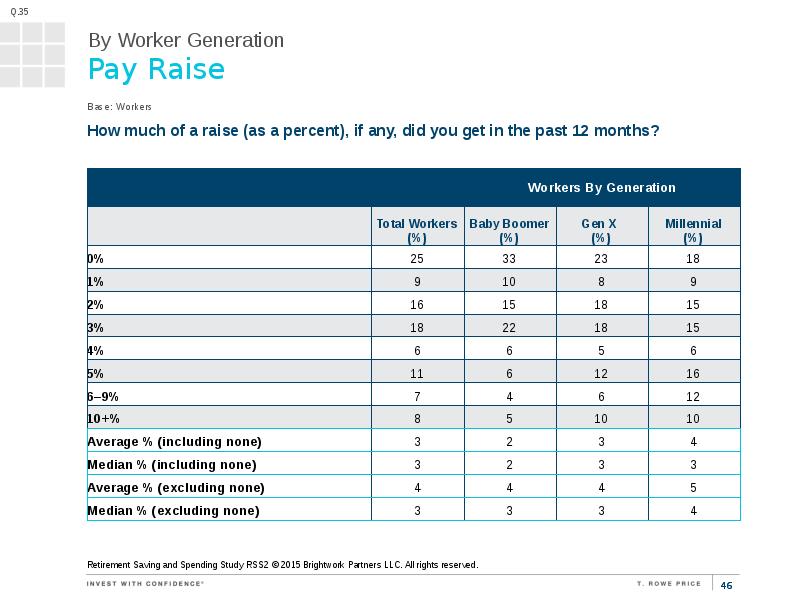

- 46. Pay Raise Base: Workers

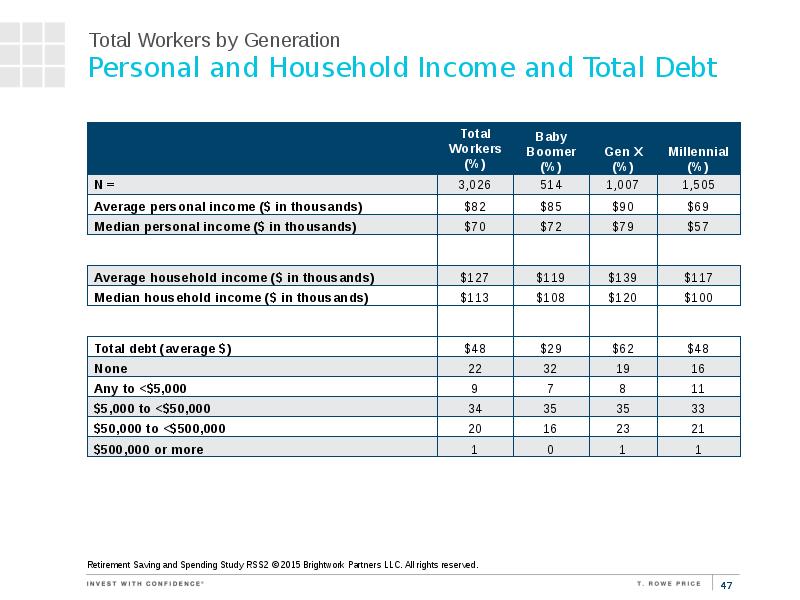

- 47. Personal and Household Income and Total Debt

- 48. Millennials who are eligible to participate in their employers’ 401(k) but

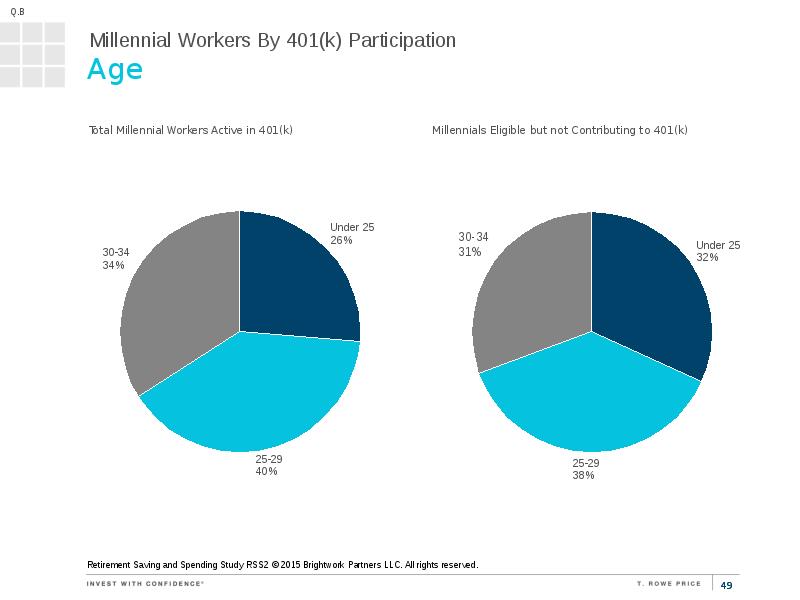

- 49. Age

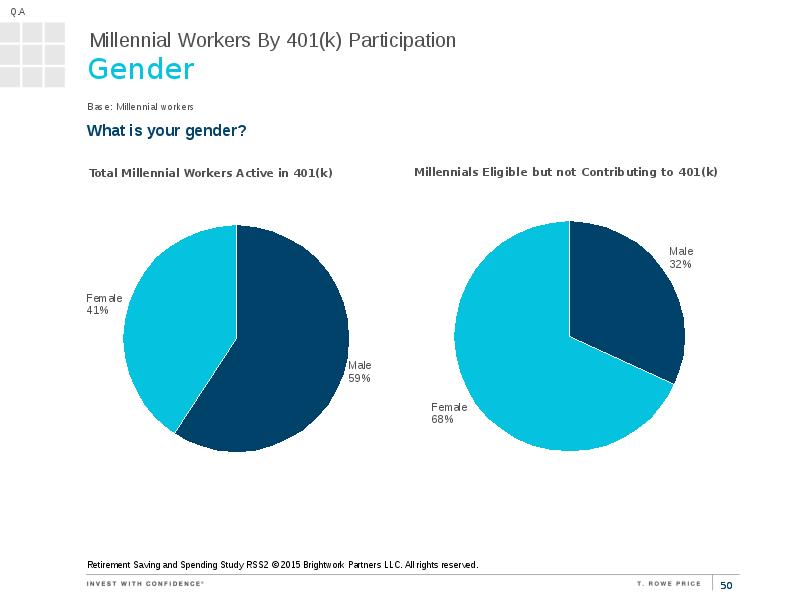

- 50. Gender Base: Millennial workers

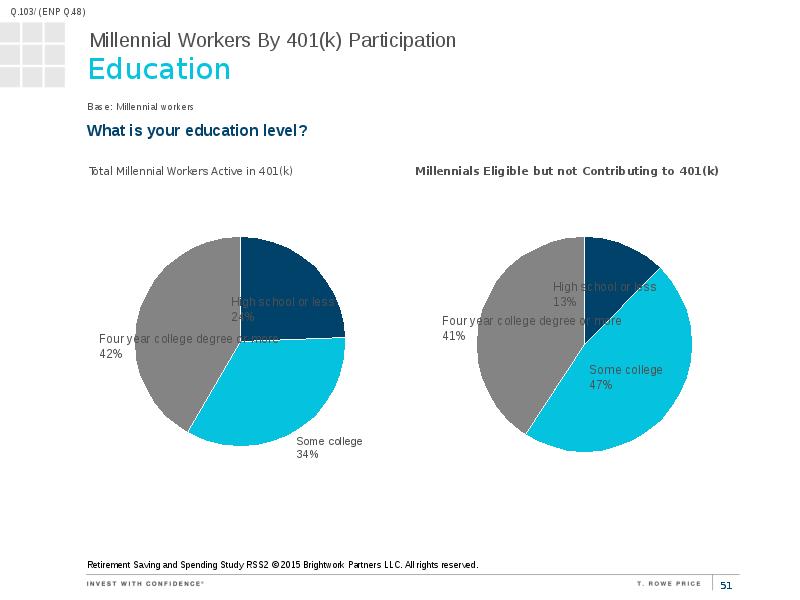

- 51. Education Base: Millennial workers

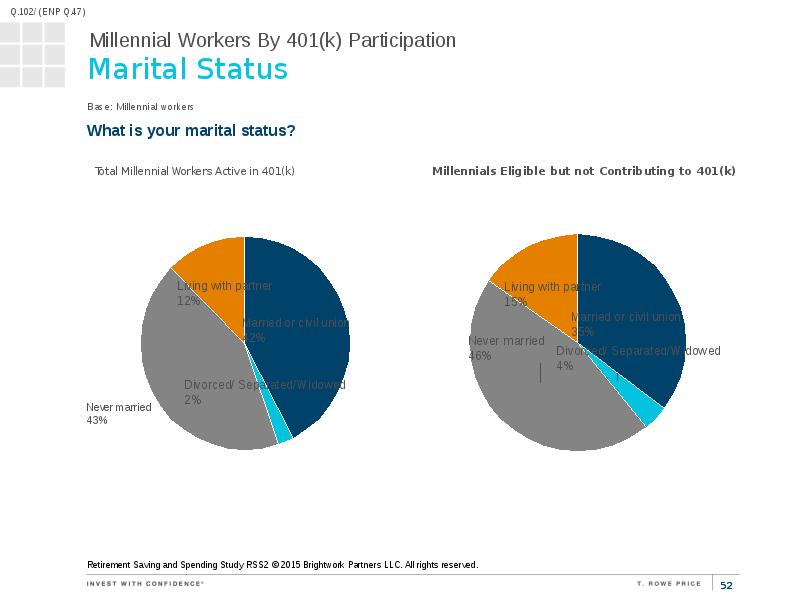

- 52. Marital Status Base: Millennial workers

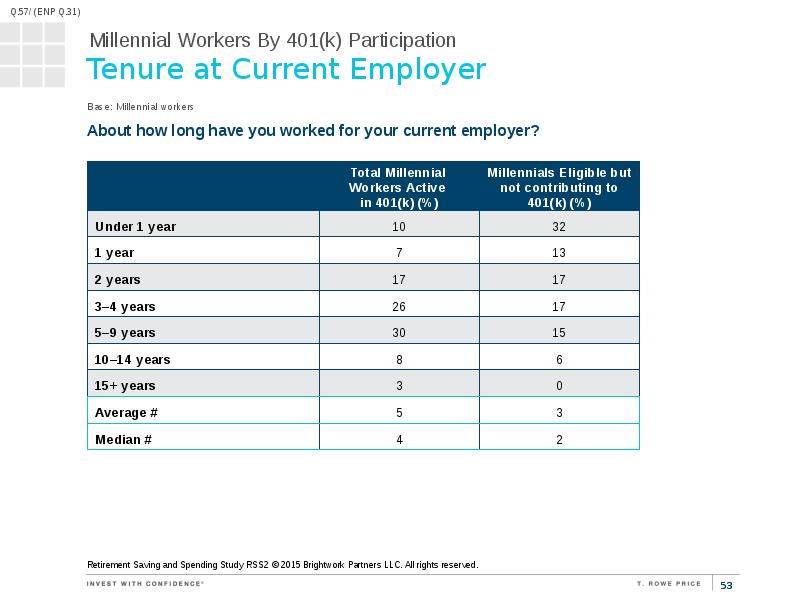

- 53. Tenure at Current Employer Base: Millennial workers

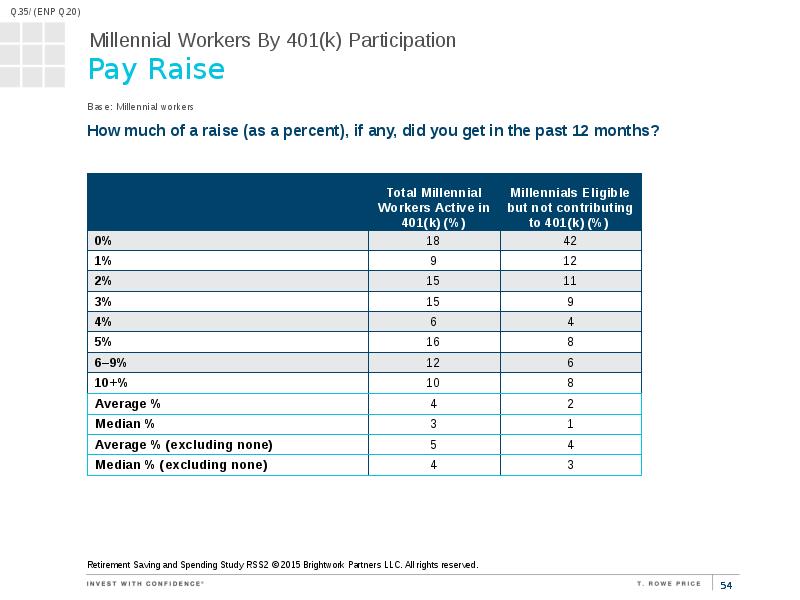

- 54. Pay Raise Base: Millennial workers

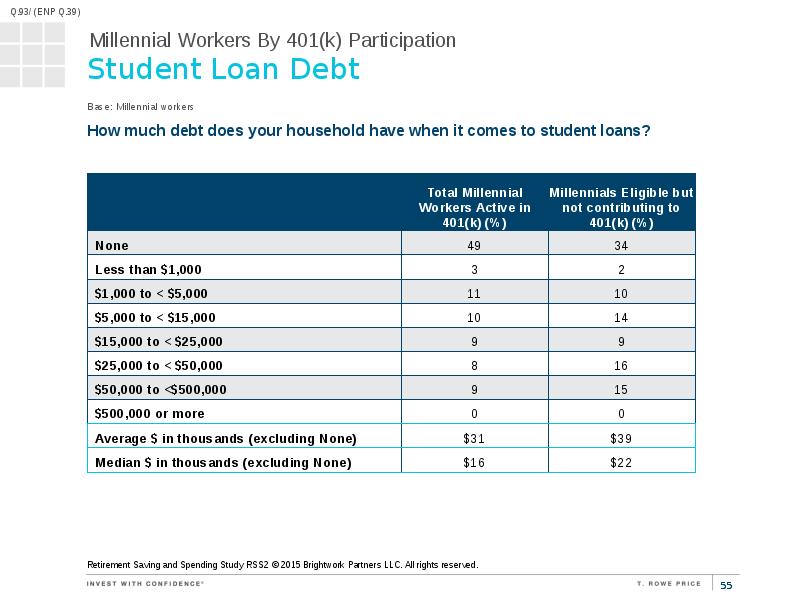

- 55. Student Loan Debt Base: Millennial workers

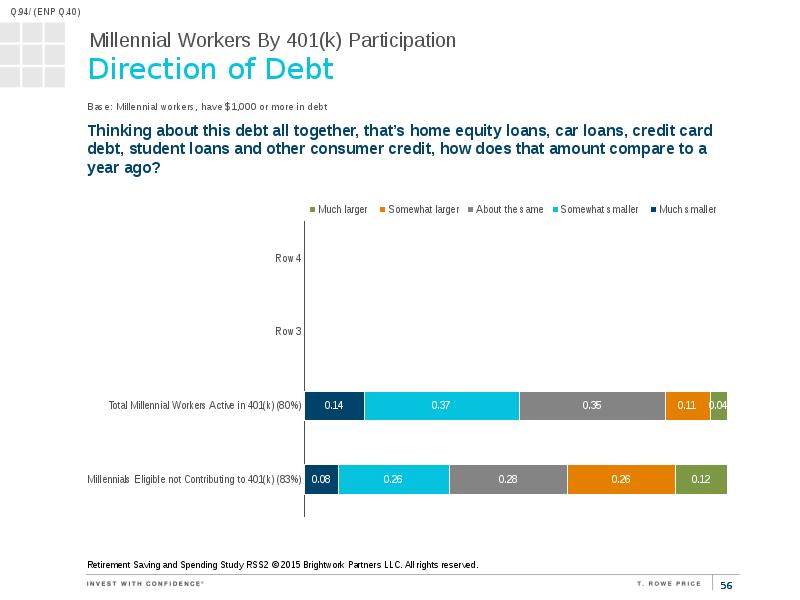

- 56. Direction of Debt Base: Millennial workers, have $1,000 or more in

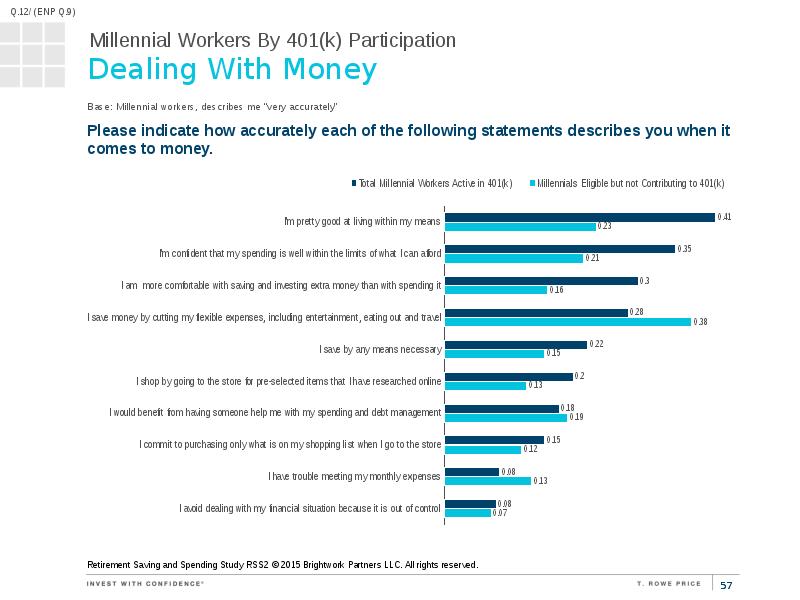

- 57. Dealing With Money Base: Millennial workers, describes me “very accurately"

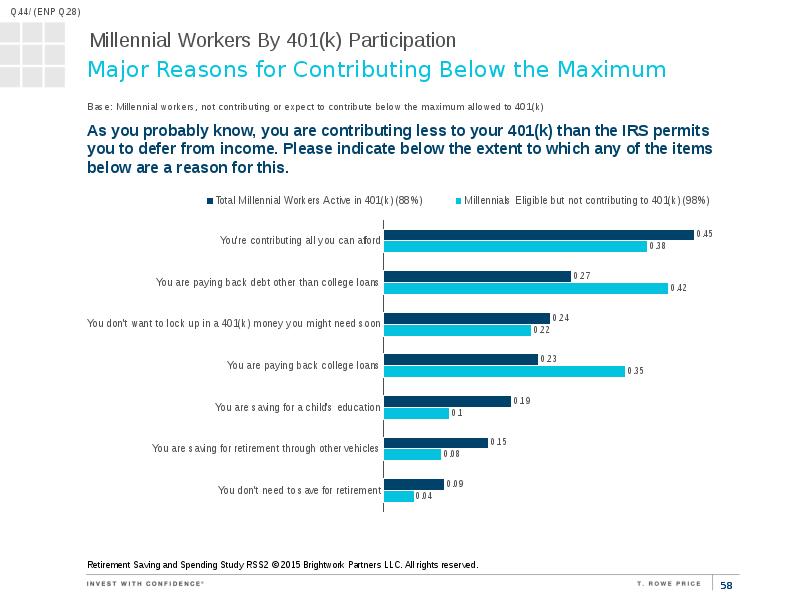

- 58. Major Reasons for Contributing Below the Maximum Base: Millennial workers, not

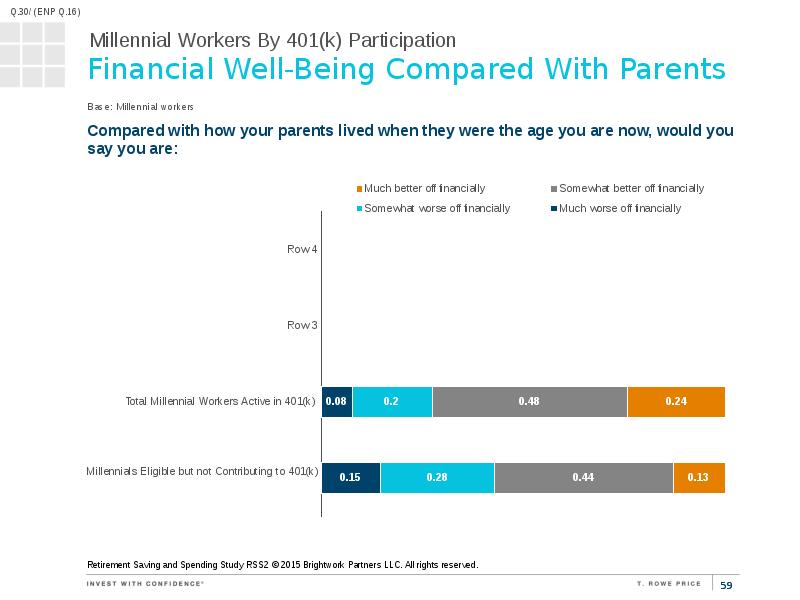

- 59. Financial Well-Being Compared With Parents Base: Millennial workers

- 60. Retirees who saved in 401(k)s

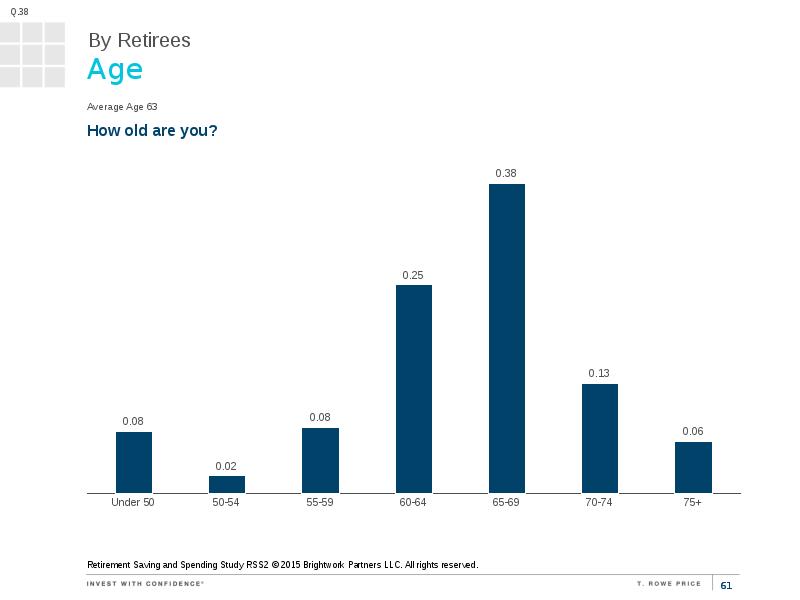

- 61. Age Average Age 63

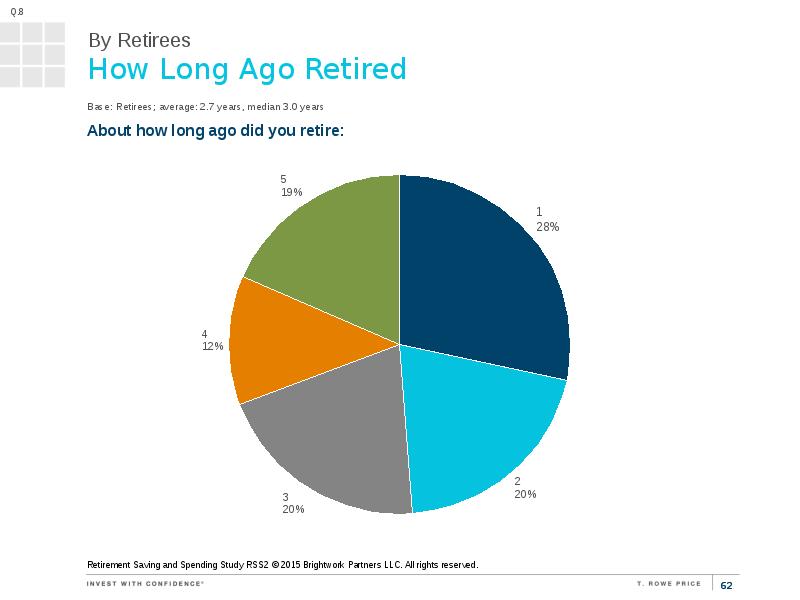

- 62. How Long Ago Retired Base: Retirees; average: 2.7 years, median 3.0

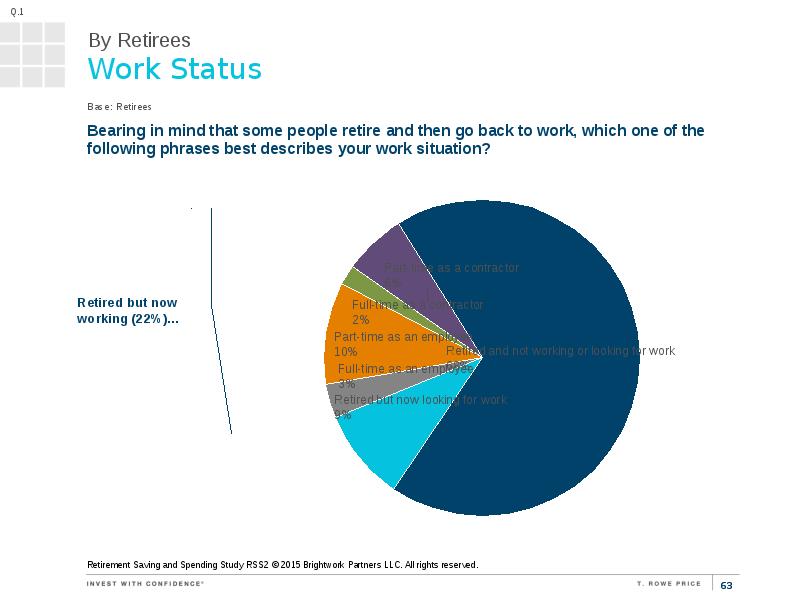

- 63. Work Status Base: Retirees

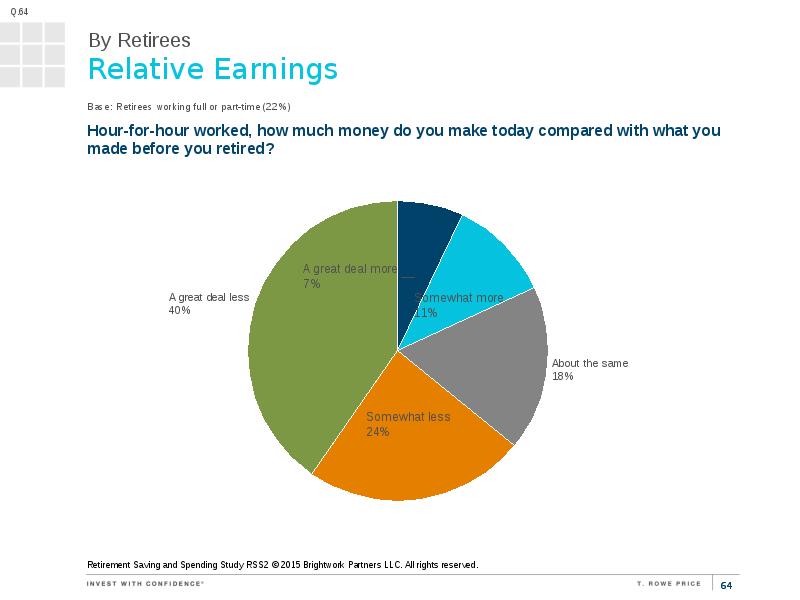

- 64. Relative Earnings Base: Retirees working full or part-time (22%)

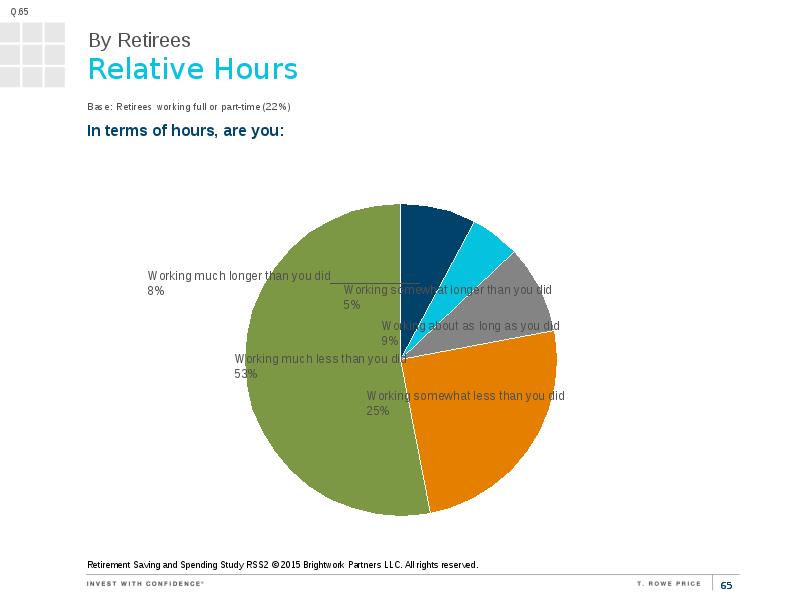

- 65. Relative Hours Base: Retirees working full or part-time (22%)

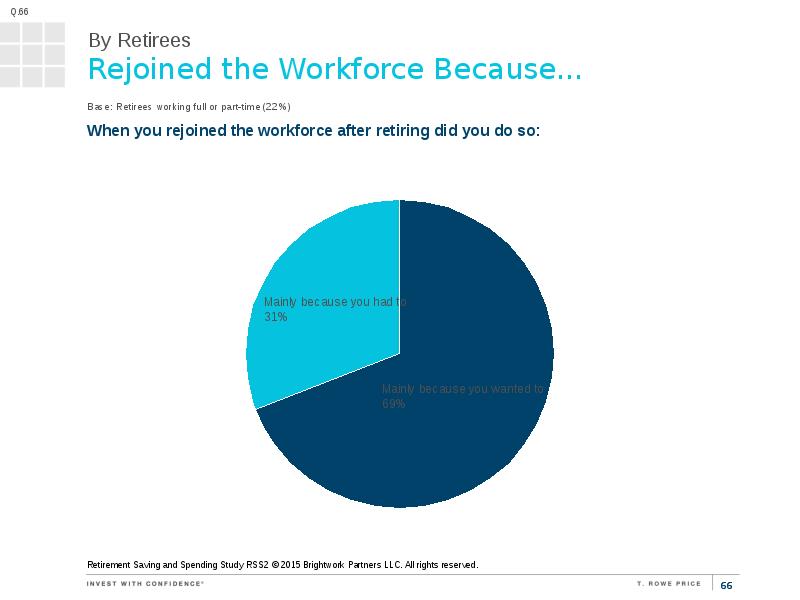

- 66. Rejoined the Workforce Because... Base: Retirees working full or part-time (22%)

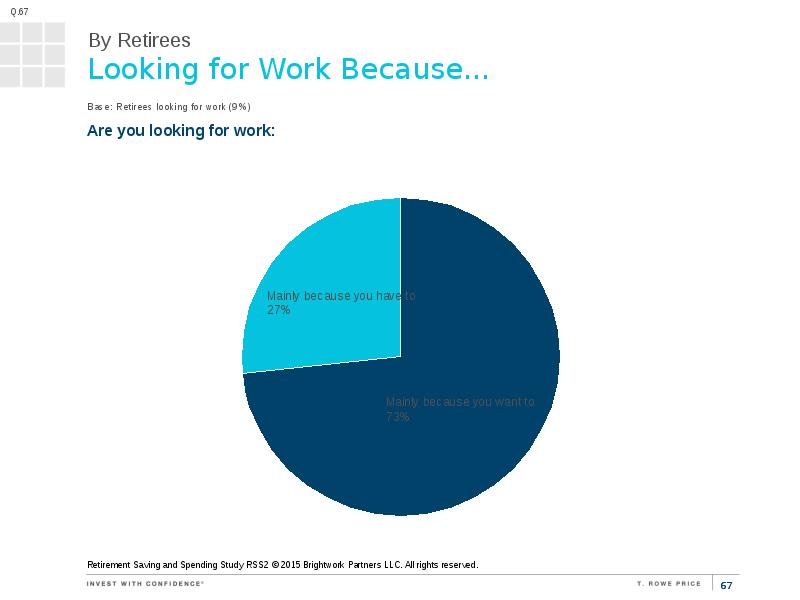

- 67. Looking for Work Because... Base: Retirees looking for work (9%)

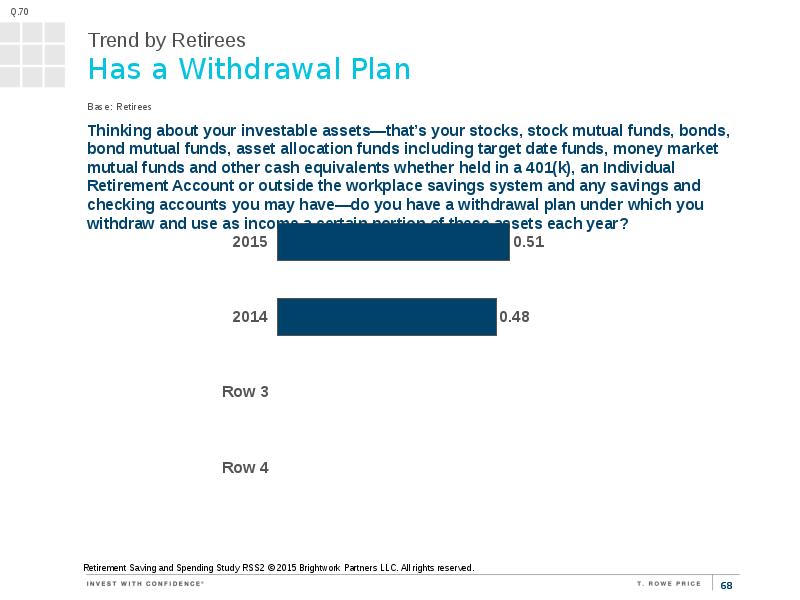

- 68. Has a Withdrawal Plan Base: Retirees

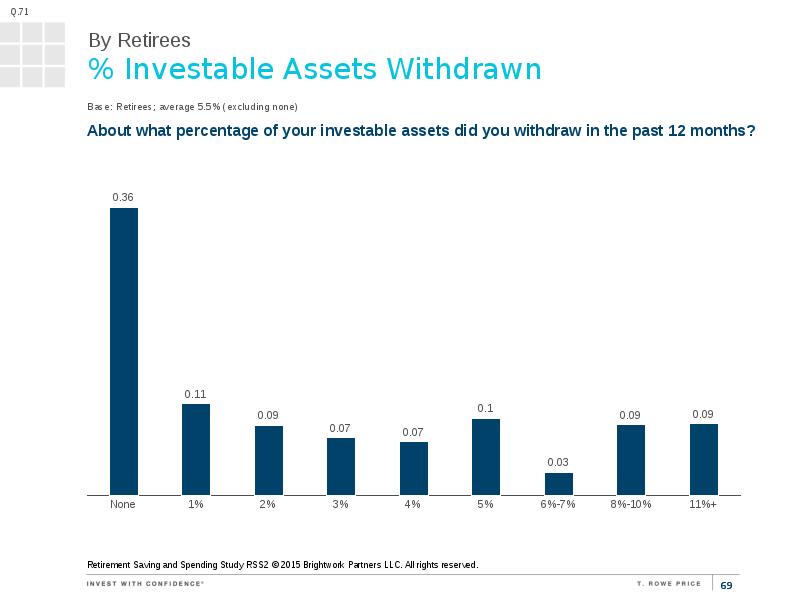

- 69. % Investable Assets Withdrawn Base: Retirees; average 5.5% (excluding none)

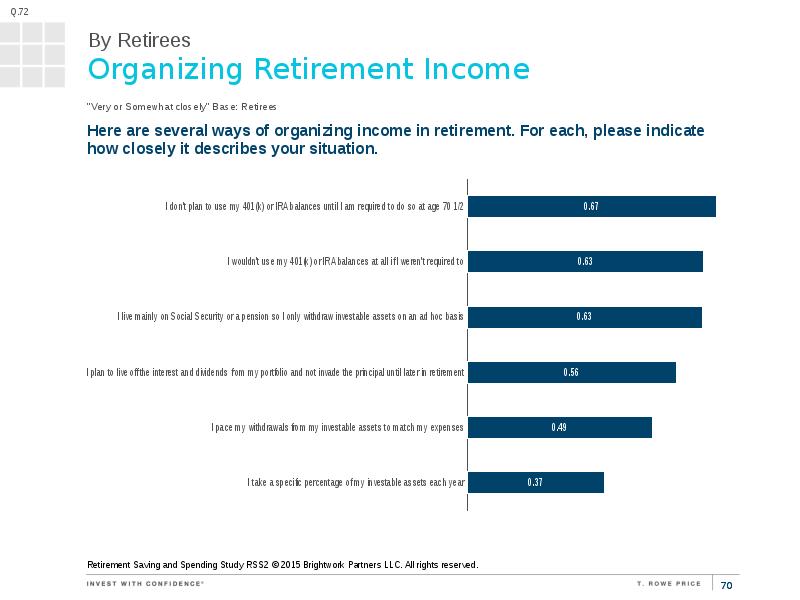

- 70. Organizing Retirement Income "Very or Somewhat closely" Base: Retirees

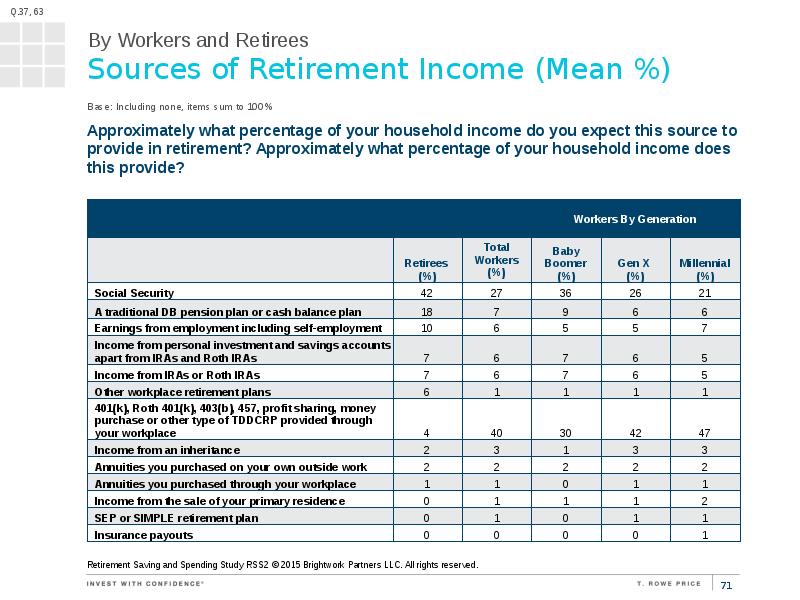

- 71. Sources of Retirement Income (Mean %) Base: Including none, items sum

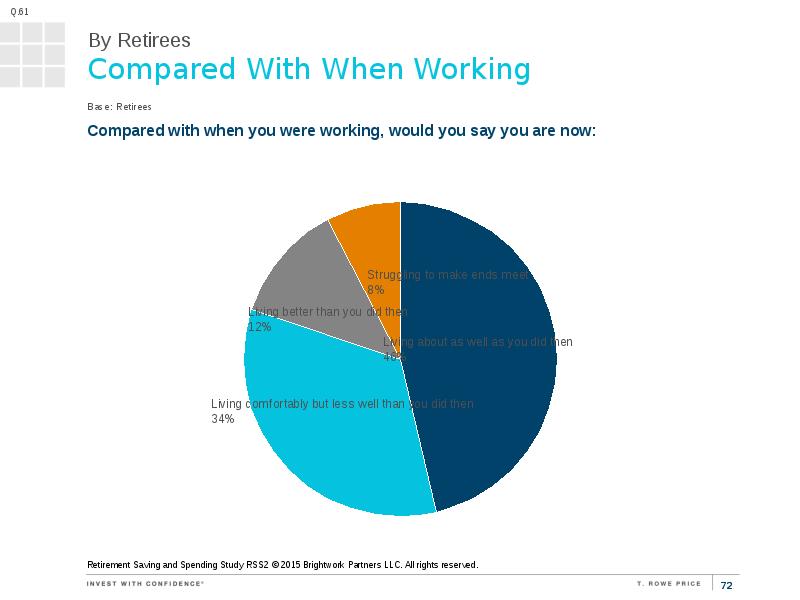

- 72. Compared With When Working Base: Retirees

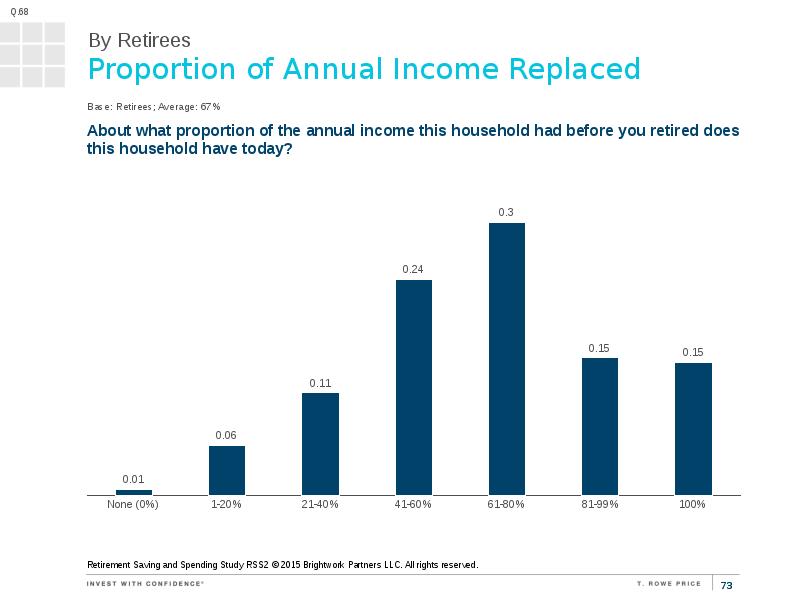

- 73. Proportion of Annual Income Replaced Base: Retirees; Average: 67%

- 74. True of My Retirement Base: Retirees

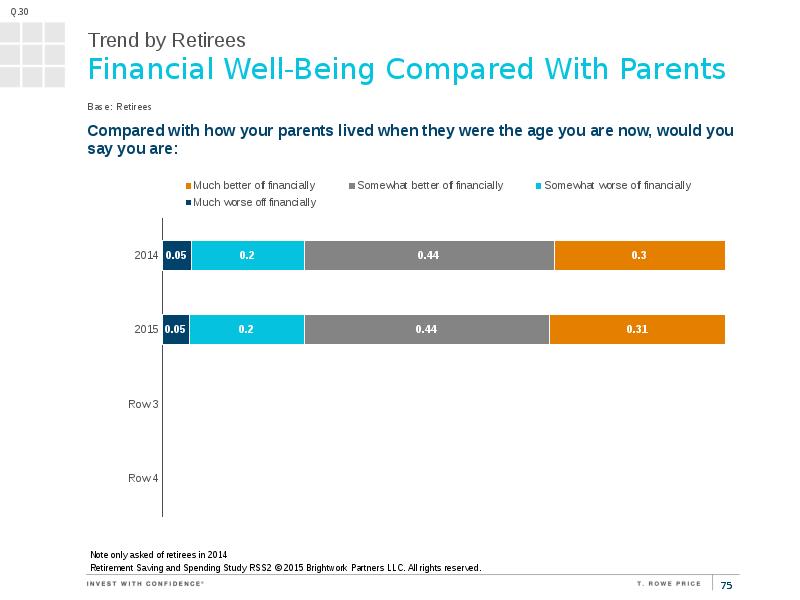

- 75. Financial Well-Being Compared With Parents Note only asked of retirees in

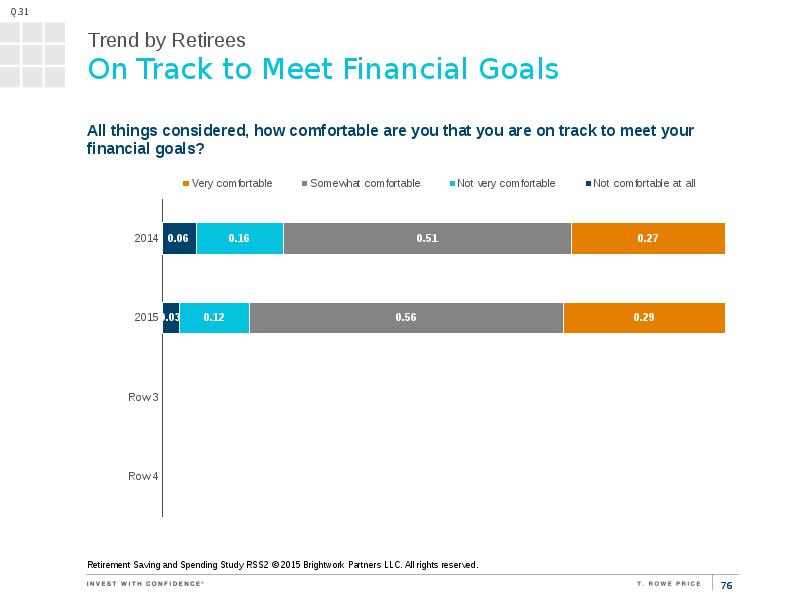

- 76. On Track to Meet Financial Goals

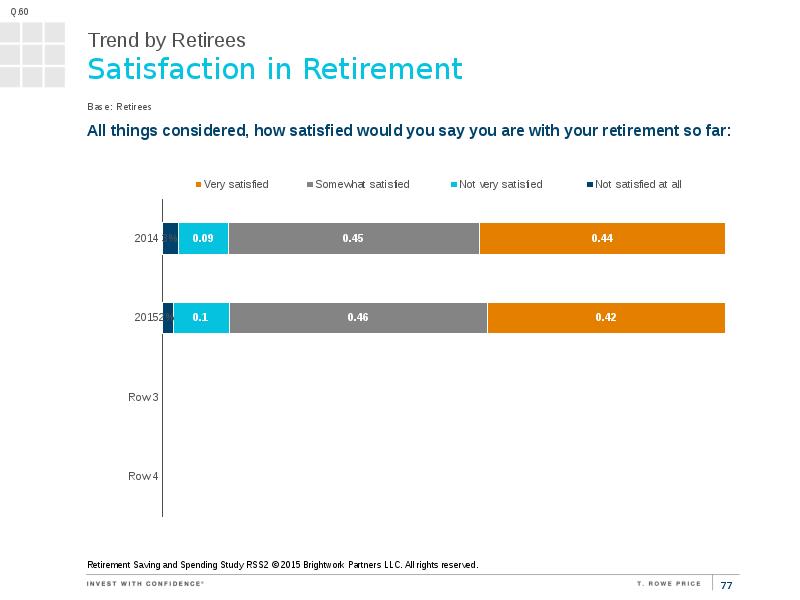

- 77. Satisfaction in Retirement Base: Retirees

- 78. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему Retirement Saving & Spending Study можно ниже:

Похожие презентации