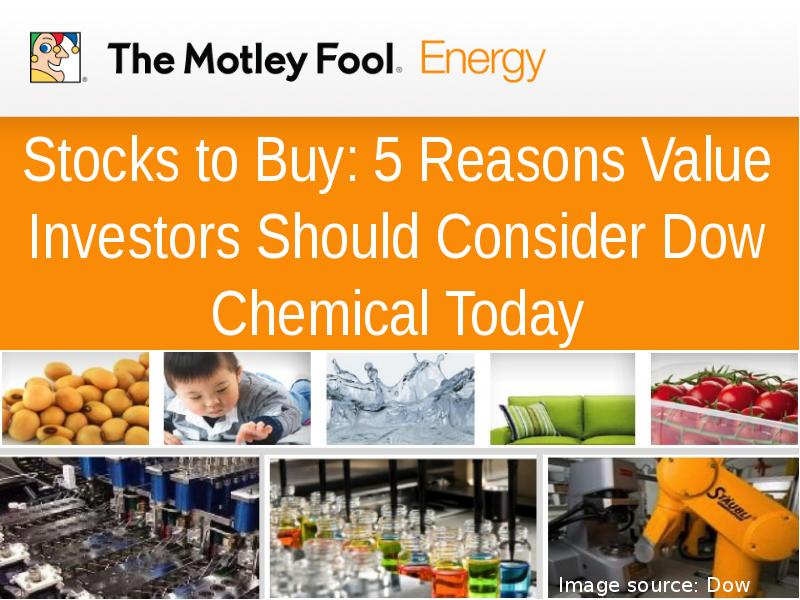

Stocks to Buy: 5 Reasons Value Investors Should Consider Dow Chemical Today презентация

Содержание

- 2. Diversity: Helps reduce earnings volatility Diversity: Helps reduce earnings volatility

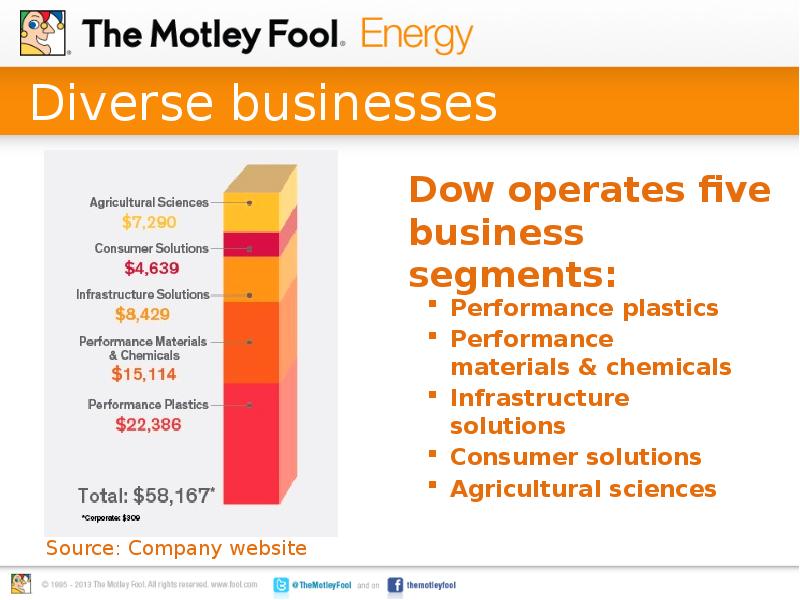

- 3. Diverse businesses Performance plastics Performance materials & chemicals Infrastructure

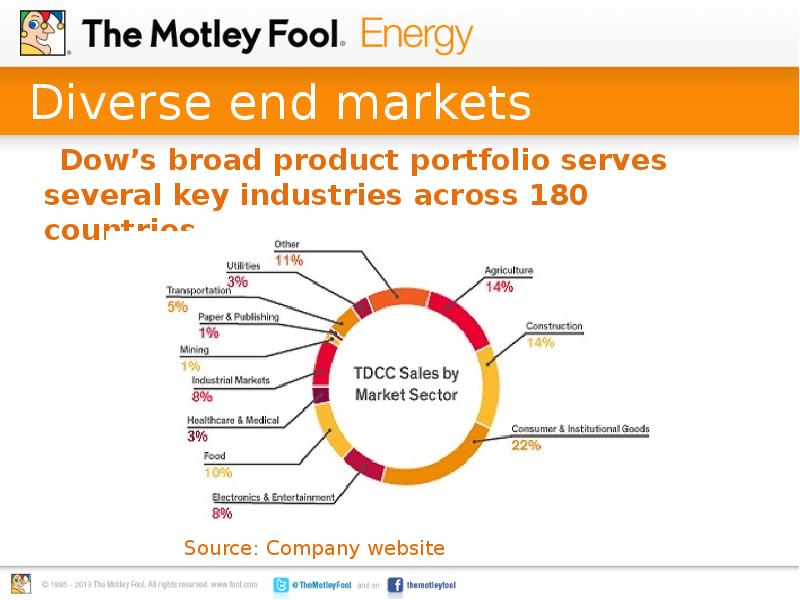

- 4. Diverse end markets Dow’s broad product portfolio serves several key

- 5. Innovative leadership: A compelling competitive advantage Innovative leadership: A compelling competitive

- 6. Full steam ahead Dow demonstrated its innovative leadership last year, with

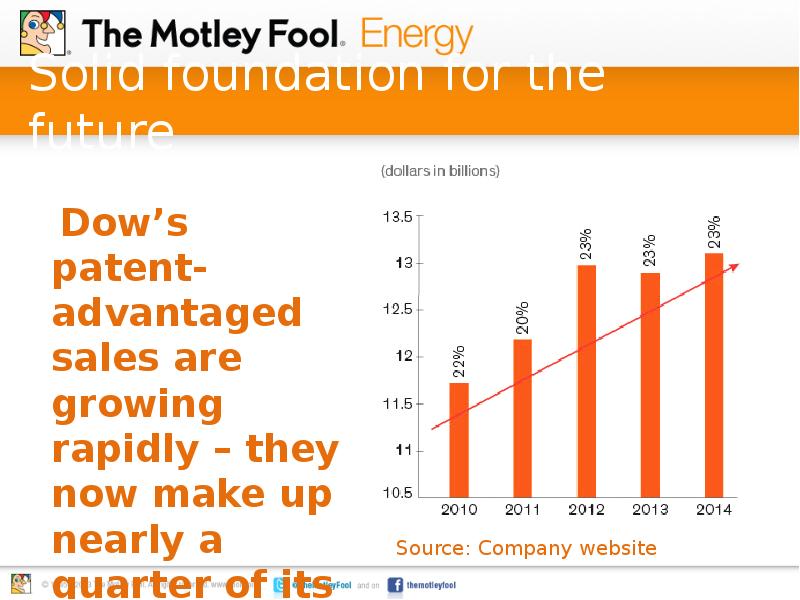

- 7. Solid foundation for the future Dow’s patent-advantaged sales are growing

- 8. Strong operational performance and financials Strong operational performance and financials

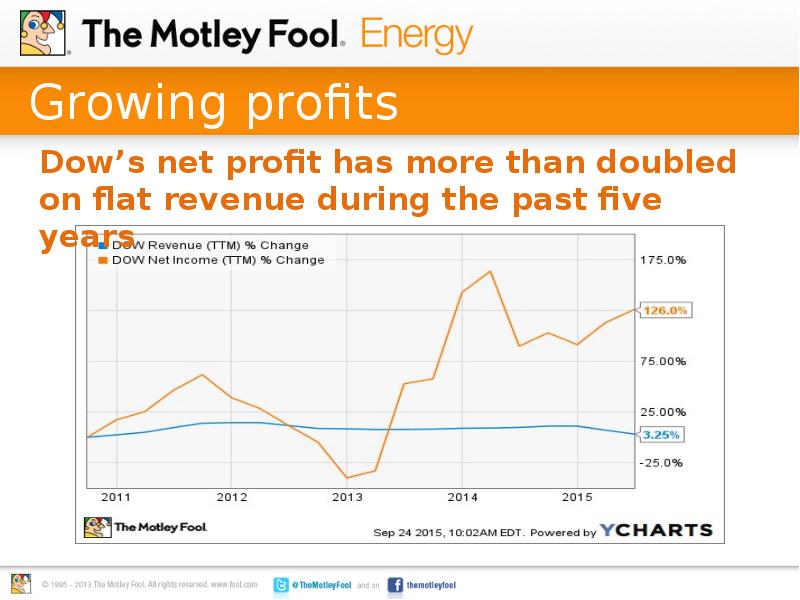

- 9. Growing profits

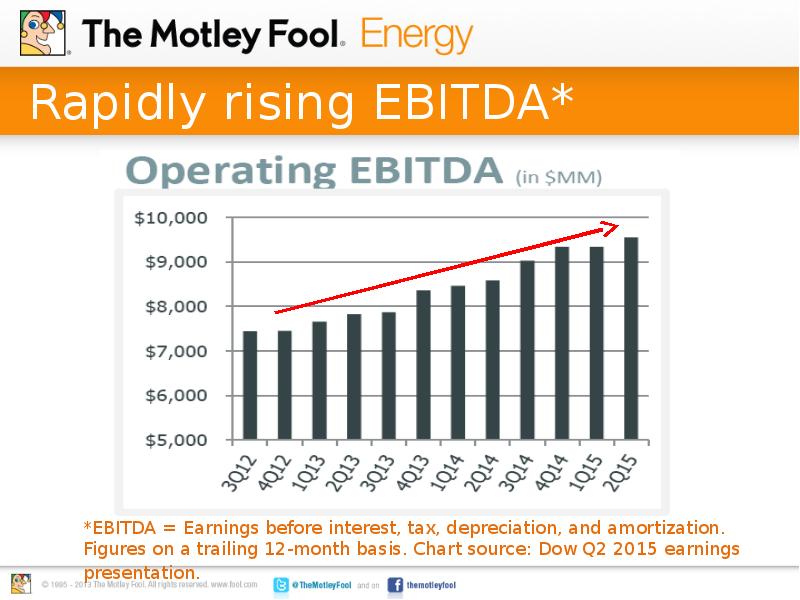

- 10. Rapidly rising EBITDA*

- 11. How is Dow pulling it off? Through a threefold strategy

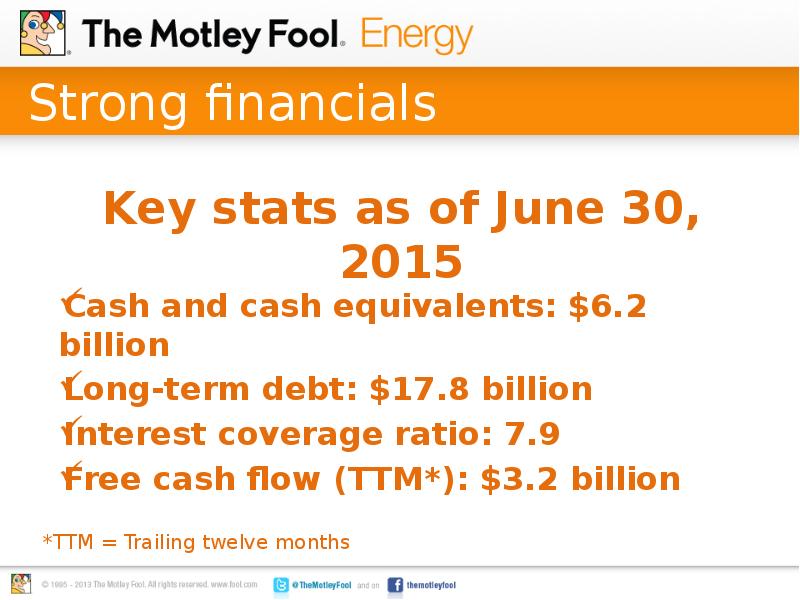

- 12. Strong financials Key stats as of June 30, 2015

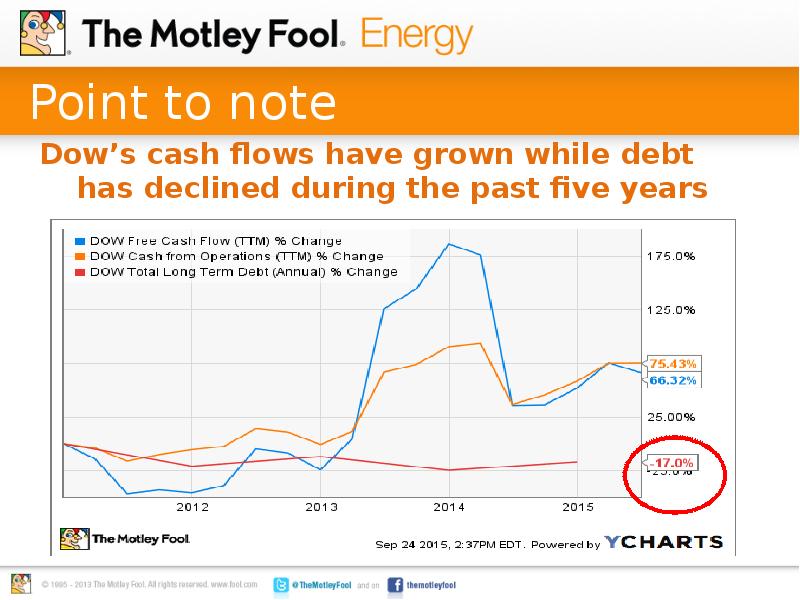

- 13. Point to note Dow’s cash flows have grown while debt has

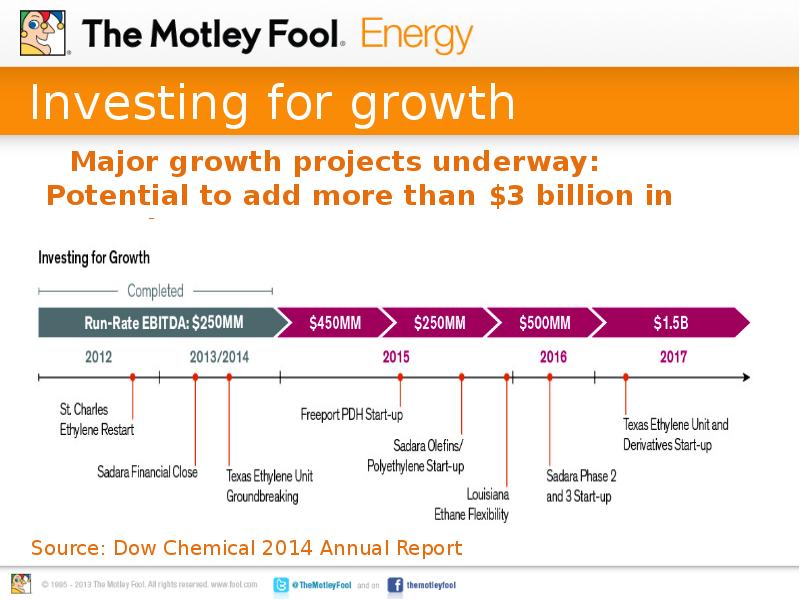

- 14. Big-ticket growth plans = solid foundation for the future Big-ticket growth

- 15. Investing for growth Major growth projects underway: Potential to add

- 16. Investing for growth Key projects include

- 17. Impressive shareholder returns Impressive shareholder returns

- 18. Value for shareholders Dow demonstrated its commitment to shareholders in 2014,

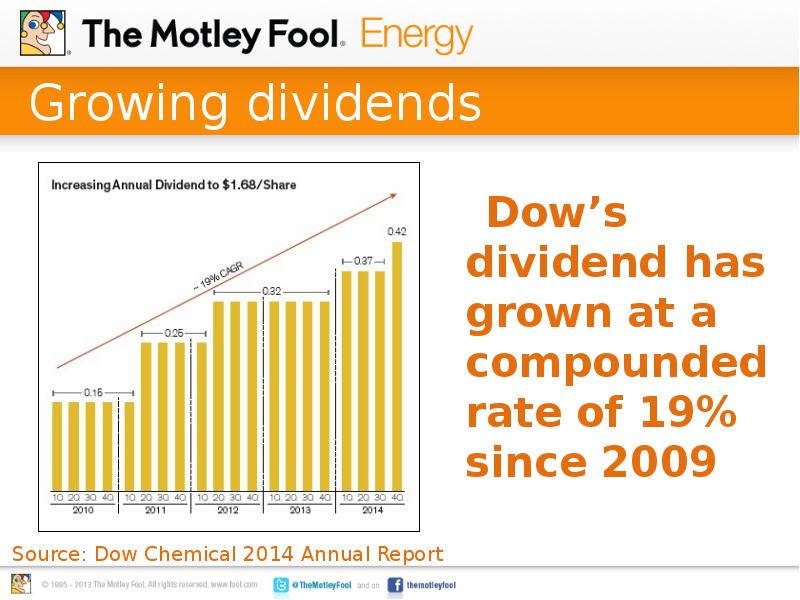

- 19. Growing dividends Dow’s dividend has grown at a compounded rate

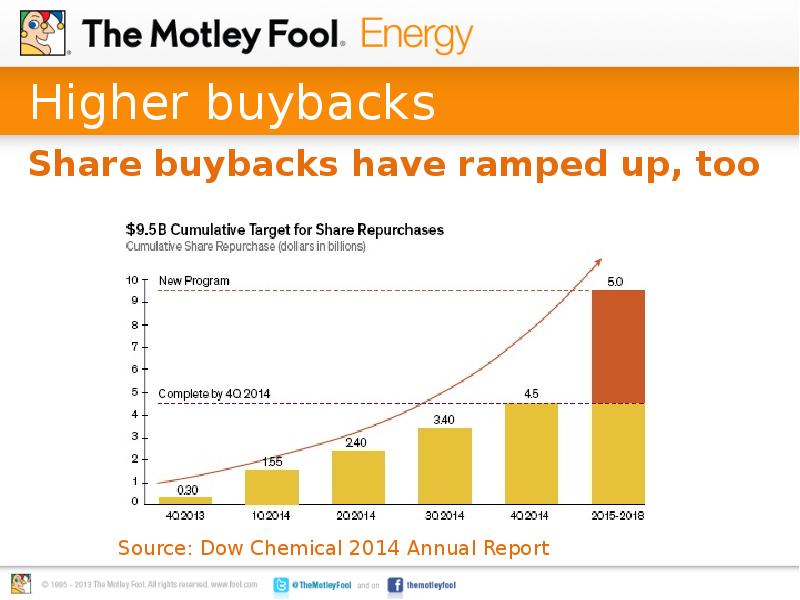

- 20. Higher buybacks Share buybacks have ramped up, too

- 21. To sum up Dow Chemical measures up on key counts: operational

- 23. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему Stocks to Buy: 5 Reasons Value Investors Should Consider Dow Chemical Today можно ниже:

Похожие презентации