The Mosaic Company Earnings: 5 Things You Need to Know презентация

Содержание

- 2. Margins continue to expand Margins continue to expand

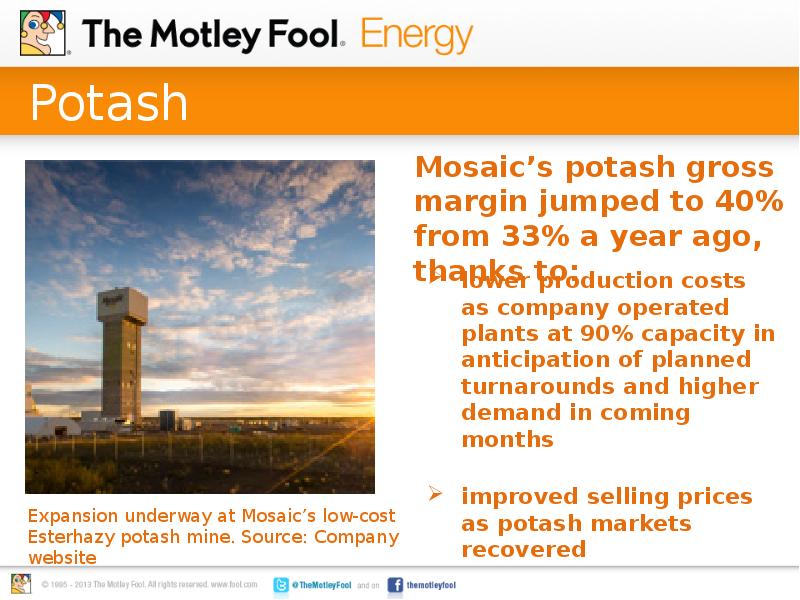

- 3. Potash lower production costs as company operated plants at 90%

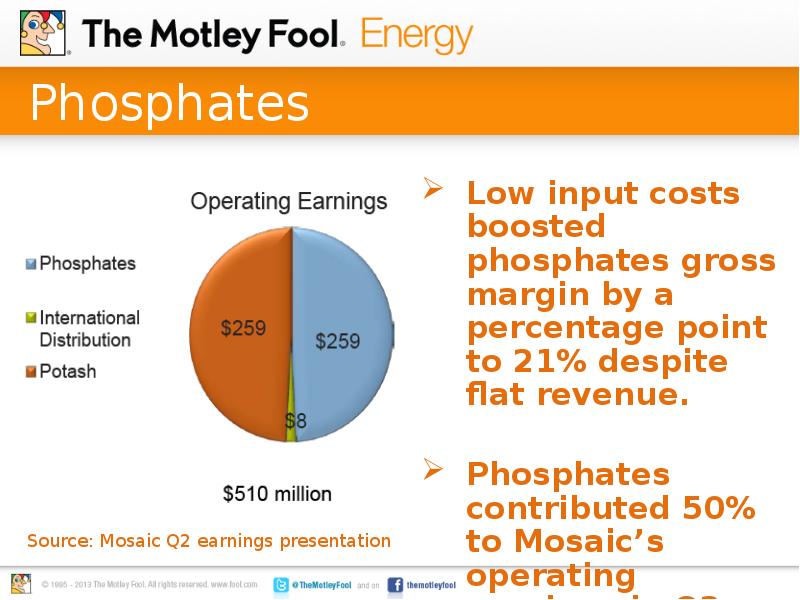

- 4. Phosphates Low input costs boosted phosphates gross margin by

- 5. Costs in control Costs in control

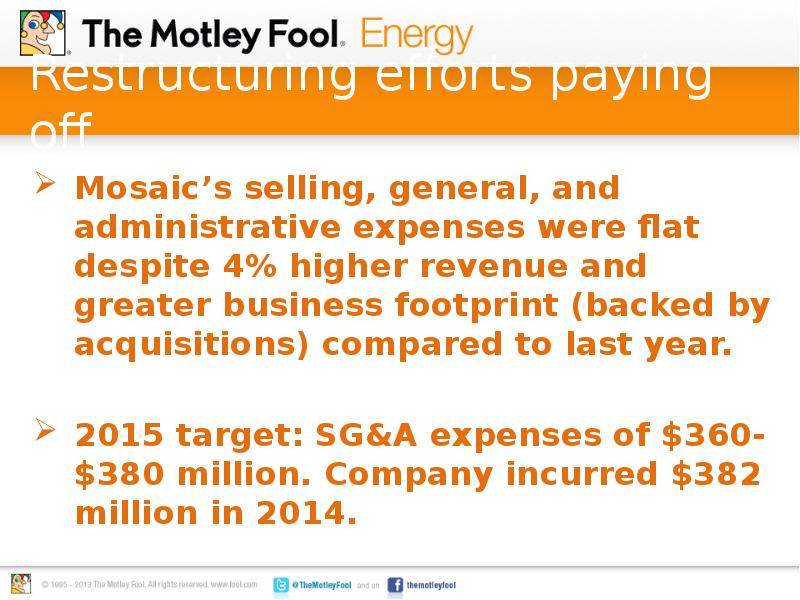

- 6. Restructuring efforts paying off Mosaic’s selling, general, and administrative expenses

- 7. Integration of acquired business on track Integration of acquired business on

- 8. International distribution segment growing Integration of Archer Daniels Midland’s fertilizer distribution

- 9. Ma’aden joint venture to cost more Ma’aden joint venture to cost

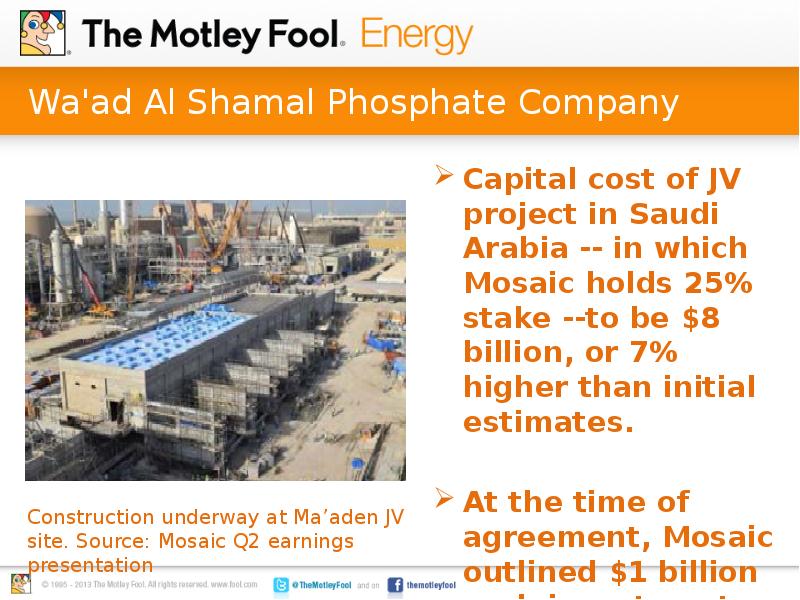

- 10. Wa'ad Al Shamal Phosphate Company Capital cost of JV project in

- 11. Sales volumes guidance revised Sales volumes guidance revised

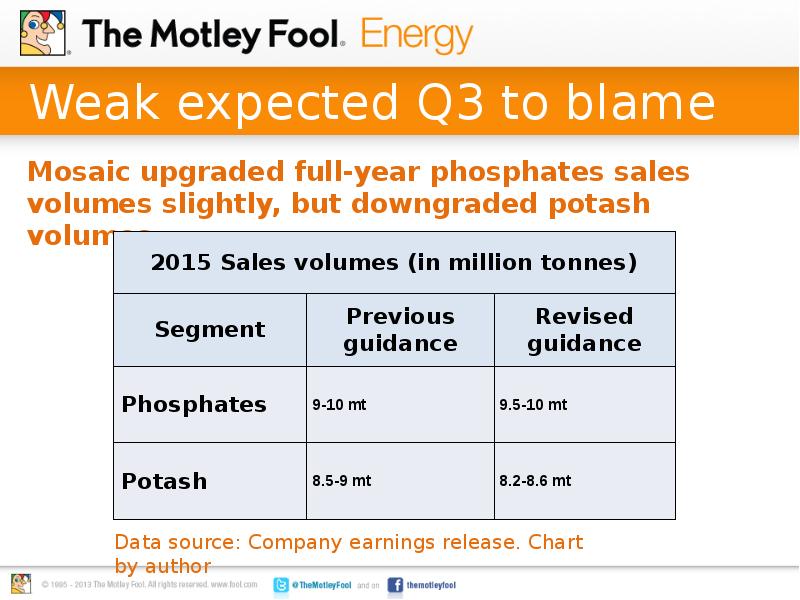

- 12. Weak expected Q3 to blame Mosaic upgraded full-year phosphates sales volumes

- 13. Foolish takeaway While Mosaic doesn’t give out full-year sales and profit

- 15. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему The Mosaic Company Earnings: 5 Things You Need to Know можно ниже:

Похожие презентации