These 3 Dividend Stocks Gave Income Investors a Nice Raise презентация

Содержание

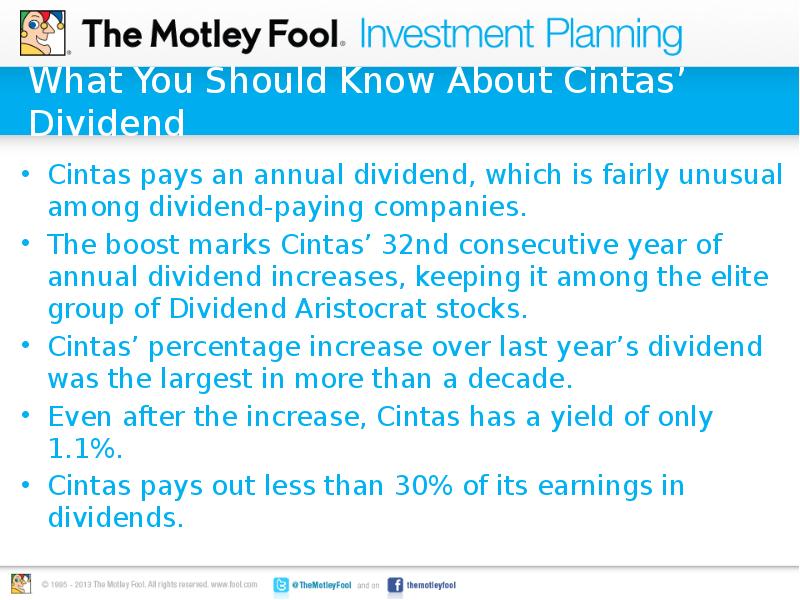

- 2. Cintas: 24% Increase to $1.05 Per Share Annually

- 3. What You Should Know About Cintas’ Dividend Cintas pays an annual

- 4. Yum! Brands: 12% Increase to $0.46 Per Share Quarterly

- 5. What You Should Know About Yum! Brands’ Dividend Yum! Brands extended

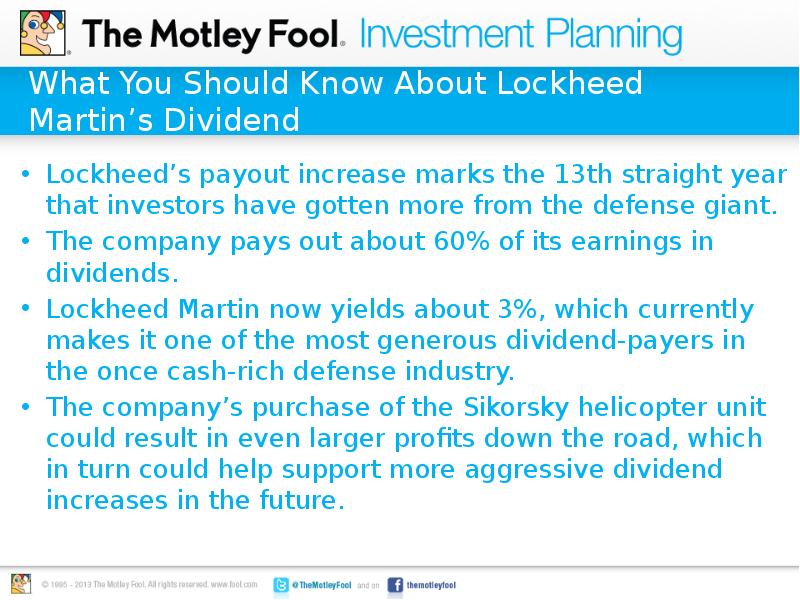

- 6. Lockheed Martin: 10% Increase to $1.65 Per Share Quarterly

- 7. What You Should Know About Lockheed Martin’s Dividend Lockheed’s payout increase

- 9. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему These 3 Dividend Stocks Gave Income Investors a Nice Raise можно ниже:

Похожие презентации