Top 10 Prime Oil Stock Takeover Candidates презентация

Содержание

- 2. Over a barrel Oil stocks both small and large have been

- 3. Over a barrel In many cases, it would be in an

- 4. Over a barrel With that deal in mind, here’s a list

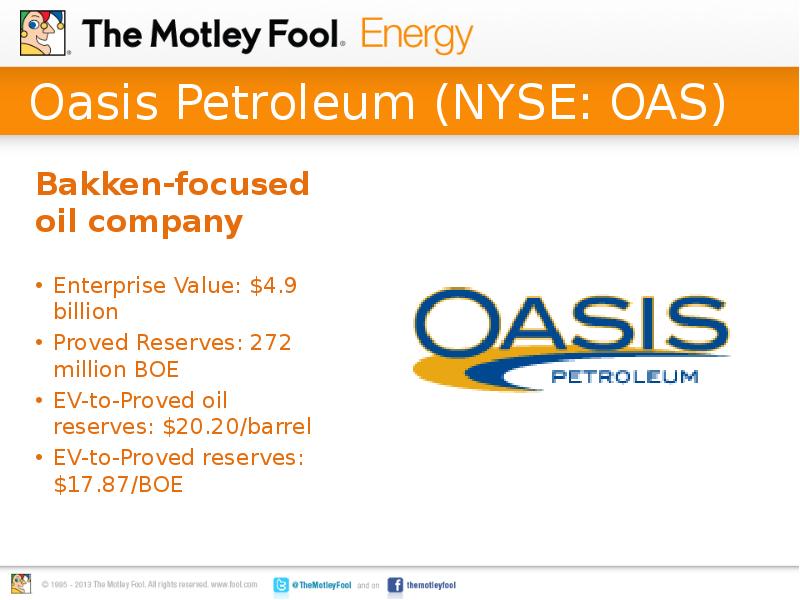

- 5. Oasis Petroleum (NYSE: OAS) Enterprise Value: $4.9 billion Proved Reserves:

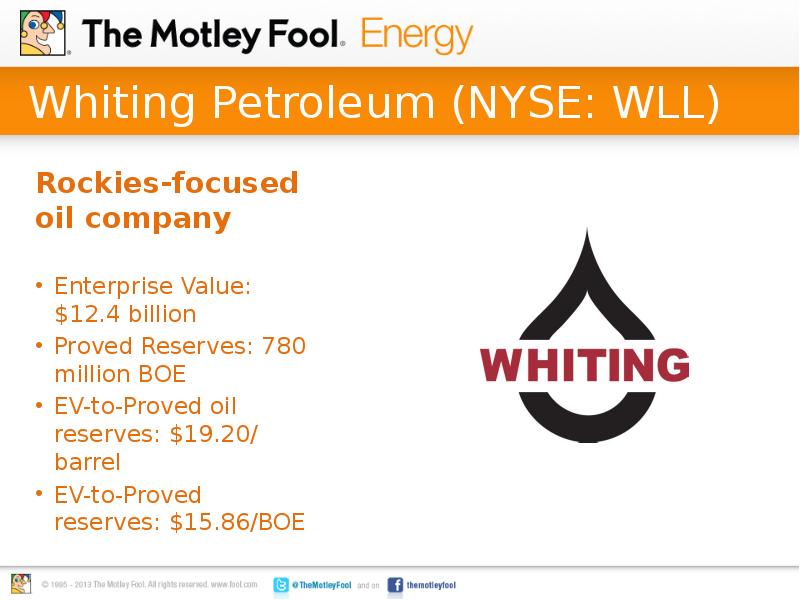

- 6. Whiting Petroleum (NYSE: WLL) Enterprise Value: $12.4 billion Proved Reserves:

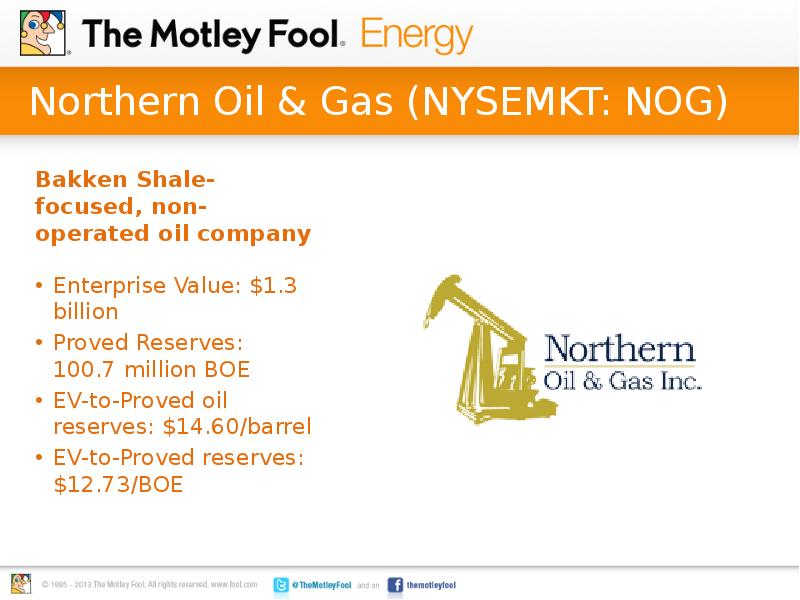

- 7. Northern Oil & Gas (NYSEMKT: NOG) Enterprise Value: $1.3 billion

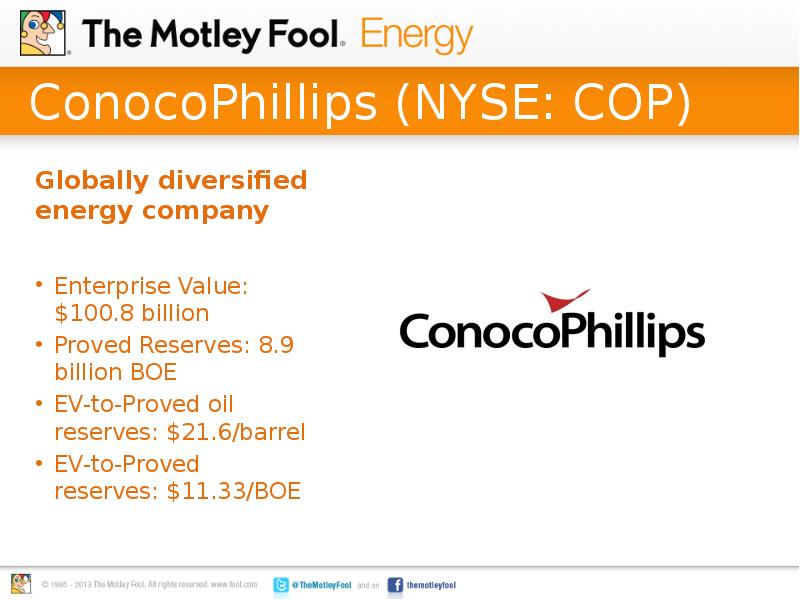

- 8. ConocoPhillips (NYSE: COP) Enterprise Value: $100.8 billion Proved Reserves: 8.9

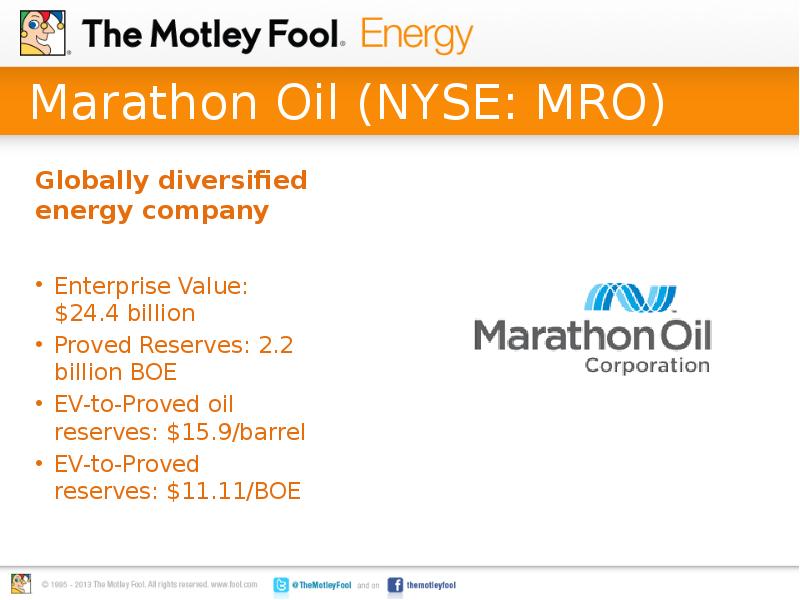

- 9. Marathon Oil (NYSE: MRO) Enterprise Value: $24.4 billion Proved Reserves:

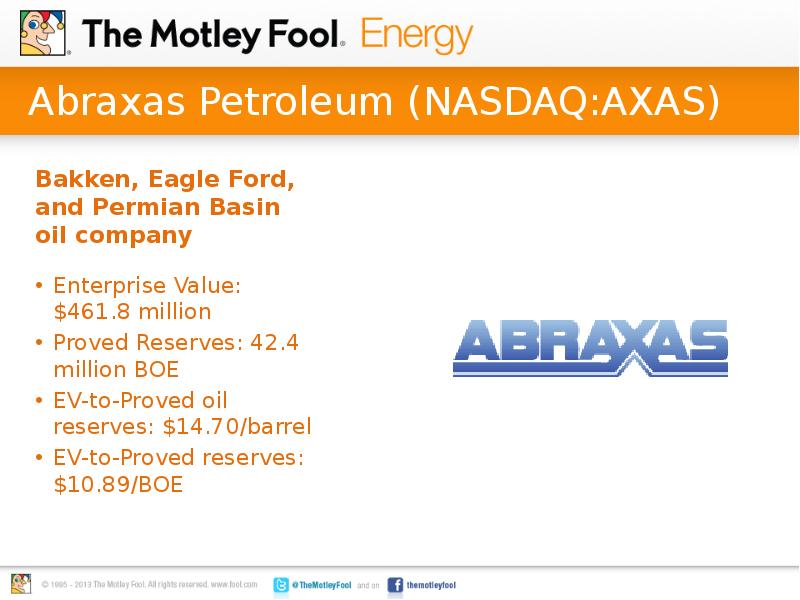

- 10. Abraxas Petroleum (NASDAQ:AXAS) Enterprise Value: $461.8 million Proved Reserves: 42.4 million

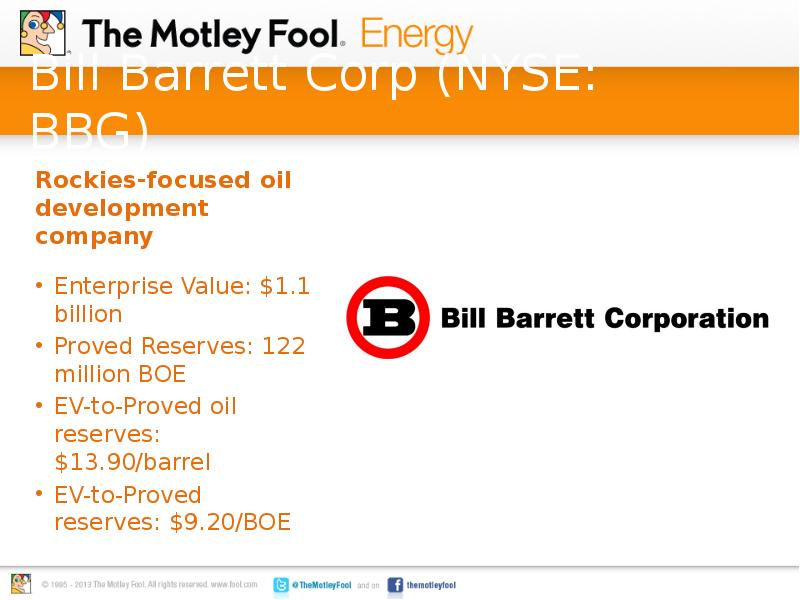

- 11. Bill Barrett Corp (NYSE: BBG) Enterprise Value: $1.1 billion Proved

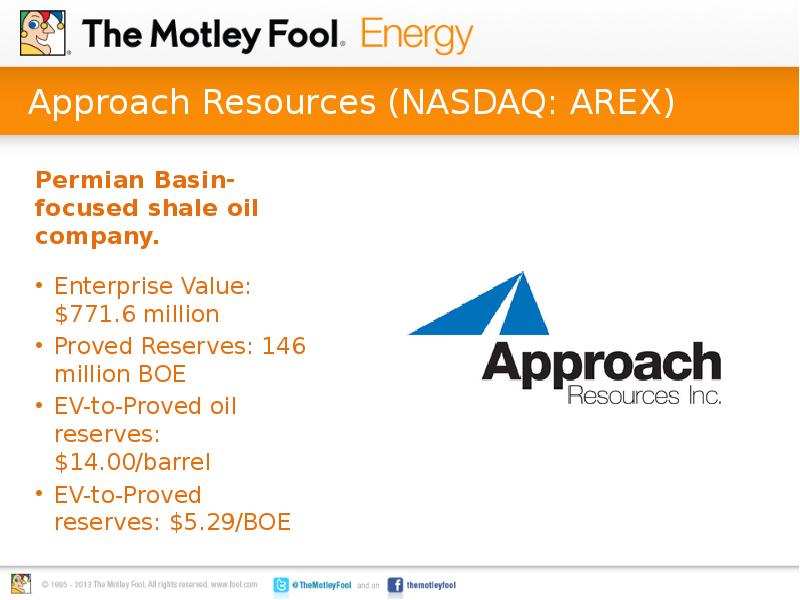

- 12. Approach Resources (NASDAQ: AREX) Enterprise Value: $771.6 million Proved Reserves:

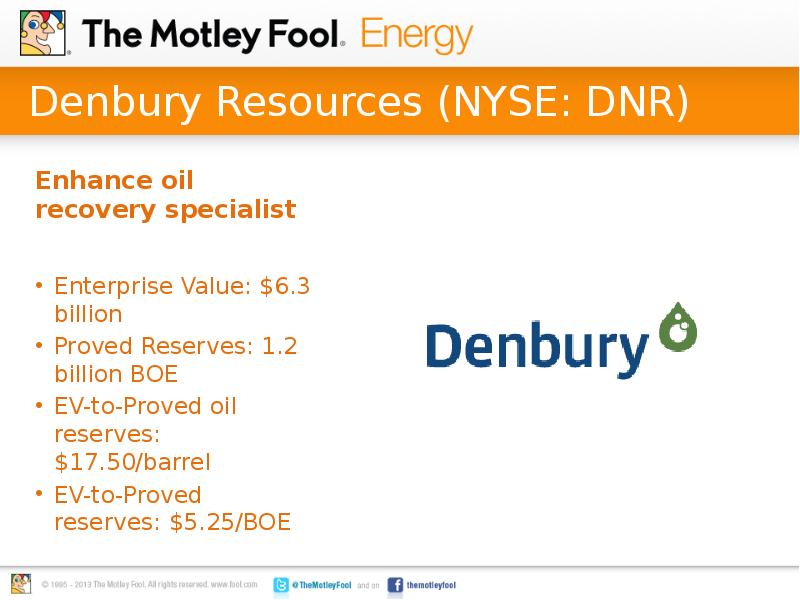

- 13. Denbury Resources (NYSE: DNR) Enterprise Value: $6.3 billion Proved Reserves:

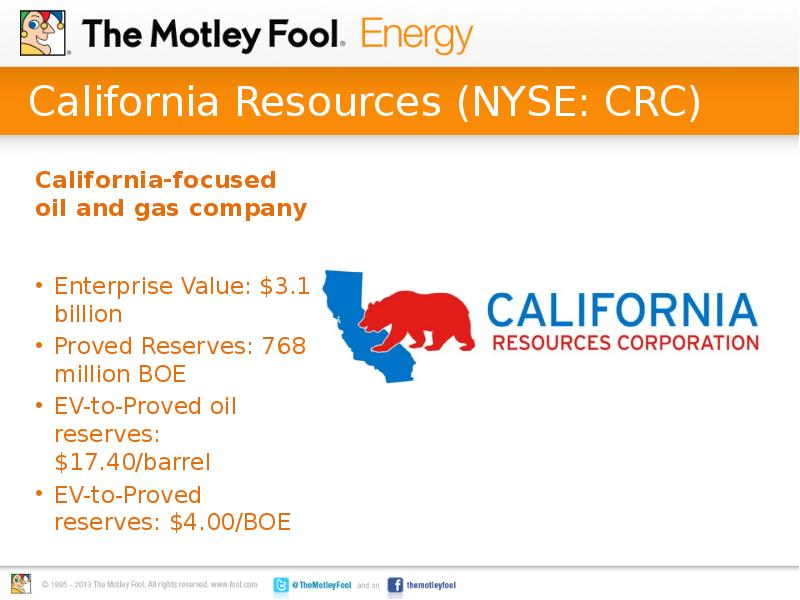

- 14. California Resources (NYSE: CRC) Enterprise Value: $3.1 billion Proved Reserves:

- 16. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему Top 10 Prime Oil Stock Takeover Candidates можно ниже:

Похожие презентации