Municipal investment plan презентация

Содержание

- 2. Agenda

- 3. Saving For Retirement

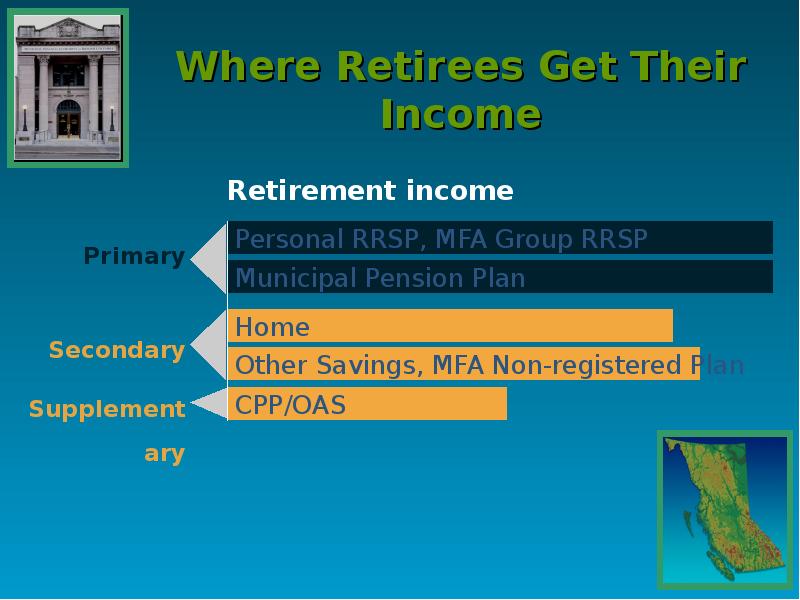

- 4. Where Retirees Get Their Income

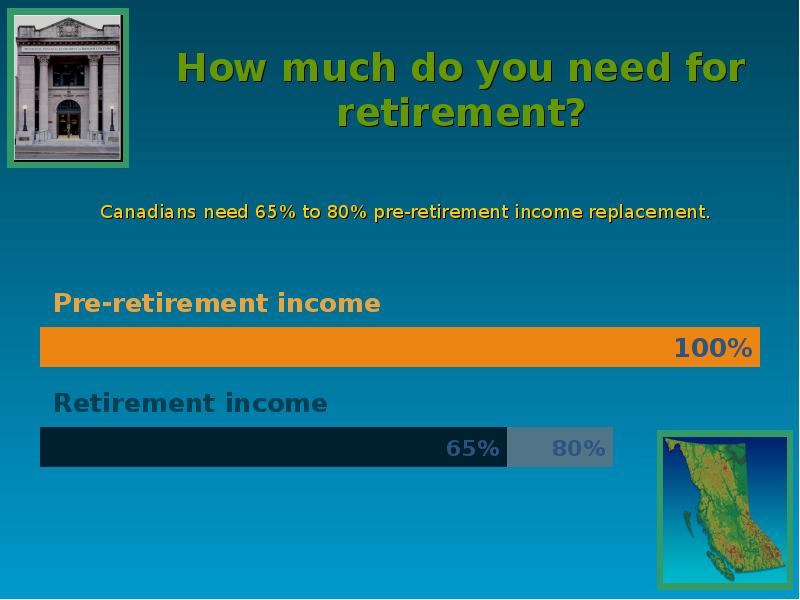

- 5. How much do you need for retirement? Canadians need 65% to

- 6. What? Me Save?

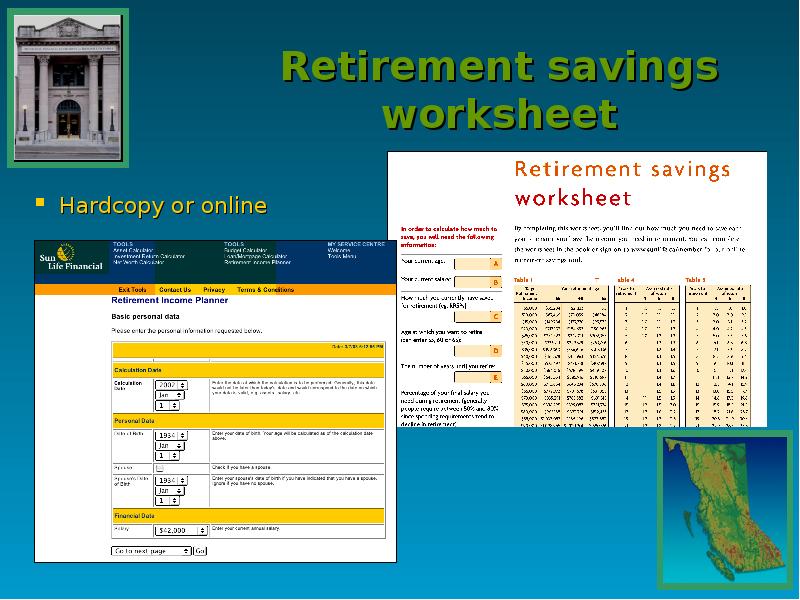

- 7. Retirement savings worksheet Hardcopy or online

- 8. Making the most of your plan

- 9. Relationships

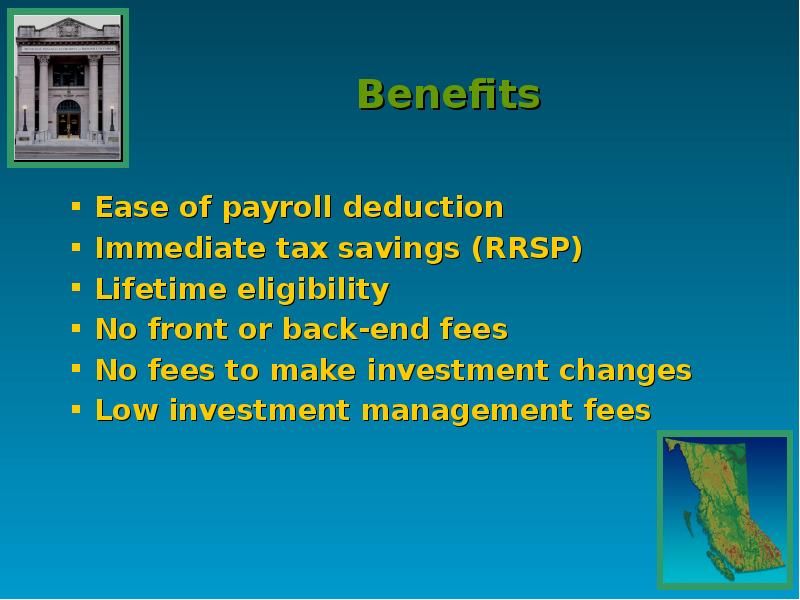

- 10. Benefits Ease of payroll deduction Immediate tax savings (RRSP)

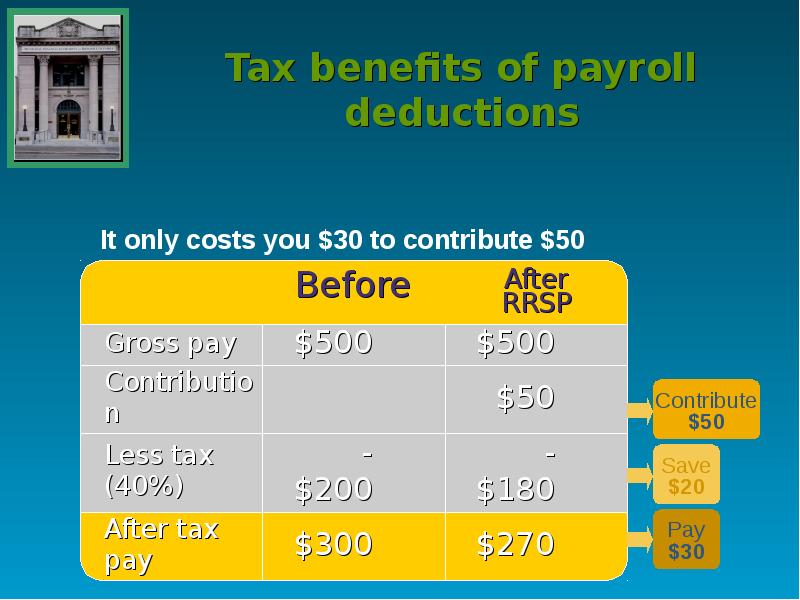

- 11. Tax benefits of payroll deductions

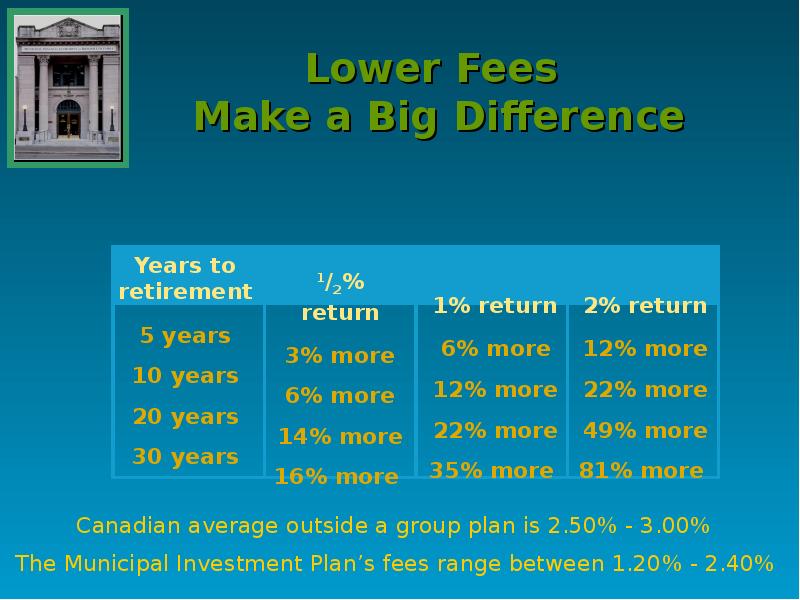

- 13. Lower Fees Make a Big Difference

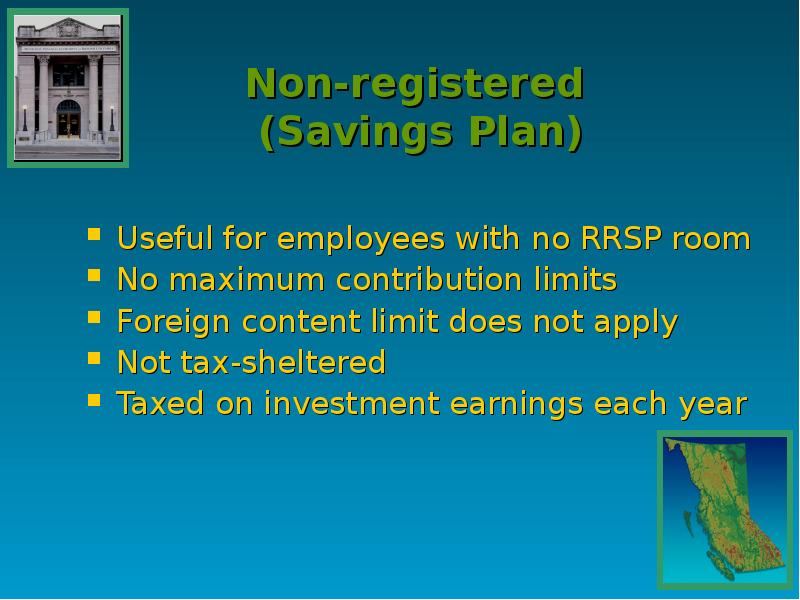

- 14. Non-registered (Savings Plan) Useful for employees with no RRSP room No

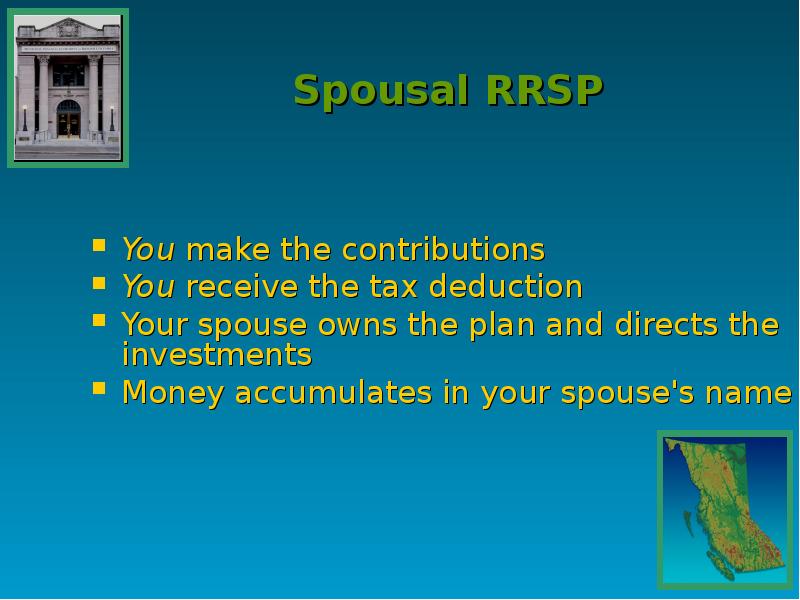

- 15. Spousal RRSP You make the contributions You receive the tax deduction

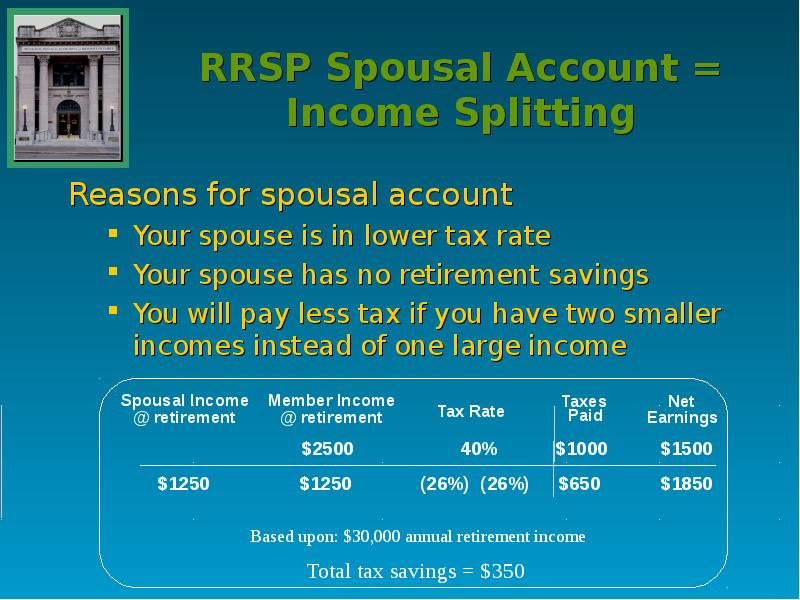

- 16. RRSP Spousal Account = Income Splitting Reasons for spousal account Your

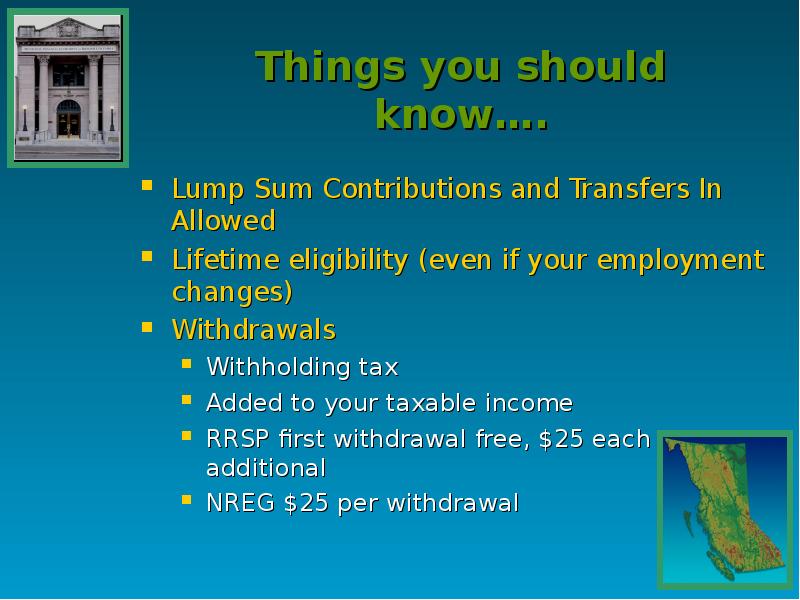

- 17. Things you should know…. Lump Sum Contributions and Transfers In Allowed

- 18. Ways to Contribute Payroll deduction (if municipality opts in) Lump sum

- 19. Developing Your Investment Strategy

- 20. Investment Types (Asset Classes) Equities (Stocks) Ownership in company Share in

- 21. Growth of $1 (1960 - 2003)

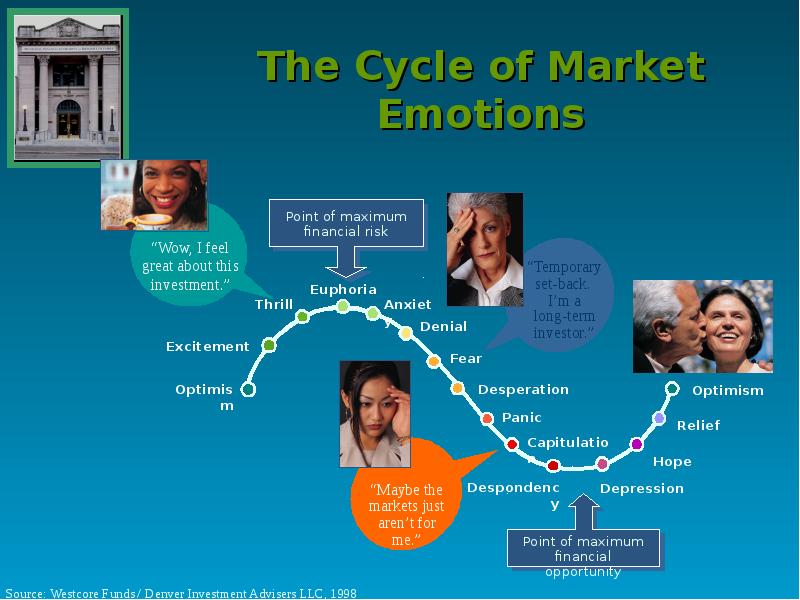

- 22. The Cycle of Market Emotions

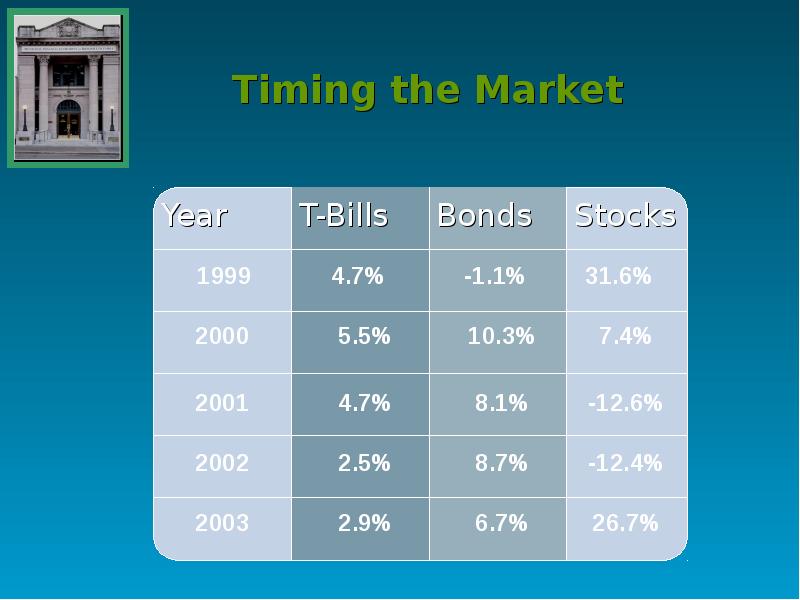

- 23. Timing the Market

- 24. Passive / Market Oriented

- 25. Value / Long Term Oriented

- 26. Growth Oriented

- 27. Specialty Funds

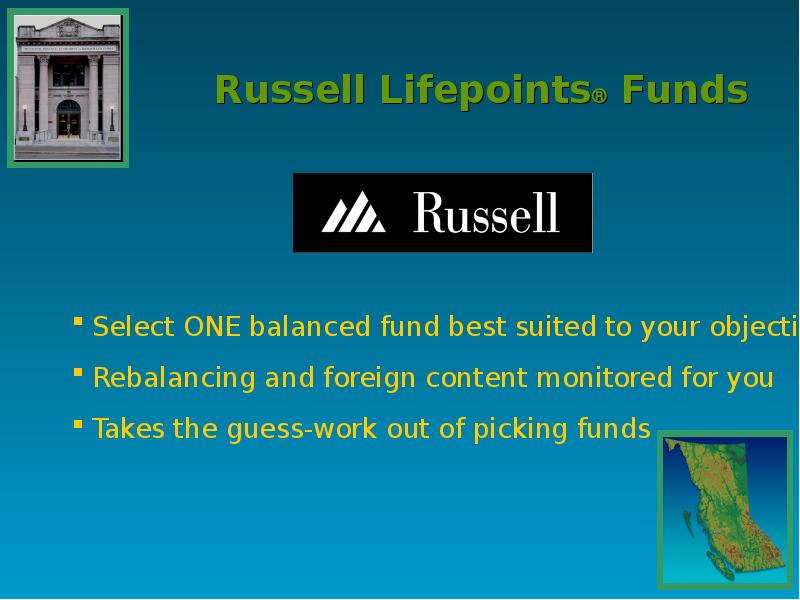

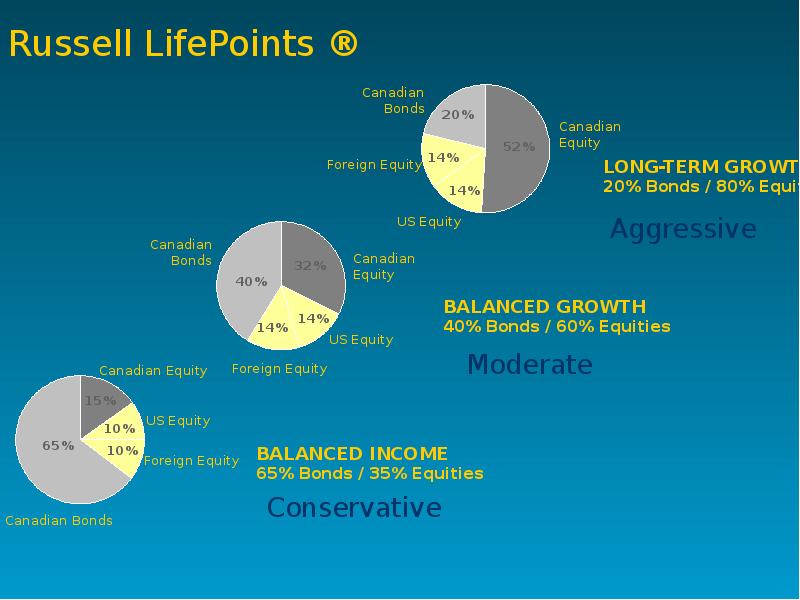

- 28. Russell Lifepoints Funds

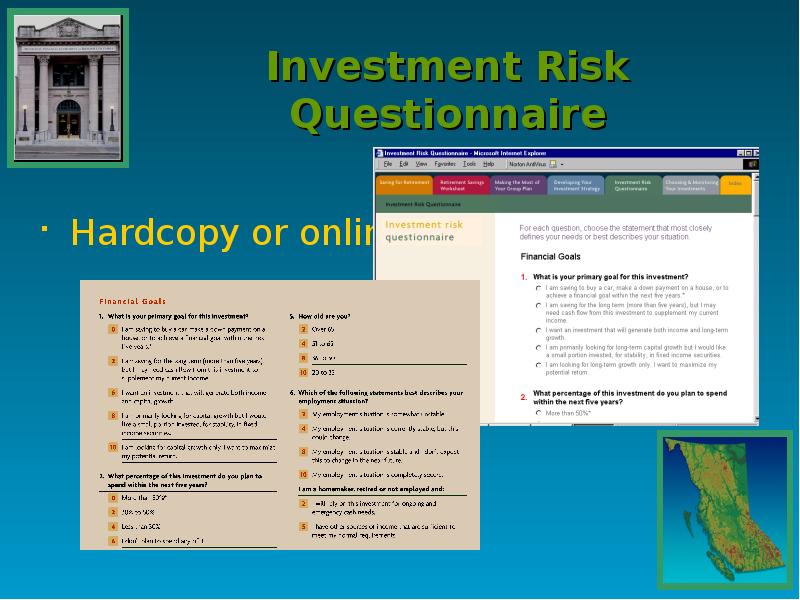

- 30. Investment Risk Questionnaire

- 31. Choosing and Monitoring your investments

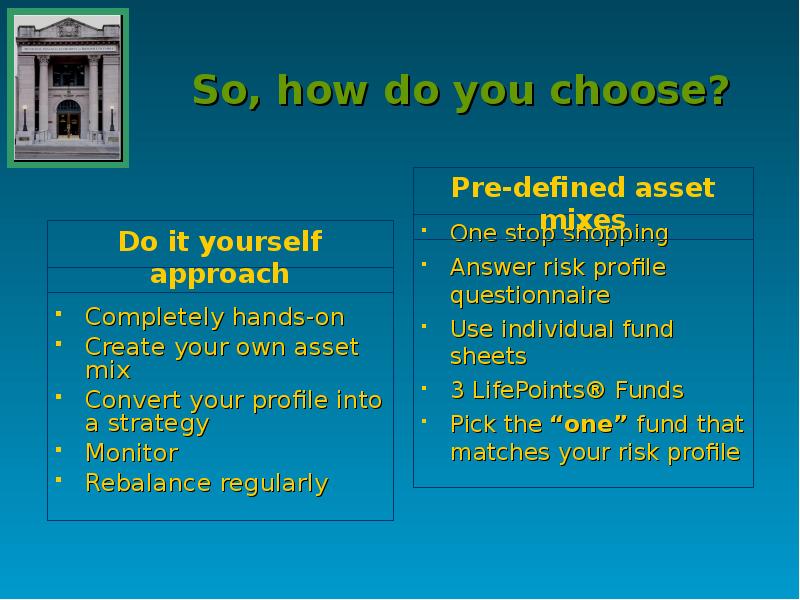

- 32. So, how do you choose? Completely hands-on Create your own asset

- 33. Monitor Your Investments Revisit your strategy periodically Will change over time

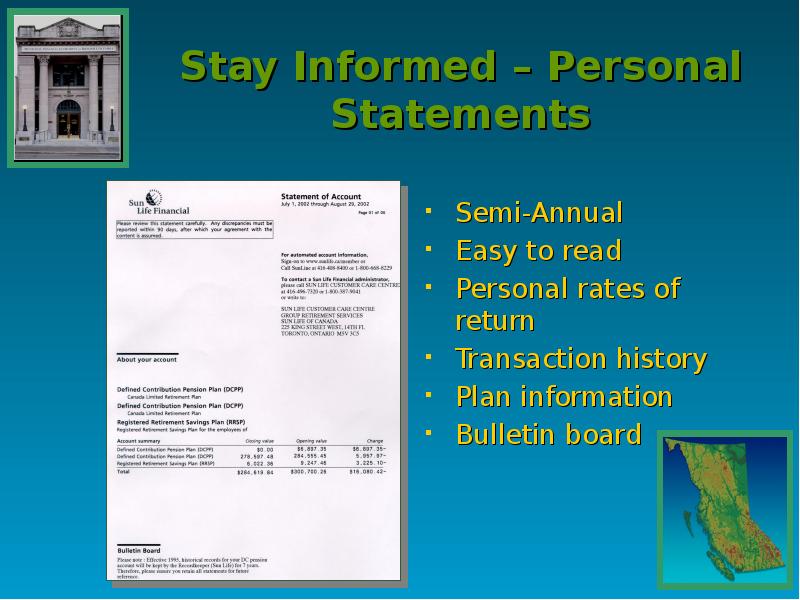

- 34. Stay Informed – Personal Statements Semi-Annual Easy to read Personal rates

- 35. Account Access Tools Customer Care Centre 1-866-733-8613 Account balances Rates of

- 36. Your Next Steps Complete the Investor Risk Profile - What? Me

- 37. Questions?

- 38. Скачать презентацию

Слайды и текст этой презентации

Похожие презентации