Business Cycle Theory: The Economy in the Short Run презентация

Содержание

- 2. INTRODUCTION TO ECONOMIC FLUCTUATIONS INTRODUCTION TO ECONOMIC FLUCTUATIONS

- 3. 10-1 The Facts About the Business Cycle 10-1 The Facts About

- 4. 10-1 The Facts About the Business Cycle When the economy experiences

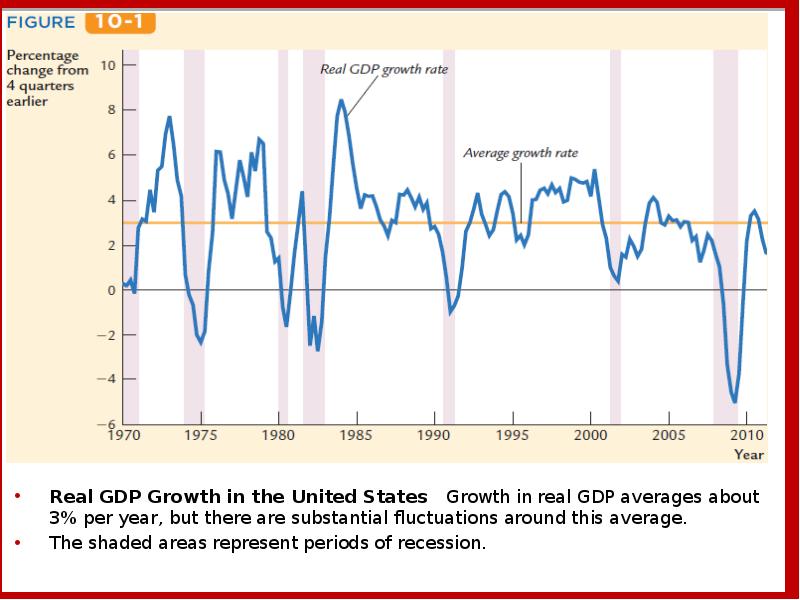

- 5. Real GDP Growth in the United States Growth in real GDP

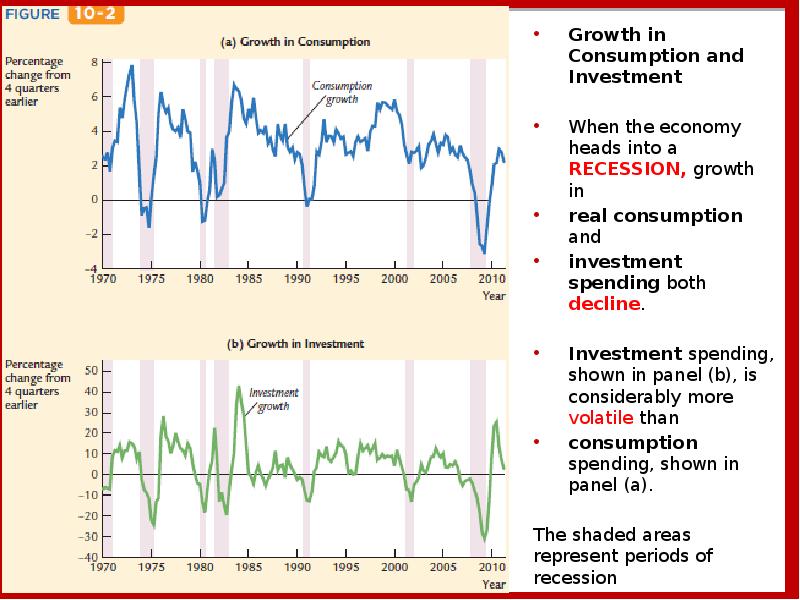

- 6. Growth in Consumption and Investment Growth in Consumption and Investment

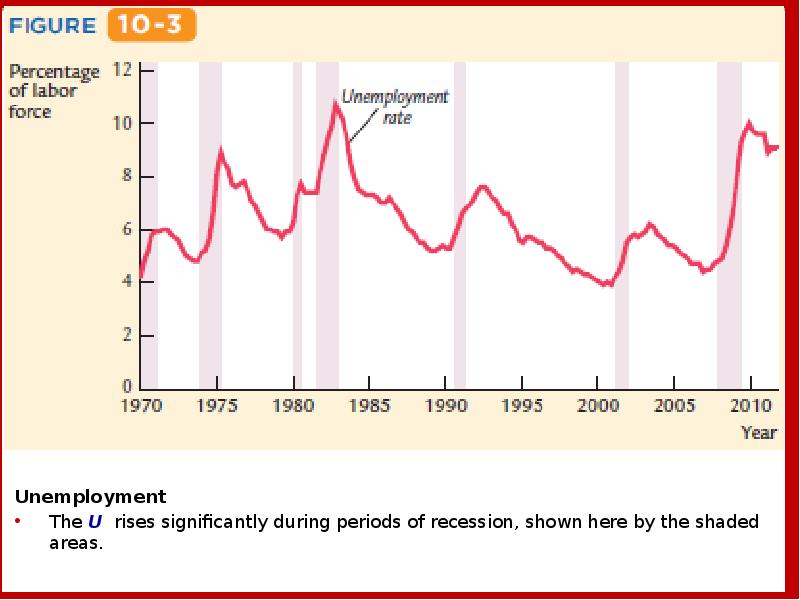

- 7. Unemployment The U rises significantly during periods of recession, shown

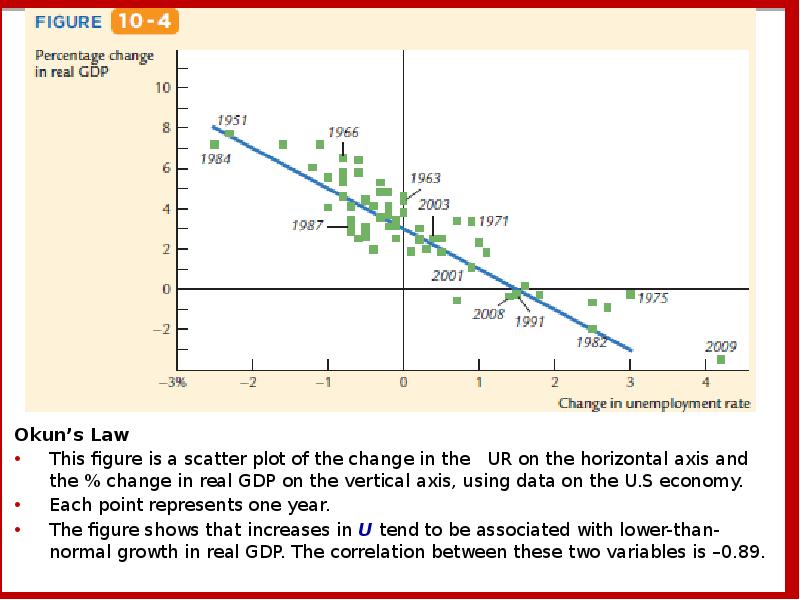

- 8. Okun’s Law This figure is a scatter plot of the

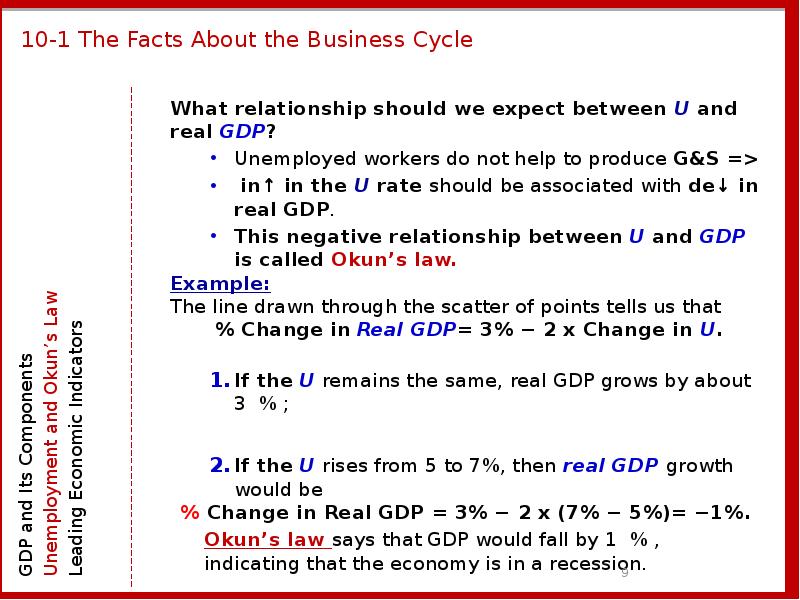

- 9. 10-1 The Facts About the Business Cycle What relationship should we

- 10. 10-1 The Facts About the Business Cycle GDP and Its Components

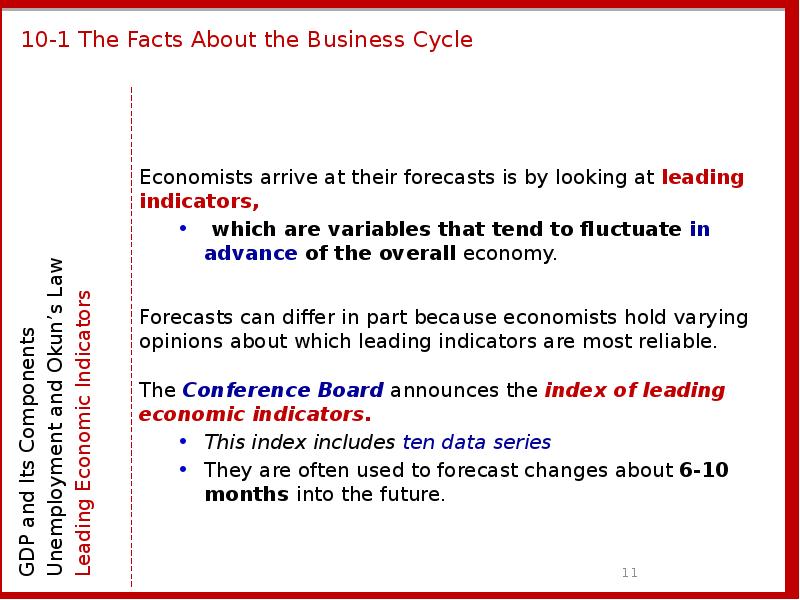

- 11. 10-1 The Facts About the Business Cycle Economists arrive at their

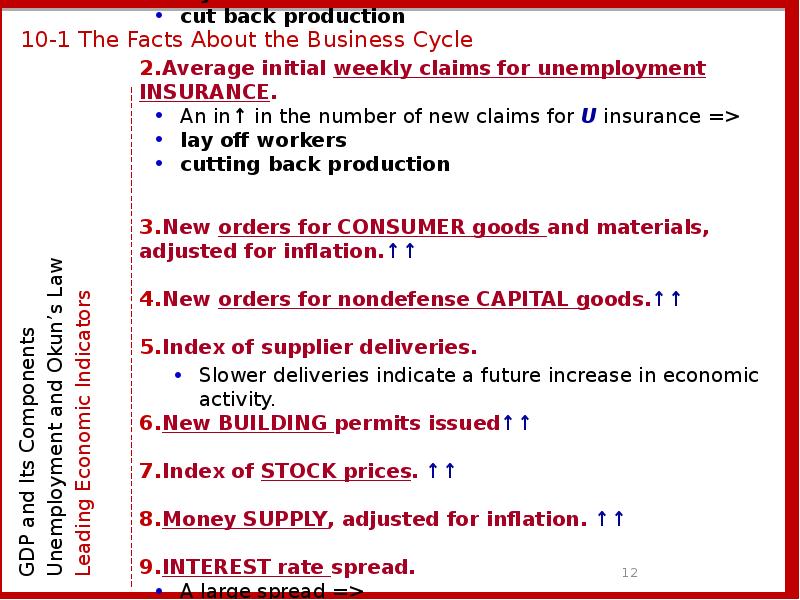

- 12. 10-1 The Facts About the Business Cycle Average WORKWEEK of production

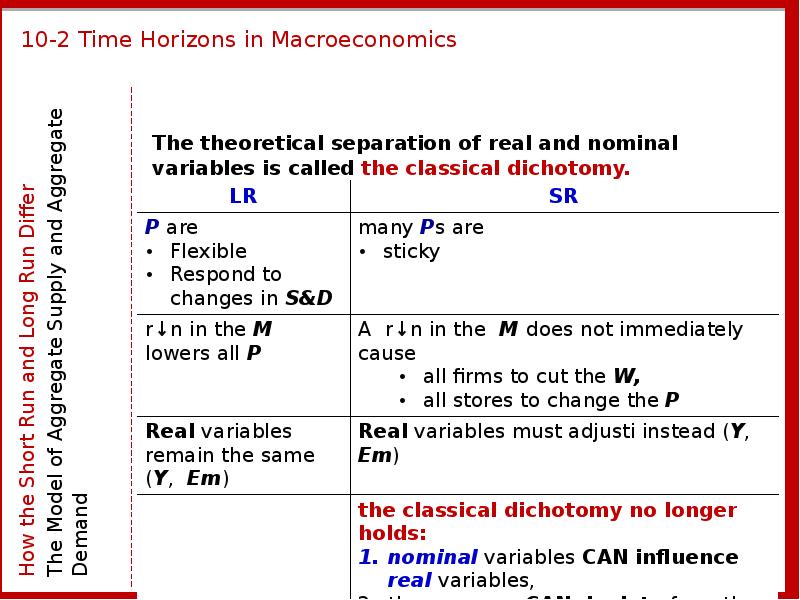

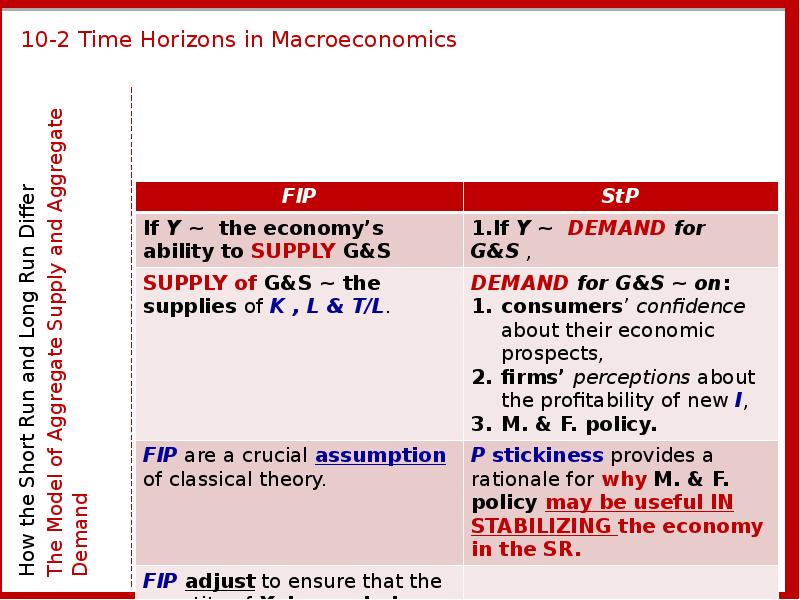

- 13. 10-2 Time Horizons in Macroeconomics The theoretical separation of real and

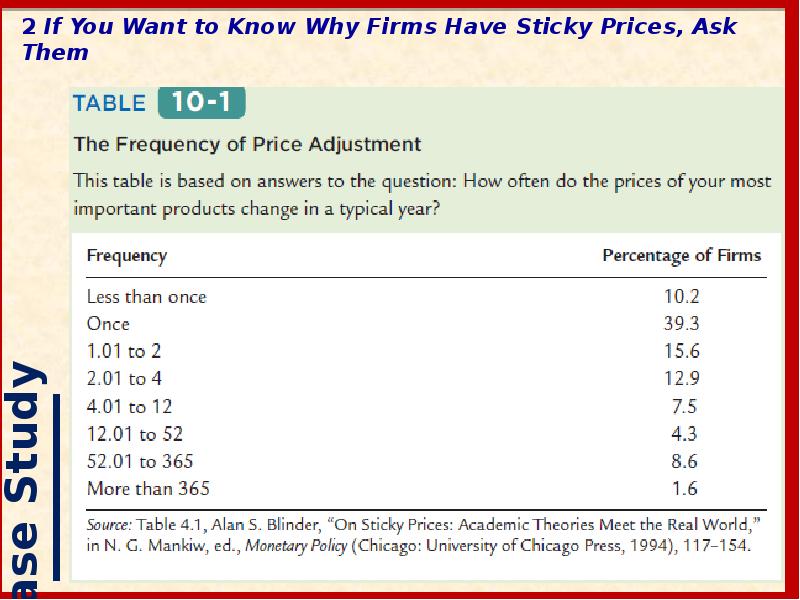

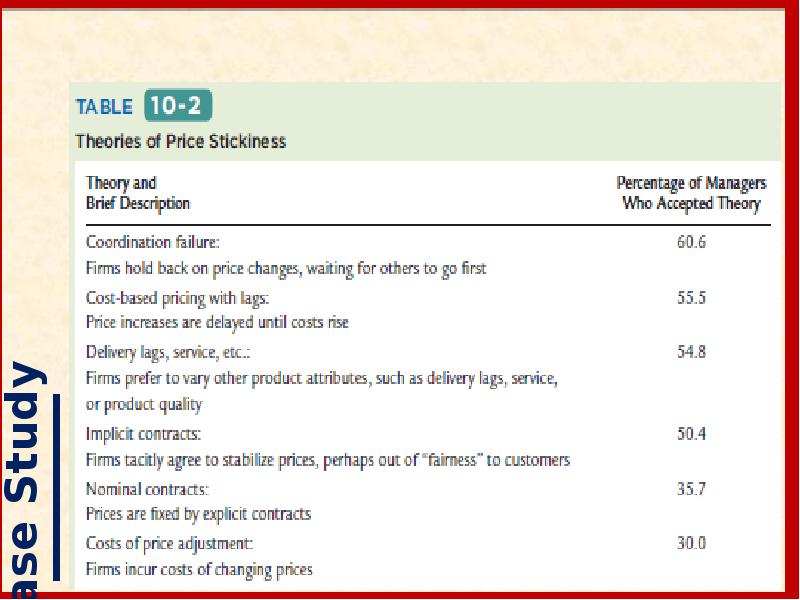

- 14. 2 If You Want to Know Why Firms Have Sticky Prices,

- 16. 10-2 Time Horizons in Macroeconomics How does the introduction of StP

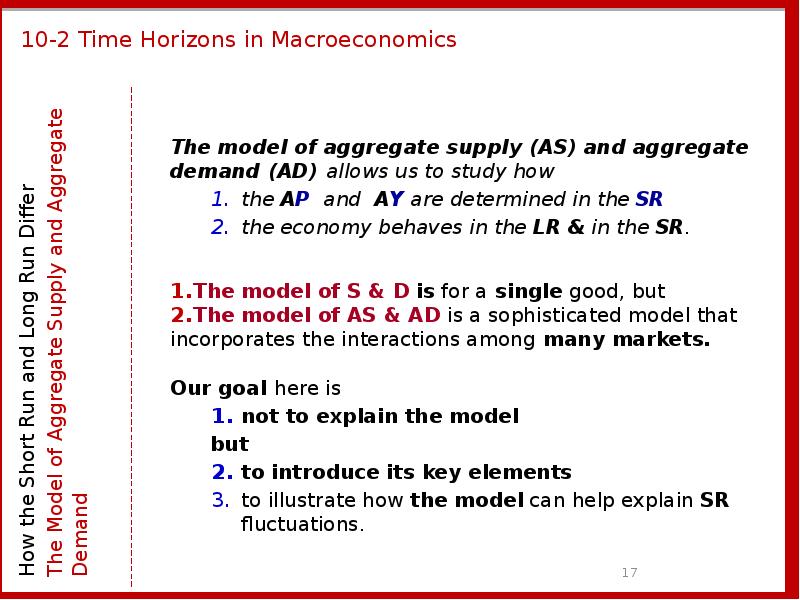

- 17. 10-2 Time Horizons in Macroeconomics How the Short Run and Long

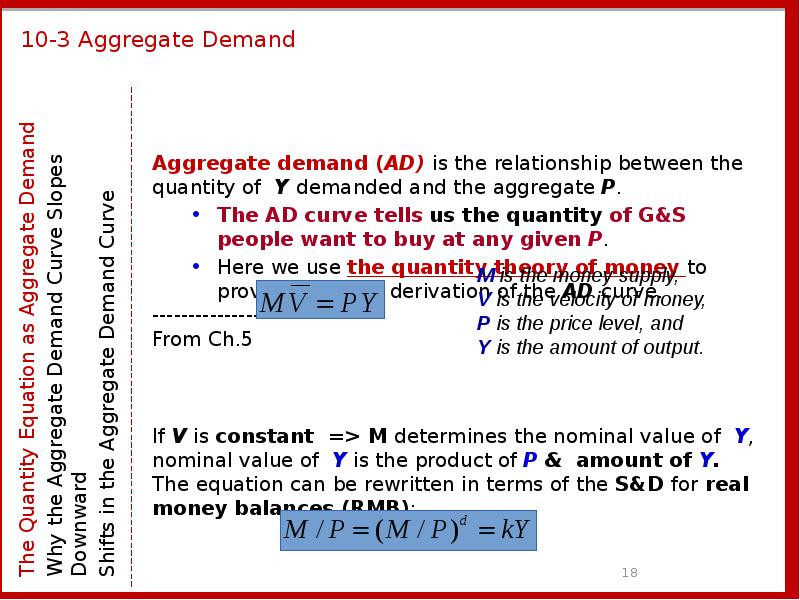

- 18. 10-3 Aggregate Demand Aggregate demand (AD) is the relationship between the

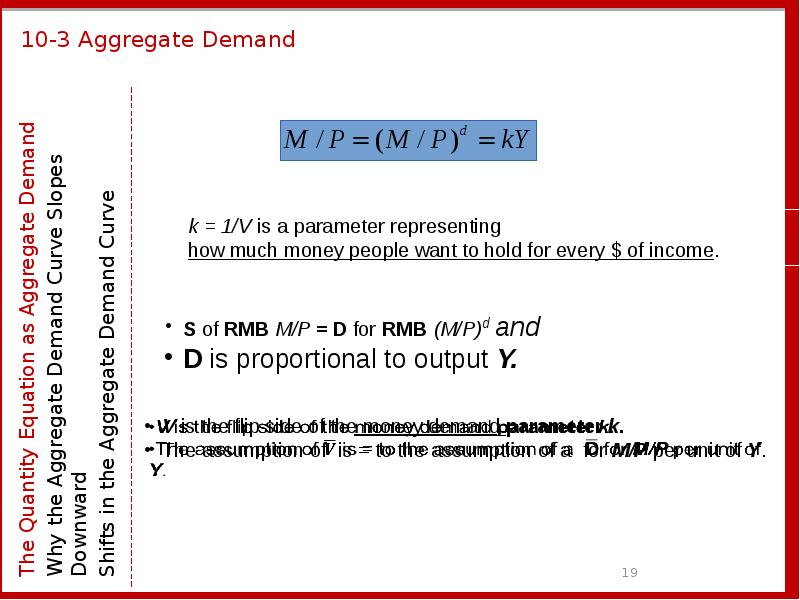

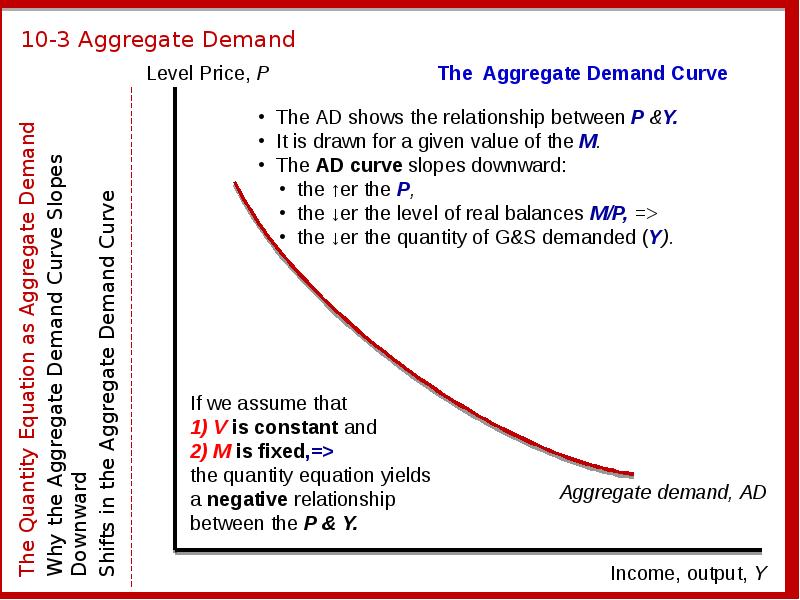

- 19. 10-3 Aggregate Demand The Quantity Equation as Aggregate Demand Why the

- 20. 10-3 Aggregate Demand The Quantity Equation as Aggregate Demand Why the

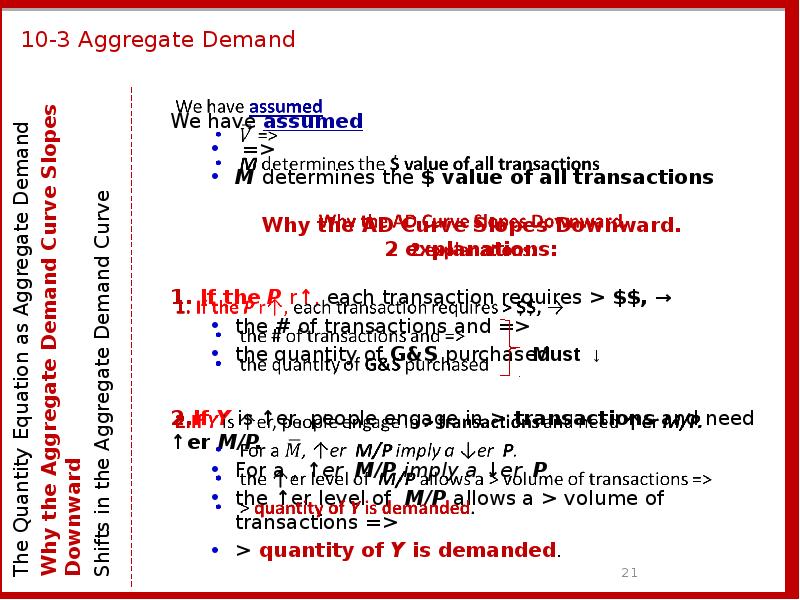

- 21. 10-3 Aggregate Demand We have assumed => M determines the

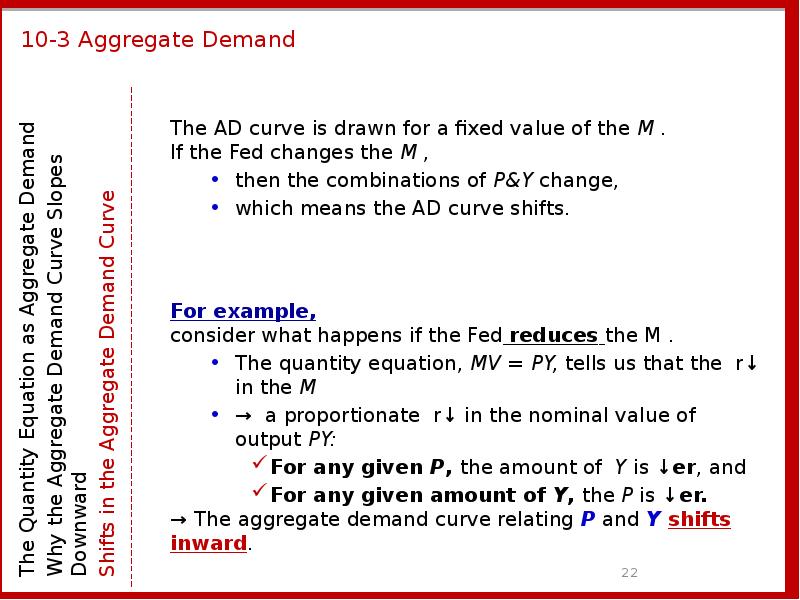

- 22. 10-3 Aggregate Demand The Quantity Equation as Aggregate Demand Why the

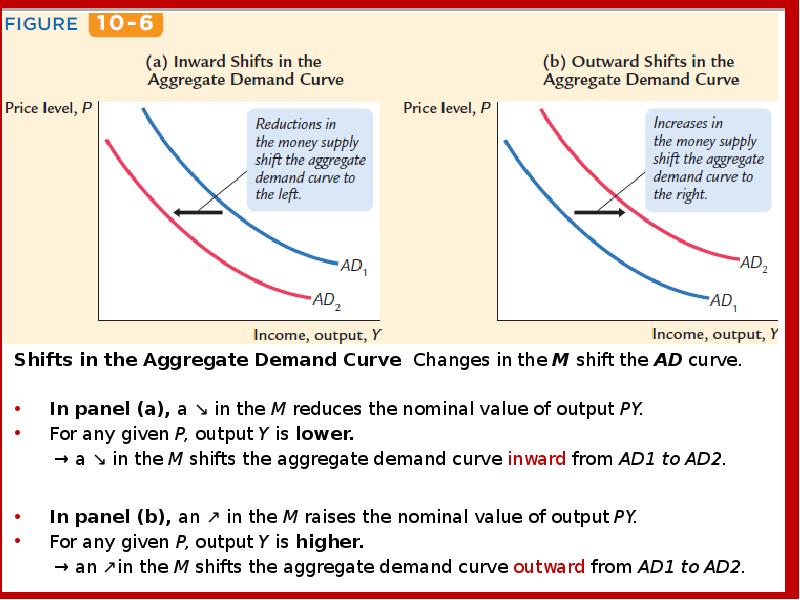

- 23. Shifts in the Aggregate Demand Curve Changes in the M shift

- 24. 10-4 Aggregate Supply The Long Run: The Vertical Aggregate Supply Curve

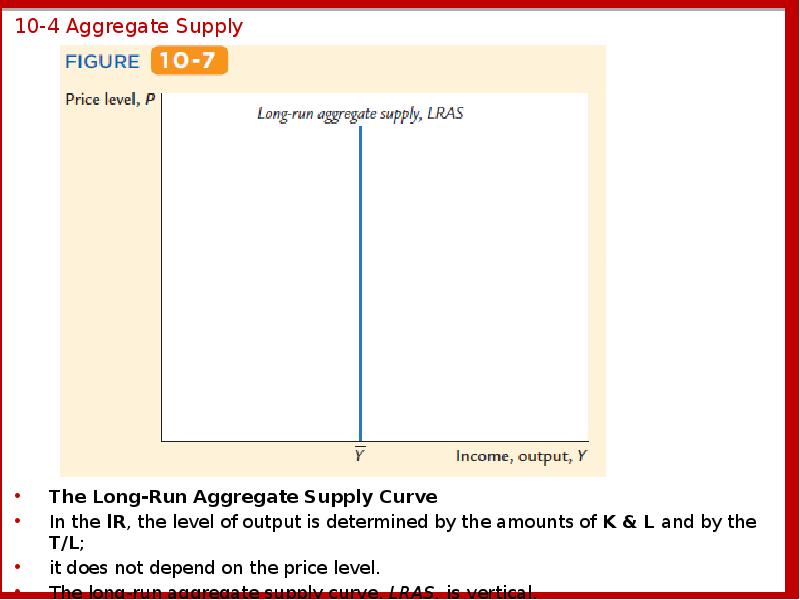

- 25. 10-4 Aggregate Supply The Long-Run Aggregate Supply Curve In the

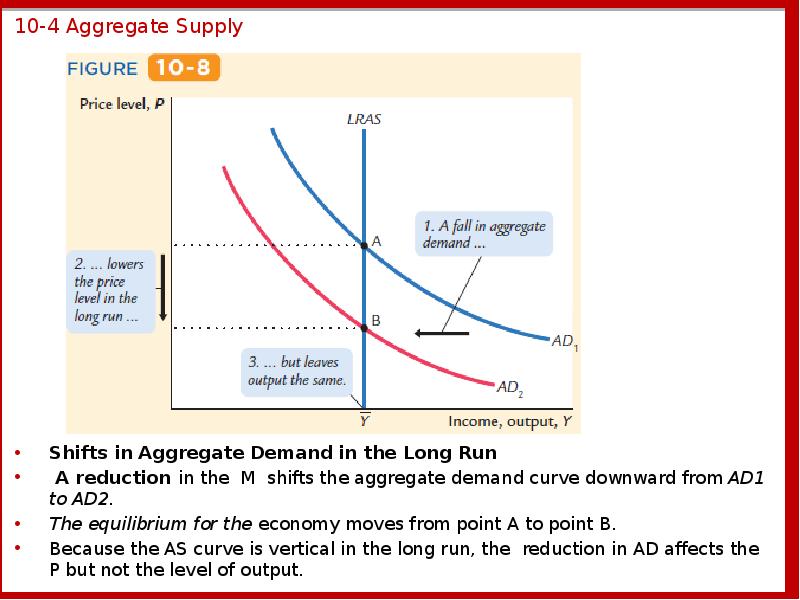

- 26. 10-4 Aggregate Supply Shifts in Aggregate Demand in the Long Run

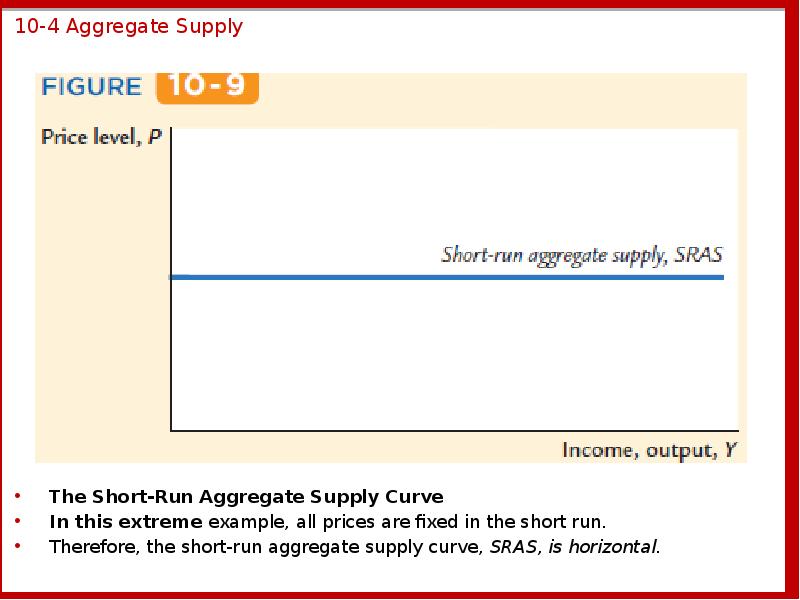

- 27. 10-4 Aggregate Supply The Short-Run Aggregate Supply Curve In this

- 28. 10-4 Aggregate Supply Shifts in Aggregate Demand in the Short Run

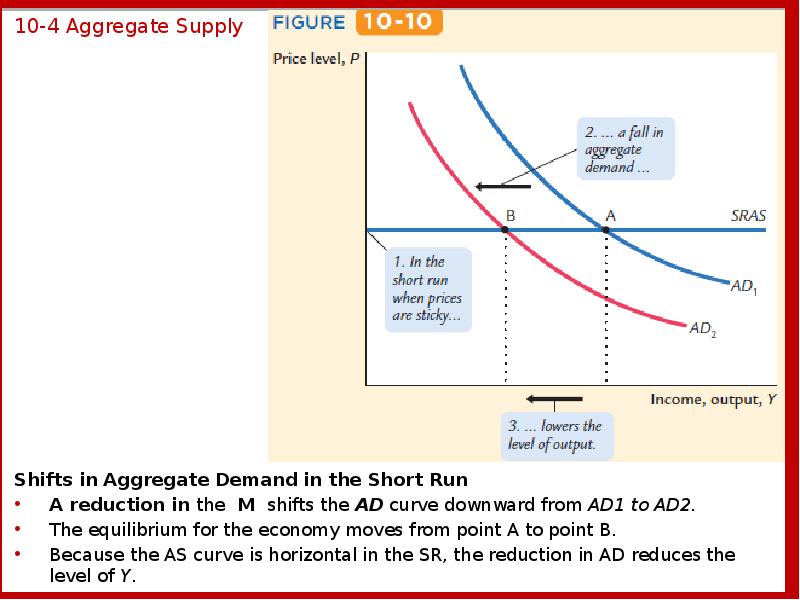

- 29. 10-4 Aggregate Supply Long-Run Equilibrium In the LR, the economy

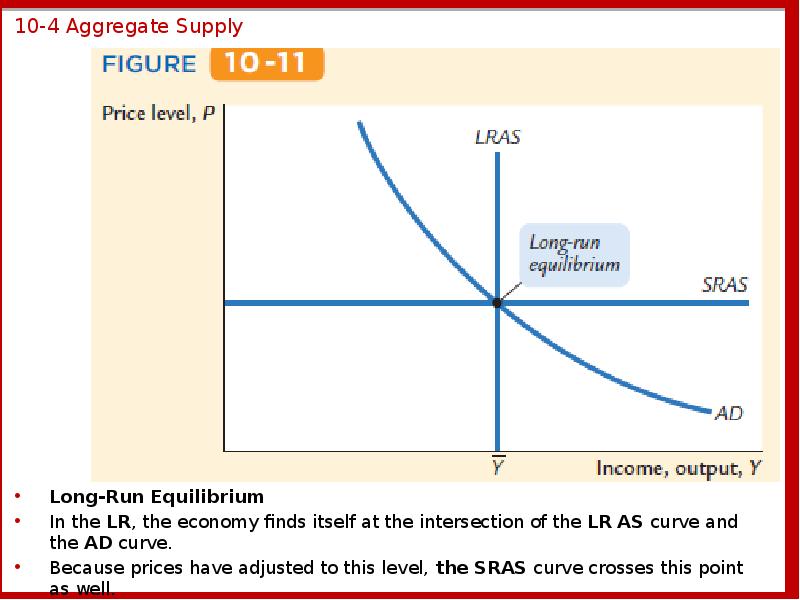

- 30. 10-4 Aggregate Supply A Reduction in Aggregate Demand The economy

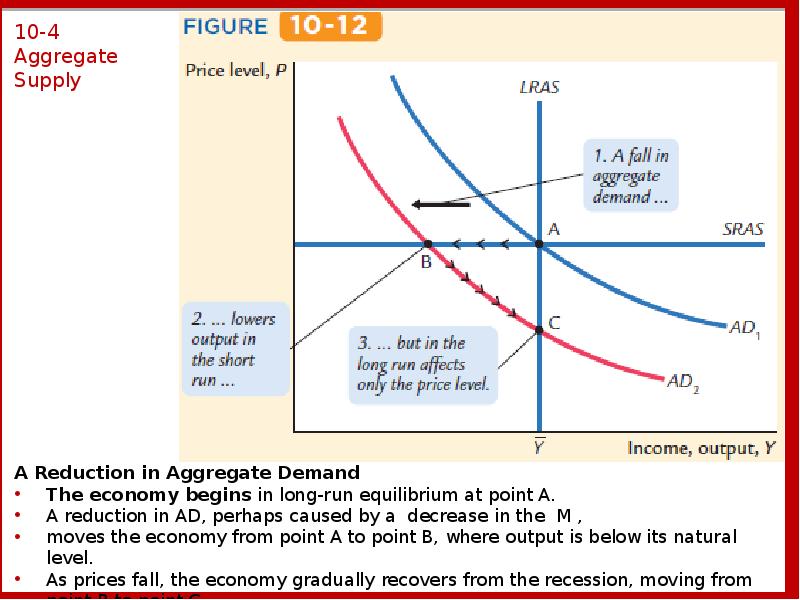

- 31. A Monetary Lesson From French History The story begins with the

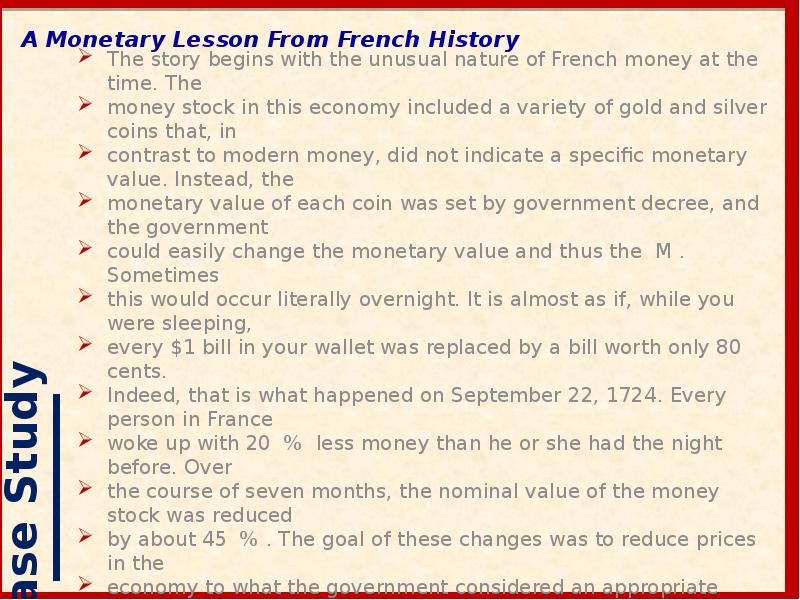

- 32. David Hume on the Real Effects of Money Here is how

- 33. 10-5 Stabilization Policy Fluctuations in the economy as a whole

- 34. 10-5 Stabilization Policy An Increase in Aggregate Demand The

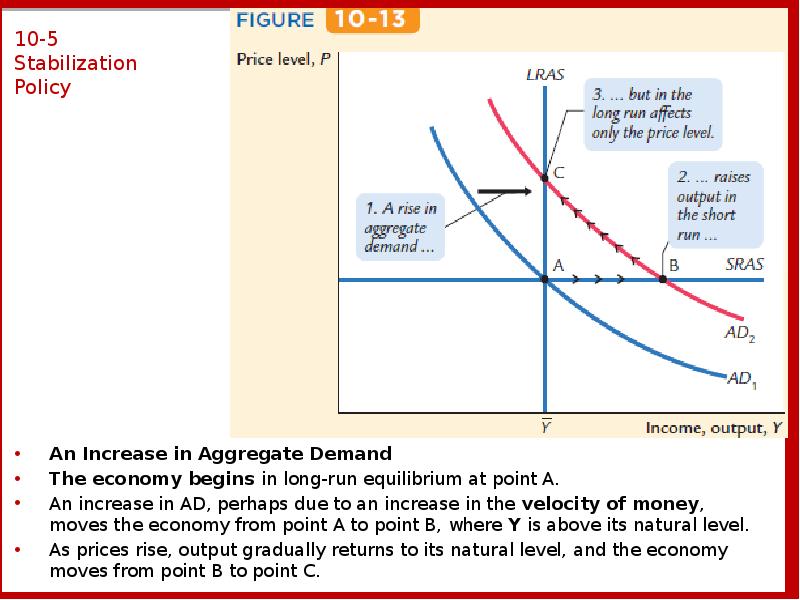

- 35. 10-5 Stabilization Policy Because supply shocks have a direct impact

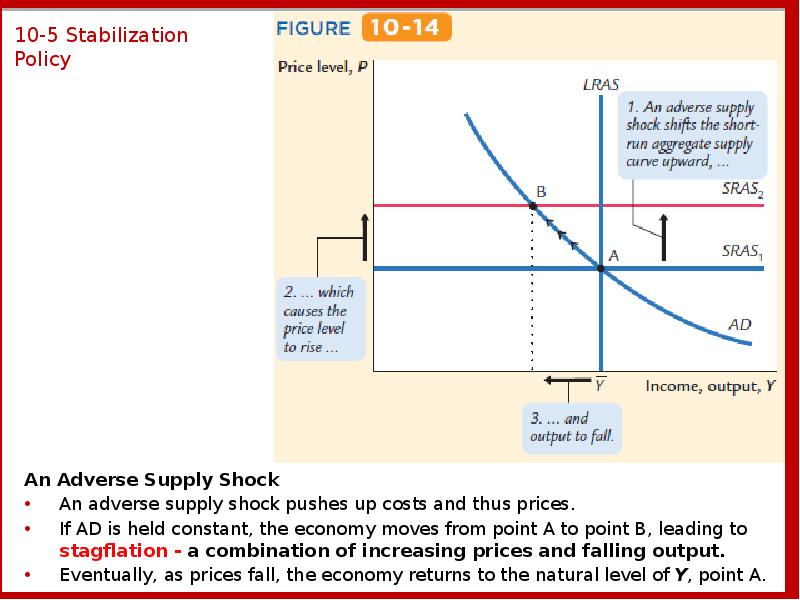

- 36. 10-5 Stabilization Policy An Adverse Supply Shock An adverse

- 37. 10-5 Stabilization Policy Accommodating an Adverse Supply Shock In

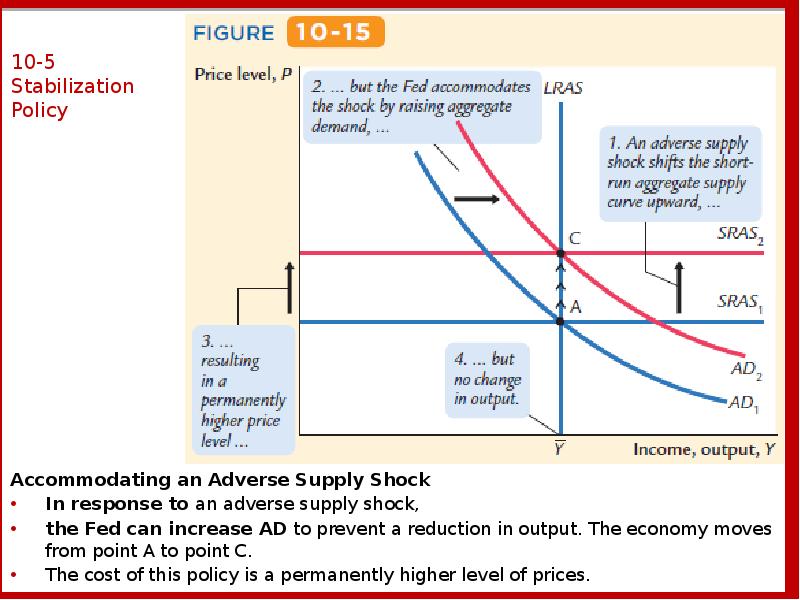

- 38. How OPEC Helped Cause Stagflation in the 1970s and Euphoria in

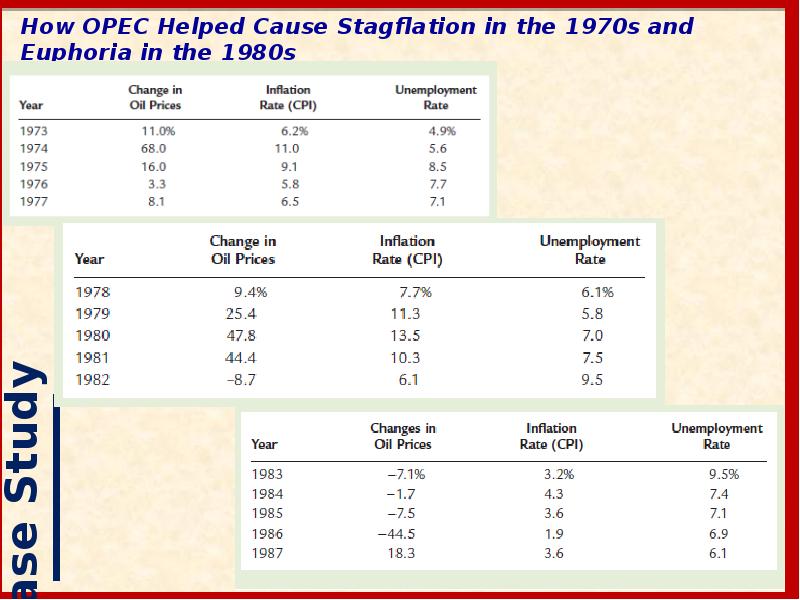

- 39. 10-6 Conclusion This chapter introduced a framework to study economic fluctuations:

- 41. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему Business Cycle Theory: The Economy in the Short Run можно ниже:

Похожие презентации