BY ROBERT J. LONGSTREET, ATTORNEY AT LAW презентация

Содержание

- 2. MEDICAID VS. MEDICARE MEDICAID IS A LARGE GOVERNMENT HEALTH INSURANCE PROGRAM

- 3. MEDICAID In Michigan, Medicaid implemented by county DHS (Department of Human

- 4. MEDICAID DOES PAY FOR LONG TERM NURSING HOME STAYS FOR SENIORS

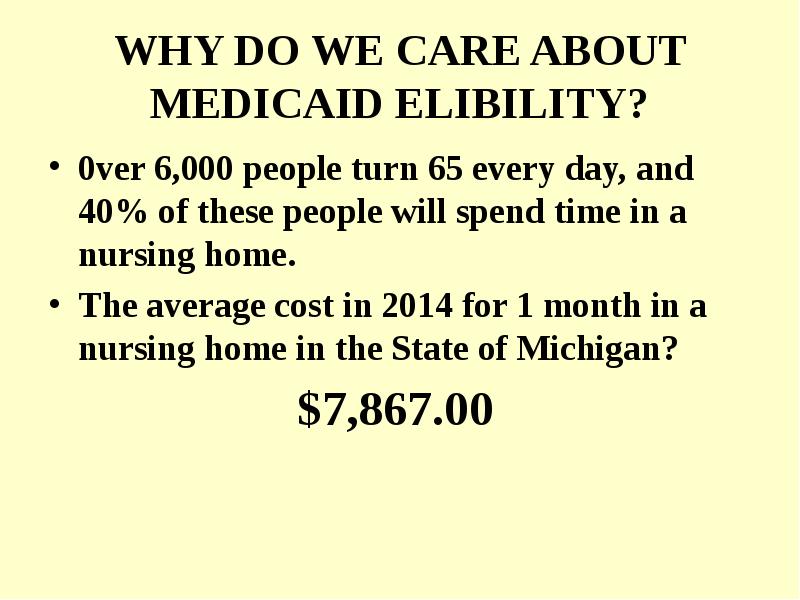

- 5. WHY DO WE CARE ABOUT MEDICAID ELIBILITY? 0ver 6,000 people turn

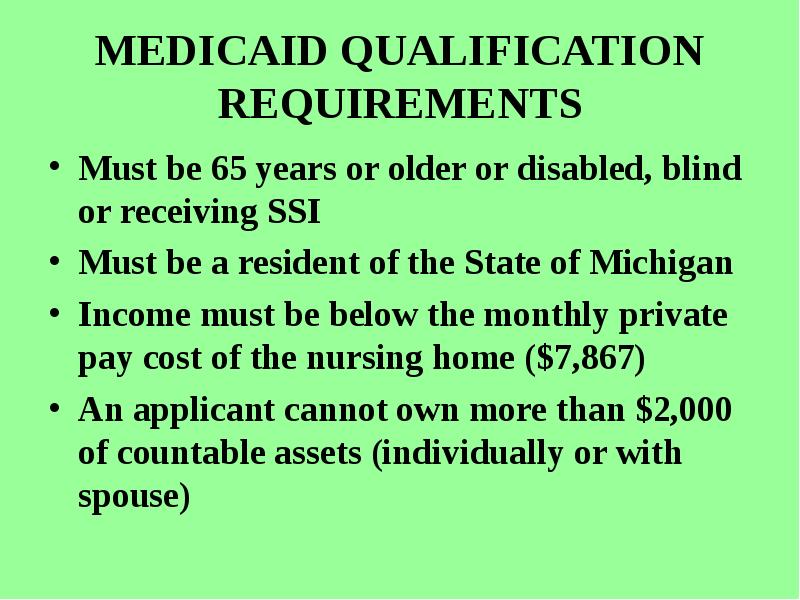

- 6. MEDICAID QUALIFICATION REQUIREMENTS Must be 65 years or older or disabled,

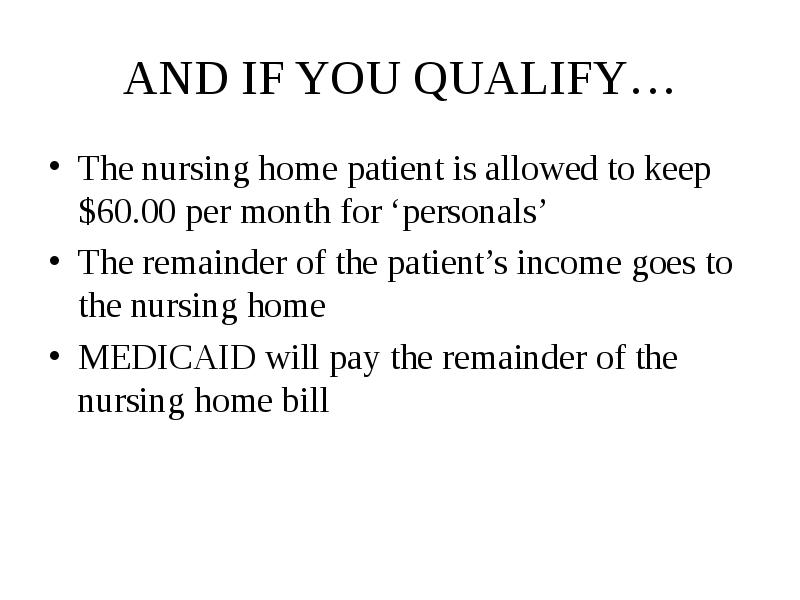

- 7. AND IF YOU QUALIFY… The nursing home patient is allowed to

- 8. THIS SOUNDS HORRIBLE!!!!

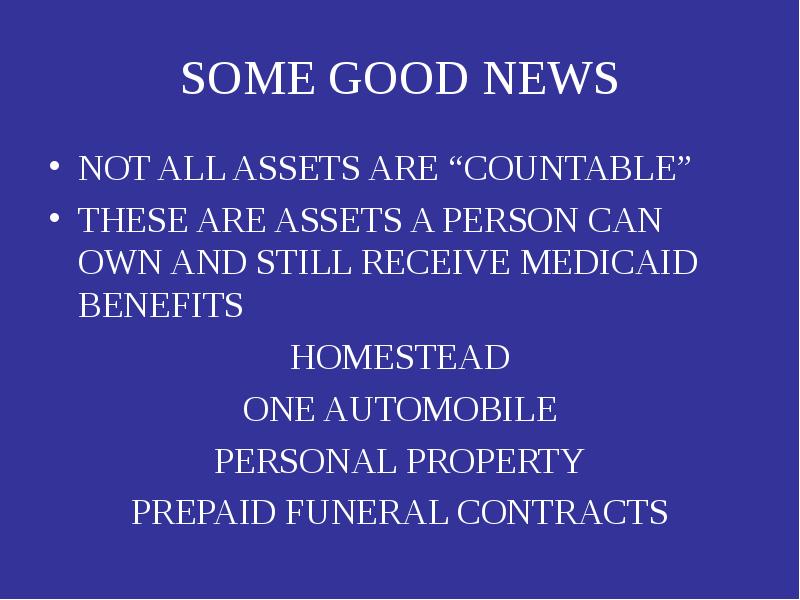

- 9. SOME GOOD NEWS NOT ALL ASSETS ARE “COUNTABLE” THESE ARE ASSETS

- 10. HOMESTEAD EXEMPTION HOMESTEAD INCLUDES HOME AND ANY CONTIGUOUS LAND CAN

- 11. ONE AUTOMOBILE OF ANY VALUE

- 12. PERSONAL PROPERTY CLOTHING JEWELRY HOME APPLIANCES FURNITURE

- 13. PRE-PAID FUNERAL CONTRACTS MUST BE IRREVOCABLE FOR HUSBAND AND WIFE CAN

- 14. EVERYTHING ELSE IS A “COUNTABLE ASSET” CHECKING ACCOUNTS SAVINGS ACCOUNTS

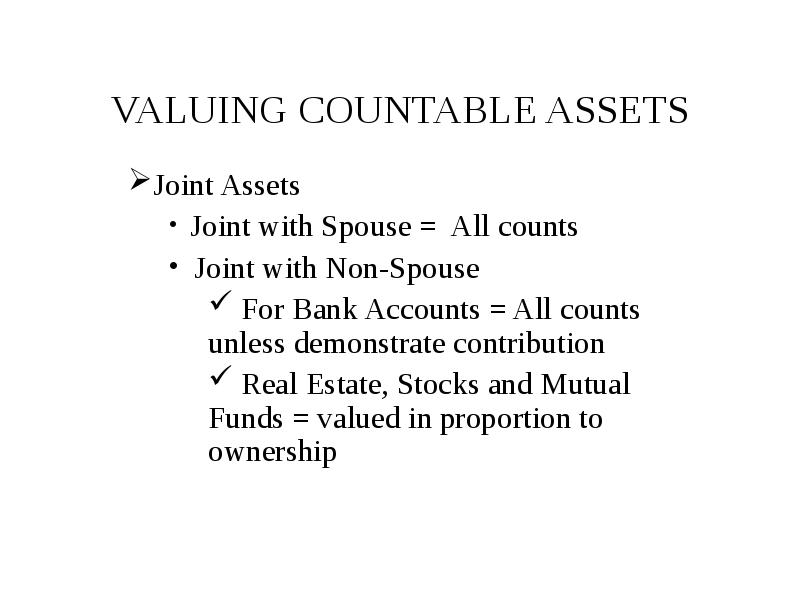

- 15. VALUING COUNTABLE ASSETS Joint Assets Joint with Spouse = All counts

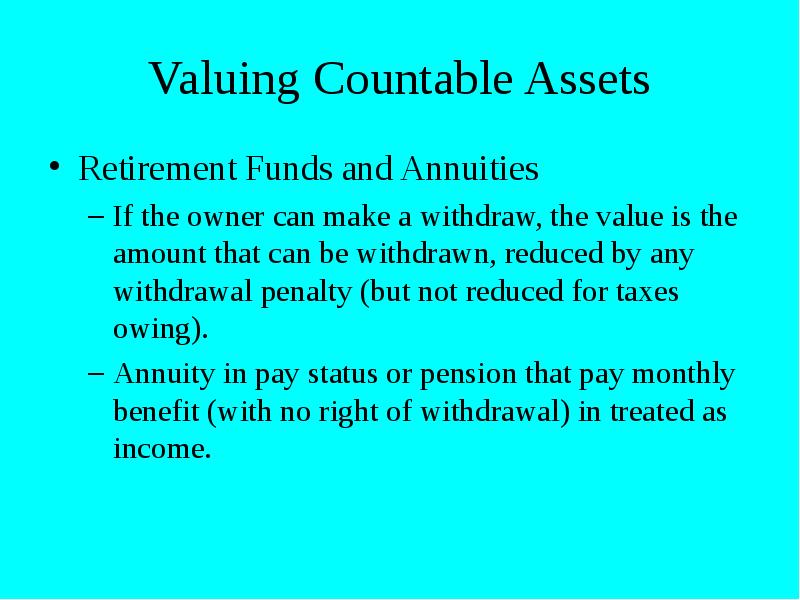

- 16. Valuing Countable Assets Retirement Funds and Annuities If the owner can

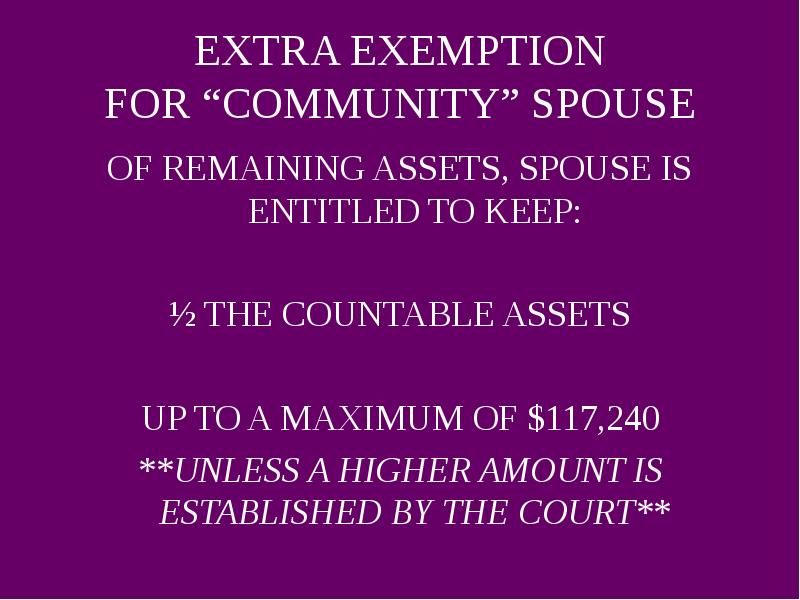

- 17. EXTRA EXEMPTION FOR “COMMUNITY” SPOUSE OF REMAINING ASSETS, SPOUSE IS ENTITLED

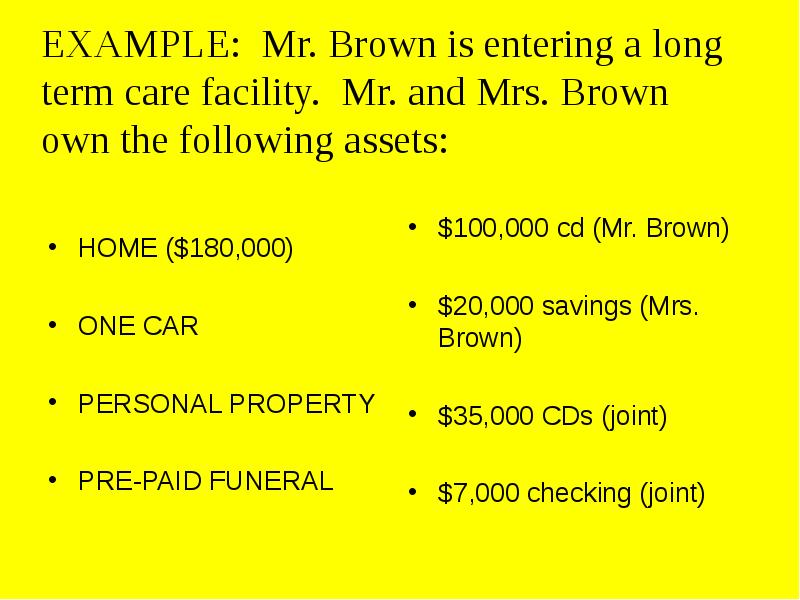

- 18. EXAMPLE: Mr. Brown is entering a long term care facility. Mr.

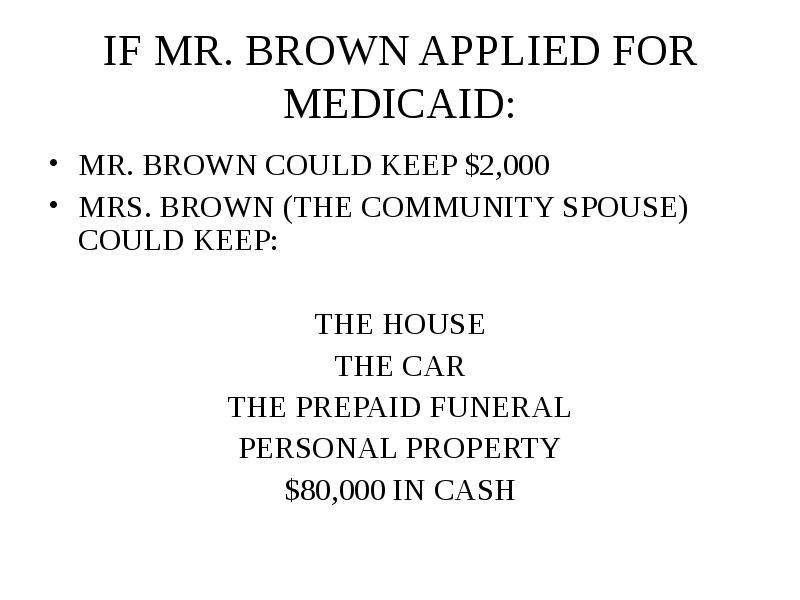

- 19. IF MR. BROWN APPLIED FOR MEDICAID: MR. BROWN COULD KEEP $2,000

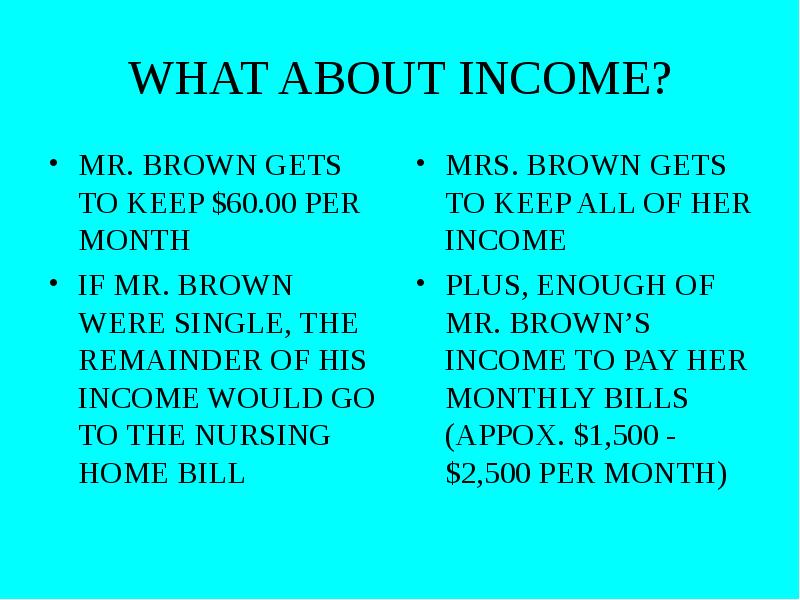

- 20. WHAT ABOUT INCOME? MR. BROWN GETS TO KEEP $60.00 PER MONTH

- 21. WHAT ABOUT THE REMAINING $80,000 THE BROWNS OWN?

- 22. WHAT ABOUT THE REMAINING $80,000 THE BROWNS OWN? THEY COULD SPEND

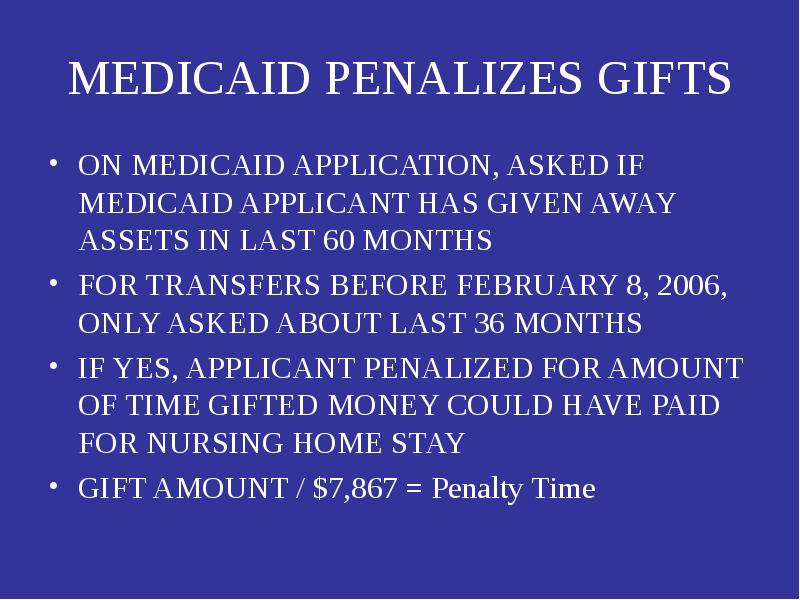

- 23. MEDICAID PENALIZES GIFTS ON MEDICAID APPLICATION, ASKED IF MEDICAID APPLICANT HAS

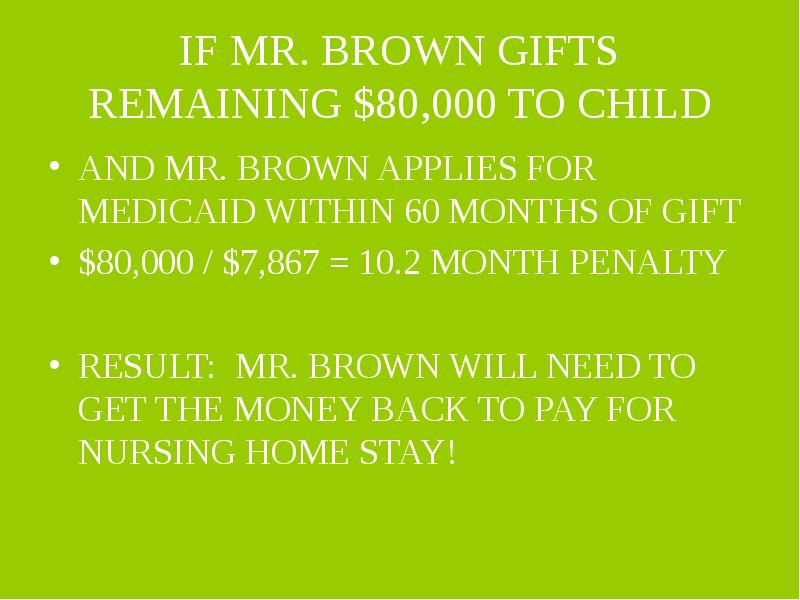

- 24. IF MR. BROWN GIFTS REMAINING $80,000 TO CHILD AND MR. BROWN

- 25. SO WHAT IS LEFT FOR CLIENTS TO DO? FOR A SINGLE

- 26. FOR A SINGLE CLIENT “HALF-A-LOAF” METHOD GIFT APPROXIMATELY 60% OF ASSETS

- 27. FOR MARRIED CLIENT TAKE ADVANTAGE OF FULL COMMUNITY SPOUSE ALLOWANCE (1/2

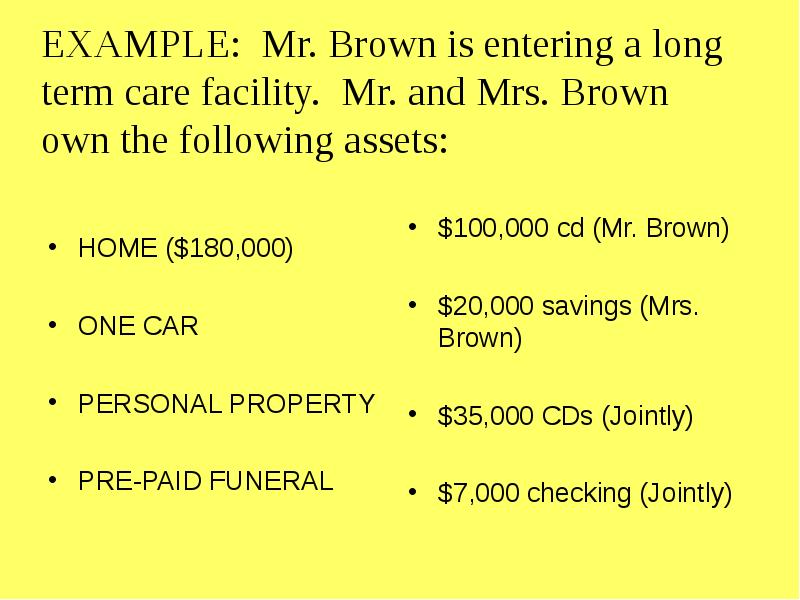

- 29. EXAMPLE: Mr. Brown is entering a long term care facility. Mr.

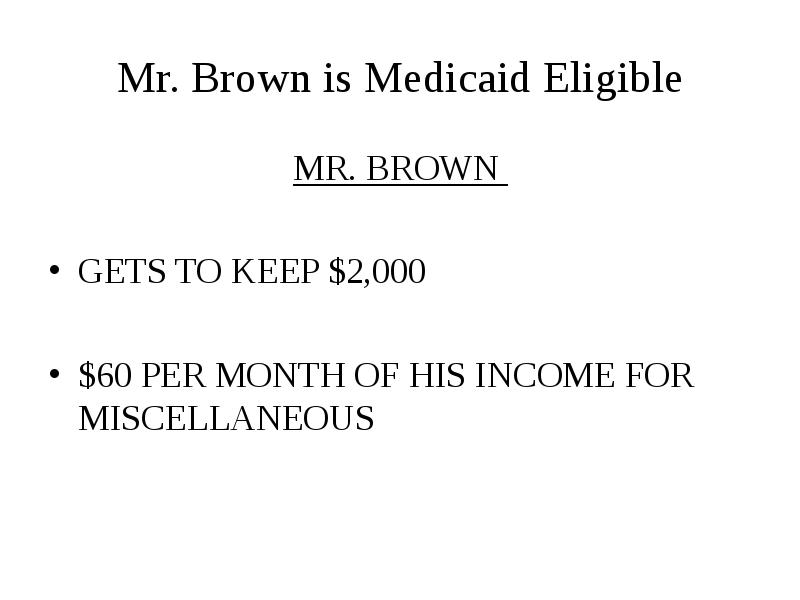

- 30. Mr. Brown is Medicaid Eligible MR. BROWN GETS TO

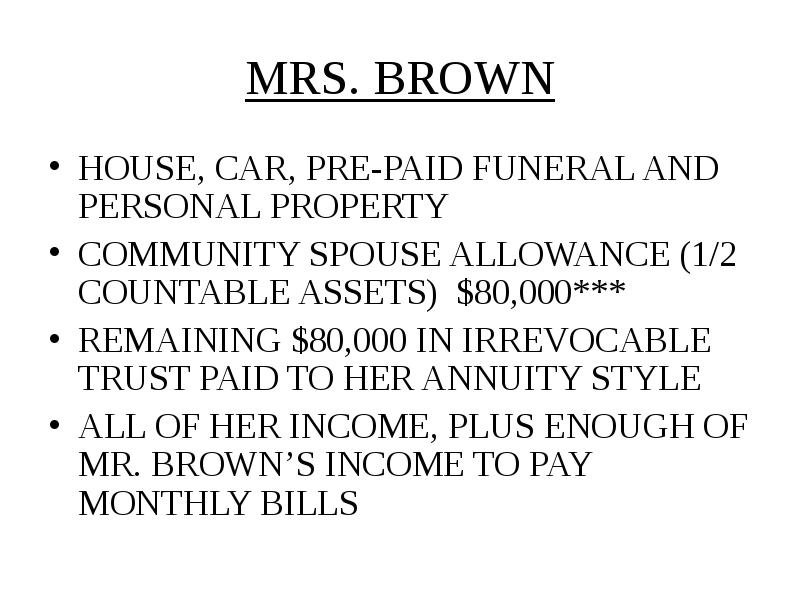

- 31. MRS. BROWN HOUSE, CAR, PRE-PAID FUNERAL AND PERSONAL PROPERTY COMMUNITY SPOUSE

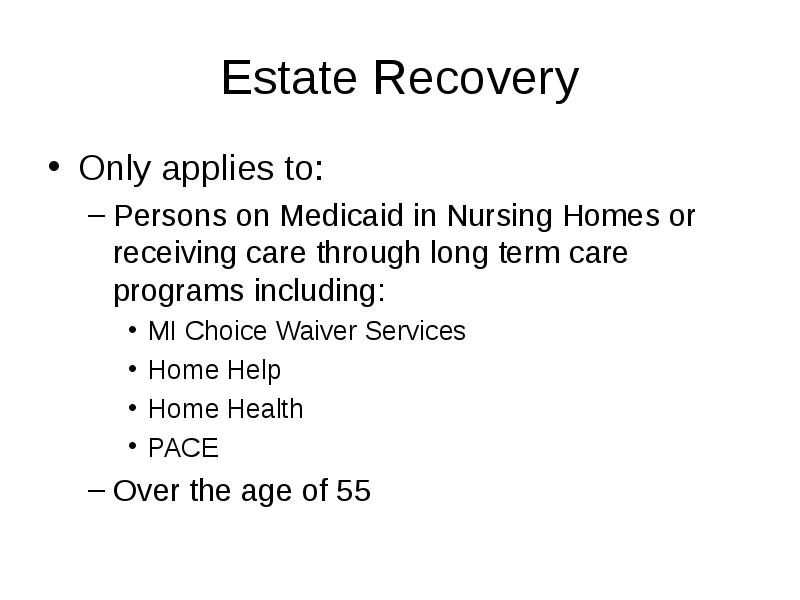

- 33. Estate Recovery Only applies to: Persons on Medicaid in Nursing Homes

- 34. Estate Recovery Normally talking about the house, as that is typically

- 35. Estate Recovery Every state is different. 2007 Michigan law provides favorable

- 36. What We Do Avoid probate by using ladybird deeds and other

- 37. Two Powerhouse Methods You Can Do NOW Power of Attorney with

- 38. IF YOU HAVE A NURSING HOME ISSUE…. ROBERT J. LONGSTREET GEE

- 39. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему BY ROBERT J. LONGSTREET, ATTORNEY AT LAW можно ниже:

Похожие презентации