The binomial model for option pricing презентация

Содержание

- 2. Contents European Call Option Geometric Brownian Motion Black-Scholes Formula Multi

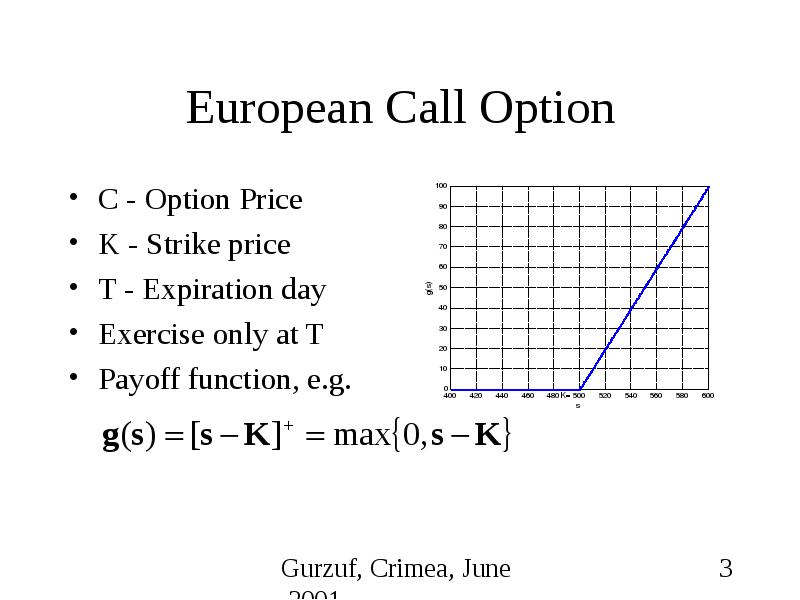

- 3. European Call Option C - Option Price K - Strike price

- 4. Geometric Brownian Motion S(y), 0y<t, follows a geometric Brownian motion

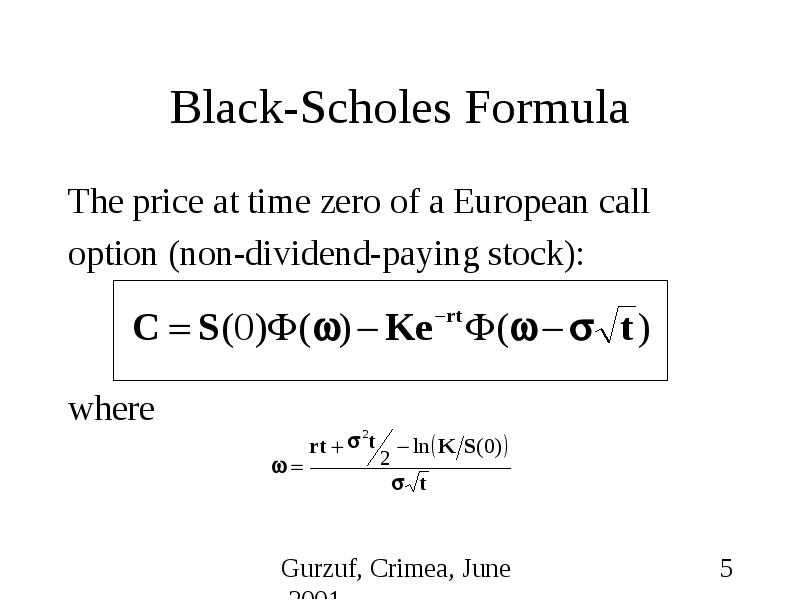

- 5. Black-Scholes Formula The price at time zero of a European call

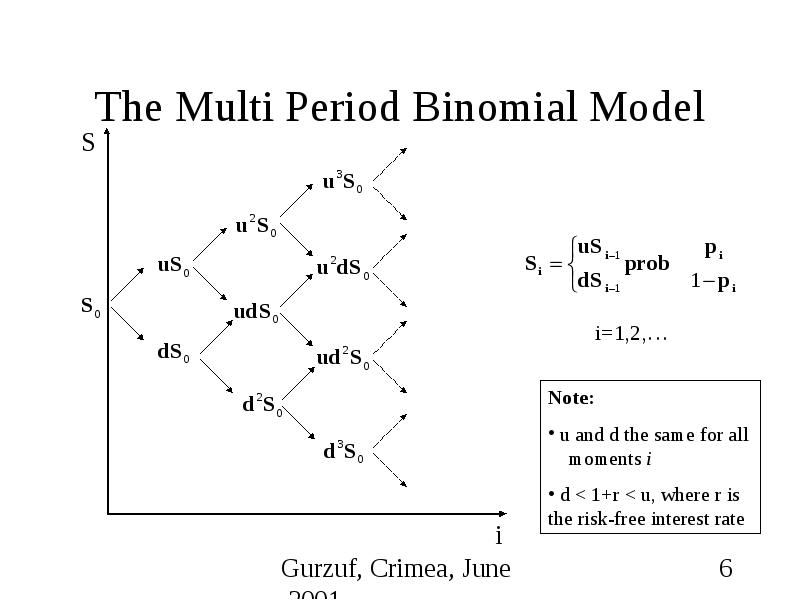

- 6. The Multi Period Binomial Model

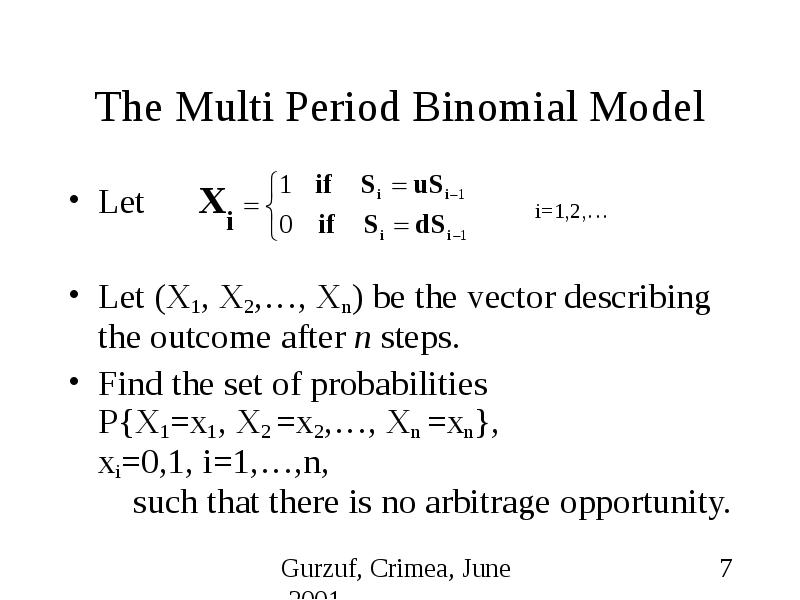

- 7. The Multi Period Binomial Model Let Let (X1, X2,…, Xn)

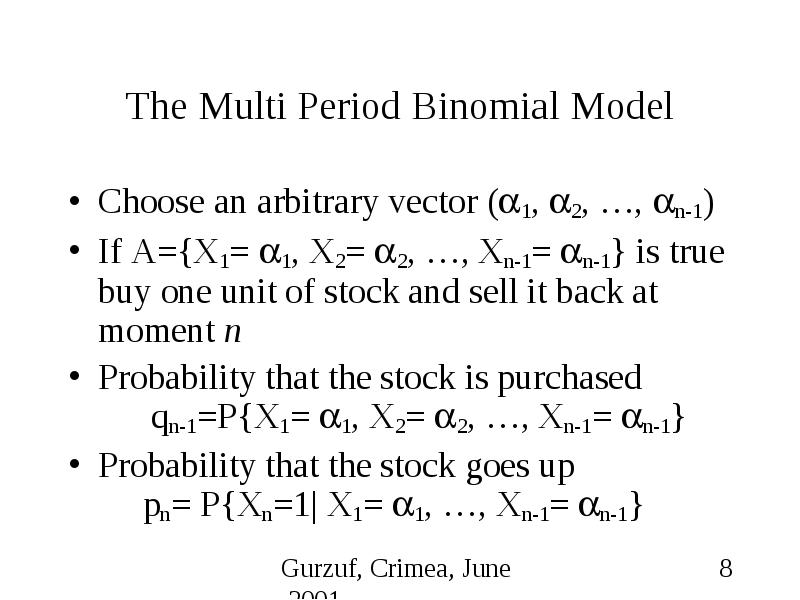

- 8. The Multi Period Binomial Model Choose an arbitrary vector (1, 2,

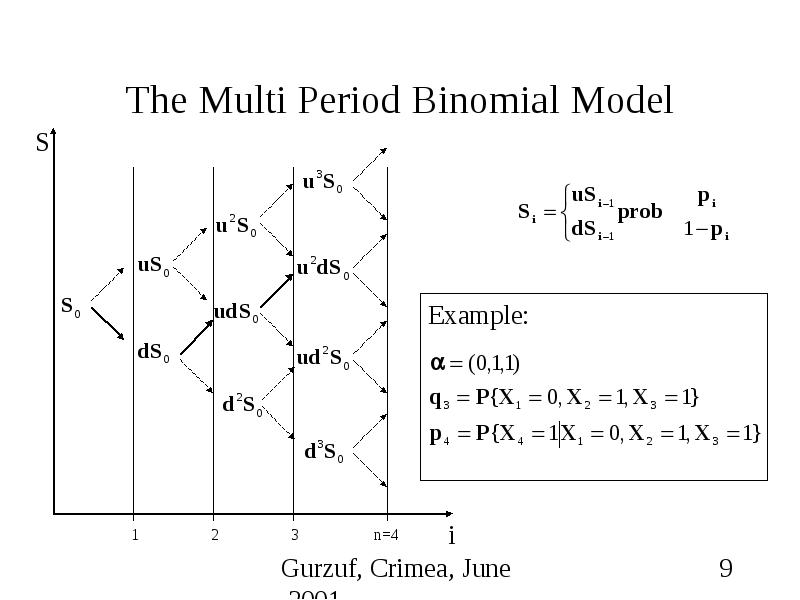

- 9. The Multi Period Binomial Model

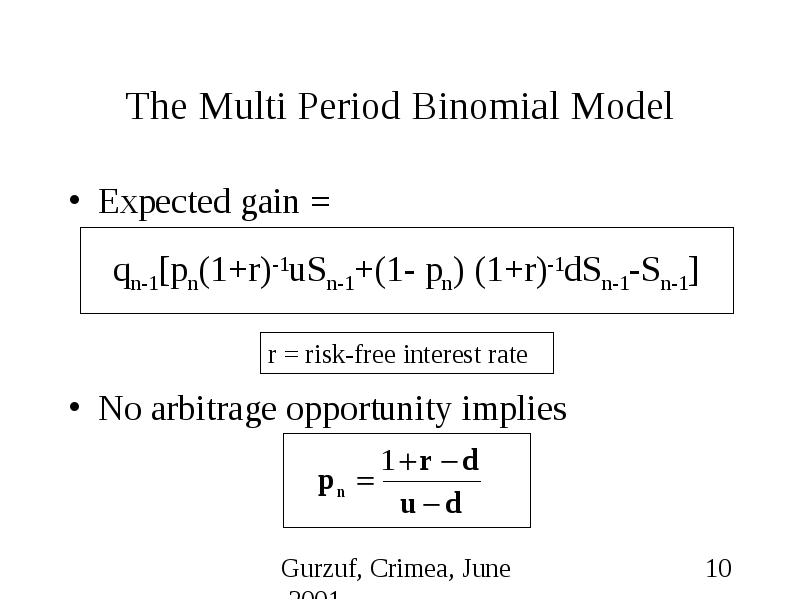

- 10. The Multi Period Binomial Model Expected gain = No arbitrage

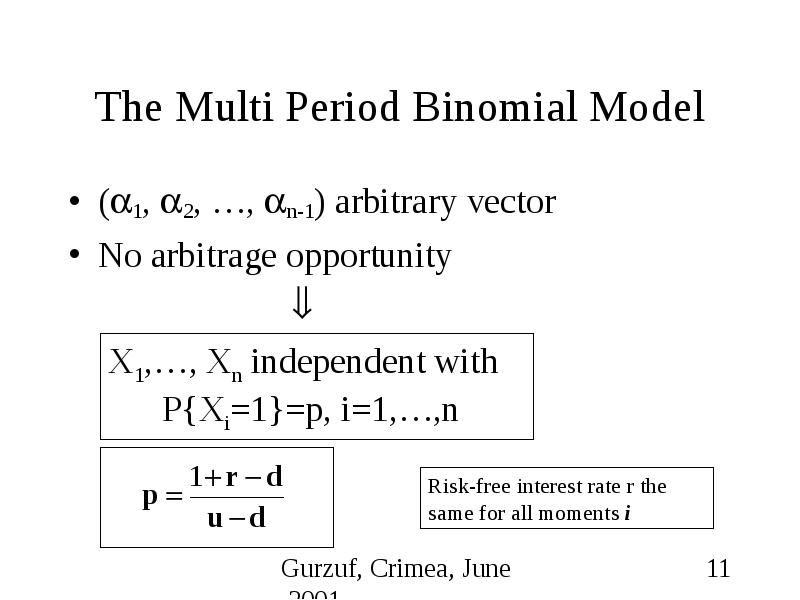

- 11. The Multi Period Binomial Model (1, 2, …, n-1) arbitrary vector

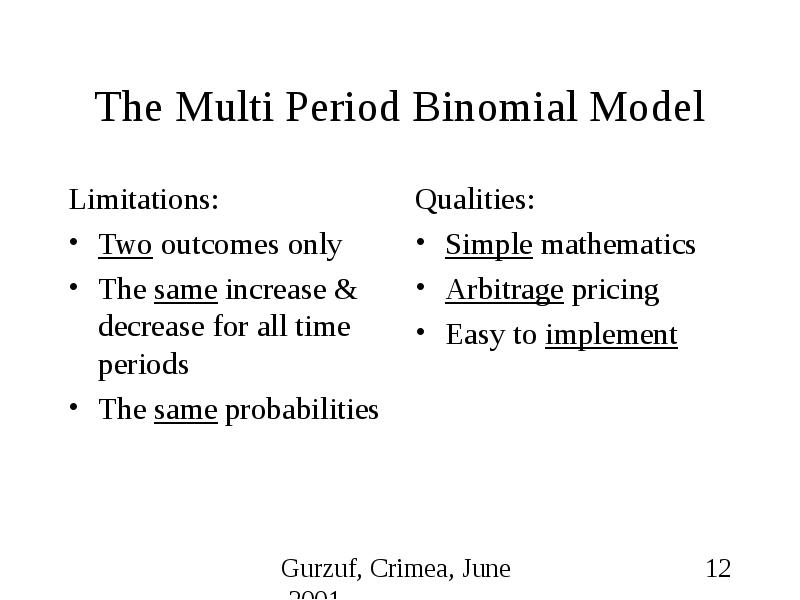

- 12. The Multi Period Binomial Model Limitations: Two outcomes only The

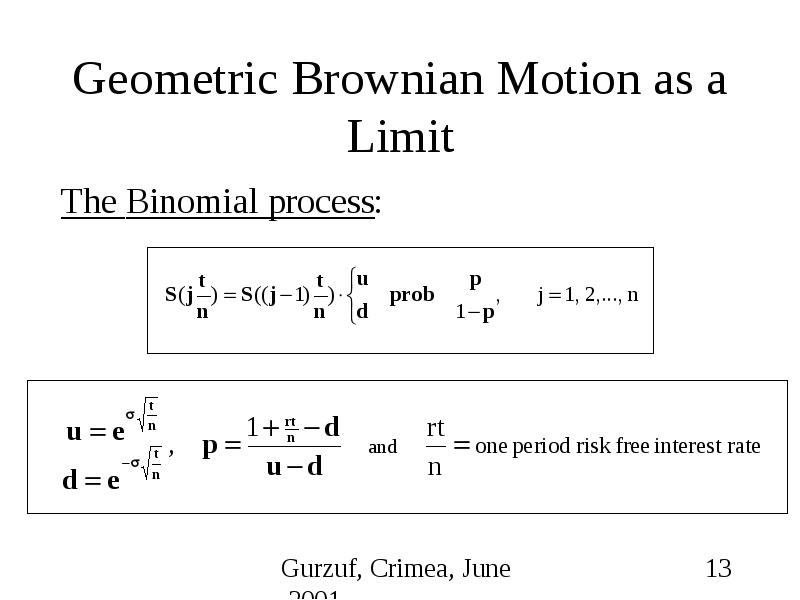

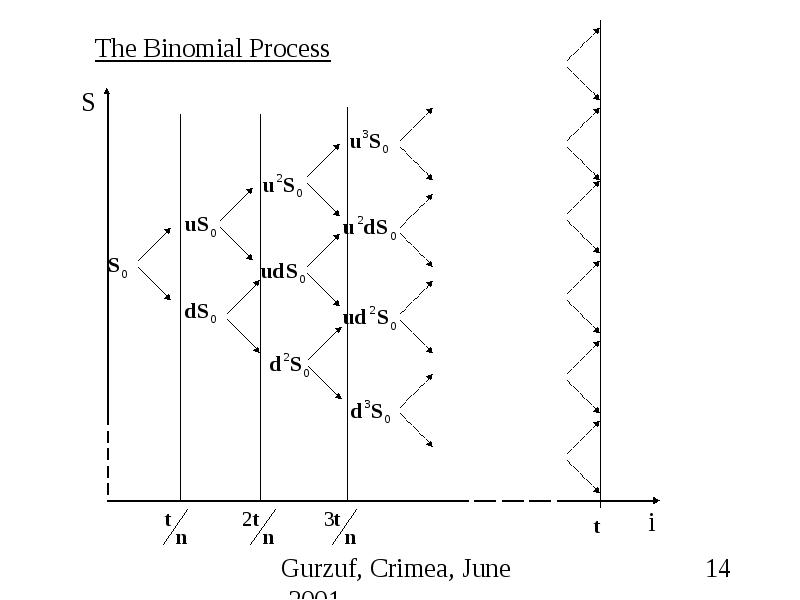

- 13. Geometric Brownian Motion as a Limit The Binomial process:

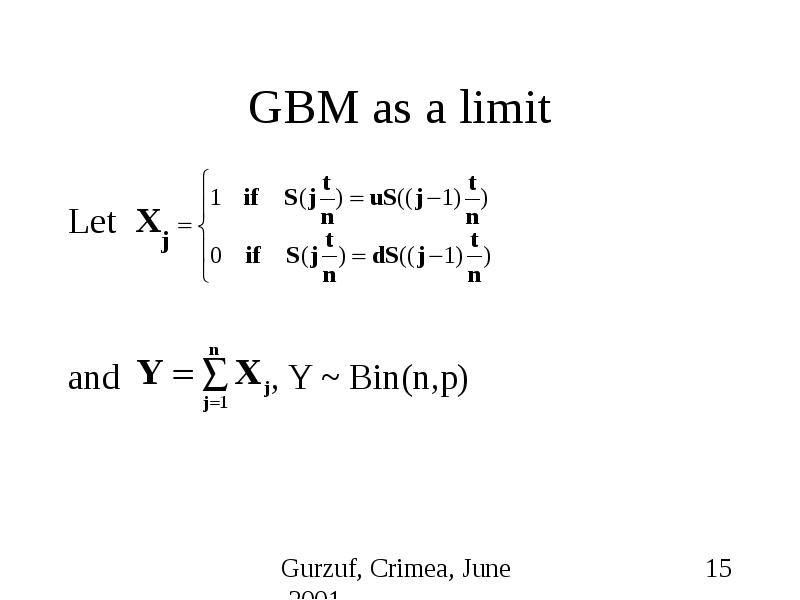

- 15. GBM as a limit Let and

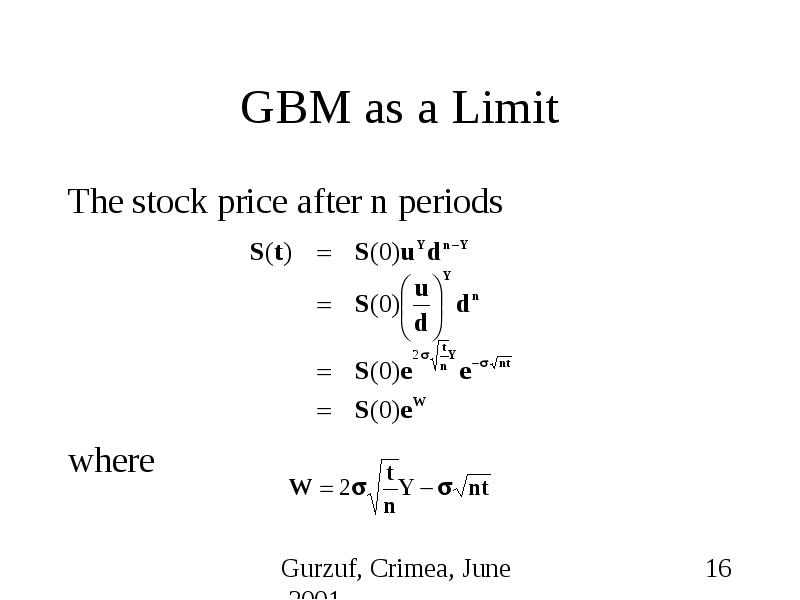

- 16. GBM as a Limit The stock price after n periods where

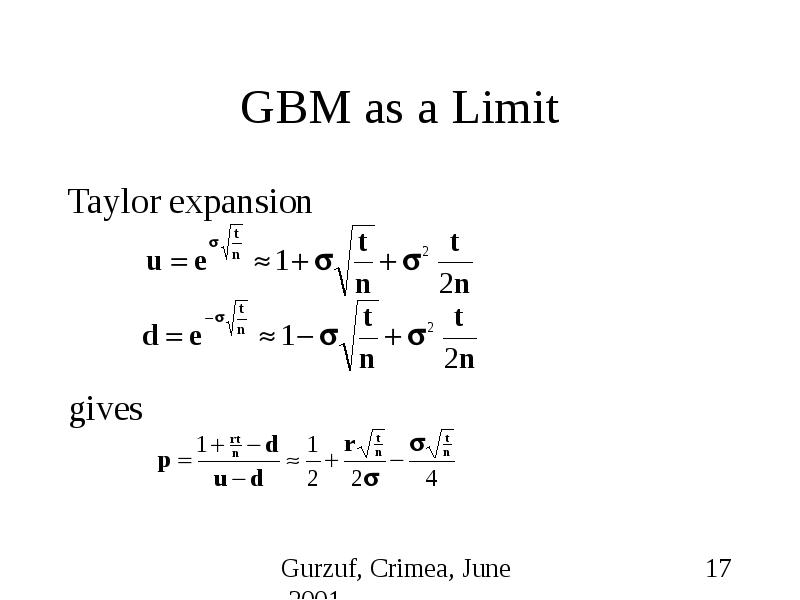

- 17. GBM as a Limit Taylor expansion gives

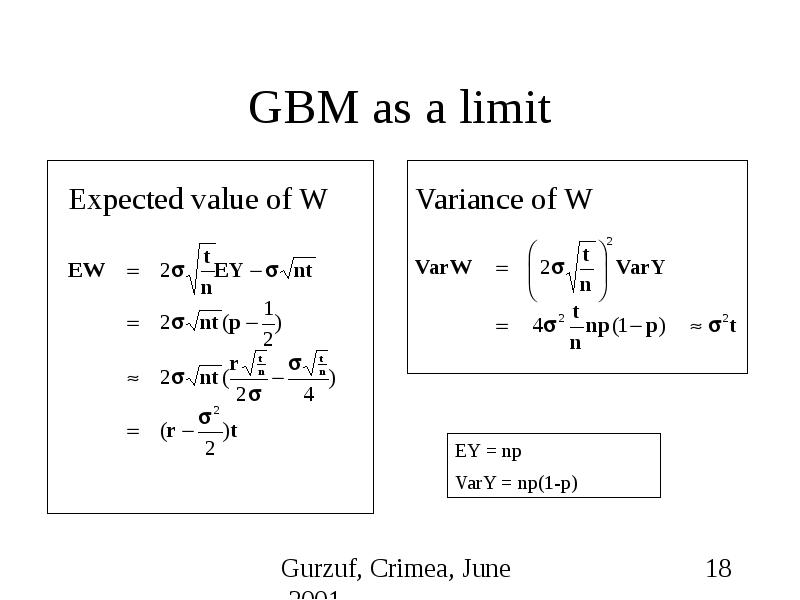

- 18. GBM as a limit Expected value of W

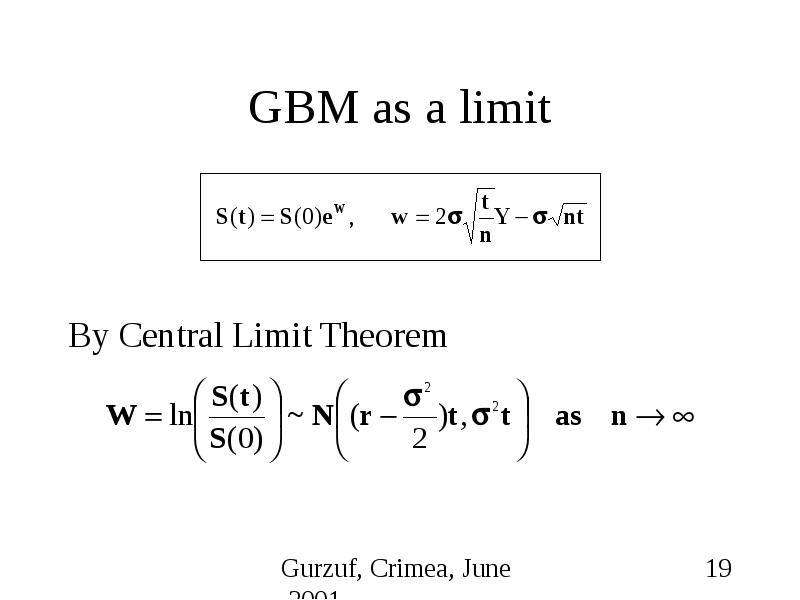

- 19. GBM as a limit By Central Limit Theorem

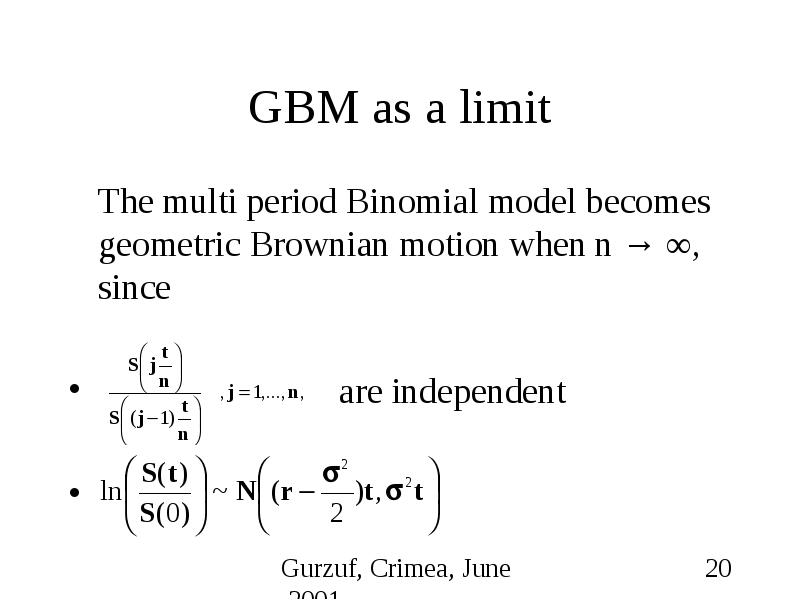

- 20. GBM as a limit The multi period Binomial model becomes geometric

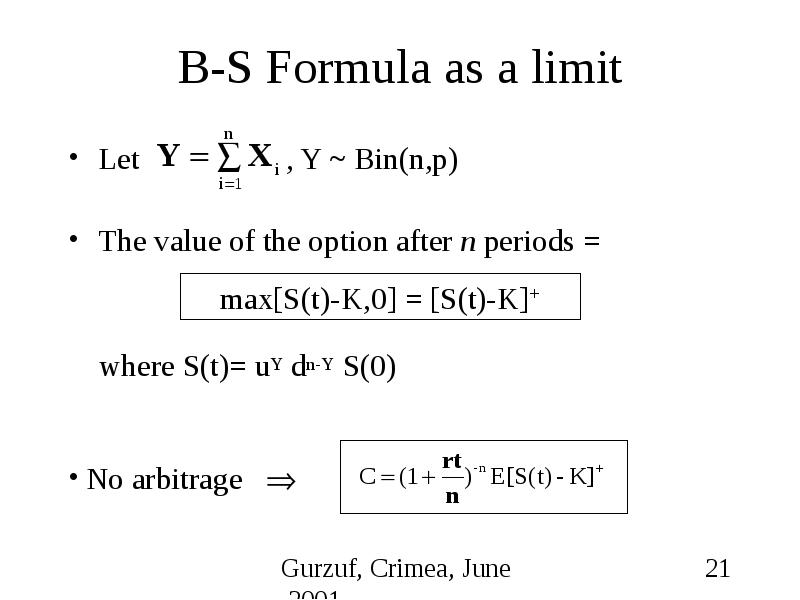

- 21. B-S Formula as a limit Let ,

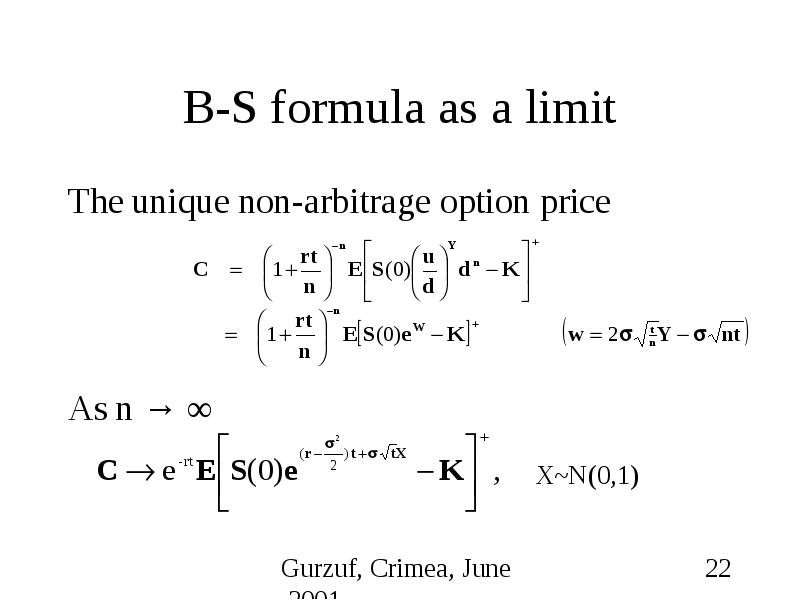

- 22. B-S formula as a limit The unique non-arbitrage option price As

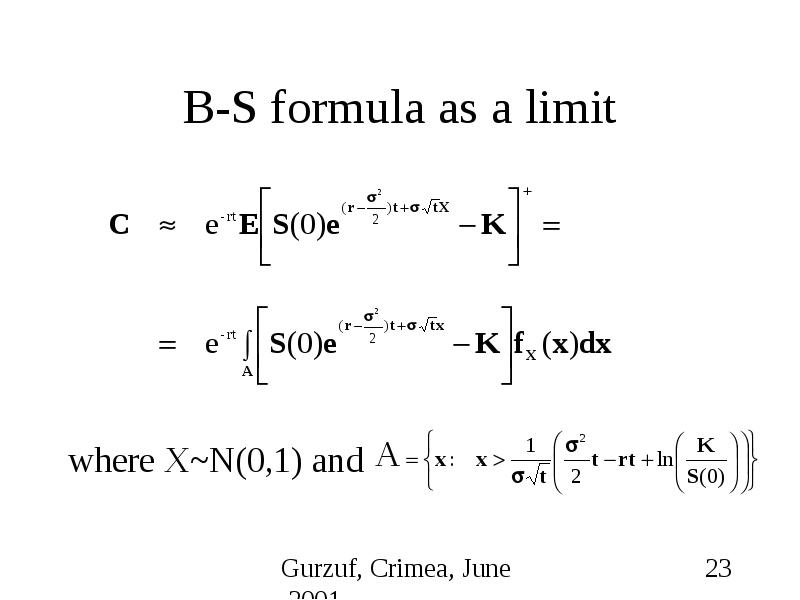

- 23. B-S formula as a limit where X~N(0,1) and

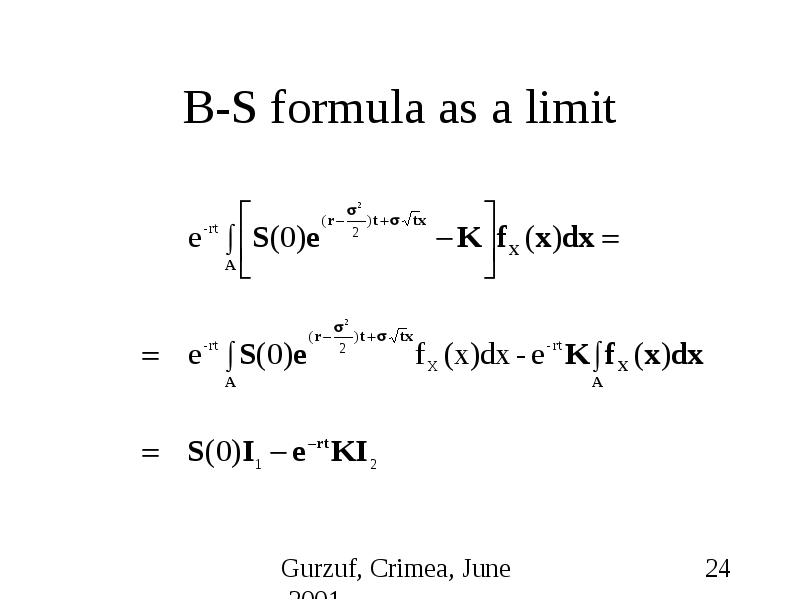

- 24. B-S formula as a limit

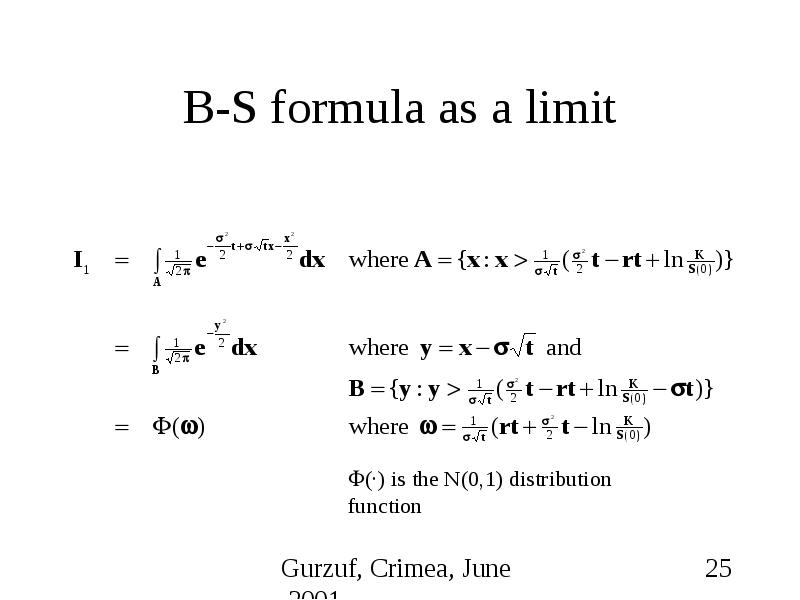

- 25. B-S formula as a limit

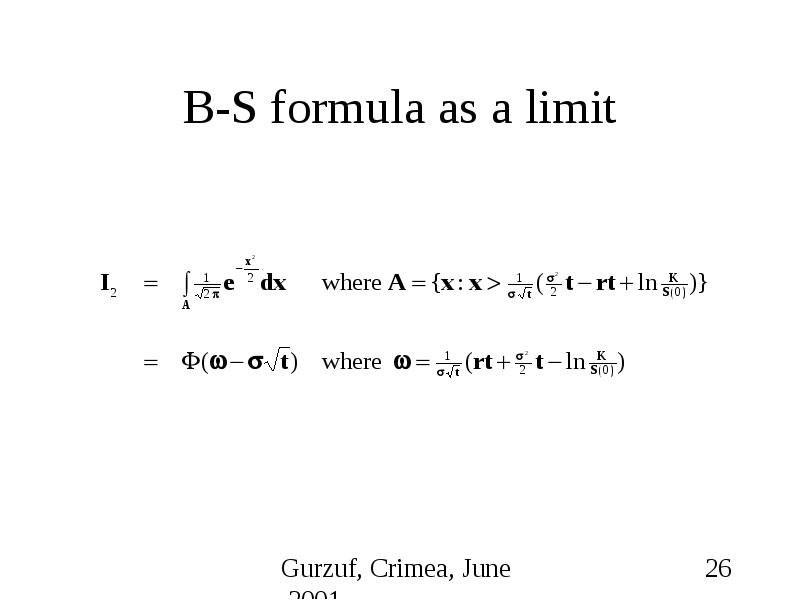

- 26. B-S formula as a limit

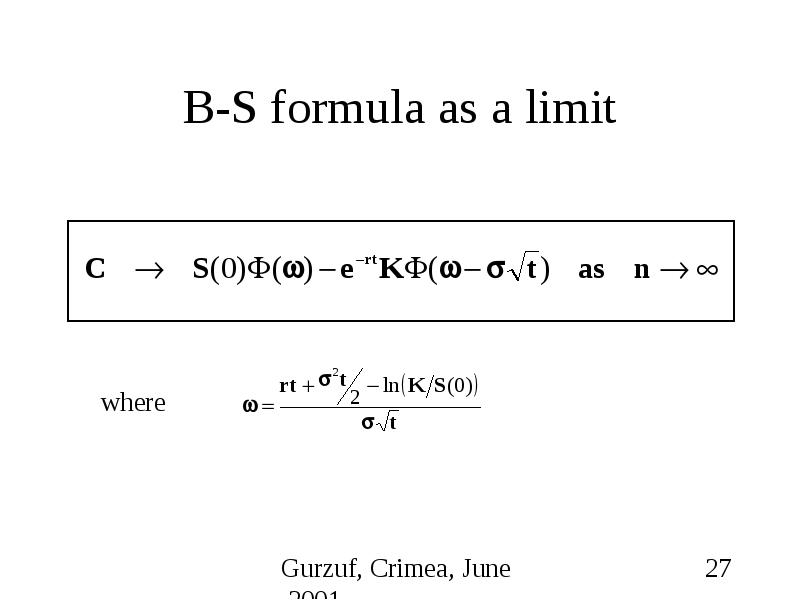

- 27. B-S formula as a limit

- 28. Скачать презентацию

Слайды и текст этой презентации

Скачать презентацию на тему The binomial model for option pricing можно ниже:

Похожие презентации